- myFICO® Forums

- Types of Credit

- Student Loans

- Completed Loan Rehab - Still showing US DEPT OF ED...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Completed Loan Rehab - Still showing US DEPT OF ED/GLELSI Late payments

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Completed Loan Rehab - Still showing US DEPT OF ED/GLELSI Late payments

Hey myFICO Familia,

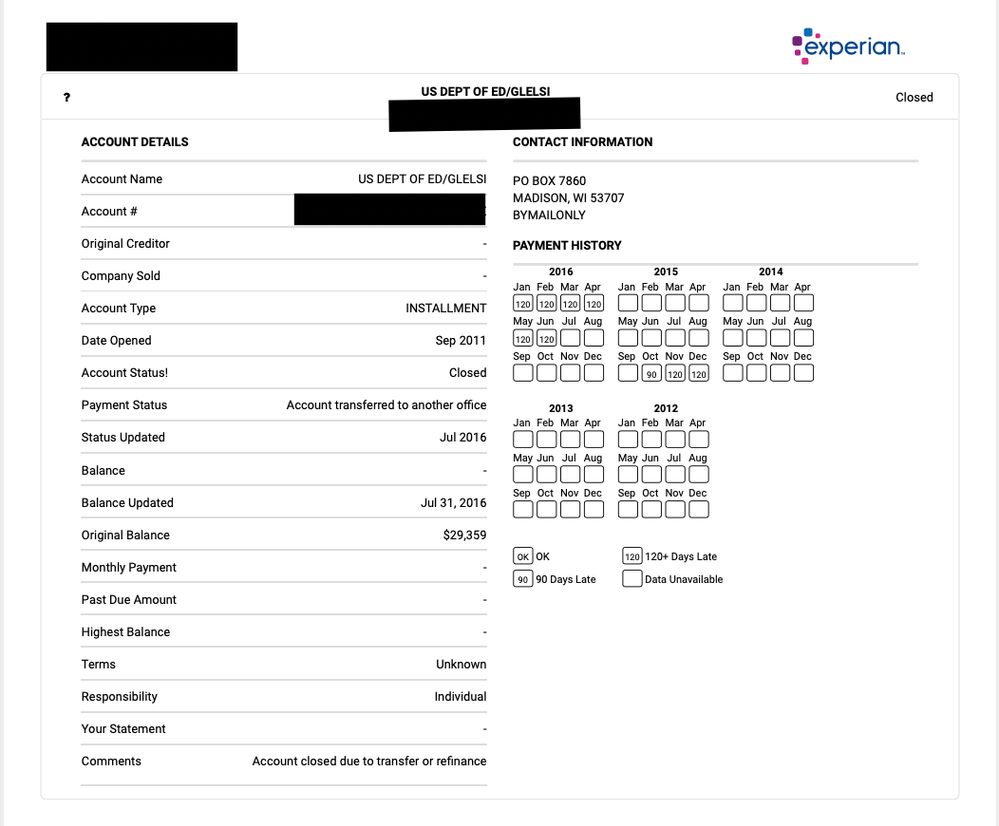

I completed my Student Loan Rehab last year and all my negative, defaulted accounts except one "US DEPT OF ED/GLELSI" with 9 late payments of 120+ days remain. Nelnet picked up the defaulted loans and report positive from when I started school.

How do I get "US DEPT OF ED/GLELSI" this account to be removed or am I just unlucky?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Completed Loan Rehab - Still showing US DEPT OF ED/GLELSI Late payments

Do you mean the default accounts are still there or just that the accounts from before the default still show up on your credit report?

Rehab removes the default, but it does not remove the old accounts with the lates unfortunately.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Completed Loan Rehab - Still showing US DEPT OF ED/GLELSI Late payments

@Anonymous wrote:

Hi,

Do you mean the default accounts are still there or just that the accounts from before the default still show up on your credit report?

Rehab removes the default, but it does not remove the old accounts with the lates unfortunately.

@Sabii "Rehab removes the default, but it does not remove the old accounts with the lates" — Pardon my ignorance but wouldn't the default account be the one with lates?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Completed Loan Rehab - Still showing US DEPT OF ED/GLELSI Late payments

Your old account (s) after just your old accounts. They remain in most cases and are rarely redlined through a dispute with the CBs. You could try though. Use your rehab completion letter. Wait until a few months after the rehab is done to be sure.

There are no guarantees though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Completed Loan Rehab - Still showing US DEPT OF ED/GLELSI Late payments

No, you can have lates and not default. The default actually makes the account negative, the lates mean that your tradeline is still ultimately "positive," just with a few dings (battered and tarnished, as it were).

I would send a goodwill letter to Great Lakes - explain that you rehabbed and that you are seeking a goodwill removal of the lates *or* the tradeline altogether. Great Lakes is one of the servicers I more often see positive information with regards to goodwill, so I think you have a good shot at it. Otherwise, it's 7 years until the lates fall off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Completed Loan Rehab - Still showing US DEPT OF ED/GLELSI Late payments

@calyx wrote:No, you can have lates and not default. The default actually makes the account negative, the lates mean that your tradeline is still ultimately "positive," just with a few dings (battered and tarnished, as it were).

I would send a goodwill letter to Great Lakes - explain that you rehabbed and that you are seeking a goodwill removal of the lates *or* the tradeline altogether. Great Lakes is one of the servicers I more often see positive information with regards to goodwill, so I think you have a good shot at it. Otherwise, it's 7 years until the lates fall off.

Hi @Calyx, @Sabii, or anyone ![]()

Can you both answer the below questions:

- Attempted to GW Great Lakes but they declined my offer as expected. I was shot down via email and phone call which I also expected I guess.

- Question: During the phone call the rep stated she could not help me and this matter would need to be handled with the US Dept of Education. I called them to which they said they didn't see anything "negative".

- Question: When I log in to the NSLDS—National Student Loan Data system no account with "US DEPT OF ED/GLELSI" or "Great Lakes" is shown or exists. Is this normal? I find that to be strange personally.

- Question: Can one of you point me in the "formal direct dispute for dummies" as I know disputing online is not smart!

A. If you can answer this, would I want to dispute the account or late payments? Apologies for the ignorance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Completed Loan Rehab - Still showing US DEPT OF ED/GLELSI Late payments

2. Without seeing it, I would say no. It's with Nelnet right now. I can't recall how or if it shows past servicers.

3. There's nothing to dispute as far as I can tell. Only with the CB maybe and technically idk that there's anything inaccurate. 7 years from Aug 2016 is Aug 2023. You could always try getting them off 6 months early with an early exclusion but it's probably just something that would have to fall off.

Sorry I couldn't be more helpful.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Completed Loan Rehab - Still showing US DEPT OF ED/GLELSI Late payments

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Completed Loan Rehab - Still showing US DEPT OF ED/GLELSI Late payments

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Completed Loan Rehab - Still showing US DEPT OF ED/GLELSI Late payments

@Mookey67 wrote:

That is the trade line prior to the default which is how it is suppose to read. Since default doesn’t occur until 270 past due on federal loans, if you dispute it then it will more than likely update and add worse delinquent marks up to default. Since it hasn’t updated since 2016, I would just leave it alone. Hope this helps

@Mookey67, @Sabii and All,

You have all helped affirm my suspicions. I was thinking if I disputed they could possibly update my report with worse delinquent marks. As someone on here once said, "Don't poke the sleeping bear". It sucks these 120/day late marks will hurt my score by 60+ points until 2022-2023 but I guess being an ignorant college kid haunts you for a while eh.