- myFICO® Forums

- This 'n' That

- SmorgasBoard

- Re: How many credit cards do you have?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How many credit cards do you have?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many credit cards do you have?

@Aim_High wrote:

@Anonymous wrote:@Aim_High

You may want to add into your mix aesthetics! Keep some eye appeal?Thanks @Anonymous but not sure: do you mean more colors for eye appeal or just not so few cards?!

Those five from the aesthetics standpoint would give me a gold, blue, grey, white, and garnet so it would seem a little more mixture than my previous color pallette of blue and silver/grey!

Eye appeal! No relation to functionality or need ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many credit cards do you have?

I had 5 -- recently closed 2. I don't really want to deal with any more than 3.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many credit cards do you have?

@Anonymous wrote:I have 13. They are all cashback except my navy federal platinum card. I would love to pc my double cash to citi custom cash when its available. And I wonder what is going to happen to my beloved bbva clearpoints when it officially goes to pnc. I saw on the website I will get a package late aug on whats going on with the card.

Down to 11.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many credit cards do you have?

I've got 12 currently, though I only use 6, with 2 as backups. The other 4 are sock drawered.

The DoubleCash will come back into rotation when it comes out of its cacoon as a Custom Cash, however that is going to take some time. ![]()

TO

TO

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many credit cards do you have?

@csryang wrote:

@Taurus22 wrote:That's a loaded question. It depends on how you manage your credit and your cards and the purpose you have for each individual card. Some people like to "collect" cards. See @Gmood1 (I think at last count he was sitting on about 68 cards in his siggy?) But everyone has their own agenda. Some people like a lot of Travel cards for mileage points. Some like myself, are Cashback junkies who want to restrict themselves to as few cards as they can while covering their cashback needs.

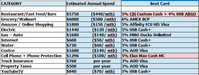

Ex: Currently I have 10 cards, as you can see from my Siggy below. I am planning to acquire 3 more at this point. However, the 3 cards in my sock-drawer will be going away.....Uber will be replaced by Elan Max Cash, Citi DC will hopefully be PC'ed to the Custom Cash, I'm also adding US Bank AltitudeGO, and I'll be closing the First Citizens card altogether. That will keep me at 10 cards, but all of my major annual spend will be covered with the best cashback cards I can get for those categories. (Until something new comes along)

[Obviously, the ones in red I haven't app'ed for yet]

The only thing I don't really have covered is Travel....but I don't travel enough to make a dedicated card worthwhile. Some of my other cards have the versatility to be used for Travel should I need it, such as BoA Cash Rewards and AOD Visa @ 3%.

Once I have the 3 cards I need, I will focus more on getting CLI's on my existing cards to increase my overall CL and keeping tabs on possible back-up cards for these in case one gets discontinued, etc.

But this is my methodology. Everyone is different and has different needs and/or objectives. So, to ask how many is too many......is entirely up to you.

Why are you adding altitude go for its 4% on dining vs 5% custom cash?

Also I thought Amex BCP 6% supermarket does not seem to cover Walmart, does it? So I hope you have better cards covering Walmart expenses.

Well, he could be like my in-laws. They wouldn't be caught dead at Walmart. So there is that. If you are rich enough you can do stuff like that I guess. Still not too smart but hey, it is only money. Also, Amex BCP is not really 6% since you need to deduct the annual fee.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many credit cards do you have?

@Citylights18 wrote:I have 12 credit cards but out of that I only run a balance on 5 of them. TCL across the 12 is $222,600.

4 of them I PIF every month, the other one is a store card that I have a 0% APR promotion.

I pay $389 in AF across all that cards but that includes:

-Amazon Prime yearly membership ($119)

-Free night at Hyatt ($150-$350)

-Uber Eats pass ($120)

-AMEX offers ($50-$100)

-Chase offers ($50-$100)

-Loungebuddy ($100)

Conservatively at least $589 of direct perks against the $389 in AF that I pay.

Why are you listing the Amazon Prime membership fee? That is not a requirement to have the card (you would get 3% back instead) and did you just sign up for membership to get the card or were you a member before. If you were that is not an extra expense at all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many credit cards do you have?

I have 17 Personal CCs(12 Bank CCs and 5 Credit Union CCs)Total Limit $131.8K and 1 Business CC(Bank CC)Total Limit $9K

this has been a 5 year rebuild journey since Nov 2016. I'm in the garden for a while.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many credit cards do you have?

Before my BK, I had 9 or so cards, with about 10k in limits.

Now I have 4 Credit Cards, 1 Store Card (fingerhut) and 1 card that survived BK but I can't actually use, as I'd have to go to the store that is halfway across my state to use it.

Realistically only 2 of my cards are worth keeping and I will be getting rid of atleast 1 of them coming this april.

1+ Year Post BK

Credit Limit: 6000

EDC: QuickSilver 1 1.5% $39 AF

Oldest Account: Tire Card $500 0% APR 6 Months After purchase. 2018. (Survived Bankruptcy)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many credit cards do you have?

maybe 30 or so. i use whichever one that makes me the most $

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many credit cards do you have?

t turns out that I have very few credit cards, only 3 in total. In fact, I try to use credit money very little, it is better to make more of my own money. There is too much risk to get carried away by a freebie and not calculate your financial capabilities.