- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- Re: June 2019 Check-In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

June 2019 Check-In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2019 Check-In Thread

A little update: called SallieMae to make sure they received my letter. They confirmed that they received it on the 10th and that they will be in touch within the next 30 days. I was hoping to get this resolved before July but hey - beggars can't be choosers! Now to call CapitalOne after work and see if they received my letter...I might even do it before 5pm. Fingers crossed!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2019 Check-In Thread

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2019 Check-In Thread

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2019 Check-In Thread

This month is nothing special, I should be gardening for a good little while, next month should be more interesting.

Welp, I failed there. I got the Chase Freedom, which was going to be my next app in the fall.

I guess I'm gardening for reals now, because I don't want Chase to get nervous about me.

I sent a goodwill request to two derogatory account holders after my terrible experience with EX. I realized they likely wouldn't change anything, but hooray! I ended up with one of them agreeing to delete the accounts they held. No word on the other, but I'm fine with waiting. I was just so mad I wanted to do something (that wouldn't harm anything).

New goal: gardening for the rest of the year. I feel like this is doable, at least ![]()

For the rest of the year:

July: Nothing - waiting to see if/when/how the Chase and AMEX post

August: Oldest accounts hit 1 year (I don't expect anything from this scoring wise, but I'm proud)

September: Clean reports (in theory), requesting USBank secured to graduate, AOYA = 3M

October: PC Disco Chrome to the 5% Cash Back

November: INQs from my Aug-Oct spree will have fallen off: EQ 2/12 (from 6/12); EX 3/12 (from 5/12); next INQ is Feb

December: Pay extra towards my student loan if necessary (goal = 10k paydown in 2019), AOYA = 6M

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2019 Check-In Thread

@calyx wrote:This month is nothing special, I should be gardening for a good little while, next month should be more interesting.Welp, I failed there. I got the Chase Freedom, which was going to be my next app in the fall.

I guess I'm gardening for reals now, because I don't want Chase to get nervous about me.

Yeah, I'm gardening too....scared of the AA Boogie Man. I'll be sitting right here behind the scare crow if ya wanna join me![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2019 Check-In Thread

@GApeachy wrote:

@calyx wrote:This month is nothing special, I should be gardening for a good little while, next month should be more interesting.Welp, I failed there. I got the Chase Freedom, which was going to be my next app in the fall.

I guess I'm gardening for reals now, because I don't want Chase to get nervous about me.Yeah, I'm gardening too....scared of the AA Boogie Man. I'll be sitting right here behind the scare crow if ya wanna join me

Belly crawling to get water, definitely not letting that charge post on a non-chase card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2019 Check-In Thread

Late check-in here. The end of May into early June have been crazy. It has thrown off my Util % due to unforseen (additional) graduation and wedding gatherings/travel expenses. I am already in the garden (a month now, woohoo) and I will remain there, as i pay down cards and grow my scores. Slow and steady I go! Here's to a calmer next few months...I need some rest now. HA!

On the credit side, I did manage to get a small $400 cli on my Kohl's card! Hey, I'll take it! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2019 Check-In Thread

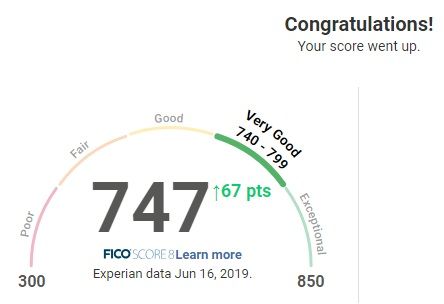

June has been absolutely magical for me.

Firstly, all of my 2018 inquiries are 1 year old thus unscorable. Due to my scores fluctuating so much, I couldn't quantify any point gains from that. I'm just glad they've aged. I plan to garden more than app, so I should never have more than one scorable inquiry on my report at any given time.

Secondly, I finally reached the 1 year mark on all levels (AOOA, AAOA, and AOYA) and saw a 9 point gain for breaking that age threshold. This puts me halfway through my 2 year gardening goal.

In saving the best for last, my 2012 foreclosure finally dropped off of my EX report this morning. Yesterday my EX 8 was 680, this morning it jumped up to 747.

My next big month should be August when the same foreclosure drops off of EQ... if Equifax adheres to their 1 month EE policy.

Rebuild Cards

Goal Cards

Loans

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2019 Check-In Thread

Latest F8 Score rolled in at 781. I'm creeping up to the goal.

Starting Score: F8 3xx

Starting Score: F8 3xxCurrent Score: F8 800+

Goal Score: F8 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2019 Check-In Thread

Mini update. Combed through my CRs again and realized that all of my delinquencies should fall off no later than June 2020 (not October 2020), which means I should get beaucoup points by next June:

- Clean 7 year history (last delinquencies falling off in April, May and June).

- AoYA > 1 yr (in May).

- No scoreable inquiries (in May).

I'm anticipating at least 50 points by June, which would raise my scores close to 800, if not over. I'm trying to remain cautiously optimistic, because it's still 12 months away and lots can happen between now and then.

Last, I put together a strategy for my next few cards, targeting another year of cash back before shifting to travel rewards in 2021. I'd like to PC two cards rather than apply de novo to preserve my age of accounts as much as possible while still applying for four cards in two years.

Time moves slowly when you've got a goal in mind. Garden on, friends.