- myFICO® Forums

- Types of Credit

- Student Loans

- My journey from default and garnishment through re...

Options

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

My journey from default and garnishment through rehab

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-14-2019

10:48 AM

02-14-2019

10:48 AM

My journey from default and garnishment through rehab

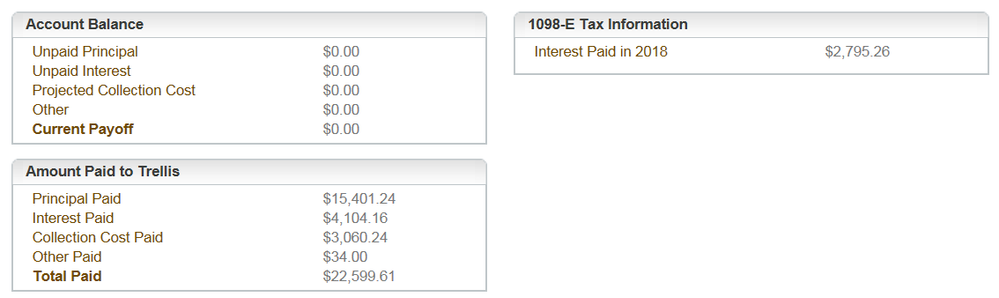

I want to share my story of my 3 federal student loans.

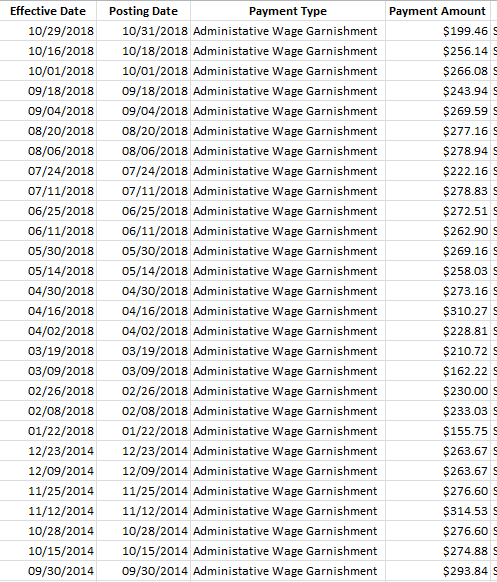

My wages have been garnished

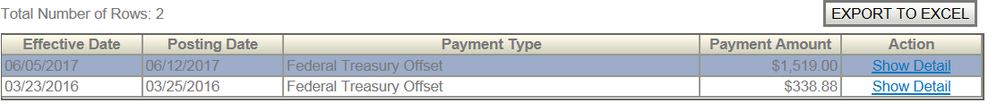

and my income tax was taken.

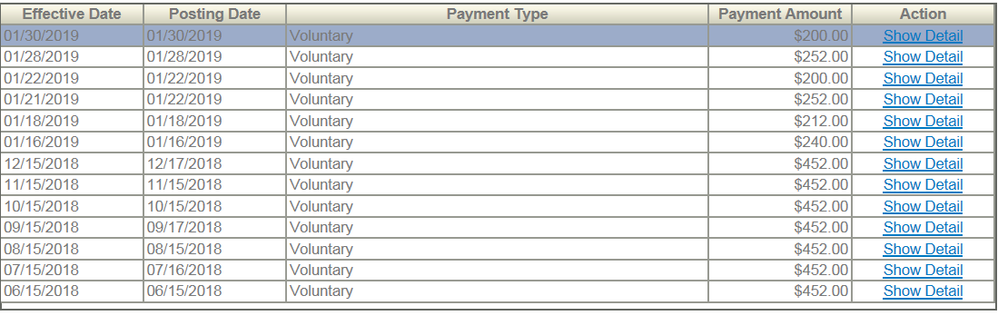

rehab

my loan was just sold.....

Hope this helps someone.

14 REPLIES 14

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-15-2019

08:47 AM

02-15-2019

08:47 AM

Re: My journey from default and garnishment through rehab

My loan was picked up on Wednesday 2-13 by Aspire .

Message 2 of 15

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2019

12:54 PM

02-16-2019

12:54 PM

Re: My journey from default and garnishment through rehab

Who was the collection agency you worked with? I wish FMS, would show more information on their dashboard in regarding to the loan information.

Message 3 of 15

0

Kudos

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2019

02:00 PM

02-16-2019

02:00 PM

Re: My journey from default and garnishment through rehab

I don't understand why people let there student loans enter default.... there are so many ways to avoid federal student loan default

Consolidation / Deferment / Forbearance / Income Based Repayment

When you consolidate you get more forbearance time added...

What I am asking is WHY WOULD someone default - is it strategic? Does it stop the interest from accruing? Do they settle?

I have 100K in student loan federally... I Consolidated and IBR I pay aprox 200-250/mo on my income

I plan on aggressively paying them off 2450/mo over the next 3-5 years to get them out of my life.

For people that let them default -- why not rehabilitate them?

Consolidation / Deferment / Forbearance / Income Based Repayment

When you consolidate you get more forbearance time added...

What I am asking is WHY WOULD someone default - is it strategic? Does it stop the interest from accruing? Do they settle?

I have 100K in student loan federally... I Consolidated and IBR I pay aprox 200-250/mo on my income

I plan on aggressively paying them off 2450/mo over the next 3-5 years to get them out of my life.

For people that let them default -- why not rehabilitate them?

Message 4 of 15

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2019

02:54 PM

02-16-2019

02:54 PM

Re: My journey from default and garnishment through rehab

Message 5 of 15

0

Kudos

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2019

10:13 PM

02-16-2019

10:13 PM

Re: My journey from default and garnishment through rehab

Trellis based out of Austin Texas.

Message 6 of 15

0

Kudos

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-17-2019

06:58 AM

02-17-2019

06:58 AM

Re: My journey from default and garnishment through rehab

I defaulted and now just finished rehab. My personal reason for defaulting was bc when I was young (18/19) I didn’t have anyone to show me or guide me on what to do or what’s the right thing. But I know better now and just rehabbed

Message 7 of 15

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-19-2019

10:31 AM

02-19-2019

10:31 AM

Re: My journey from default and garnishment through rehab

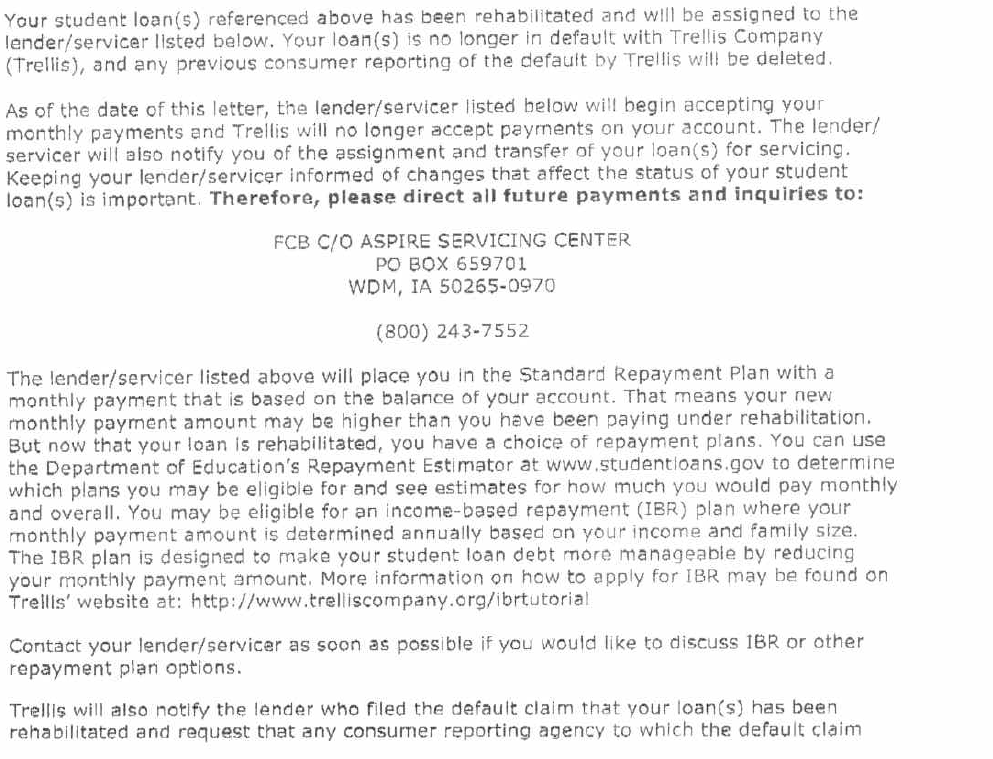

I finally got a copy of my rehab completion letter.

Message 8 of 15

0

Kudos

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-19-2019

10:40 AM

02-19-2019

10:40 AM

Re: My journey from default and garnishment through rehab

FPapiSalOC: Congrats! Won't be long until you start seeing some changes on your credit report, although it can take a few months.

The letter says you'll be on the Standard repayment plan. Were you able to sign up for an income-driven repayment plan yet?

The letter says you'll be on the Standard repayment plan. Were you able to sign up for an income-driven repayment plan yet?

Message 9 of 15

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-20-2019

11:22 AM

02-20-2019

11:22 AM

Re: My journey from default and garnishment through rehab

I have no excuse for defaulting.

Message 10 of 15

0

Kudos

† Advertiser Disclosure: The offers that appear on this site are from third party advertisers from whom FICO receives compensation.