- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- Re: June 2021 Check-In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

June 2021 Check-In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

June 2021 Check-In Thread

I know you are all hard at work with your credit goals. Have you progressed as far as you hoped? Were there any unforseen expenses that cropped up and may have thrown you off schedule?

As a reminder, participation in these monthly check-ins is optional, just encouraged. The goal is to help keep you on track, so feel free to post your progress updates here. This is a judgment-free zone. Feel free to say what's keeping you up at night or give yourself a Kudo for having it all together.

Did you hit any potholes or speedbumps? Achieve some milestones, either small or mighty? Change your goals or add new ones?

Let us know how you're doing!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2021 Check-In Thread

Happy June, everybody!

I am looking forward to pulling my reports on Flag Day, when I will be down to one scoreable inquiry. For anyone following along, I had a small spree when I joined MyFico in May 2019 and have been looking forward to those inquiries aging off my reports. It turns out, due to varying interpretations, that EQ and TU removed those inquiries in May 2021, but EX interprets the rule differently, and the inquiries on their report will fall off "the first Saturday after the first full week of the month following the two year anniversary," i.e. 12 June, 2021. I will still have one unscoreable inquiry on each report (all three will fall off by the end of the year), but only one scoreable inquiry on one report.

There's no great reason why I set this as a benchmark. At first it was the "credit seeking" negative on my reports, but that was removed when the inquiries became unscoreable. I think it had more to do with restraint. This forum has the unintended consequence of promoting credit seeking behavior, and I wanted to curb that asap. I don't expect my scores to improve. If nothing else, my OCD inclinations appreciate the tidiness.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2021 Check-In Thread

Oh, goodness there's been a few claps and a few curses this past month. I had to use a paid off cc to buy groceries one night because I left my debit card on my desk at home. I turned around and paid it off the moment it posted. Which yay! However, I didn't mark it down on my grocery budget list and still spent all the initial grocery budget so that $80 could have gone to debt. It happens though back on the saddle again. To be honest, last month was a rough month on my food budget or budget really overall.

We are still also waiting on insurance reimbursement for our dog's emergency vet visit. Hopefully, they decide to pay out and that money will go to our travel fund. Once our travel is over and we're back home, any money leftover we will split left between savings and debt.

We are on par to pay off another small cc in july, another one in August and the last small one in December!

I applied and approved for a Citi Card (it has a good BT on it). Moving one balance (from a card that I plan to cut up) and I want to close it but it's a high limit card. So I will keep it open until my utilization is further down. With this new cc I also plan on closing 4 small limit cards (3 store cards and a secured card- all 4 paid off).

Hope everyone is doing well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2021 Check-In Thread

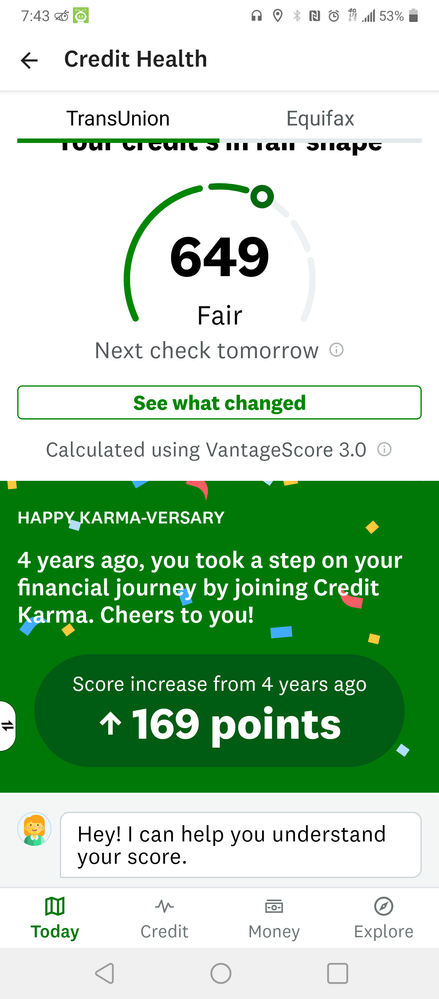

My score is much lower with Vantage so this is not reflective if it. In reality it is currently 691 without the June updates which are still coming but this is still pretty impressive. Thought I'd share to help anyone take courage in the journey.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2021 Check-In Thread

I have been MIA a couple months again, but am still chugging along on this financial health journey. I am a couple weeks from my 1 year anniversary from BK discharge, which I am excited about. I am also five months from my second anniversary from BK fling - excited about that too. Almost two years down and eight more to go.

My scores have been pretty steady over the last couple months - Equifax dropped 2 points, Transunion increased 8 points, and Experian increased 3 points. Actual scores in signature.

I’m thinking the high amount of student loans I have will keep my scores suppressed for some time. But I guess the silver lining is that by the time my BK is falling off, I should be at 10 years in the government so I can also get my loans forgiven. Long term goals to look forward to.

In the more immediate, I am in the process of looking for apartments and hope my credit has recovered enough to be approved for an apartment at least. I am also closer to returning my car lease so will begin looking for cars and loans for that as well.

My discover secured card still has not graduated ![]() but I did get approved for the PenFed Power Cash card in April ($7500 SL). I am gardening for a good long while until I’m able to request a CLI on my Navy Cash Rewards card.

but I did get approved for the PenFed Power Cash card in April ($7500 SL). I am gardening for a good long while until I’m able to request a CLI on my Navy Cash Rewards card.

Starting FICO 8: 6/2020: EX 546 - TU 507 - EQ 596

Starting FICO 8: 6/2020: EX 546 - TU 507 - EQ 596Current FICO 8: 11/2022: EX 695 - TU 676 - EQ 680

2021 Goal Score: EX 690 - TU 690 - EQ 690

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2021 Check-In Thread

Happy June!!!

I finally since 2016 have graduated my Discover It secured to unsecured. What a journey and it came by surprise. The start of rebuilding my credit. Cant wait for the deposit to come back so I can invest it.

I have been in the Garden since March as my last application was my NFCU Go Rewards card. Looking at a total overall CL 14250 now and a 644 EXP credit score and TU and EQ hovering around 620s. I have came along way of low 400s it feels like last year. Looking to bust 680 later this year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2021 Check-In Thread

I've not posted any updates for the last couple months as I had none. It was like watching paint dry...

A year past since my last CC app/approval so I finally went for it and app'd for my 2nd NFCU CC. I had not dreamed they'd actually approve me for a $25k More Rewards which they did. Patience is definitely a virtue in the credit rebuild world.

I am trying to get my scores into the 700+ ranges and overall credit worthiness beefed up. I hear 3 years post Ch 7(disch 3/2019) is a magic number for some CC lenders.

Next target goals are a CLI or two and I need replace my expiring Self loan by the end of this year with an NFCU SSL. Also, I would like to qualify for a business card when the opportunity permits.

Still thinking I ought to join another CU or two. Not in a rush for more cards, primarily to establish relationship.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2021 Check-In Thread

I got approved for not one, but TWO primo cards in 48 hours!

American Express Gold (no hard pull) and then the Chase Sapphire Preferred (now I'm 5/24) two days later (Equifax and Experian). The SUB's were TOO good to pass up. My Equifax score took a 6 point hit and my Experian lost two. I can attribute the Equifax drop to another HP for the Citi Custom Cash application which was promptly denied. Recon didn't work either. Guess I need to garden for 6 months, then I'm going to try again.

My Amex Gold is no preset spending limit of course, but the big news is that while I was expecting Chase to give me just at or a little above the minimum $5,000 SL required for the CSP, they doubled down and gave me a limit of $18,400! Not that I need it, but wow! This time last year all I could get was $400 from Credit One, who I will be divorcing by the end of the month.

I was also the victim of someone opening 2 accounts at a bank in my name. Norton LifeLock and Credit Karma (or Equifax) caught it and I was able to report the fraud. All accounts are fine and credit is frozen over like the South Pole. Whew.

DEARLY DEPARTED:

NEXT UP:

Starting Score: 700

Starting Score: 700Current Score: 800

Goal Score: 850

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: June 2021 Check-In Thread

Some of my scores took a little dip this month. I let my Disco report a much higher balance than I probably should have. I'm not trying to finance anything this month anyway.

But on the positive side, my 3B report I pulled this morning showed me my FIRST EVER 800+ score.

One of the twenty-eight scores, TransUnion Bankcard 8, is an 809.

Starting Score: EQ8 680, TU8 713, EX8 701

Starting Score: EQ8 680, TU8 713, EX8 701Current Score: EQ8 778, TU8 766, EX8 770 as of April 19

Goal Score: EQ8 780, TU8 780, EX8 780

Take the myFICO Fitness Challenge