- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Working on my Fiance's credit, which to fix fi...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Working on my Fiance's credit, which to fix first?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Working on my Fiance's credit, which to fix first?

I am making a new thread on her journey (with my help) of credit repair in order to not cause confusion on my own thread.

Here Fico right now is about 520.

Accounts:

Victoria's Secret Credit Card. Opened 7/17/17. Balance of $573 on a $500 CL. Just paid it down to $500 and am seeking refunds of fees. Almost $200 are late fees. We have paid the bill whenever we can, but there hasn't been a charge on this account since April of last year. We have pretty much been making payments on the fees!

Discover Card. Unsecured. Balance of $507 on $500 CL. Going to pay $40 off it off next paycheck.

State Farm Bank Visa. $813 CHARGE OFF of original $500 limit. They were not wiling to work with us when we got behind, at ALL, and as you can see they snuck in over $300 in fees.

SYNC/ WALMART. $100 CL. Says "account closed by creditor". It's not charged off though. I take it this is not negative??

SYNC/ TJMAXX. Charged off and sold to another lender. $100 original CL.

Lastlty. Capital One Bank. Charge off of $269. However this is currently in their dispute department, because they took a $75 payment from us "to keep the account from charging off", and charged it off anyway.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Working on my Fiance's credit, which to fix first?

Also..if I dispute an item with one bureau and it gets deleted, do I need to follow up with the others, or will the others follow?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Working on my Fiance's credit, which to fix first?

On the TJMAXX account, it shows charged off in December, but just "closed" in January, yet the charged off state farm account shows "charged off" every month.

Would this be incorrect reporting?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Working on my Fiance's credit, which to fix first?

Whats done is done. Focus on paying these things off quick before its handed over to a CA. If you read your post again. Theres a pattern that your other half needs to learn responsibility on how to handle CC's. All accounts were over the limit beyond maxed out. You need to get them to foucus on cleaning everything up so the accounts will say paid in full. The amounts arent that high. If you dont have the money dont charge it. CC's arent a blank check. Right now no matter what the description of the accounts say. You want all 0 balances paid in full. Good Luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Working on my Fiance's credit, which to fix first?

The reporting of charged off every month is only counted as one credit account charge off.The Fico score model is designed to pick up on the month after month reporting of charged off in the credit account payment history and only count them as a single event, ageing from when it was first reported.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Working on my Fiance's credit, which to fix first?

Can anyone tell me what the law is regarding notices for payment on an account that was going to be charged off?

Capital One mailed a letter on 11/30/18 detailing the account would be charged off if payment is not receivied by 12/23/18.

However, that time frame is only 23 days, even less than that if you account for the several days it took for the letter to reach her.

Also..from what I'm reading..a creditor has 180 days to charge off an account, and I think it was much less than that, however Capital One has completely erased the account online, and the payment status was removed from the credit report once it charged off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Working on my Fiance's credit, which to fix first?

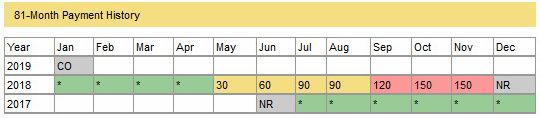

I found the payment key on EQ. It looks very messed up.

Shows NR for December, and CO for Jan. The account CO in Dec.

Can I dispute this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Working on my Fiance's credit, which to fix first?

The taking of a charge-off is an internal accounting measure that permits, and in some cases requires, the creditor to remove the debt from their accounting ledger as an account receivable asset, and move it to a non-asset (bad debt) column that is not included in the final calculation of their net assets. The primary purpose of charge-off regs is to prevent creditors from over stating their value to existing and potential shareholders and investors by including debts in their statement of assets that are not likely to ever be paid.

You need to consult an accountant for details on when a debt can or must be charged off under federal regs. The regs follow the general standard of when a debt is considered as unlikely to be paid, which is subjective. While the regs do provide general guidelines of approx 120 late for installment loans and 180 late for revolving debt as prima facie showing that the debt has become unlikely to be paid, creditors are permitted discretion in developing thier own criteria, and it is not per se impermissible to take a CO earlier than 180 late if it meets their internal established criteria. See sample regs at Fed Reg, Vol 65, No. 113, June 12, 2000 relating to taking of charge-offs, and consult an accountant for any revisions, state regs, or court interpretations.

As for reporting, a creditor is permitted, once they have taken a charge-off, to thereafter report the level of delinquency as either the standard days delinquent since billing due date, such as 150-late, or alternately as simply CO.

If a creditor has reported delinquency as CO, they are then required under FCRA 623(a)(5) to additionally report the date of first delinquency to the CRA, which is then used to determine the overall period of delinquency.

Creditors do NOT report the date that they took a charge-off. It is not needed by the CRA, and they have no code for storing that information. They are permitted, after taking a CO, to thereafter report either the current status as CO, or any prior monthly delinquency after they took the charge-off as simply CO. Reporting of CO for multiple months thus is not the reporting of multiple charge-offs, it is simply the reporting that, at some prior point in time, they took a CO, and the account continues to be delinquent.

As for required deletions based on a dispute, finding any inaccuracy is not basis for deletion of anything unless it cannot either be verified as accurate as reported or it cannot be corrected by the creditor to overcome an agreed inaccuracy. The creditor always has the ability to correct without there being any requirment to delete simply because the reporting was found inaccurate.

The incorrect reporting of a CO, or of balances thereunder, for example, does not require deletion of the CO or of the account. The creditor can always simply correct any agreed inaccuracy without any need to delete anything.

Thus, finding some inaccuracy will not compel deletion as long as the creditor updates their reporting to overcome the agreed inaccuracy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Working on my Fiance's credit, which to fix first?

Why does Fico 9 not give one incentive to pay collections or charge offs?

They score paid collections the same as unpaid.

Makes little sense.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Working on my Fiance's credit, which to fix first?

FICO is for lenders to assess risk of lending to a consumer and a collection or charge off is a major derogatory item that shows you have a history of not paying your debts which makes you a bigger risk to lenders.

The scale is not tipped towards the consumer’s benefit at all, it’s purely an algorithm that helps give lenders guidance on future performance. When an account is updated to show payment, it’s refreshed and treated as a new item by the score but once paid, the impact will lessen over time before it falls off the report.

One way to look at it is this way - you lend someone $500 and they are supposed to repay you in full in 60 days. You create your budget including that $500 and the 60 days comes and you don’t get paid back so your budget is in the hole $500. You end up having to write that $500 out of your budget since you can’t get ahold of the person, dipping into another account to replace that $500. They don’t pay you for 5 years, avoiding you the whole time, and then one day you run into them at the grocery store and confront them about the debt and they pay you on the spot.

Are you now going to look at them as being worthy of another loan because they paid you back 5 years after intentionally dodging you or are they just as risky in your mind as the day that they messed up your budget?

If you look at FICOs from a personal perspective, they’re reputation scores. Once you have a reputation of not paying back debts, it understandably takes time for the reputation to recover.

Moving beyond the scoring algorithms, a paid off debt will make a new lender more willing to take a chance on you than if you submit an application with an unpaid item and that’s why it’s best to pay them in full if you can’t get a pay for delete.