- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- "Serious deliquency" notation on CR

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

"Serious deliquency" notation on CR

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Serious deliquency" notation on CR

That is from a Cap1 CO in 2018, paid Feb 21. Date of 1st deliquency July 2018, so I gather that's going to haunt me for 7 1/2 years, or until the end of 2025. On the CR, it lists "serious deliquency." Is that term going to hang around for the next 4 1/2 years? Supposedly the black mark doesn't count as much as it ages, maybe the terminology gets a little less ...awful...in a couple of years?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Serious deliquency" notation on CR

Any CO is a serious delinquency all the time its on file, however as it ages back in time post the last update it affects your Fico less and less.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Serious deliquency" notation on CR

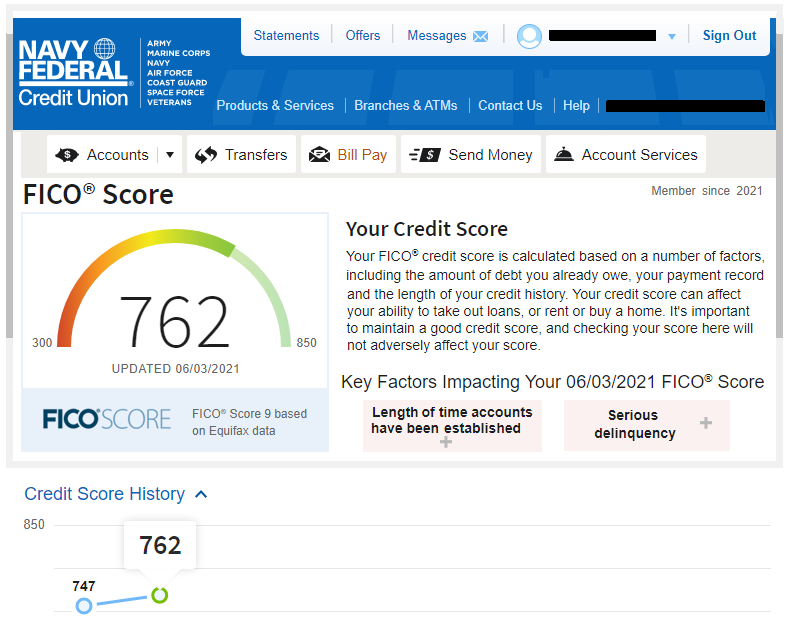

Greetings W261w261 ~ Unfortunately, the terminology will remain the same until the item purges . . . I have only 1 adverse item on my EQ report and that's from a 2016 BoA CO totaling $429.00 (scheduled to purge 12/2022). I've been told also that the "black mark" doesn't count as much as it ages -but- on my FICO 9 Score, I'm still 38 points from a 800 score -and- 88 points from a perfect 850 score. I still have 1.5 years and it's still haunting me even as my score increases . . . looking forward to it purging. My EX and TU reports are 100% clean as both deleted the BOA CO early.![]()

Current FICO 8 Score in 06/2021: EQ-796, TU-806, EX-812

Goal FICO 8 Score in 06/2022: EQ-825, TU-850, EX-850

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Serious deliquency" notation on CR

@babygirl1256 have you found that your F8 scores are less than the F9? I'm thinking that F9 is more focused on the past few years, and doesn't hold a grudge to the extent that F8 does. An oversimplification, I know. And while I'm at it, F9 doesn't seem to have gained traction as much as it should have by now. Like Bonnie Prince Charles, will it finally ascend only to be replaced by F10?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Serious deliquency" notation on CR

@W261w261 my scores are in my signature and my fico 8 are wildly lower than my fico 9 scores. I remember seeing somewhere and can't remember where that fico 9 treats paid off collections differently. Not sure if it was trustworthy source since I can't remember where I saw it from buy in my case would explain my situation.

*Edit. I did a quick Google search and found the article I was reading. Again no clue the validity of it but it's below for reference*

https://creditmashup.com/new-version-fico-better-collection-accounts/

Current FICO8 Score on 04/2022: EQ-681, TU-668, EX-665

Current FICO9 Score on 04/2022: EQ-676, TU-707, EX-724

Goal FICO8 Score: EQ-720, TU-720, EX-720

Credit Cards

Discover IT (1/15/2021) - $1,500 SL

Capital One QuickSilver (3/4/2021) - $300 SL

NFCU Cash Rewards Mastercard (4/12/2021) - $6,000 SL

NFCU Cash Rewards Visa (5/31/2021) - $23,000 SL

Lowes Advantage (9/3/2021) - $6,000 SL

Directions CU Rewards Visa (9/9/2021) - $1,000 SL

Amex Blue Cash Preferred (2/13/2022) - $1,000 SL

PenFed Power Cash Rewards Visa (2/15/2022) - $2,000 SL

Capital One Platinum (3/1/2022) - $2,000 SL

Total CL - $42,800

PenFed Auto Loan at 4.4% APR(12/26/2021)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Serious deliquency" notation on CR

Not that my scores and scenario are the same as above, but my FICO 8 scores are anywhere 23 points to 62 points lower than my FICO 9 scores. However, as I alluded to above, my issues were more of a Chapter 13 nature where my last "Derog" was my filing back in February of 2015, then in credit never-never-land until early last year, and since then all PIF every month before the statement cuts. Even still, my FICO 8 definitely represent the lowest of my scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Serious deliquency" notation on CR

I went 120 on 2 accounts in 2018. Cap1 CO'd when I defaulted on a payment plan, and I paid Merrick. Nothing went to collection, and I eventually settled for less with Cap1. The referenced article talks about F9 v F8 in terms of medical collections and paid collection accounts. It doesn't say anything about CO's. Perhaps the CO doesn't count per se, but the 120+ lates still speak for themselves.

In any case, my F9 is about 20 pts higher than my F8. As an aside, I opened 4 new accounts in the past 60 days: Amex Gold, Amex Delta Res, Navy Sig Visa, and Synchrony Lowe's. Amex was SP (existing cust) the others were 1 HP each. I needed 5k spend on the Delta Res, so shifted a chunk of spend right away over to it and got caught by Amex's quicker reporting of new accounts, so had 2k on the Gold and 5k on the Delta report. So AZEO went away this cycle. All those things cost me about 20 points on both F8 & 9 (not unreasonable I think), but my Vantage scores fell right out of bed, 45 pts TU and 65 on EQ. The Vantage scores are at the moment slightly above and slightly below my F8's. Kind of funny; that thing is so volatile! Glad it's not all that important. I'll have AZEO back this month so I'm curious how much the Vantage score will recover, eg was it the new accounts, the two HP's, or the UTIL up to 28% that caused the nosedive?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Serious deliquency" notation on CR

@W261w261, very interesting data points regarding your FICO vs. Vantage. Oddly enough, since my Chapter 13 discharge in March 2020, it has been my FICO 8 numbers which have been by far the most volitiale; my Vantage numbers have swung up and down within a range of 28 points, my FICO 8 numbers have swung within a rage of 63 points, and as things stand today, they are hovering roughly 30 points below Vantage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Serious deliquency" notation on CR

It's certainly entertaining. My Vantage score peaked at I think 780, it's now dead even with my EX F8, 695. If the Vantage was an airplane, the passengers would be plastered on the ceiling, screaming throwing up, praying. Then the nose points up, and they're jammed into their seats as the plane rockets back up. Makes a good movie, but as an underpinning to financial decision-making, sounds nicht so gut to me.