- myFICO® Forums

- Types of Credit

- Student Loans

- Re: Student Loan CRA Decrepencies

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Student Loan CRA Decrepencies

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Student Loan CRA Decrepencies

Hi Family Forum,

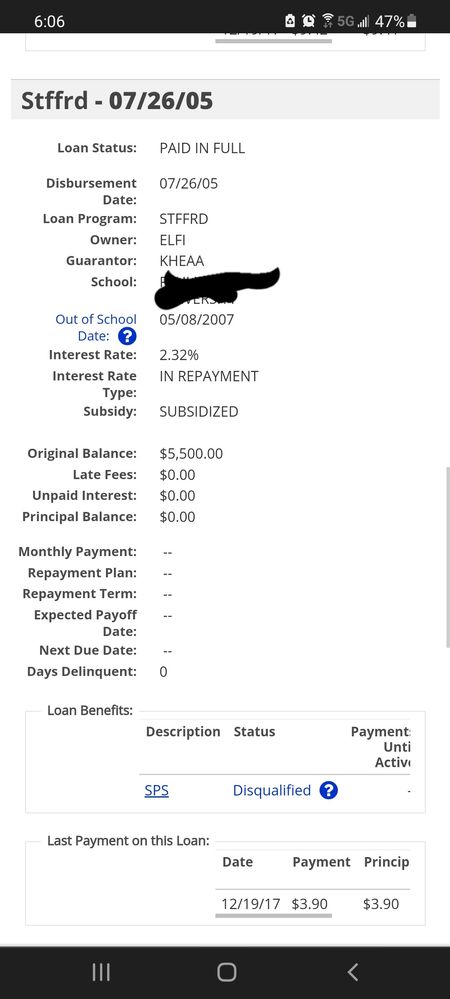

I am having an issue with the CRA(s) and AES Student Loan. So just a little background, I have a TDD on my student loans as of 2019. Well, I recently put in a dispute with all the CRAs because AES is reporting that I was 90 to 120 days late on my SL back in O/N of 2017. The problem is, I was in school for my MBA until May of 2017 and my SLs were all transferred to Navient at the beginning of 2017. I have 3 accounts showing with them during that time. There is a $5000, which shows current, PIF and no lates. $23k, closed/current/ PIF and no lates but this one with $5500, they are showing closed/ Delinquent/ 90 to 120 days late! They just updated that on TU and EQ yesterday based on my dispute.

I didn't think of it until today, but I went on my account history and it does not show any lates, delinquency or anything. Just PIF. I emailed AES about this and I will update as soon as I get a response, but this is affecting my overall credit worthiness. I NEVER was late with them because everything was transferred to Navient. This is making creditors think I am high risk and it is ticking me off.

That is the only late payment I have showing on my report, other than Fed Loan Servicing showing me late back in 2015 for two months. (Oct and Nov, which seems like a trend for them reporting lates for me). I disputed to have the lates removed because it's been 7 years and they should be falling off. They have updated that the loan was transferred but not taken the lates off. I will be calling each CRA and getting them removed tomorrow.

My question is, have anyone else faced this and it was resolved with an update of lates being removed? If so, how did you achieve it? Any information or response would be helpful. I am trying to purchase a home and even though the lates are 3 and 7 years old, I do not want inaccurate information on my report and me being a high risk to creditors. Thanks in advance for all who read the long post and responds. ![]()

Update 10/19/21: Spoke to AES on last night. The first rep was clueless. Spoke with a rep and he looked up the info and saw all my accounts were showing current from the dates they were showing late and he sent me a document that showed all accounts were PIF and never late. I mailed it to Transunion today. I will be sending to Equifax via online and mailing to EX. I will update once report is adjusted.

;FICO Profile:

EX: Fico 8: 775 INQ: 9/24,

EQ: Fico 8: 762 INQ:6/24,

TU: Fico 8: 739 INQ: 8/24,

GOAL: 750-780: By the End of the Year!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Student Loan CRA Decrepencies

Two points:

1) the lates from 2015 aren't 7 years old yet, so they won't be taken off, and I'd leave it be.

2) Download your data from NSLDS and any other proof that you were in school and the loan was supposed to be in forebearance.

Good luck with AES, I have had a lot of issues dealing with them - they can be pretty difficult.

After you send them proof (by mail, not email or phone call) with CMRRR and they don't fix the reporting take it to the CFRB.