- myFICO® Forums

- This 'n' That

- SmorgasBoard

- Being Judged for your CC at high end stores

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Being Judged for your CC at high end stores

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being Judged for your CC at high end stores

At the beginning of my rebuild, I was in Walgreens and handed the cashier my CreditOne Platinum Visa, to which she said, "ooohhhhh platinum. fancy!"

LOL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being Judged for your CC at high end stores

@Anonymous wrote:At the beginning of my rebuild, I was in Walgreens and handed the cashier my CreditOne Platinum Visa, to which she said, "ooohhhhh platinum. fancy!"

LOL

LOL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being Judged for your CC at high end stores

@Anonymous wrote:

@coreysw12 wrote:That said.... when I go on a first date with a new girl, I generally don't pay for dinner with the Cap1 card

Are you embarrassed by your Cap One card? Using that card like taking her to McDonald's on a first date?

Nah I was just joking about that, it would just be silly to use the Cap1 card for that and miss out on 2x UR points! She might judge me for my inability to maximize points earning ![]()

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being Judged for your CC at high end stores

@coreysw12 wrote:

@Anonymous wrote:

@coreysw12 wrote:That said.... when I go on a first date with a new girl, I generally don't pay for dinner with the Cap1 card

Are you embarrassed by your Cap One card? Using that card like taking her to McDonald's on a first date?

Nah I was just joking about that, it would just be silly to use the Cap1 card for that and miss out on 2x UR points! She might judge me for my inability to maximize points earning

I dine a few times a year at a local restaurant full of wealthy seniors. I pull out my Cap One card, and I have to say I did think about it once (a misfit for the establishment), where other diners have high-end cards.

And I have to say, my Savor is all black--- so that it doesn't look like a Cap One card, except the Capital One logo is at the top right. I ought to paint over it with black paint lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being Judged for your CC at high end stores

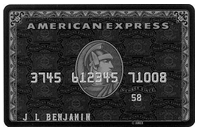

I have only seen a black Amex twice in my life. That's probably the only card that made me wonder (for all of 5 seconds) what the person did for a living.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being Judged for your CC at high end stores

I never really thought about it and normally buy online only or I use apple pay at the stores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being Judged for your CC at high end stores

@OmarR wrote:I have only seen a black Amex twice in my life. That's probably the only card that made me wonder (for all of 5 seconds) what the person did for a living.

Same, I've only ever seen it once, and I knew what the guy did for a living so I mostly wondered how he, as a doctor, managed to get an invitation. Must be a hell of a doctor.

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being Judged for your CC at high end stores

@coreysw12 wrote:

@OmarR wrote:I have only seen a black Amex twice in my life. That's probably the only card that made me wonder (for all of 5 seconds) what the person did for a living.

Same, I've only ever seen it once, and I knew what the guy did for a living so I mostly wondered how he, as a doctor, managed to get an invitation. Must be a hell of a doctor.

Well, then I got a lot of work to do to make my black Capital One card look exactly like the Amex. Man, that's a lot of detailed painting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being Judged for your CC at high end stores

Guess I don’t haunt the places where people have stuck-up attitudes?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being Judged for your CC at high end stores

@Anonymous wrote:

@Anonymous wrote:

They don't care.

...which is why I usually make sure to make my metal cards "ping" multiple times before handing it to them so they know how impressive it is. If they still don't care after that, I usually tell them my credit limit.Haha this post made me really laugh!!

But what if this wasn't a joke? ![]()

Quoting your credit limit and FICO scores

always seems to impress people I talk to.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.