- myFICO® Forums

- This 'n' That

- SmorgasBoard

- How to use money wisely -- 100K a year income - li...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How to use money wisely -- 100K a year income - living paycheck to paycheck.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to use money wisely -- 100K a year income - living paycheck to paycheck.

Can anyone provide some advice?

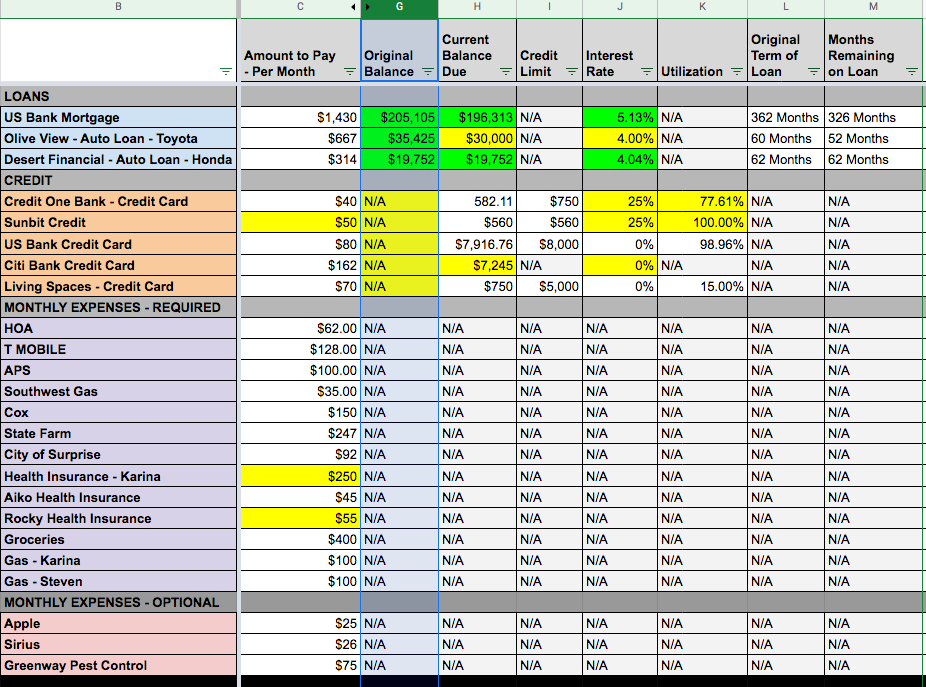

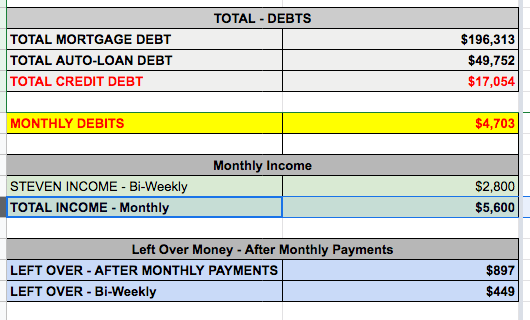

I live paycheck to paycheck despite making 100K a year - or about 6K a month after taxes.

The only real solution I have - is to be super strong willed - and dont go out or do anything that will waste money.

Save all extra money - and use it to reduce debts - get 6/12 month long auto insurance policy so its more cost effective.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to use money wisely -- 100K a year income - living paycheck to paycheck.

Wow thats some in depth details. I see 3 different insurance, and I also noticed the Toyota payments are double the Honda payments. I think you have great accountability of knowing where your finds go. For extra income have you ever considered renting out a room in your home or making it a airbnb?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to use money wisely -- 100K a year income - living paycheck to paycheck.

I see a couple of places you could cut back.

1. T Mobile. See if you can get a cheaper phone plan

2. Cox. See if you can drop cable and go with cheaper streaming options.

3. Sirius. Depending on how far you drive, this might be extraneous.

CC work

stop using them

attack your lowest one, then move on to the next lowest. Each payoff, swing that money over to the next one

make all min payments except for the list below. Put all extra $ on the one you are focusing on paying off first

1. Sunbit. Should be paid off in Jan

2. CreditOne should be done by Feb

3. Living Spaces. Should be done by Feb/March

4. USBank You will now have an extra $160 to throw at this, since the above 3 are at zero

i see that this is very doable over the next 12 months.

your scores will follow this process. And increase monthly.

Jan 25/2024 EX. 774 EQ. 751 TU 758

Inq. EX 2 EQ 3 TU 6 - - CC 2x24, 0x12

Amex BCP $35k - Apple GS $21k - BMW/Elan $19k - Cap1 QS $16.7k - Chase Amazon $13.6k - Chase Bonvoy Bountiful $10k - Chase United Club Infinite $26k - Citi CustomCash $3k - Citi DC $14.5k - CreditUnion1 $9k - DiscoverIT $31.5k - PayBoo - $15.6k - Penfed Gold - $19.3k - USB AltitudeGO -$19k- USBank Cash+ -$25k - PenFed LOC - $20k - USB LOC - $15k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to use money wisely -- 100K a year income - living paycheck to paycheck.

Pest Control is a bit high. A lot can be learned online and it is very cheap to DIY here. You typically don't need this every single month. Is there a reason you are paying $900 a year on this? I would cancel this immediately and put that money towards your 25% interest CC.

I would comparison rate shop State Farm. Make sure you are getting all your discounts possible with State Farm, talk to your agent. Let them know you are looking to reduce your rate without reducing your coverage. Make sure you don't have any overlapping coverage. For example, do you need towing if you have it on a credit card (if applicable). Saving on the margins really helps over the long run.

T-Mobile - See if you can bargain for a lower deal. Call the retention department. See if your work gives you a discount. There should be a T-Mobile corporate advantage plan of some sort where you can input your email to see if you can get a discount.

Cox - Call their retention department. Do you need all those channels? See if they can get you into a promo discount. Almost all cable providers offer discounts.

Sirius - Definitely call their retention program. They very readily offer discounts.

Groceries - Groceries are definitely a necessity but you can save on the margins here through bargain hunting and buying mostly what's on sale and shopping at the right stores.

Lastly - Are you happy with your job? Have you been there long? Are you due for a raise but are too afraid to ask? Best way to get a raise IMO is find a new job. It doesn't hurt to look around unless you are 100% happy with your employer, work culture, and payrate. Increase your income either via raise, new skills\certifications, new job, and/or side hustle. Are you doing all you can?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to use money wisely -- 100K a year income - living paycheck to paycheck.

Your calculations include Bi-weekly payroll of $2,800, which I presume is net of withholding and Social Security, since your headline is $100k annually.

$2,800 bi-weekly is 26 pay periods a year, so that works out to $6,066 per month, with two months out of the year you get an extra lump of $2,800 to get to that average.

With all the expense amounts, that should leave $897 on any given month, and $1,300 on average through the year. So outside your budget, and living paycheck to paycheck, that implies you are spending $1,000 per month on non-budgeted items.

If you review your last few months activity, what was spent on that non-budgeted ~$1,000 per month?

You will want to focuse on paying down the US Bank and Citi cards, since that nice 0% will expire before long, and they will start adding substantial interest each month. It's easier now to pay it down, you get a lot better traction, than in the future when the sand around the debt keeps slipping back in the hole you are trying to shovel out of.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to use money wisely -- 100K a year income - living paycheck to paycheck.

You make $100K/yr and have $50K debt in cars.

I would get rid of the cars, take the hit on the negative equity, and drive cheap cars.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to use money wisely -- 100K a year income - living paycheck to paycheck.

Very interesting thread, this mirrors my situation almost exactly. Except I'm single and rent my home. But otherwise, very similar. I might copy your excel format and put together my own and see what it looks like.

I also have 100k income and live pretty close to paycheck to paycheck... which is insane to think about, but it's true. California is expensive. I'm guessing you live in AZ, since one of the bills is "City of Surprise"?

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How to use money wisely -- 100K a year income - living paycheck to paycheck.

@OmarR wrote:You make $100K/yr and have $50K debt in cars.

I would get rid of the cars, take the hit on the negative equity, and drive cheap cars.

This. Total auto debt (car notes + insurance + maintenance + fuel) absolutely wrecks many budgets. Cars should consume no more than 10% of one's income, less is preferred.