- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Relationships and Money

- the worst part of helping friends with credit

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

the worst part of helping friends with credit

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the worst part of helping friends with credit

@TheBoondocks wrote:Loyalty means nothing anymore, I had to learn that the hard way. Even if you knew them for years, the trust could go away in a second. It's very sad, this generation is really messed up. But, I would have thought he would be responsible enough but I guess age doesn't really say much.

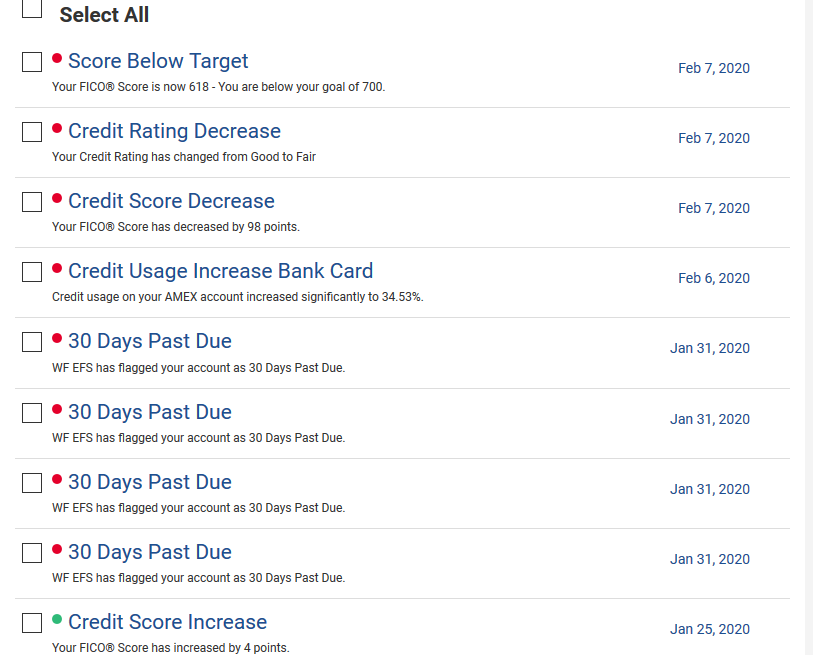

he must be 67 or 68. if he cannot pay something on-time at this point I have no response. this is not a single 30 day, this is 4-30 day lates. I love and care for this indiviudial but I will not invest a second relating to his credit going forward

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the worst part of helping friends with credit

@bourgogne wrote:

@TheBoondocks wrote:Loyalty means nothing anymore, I had to learn that the hard way. Even if you knew them for years, the trust could go away in a second. It's very sad, this generation is really messed up. But, I would have thought he would be responsible enough but I guess age doesn't really say much.

he must be 67 or 68. if he cannot pay something on-time at this point I have no response. this is not a single 30 day, this is 4-30 day lates. I love and care for this indiviudial but I will not invest a second relating to his credit going forward

At the core of most financial problems is a failed human element. Greed or pride driving someone to live beyond their means. Love or loyalty to trick someone into co-signing or loaning money to a high-risk borrower. Empathy or sympathy driving people to give away money to causes or funding campaigns with little or no understanding that their money won't actually do any good or make any differences.

Things like loyalty make for clever Instagram posts and sappy Hollywood movies, but they don't mean anything and never meant anything. A family that bails water together sinks together.

Never mix finance and personal. Don't spend, borrow, or loan money to someone because it feels like the nice/loyal/caring thing to do. Don't even try to advise them unless they ask first. We owe our families and friends nothing, and they likewise owe us nothing.

Sorry that you've both had to learn this lesson the hard way.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the worst part of helping friends with credit

@bourgogne wrote:is when they care less about the process than you do. how in the world can somebody be so out of touch that they let 4 loans spin out of control and have ALL 4 results in a 30 day late? I have known this man for 45 years. he is special to me. we were on our way to see alan parsons at the saban last night - great show btw - and thought I would look at his credit which I have not done for a while. wow, what a surprise, 98 pts gone in a flash. all the hard work I have invested into helping this man. very disappointing. as a side note will there be any luck in trying to get WF EFS late removals and if so what is the right way to go about it. maybe I will post in the rebuild area. sorry for venting but I guess I will just never understand people. is is so flipping hard to just pay ones bills ontime? have a nice weekend all

It's always ok to vent or we'll all explode if we didn't. Unfortunately, we can only control what we can control. So don't lose sleep over it or stress the heck out. Things have a way of working themselves out whether we have a hand on it or not...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the worst part of helping friends with credit

You can lead a horse to water, but you can't make it drink.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the worst part of helping friends with credit

I've helped people for years. Everybody from the president of the company where I once work fix his personal credit to Uber drivers I met once. Most of them increase their score a 100 points or more and are satisfied though there is more work to be done. They get lazy. Their scores have improved. Return receipt mail costs money. They get approved for a decent card.

There is one person who now helps people. She followed through and removed all late payments and CO. Now she bought a house. Bought two vehicles. Has really good CC. She made it worth it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the worst part of helping friends with credit

I'm not sure if it's been asked yet, but is he in financial trouble?

But I've been there .. I helped my ex build her credit from being non existant to high 600's at the most. Her CC utilization kept it from going any higher. But for years, I busted my hump making sure everything was paid on time, requesting CLIs, getting better cards and transferring balances, etc. After we broke up, I started getting calls from the CC companies and debt collectors so I know she wasn't paying on anything. Just out of curiosity I checked her old Credit Karma account, and her scores were in the 400's.

EQ: 1/2018: 494 | 4/2021: 652 (+158)

TU: 1/2018: 536 | 4/2021: 657 (+121)

EX: 1/2018: 499 | 4/2021: 641 (+142)

Mortgage Scores:

EQ: 9/2020: 560 | 4/2021: 648 (+88)

TU: 9/2020: 564 | 4/2021: 649 (+85)

EX: 9/2020: 576 | 4/2021: 672 (+96)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the worst part of helping friends with credit

I'm currently dealing with this with a close relative. It is beyond frustrating, especially when they've seen all the work that I've done on my credit in recent years.

Starting FICO 8s | 06/2018: EX 601 ✦ EQ 605 ✦ TU 590

Starting FICO 8s | 06/2018: EX 601 ✦ EQ 605 ✦ TU 590Current FICO 8s | 9/2022: EX 732 ✦ EQ 739✦ TU 743

2023 Goal Score: 760+

Business Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the worst part of helping friends with credit

I'm dealing with the same thing with my DM. She cleaned up her credit a few years ago but wanted my help to keep going after she saw the strides I was making.

I had her apply for the Chase FU earlier this year as she needed a general spend card and a balance transfer.

We made a plan to transfer her balances and she agreed to pay it off according to our plan along with all other charges she made.

Needless to say, that plan went out the window in two months and she had another maxed out card. So frustrating...

The best/worst part is that she has zero derogs. Her scores would be great if she simply paid her cards off and didn't see it as "free" money.

I don't know what to do with her.

My younger DS also came to me for advice about paying down her CO's and fixing her credit. I had her apply for a Cap1 QS which she was approved for. Credit steps starting limit. It was only a few months before she wasn't paying her charge offs down, her QS was maxed out and she had brand new student loan lates.

It seems like my DS wants to be a bit too much like our DM.

Meanwhile, my DF has amazing credit and has had an AMEX in his wallet since the 80's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the worst part of helping friends with credit

It's so tempting to go on a spending spree when you get that new card .. I've been guilty of it when I started getting store cards a few years ago. Balances add up quick and before you know it, you're either maxed out or over 50% util on all of your $300 limit Comenity cards and only able to make minimum payments. But, as soon as you make a few payments, you spend again and the cycle continues.

EQ: 1/2018: 494 | 4/2021: 652 (+158)

TU: 1/2018: 536 | 4/2021: 657 (+121)

EX: 1/2018: 499 | 4/2021: 641 (+142)

Mortgage Scores:

EQ: 9/2020: 560 | 4/2021: 648 (+88)

TU: 9/2020: 564 | 4/2021: 649 (+85)

EX: 9/2020: 576 | 4/2021: 672 (+96)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: the worst part of helping friends with credit

@vertekal wrote:It's so tempting to go on a spending spree when you get that new card .. I've been guilty of it when I started getting store cards a few years ago. Balances add up quick and before you know it, you're either maxed out or over 50% util on all of your $300 limit Comenity cards and only able to make minimum payments. But, as soon as you make a few payments, you spend again and the cycle continues.

This is also why trying to help kids, loved ones, or friends in the credit world by helping them boost their score (authorized users, etc) is misguided help. Until the problem of uncontrolled spending is addressed, all of the credit boosting in the world cannot help someone...and in some cases it will hurt them as it enables them to continue with their uncontrolled spending problem. Likewise, solve the spending problem and the credit score problem takes care of itself in time with no external assistance required.