- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- Re: April 2017 Check-In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

April 2017 Check-In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: April 2017 Check-In Thread

Hey there ladies and gents, haven't been here in a while. My challenge has been improving for some months now. This credit tooling is an ever learning road which has a lot of lumps and bumps. My numbers seem to be on a steady gain forbidding I do not apply for a cc. Sometimes, I feel like going back to using cash for anything needed which was not as complicated. I will be back in two months with another update.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: April 2017 Check-In Thread

My goals for 2017

1) Raise FICO to 760+ (Progress - 698 in January to 742 in April)

2) Reduce credit card debt by 1/3 to 1/2 (Progess - but still a long way to go)

3) Increase overall CL (No CLI yet)

4) Patiently sit in the garden (Sitting in the garden since December)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: April 2017 Check-In Thread

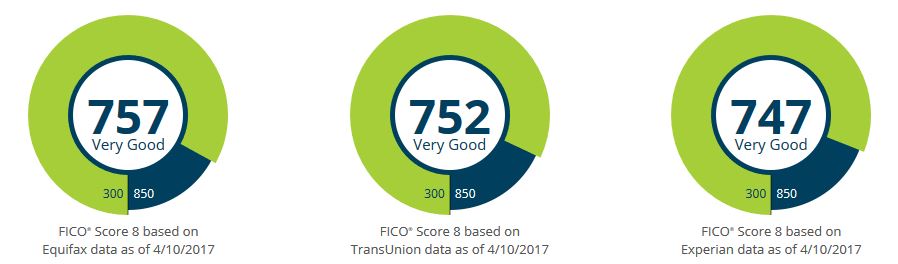

Been quite a while since I've been here, but I got some great news a couple days ago!!

Holy Smokes, it's been a LONG journey!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: April 2017 Check-In Thread

Score as of May 9th:

EX- 596

TU- 597

EQ- 586

When 2017 started I had one credit card with 500CL. While messing around on my Cap1 app I found the "ask for increase" button. Boom, 250 increase. I was overjoyed. Then two days later I applied for QS1 card. Approved 500SL. In mid March my vehicle took a dump and checked for pre approval via cap1 now I am the proud owner of 17000 debt. Long story short, I went from not thinking I could get anything to feeling on top of the world. So then I applied for a few more cards. Denied. My high wore off. That's when I found the forums. Started slow, reading a few posts here and there, now I am on this site more than my kids are on facebook. So I set myself a small goal of getting a better cc by end of year..ie. upgrading to regular QS, discover it, or NFCU rewards. Well today I met my goal and was approved for NCFU cash rewards card with 1600SL. So now to set more goals, only now instead of getting credit goals, it's raising score goals and cleaning up reports.

2017 Goals:

PIF charged off citi visa and goodwill letter

PIF last account in collection and ask for pay for removal.

Have as many judgements vacated as possible - 9 reporting - 2 of them in process of vacating. Mainly medical

Get 2 credit cards to $0 and one reporting under 9%. Should be easy considering my low CLs and balances under 20% always PIF every 2 weeks.

Increase scores across the board to at least 650s.

I believe this is attainable, I have a decent mix of credit. Student loan, auto loan, revolving. Not baddies since June 2015 and hoping g to get that removed.

Wish me luck as I wish everybody here the best as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: April 2017 Check-In Thread

Update:

- Garden - April 28, 2017 = 7 months.

- Increase CL on a few cards - Nothing new to report.

- Combine Cap 1 accounts - Nothing new to report.

- Reduce utilization - I paid off a couple of small balances a week ago. Now, I'm focused on the BIG one.

There's really not a lot going on credit wise for me. I am staying focused on my goals and patiently waiting for my Gardenversary.

Stay positive & focused so we can meet our goals!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: April 2017 Check-In Thread

I've had some bumps this month and almost scared to post my progress, thinking my laptop might blow up.

Was real excited and pumped on goals, this past month was not able to achieve some things, as 1) a huge storm blew through and took out 3 panels of fencing, and most of gutter on garage (deductible higher than repairs), then a garage door pulley busted and can barely open it, and when closed is askewed. Everything is falling apart around us.

Anyway, did see some score increases on utilization, not totally at the percentage I need to be, but still working on it. I was able to get a nice CLI soft pull increase on one CC, so that helped with overall utilization, and I'm still paying more than minimum. Two cards are PIF, the other 2 I'm paying simultaneously higher amounts. I miscaluated the amount on one, and util is showing 14% not the <8.9% I was shooting for, but will rectify that this next month, barring no other natural disasters, emergencies.

I did PFD on 3 collections, have confirmation will be removed from the bureaus, but they stated won't report till Apr 15th, so not seen that removed as yet. Leaving me with 2 medical collections showing. 1 is a paid collection from 2011, and has gone out of business, I have disputed, haven't heard anything yet on the status, filed the dispute end of March. If it goes (I'm praying), I'll be down to 1 for $34 that I'm scared to death to tackle, it's with a one of the worst CA ever from what I've read on the forums, and BBB complaints. I'm saving that for last.

I may reach my original goal of 700 ATB next month, and modify my next goals, ie, replace my subprime CC for decent cards that will grow with me and grant CLI as they age and payment history, and up my goals on scores once I achieve my current goals.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: April 2017 Check-In Thread

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: April 2017 Check-In Thread

@BungalowMo wrote:Been quite a while since I've been here, but I got some great news a couple days ago!!

Holy Smokes, it's been a LONG journey!!

Congrats Mo! Not only good to see you but yippie!

Hoping to finally break 740 personally later this year on a couple bureaus, it has been a long time even for me having started years after you did!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: April 2017 Check-In Thread

Thanks Revelate!!! When I initially saw my numbers, I thought I was IN the high acheivers club! Then I realized the scores need to be higher with FICO 08.

REALLY??? Lol!!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: April 2017 Check-In Thread

@BungalowMo wrote:Thanks Revelate!!! When I initially saw my numbers, I thought I was IN the high acheivers club! Then I realized the scores need to be higher with FICO 08.

REALLY??? Lol!!!!

Hahaha! I don't think we changed the high achievers club or did it use to be at 740 back in the day or something? I'm a short-timer in comparison though admittedly.

That's an interesting point though which I hadn't really considered, FICO 9 we may have to revist that as the market redraws their UW lines which I suspect they will: my ugly file has broken 790 on that score, just sayin ![]() . Or Vantage 3 as I recently peaked at 802 on a bureau as an example. 760 was a clear breakpoint in the past and even today, and probably it should stay there until the mortgage market changes even if getting an 760 or even 800 on FICO 8 is way way easier than it is on any of the trimerge models.

. Or Vantage 3 as I recently peaked at 802 on a bureau as an example. 760 was a clear breakpoint in the past and even today, and probably it should stay there until the mortgage market changes even if getting an 760 or even 800 on FICO 8 is way way easier than it is on any of the trimerge models.

I like your response better than mine though; my tax lien wandered away for a week on Experian and my FICO 8 moved all of 16 points to 756... and my reaction was: "OH COME ON, WHAT DO I HAVE TO DO?!?!?" ![]()