- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Would You Dispute This Account if you Could?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Would You Dispute This Account if you Could?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Would You Dispute This Account if you Could?

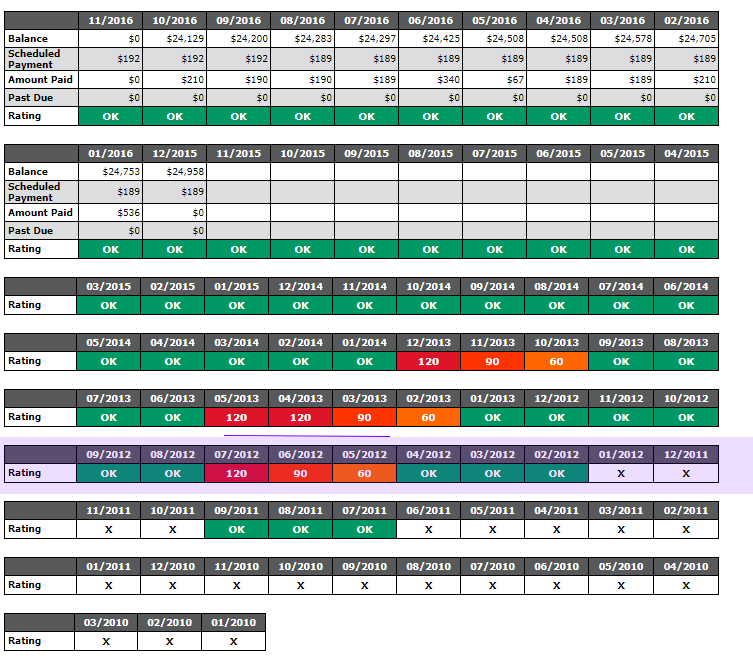

Please take a moment to look at this account. There are many late notices yes, but it also has 3 good years of on time payments which are most recent. I'm like to dispute the account but I've read they will usually just delete the whole account (the good and bad), so I'm hesitant.

The baddie is reported through company A who sold to my current company B starting Jan 1 2017 who is now servicing the loan. I asked them for goodwill to remove the baddies with reasonable explanations but they said I need to ask company B since they are servicing the loan. It sounds like they don't want to waste time on a loan they are not servicing, which could be a good thing. If I dispute with a CRA, they may likewise choose not to respond. I'm worried the whole account will be deleted though.

My current score is 648. I've been current the last 4 years paying 740 a month. I don't want to wipe out 3 years of this history since I only have a few other credit histories. Only one department store credit card that is open.

If you were in my situation, what would you do?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Dispute This Account if you Could?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Dispute This Account if you Could?

You have not given us enough info to be able to decide. This is because the decision relies upon what else is in your credit report, which only you can see. For example, if you have other accounts that are some years old, the deletion of this one will not hurt your average age of accounts nearly as much as if you only have much more recent credit besides this one. We also don't know how many other negatives you have, or how many positive accounts you have. This really is going to depend heavily on what else your credit report says. If you have other accounts showing good payment history over the last few years, then I would imagine that this one reporting negatively probably hurts your score a bit more than the last 3 years help it. But again, this is all just guesswork without knowing what exactly is on your credit.

I also do not buy the line you were fed that they need to check with the current debt collector who has the account---they are responsible solely for what they have reported on your credit, and if "B" is not the one reporting that info, then "B" has literally nothing to do with it. If B wants to report, that's their prerogative, but A cannot rely on B for its reporting. I'd say you are correct, in that A is not really interested in doing much because there's no benefit for them now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Dispute This Account if you Could?

@buildingafuture The account with the negatives is closed, I think. They sold to another company so I think that means the old account is closed insofar as that company will no longer be updating with new reports. Technically, however, it is the same account I am paying on, just to another company.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Dispute This Account if you Could?

@bass_playr

I have about 7 accounts of history in the past (4 of which are student loans). My previous example is one of four of the student loans. Two other student loans have very similar track records (baddies but last 3 years all clean). I only have a few other credit histories other than these, all clean except one 30 day late.

7 accounts

4 student loans (23 baddies all together, over 5 120 late)

1 discovery card

1 bank of america card

1 paypal credit

Current

1 Kohnls Card

3 Student Loans

What is more valuable to my score, the recent 3 plus good years of payment on the account, or removing the 23 cases of negatives prior to this. Would the 18 months of positives on my new accounts after the loans have been transferred pick up the slack lost from loosing 3 years of recent, good history?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Dispute This Account if you Could?

What is the basis for a dispute of accuracy of the reported derogs?

A "dispute" that does not identify how the reporting is considered to be inaccurate can be dismissed without any requirement to investigate on the basis that it is "frivolous or irrelevant." Thus, unless you explain and/or document an actual inaccuracy,they will be under no requirment to investigate or verify anything.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Dispute This Account if you Could?

Thanks @RobertEG.

The basis for dispute is completely legitimate, payments should have been deferred after six months while I was still enrolled in college, and the other ones I was not employed at the time.

However, this information is not necessary to my initial question. Should I take the risk and dispute the account, knowing they could delete the account?

At this point it seems there is no clear answer. If they do delete the account it could make things much worse, or much better. It is a gamble!?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Dispute This Account if you Could?

If it is a federal student loan, then they may be required under mandatory reporting provisions of the Higher Education Act to report the loan to the CRA, and thus can only correct inaccuracies, but could not delete the entire account.

Is it a federal student loan, and if so, what type is it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Dispute This Account if you Could?

Wow! I would be so happy if they can somehow just correct the innacuracies while leaving the account on record! That would solve everything!

Alas, they are all private loans!

Atleast it still sounds like it is possible that they can simple correct the innacuracies. Would it help if I paid them to only correct the innacurraices?

The real question is though, can the CRA correct the report or does it absoluetly have to the company that sent the report in? It sounds like the company who submitted the report will likely ignore the report, so it would be up to the CRA to correct it, but, can they?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Would You Dispute This Account if you Could?

If you dispute via a CRA, then the ultimate legal determination is made by the CRA.

That is referred to as their "reinvestigation."

The CRA is required to refer a copy of the dispute to the furnisher of the disputed information, and the furnisher is required to respond back to the CRA with the results of their investigation. If the furnisher verifies the accuracy of the information as reported, the CRA will normally have no additional basis or documentation to support verification if the furnisher does not verify, so the CRA will be required, in their reinvestigation, to delete the disputed information. They would not delete the entire account, as deletion only applies to the information identified in the dispute as being inaccurate.

Thus, if the creditor fails to verify or correct, the CRA must delete unless they have independent basis for verification or correction.

However, if upon receipt of the dispute, the creditor decides to simply delete the entire account, they could do so.

By deleting the disputed information, the dispute is then rendered moot, and is dismissed by the CRA.

Thus, there is still a possibility of creditor deletion should they decide not to investigate the dispute.