- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- "Sweet Spot" (According to EX)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

"Sweet Spot" (According to EX)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Sweet Spot" (According to EX)

Hello, all.

I use myfico premier, but also research alot. I was reading on EX blogs that 3 revolvers and 2 installment loans is the "sweet spot" for lenders (they didn't specify FICO or manual review, though). I currently have 2 open CCs, and no open installment loans. I understand the need for the 3rd revolver for AZEO.

My questions are:

1) Is this 3/2 mix just min/maxing, or a big deal?

2) Isn't one open installment enough for credit mix points?

3) Is the gain enough to justify a major AAoA hit for 3 brand new accounts?

4) I assume since I'm in rebuilding mode, using Opensky, Self, and CreditStrong would be best in order to avoid any HPs?

Thank you so much for your input!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Sweet Spot" (According to EX)

@Anonymous wrote:Hello, all.

I use myfico premier, but also research alot. I was reading on EX blogs that 3 revolvers and 2 installment loans is the "sweet spot" for lenders (they didn't specify FICO or manual review, though). I currently have 2 open CCs, and no open installment loans. I understand the need for the 3rd revolver for AZEO.

My questions are:

1) Is this 3/2 mix just min/maxing, or a big deal?

2) Isn't one open installment enough for credit mix points?

3) Is the gain enough to justify a major AAoA hit for 3 brand new accounts?

4) I assume since I'm in rebuilding mode, using Opensky, Self, and CreditStrong would be best in order to avoid any HPs?

Thank you so much for your input!

The standard rebuild kit is:

3 revolvers (preferably implementing AZEO technique)

And

1 installment loan (auto, personal, secured, SLs, etc.)

For max credit mix points

That is my understanding and it seems to have given me a good boost with that in combination with AZEO. My installment loan is now below 28%, so I just got another bump. Ideally if you can do the SSL technique, that is the best option. I believe the most popular is through NFCU, but I used Self and it still works, I just don't jave it at 8.9% for 5 years. It is no big because my SLs will be back on my credit reports just a couple months after my Self Lender loan is done.

The HPs are up to you. Depends on how many you already have and if you feel like you will qualify gor any secured or unsecured products.

And, yes, adding accounts lowers your AAoA, so it will depend on how solid yours is before adding several TLs to it.

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Sweet Spot" (According to EX)

My middle score is in the 810s with no installments and lots of new/young revolvers. I've also read on this site about someone with a perfect score with 1 revolver (possibly apocryphal). My point is that while there may be a perfect mix for scoring, you don't need it to have high scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Sweet Spot" (According to EX)

@VanderSnoot wrote:My middle score is in the 810s with no installments and lots of new/young revolvers. I've also read on this site about someone with a perfect score with 1 revolver (possibly apocryphal). My point is that while there may be a perfect mix for scoring, you don't need it to have high scores.

I believe it without a doubt!

Congrats on your awesome credit profile!

When rebuilding, though, we are trying to squeeze every point out where possible. I was mainly hitting the credit rebuild point, but again, you are absolutely right that it isn't a requirement for high scores for everyone. Every credit profile is unique and we don't conpletely understand who requires what to hit high scores. So it doesn't hurt to go down the tried and true path (for many, obviously not an absolute for all) for the immediate and then down the road it may be completely unnecessary to maintain high scores and one can deviate once they have a more solid profile.

My SO is rebuilding with 1 bankcard of his own, one new bankcard as an AU, and a Self Lender loan, and he has made leaps and bounds in score gains over my 3:1 rebuild kit, but who knows what it is?

He has less baddies?

He has a slightly thinner file than me?

These are his first revolvers ever in his 18 year old credit file?

I can only make guesses at this point, but it is fascinating to watch how our scores fluctuate in rebuild, side-by-side in comparison with many similarities, but still a few differences seem to make or break the progress seen!

Thanks for sharing! It is always neat to see how others have achieved high scores outside the box!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Sweet Spot" (According to EX)

Thank you guys for the awesome input!

Not to derail my own thread, but do you know if the SSL technique would work on Self? I understand it would take a chunk of money. So...if a brand new Self Lender $500 account had $460 immediately thrown at it, would that make the next payment due in X-teen months, or just go toward the principle and still have a payment due the next month? If so, it would be pretty pointless, as the note would be paid off just a few months later.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Sweet Spot" (According to EX)

@Anonymous wrote:Thank you guys for the awesome input!

Not to derail my own thread, but do you know if the SSL technique would work on Self? I understand it would take a chunk of money. So...if a brand new Self Lender $500 account had $460 immediately thrown at it, would that make the next payment due in X-teen months, or just go toward the principle and still have a payment due the next month? If so, it would be pretty pointless, as the note would be paid off just a few months later.

Can't do the early pay with Self, only one month ahead or you shorten the term.

NFCU is popular but some can't get in.

I just paid off my Self and opened loans with AOD and SECU MD.

It looks like AOD lets you do the early pay, as I've paid down a huge amount and have had 0.00 payment due on my next due dates. It costs $5 donation to join AOD through the bike club. Worth it for me at least.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Sweet Spot" (According to EX)

@Anonymous wrote:

@Anonymous wrote:Thank you guys for the awesome input!

Not to derail my own thread, but do you know if the SSL technique would work on Self? I understand it would take a chunk of money. So...if a brand new Self Lender $500 account had $460 immediately thrown at it, would that make the next payment due in X-teen months, or just go toward the principle and still have a payment due the next month? If so, it would be pretty pointless, as the note would be paid off just a few months later.

Can't do the early pay with Self, only one month ahead or you shorten the term.

NFCU is popular but some can't get in.

I just paid off my Self and opened loans with AOD and SECU MD.

It looks like AOD lets you do the early pay, as I've paid down a huge amount and have had 0.00 payment due on my next due dates. It costs $5 donation to join AOD through the bike club. Worth it for me at least.

AOD does the SSL?

Please update when you find out when your next actual due date is, please!

I have checking/savings with them and wouldn't mind doing this after my Self Lender is done!

Thanks!

Edit: will it be another HP for the SSL? I already took one to join and really do not want another!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Sweet Spot" (According to EX)

@Anonymous wrote:Thank you guys for the awesome input!

Not to derail my own thread, but do you know if the SSL technique would work on Self? I understand it would take a chunk of money. So...if a brand new Self Lender $500 account had $460 immediately thrown at it, would that make the next payment due in X-teen months, or just go toward the principle and still have a payment due the next month? If so, it would be pretty pointless, as the note would be paid off just a few months later.

As @Anonymous stated above, it will not advance the due date, it will instead shorten the term of the loan. Since I found that out, I just pay it every month for the positive reporting credit history. I totally agree with you, it is pointless to pay it off rapid-fire!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Sweet Spot" (According to EX)

@Anonymous

I got an unsecured personal loan from them, but I'd assume you can pay it and a secured one from them the same way. It does have a disclaimer saying that it may not advance your next due date, though.

I used same HP from initial CC application. Couldn't get their CC because I'm underage ![]()

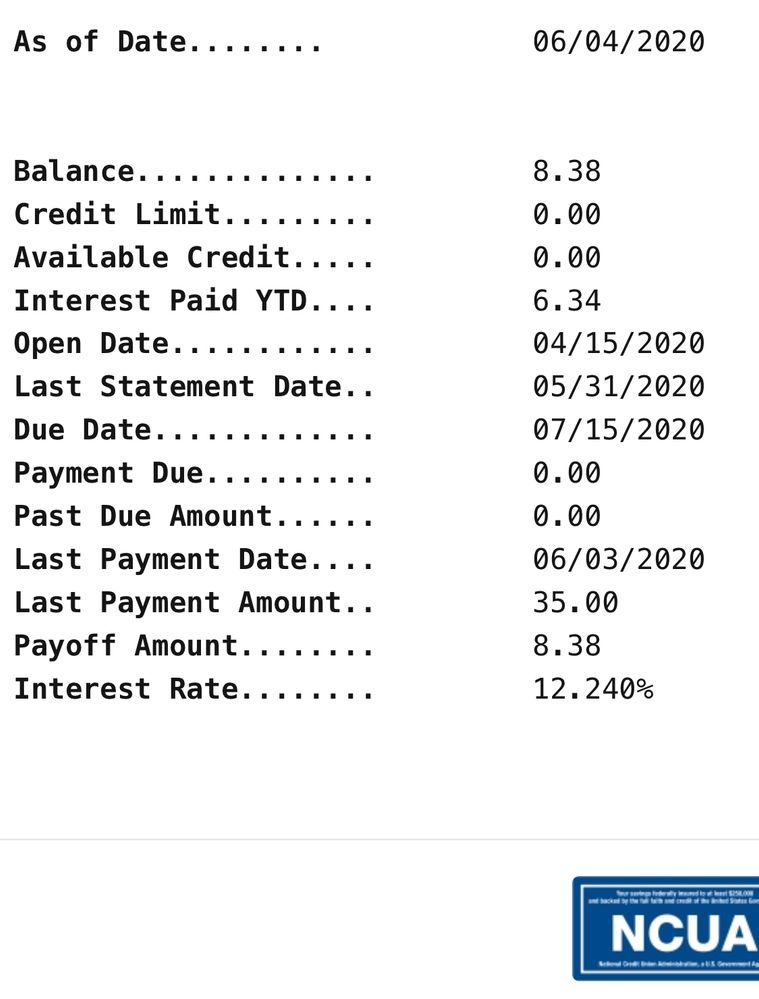

My next due date is 7/15, payment due 0.00. Was the same due on 6/15 because I paid it down before then.

When it reported the new balance this month my total loan utilizations went from ~18% to ~5.5%, +18 on EX; probably getting much more points from the upper util thresholds + credit mix I've had prior.

Much less interest and no fees compared to Self.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: "Sweet Spot" (According to EX)

@Anonymous wrote:@Anonymous

I got an unsecured personal loan from them, but I'd assume you can pay it and a secured one from them the same way. It does have a disclaimer saying that it may not advance your next due date, though.

I used same HP from initial CC application. Couldn't get their CC because I'm underage

My next due date is 7/15, payment due 0.00. Was the same due on 6/15 because I paid it down before then.

When it reported the new balance this month my total loan utilizations went from ~18% to ~5.5%, +18 on EX; probably getting much more points from the upper util thresholds + credit mix I've had prior.

Much less interest and no fees compared to Self.

Yeah then probably no-go for me then. I will not take another HP for that place right now lol i won't burden you with my terrible experience with them, but I cant even get a secured CC for $300 because of my DTI (which they deemed like 300% when it is like 1%) and apparently they only look at 1 number on your paystubs (less than 1/6th of my actual annual income)

Thanks for the feedback!