- myFICO® Forums

- Types of Credit

- Student Loans

- Navient Student Loan, Rate locked in a long time a...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navient Student Loan, Rate locked in a long time at 8%... Any place to refi?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Navient Student Loan, Rate locked in a long time at 8%... Any place to refi?

Hello-

We have paid $675 a month for years, just like clockwork, on time every time, and are getting nowhere. Any place to refi a Navient loan? Thank you in advance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navient Student Loan, Rate locked in a long time at 8%... Any place to refi?

@Anonymous wrote:Hello-

We have paid $675 a month for years, just like clockwork, on time every time, and are getting nowhere. Any place to refi a Navient loan? Thank you in advance!

If this is a Dept of Ed loan, there isn't a way to refinance it into another DoE loan (though Fed loans are currently 0%, so you could easily drop it down now, and I wouldn't refi it until the 0% ends in October anyway). If it's a private loan, you can ignore that prior sentence, because it doesn't matter.

You can look into a number of lenders who offer refi for loans - Sofi, Lendkey, your personal banks can all refi - some of them have soft preapprovals online, some you'd have to check into a little harder. I get random offers from different lenders that I already have accounts with, so you might want to check places where you are already a customer/client. If you do refi into a private loan from a Dept of Ed loan, please note that you would lose any benefits or protections that Dept of Ed loans usually have (different payment plans, deferments/forebearances, options for rehabs in case of default).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navient Student Loan, Rate locked in a long time at 8%... Any place to refi?

Yes its listed as an FFELP? I think it started out as a stafford loan maybe?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navient Student Loan, Rate locked in a long time at 8%... Any place to refi?

PenFed and Navy Fed have lower rate refits.

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navient Student Loan, Rate locked in a long time at 8%... Any place to refi?

@calyx wrote:

@Anonymous wrote:

If this is a Dept of Ed loan, there isn't a way to refinance it into another DoE loan (though Fed loans are currently 0%, so you could easily drop it down now, and I wouldn't refi it until the 0% ends in October anyway).

I have been searching and do not understand this.

HOW DO you have your loans dropp down to 0%? I can understand one should refi until the 0% is over however, I would like to benefit from the temporary 0% DoE.

Please explain.

I have $23K remaining and I am made nauseous by their seemingly daily calculated % accrued vs some or most other types of installment loan.

THANKS in advance to @calyx and any others!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navient Student Loan, Rate locked in a long time at 8%... Any place to refi?

@Credit4Growth wrote:

@calyx wrote:

@Anonymous wrote:

If this is a Dept of Ed loan, there isn't a way to refinance it into another DoE loan (though Fed loans are currently 0%, so you could easily drop it down now, and I wouldn't refi it until the 0% ends in October anyway).

I have been searching and do not understand this.

HOW DO you have your loans dropp down to 0%? I can understand one should refi until the 0% is over however, I would like to benefit from the temporary 0% DoE.

Please explain.

I have $23K remaining and I am made nauseous by their seemingly daily calculated % accrued vs some or most other types of installment loan.

THANKS in advance to @calyx and any others!

Apologies for not being clear - I'd drop the principle down as much as possible while we have the 0%, before attempting a refi.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navient Student Loan, Rate locked in a long time at 8%... Any place to refi?

@calyx thank you...

You definitely made a clear point to me and I too have the intention of knocking down the principle quite a bit.

Maybe I have been working too much & not paying enough attention. For months I have heard Fed Student loans % would be waived or at 0%.

I have not noticed what triggers/activates this.

I am certain my Fed loans nor my DW's reflect 0%.

I guess we will have to make a few calls Monday morning to the servicars and inquire about the rates.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navient Student Loan, Rate locked in a long time at 8%... Any place to refi?

This only applies to certain loans. Somehow they got to wiggle out of some things in the fine print. I know what direct student loans count. Mine have no interest accruing, no payment due, show up as a good payment vs usual deferment with a blank ok my credit report, and all "payments" will go toward total payments for forgiveness.

Other loans types were not so lucky. In addition you have the usual servicer mistakes like Great Lakes I believe (huge inaccuracies in reporting to the bureaus).

Best policy is to look up your specific federal loan and see if it would qualify. If so, anything that applied should have done so automatically.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navient Student Loan, Rate locked in a long time at 8%... Any place to refi?

Thanks @Anonymous

I will continue looking into the different types tonight.

8 out of the 9 remaining loans I have are Fed loans but mixed between Sub and unsub loans.

I definitely will be calling the servicer (AES) in the morning for my own loans.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navient Student Loan, Rate locked in a long time at 8%... Any place to refi?

@Credit4Growth wrote:Thanks @Anonymous

I will continue looking into the different types tonight.

8 out of the 9 remaining loans I have are Fed loans but mixed between Sub and unsub loans.

I definitely will be calling the servicer (AES) in the morning for my own loans.

Are they older loans? Like 2010 or earlier? If they are sub/unsub FFEL loans, they may not have the 0% interest rates. I have 3 SL servicers and my SO has 2, we noticed loans through the US dept of ED are at 0%, but not so much the ones with the "private servicers", such as : NMSL/NMEAF and Wepls Fargo. They are all Fed Loans, but were in a "grey area". I think some have been working that out, some not so much.

I would check the NSLD. They list all your loans and the interest rates they are at:

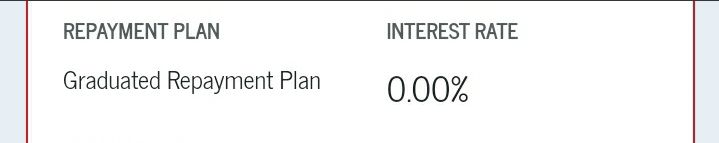

Examples from my account:

Good luck!