- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- Re: January 2023 Check-In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

January 2023 Check-In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

January 2023 Check-In Thread

A new year is often a time that people reflect on past events and is also a great time to renew something in your life. Maybe that renewal or renovation is on your financial body or physical, now is a great of a time as any to shed those extra things holding you down from being the best you possible.

Most people sit down and write out New Year's resolutions. Credit wise, what is on your list?

As a reminder, participation in these monthly check-ins is optional & encouraged. The goal is to help keep you on track, so feel free to post your progress updates here. This is a no-judgment zone; feel free to say what's keeping you up at night or give yourself kudos for having it all together.

If you're a continuing myFICO fitness challenger: Did you hit any potholes or speedbumps? Achieve some milestones, either small or mighty? Change your goals or add new ones?

Let us know how you're doing! Now that 2022 is behind us, may 2023 be ever more fruitful going forward.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2023 Check-In Thread

No immediate plans for financial products. Looked at that US Bank Shoppers Charge but the annual fee would not work for my spend

Door will remain open as we move along ...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2023 Check-In Thread

Happy New Years all.

No major credit plans other then my annual closing of some accounts that I don't use and no new inquires . Unless some major FOTM is too good to resist 🤔😂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2023 Check-In Thread

As mentioned in the main 2023 thread this year my focus is entirely on paying off my consolidation loan as soon as possible. To that end, plan on utilizing some balance transfers this month which combined with my company bonus will take my loan down to just $2000. Credit scores will take a temporary hit these next two months especially although maybe will get a bump for the high balance loan being paid/closed? Not worried about the short term score impacts though...

Current Scores - June 2023

Goal Scores - January 2024

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2023 Check-In Thread

Small progress this month. I expect bigger increases next month ![]()

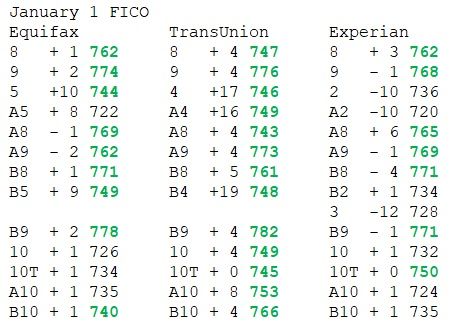

December 1: EQ8 761, TU8 743, EX8 759

January 1: EQ8 762, TU8 747, EX8 762

Across all 40 FICO scores I gained an average of 2.525 points.

Starting Score: EQ8 680, TU8 713, EX8 701

Starting Score: EQ8 680, TU8 713, EX8 701Current Score: EQ8 778, TU8 766, EX8 770 as of April 24

Goal Score: EQ8 780, TU8 780, EX8 780

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2023 Check-In Thread

I have a collection that is handled by MCM for a CreditOne CC I previously had. My short term goal is to pay this off before the month is over ![]()

Current Score: EQ-590(Jan '23): TU-602(Jan '23): EX-613(Jan '23)

Goal Score: EQ-630: TU-650: EX-620

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2023 Check-In Thread

Aggregate Utilization sitting at 13%, my CLI on my Discover card hasnt reported yet so it should still come down a bit. Paid the Platinum AF which stung but i could handle it, i was able to liquidate the $200 airline credit. Waiting for my EX Fico 8 to pass 670 which im anxious about. Aiming to get my overall down to under 10%. Next card on the horizon might be the Chase United Explorer card.

Total Credit Limit : $42500

Experian FICO 8 : 694

| Experian Vantage : 701 | TransUnion FICO 8 : 683 | TransUnion Vantage : 695 | Experian FICO 9 : 665

Starting Score: 512

Starting Score: 512Current Score: 693

Goal Score: 700+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2023 Check-In Thread

On my New Years resolutions this year, finance related specifically, is to simply end with zero cc debt

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2023 Check-In Thread

Sitting at 12% now and 3 inquiries fell off my report, BUUUT a medical debt was added yesterday which really grinded my gears lol hoping to regain those points back ASAP

On the other hand my Transunion VantageScore crossed the 700 club to 705, happy about seeing that although its not FICO.

Total Credit Limit : $42500

Experian FICO 8 : 694

| Experian Vantage : 701 | TransUnion FICO 8 : 683 | TransUnion Vantage : 695 | Experian FICO 9 : 665

Starting Score: 512

Starting Score: 512Current Score: 693

Goal Score: 700+

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2023 Check-In Thread

An update:

1) I have a collections account with FirstPoint Collections, and I am ready to pay it off. I have sent a "Pay for Delete" via email and fax. Let's hope they are willing to work something out! *fingers crossed*

2) My credit scores tanked today, as a NEW collection account from Berlin Wheeler was added for an old cable bill. However, I will be disputing this entry, as the account was paid at the beginning of this year. Thank the Heavens for payment receipts.

3) My plan is to payoff my collection account with MCM next week.

If all goes well with FirstPoint and MCM, I will only have one collection account left, and that's with NCA for my Total VISA. I plan on taking care of that next month. I will ask Total VISA if they are willing to take the payment directly.

I hope everyone else is making good progress with their journey!

Current Score: EQ-590(Jan '23): TU-602(Jan '23): EX-613(Jan '23)

Goal Score: EQ-630: TU-650: EX-620

Take the myFICO Fitness Challenge