- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- Re: March 2021 Check In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

March 2021 Check In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Check In Thread

@Anonymous wrote:Believe it or not it is officially March 2021! In some areas of the country and posters on this Forum have been planting their early crops. As for myself, the Arctic Circle still prevails with temps below zero again!

Since we are on the cusp of spring some of you may want to consider what your course and direction are for March? Cleaning out the sock draw and using that card so a lender doesn't think you no longer love them and close it or reduce the credit line? You may want to cull the herd on credit and deliberately eliminate unused credit lines (remember to check on what that might do long term - 10 years is an estimate on how long credit may remain on your CBs)?

Lot's of good solid spring cleaning may be the ticket?

I have two sock drawer cards that I need to put a little something on this month. I have calendar alerts set up on my phone to let me know the last day I can use my cards, and a "hold time" of 3 days before my statement closes. That way I don't make the mistake of leaving a balance hanging out there, or running the risk of a payment not clearing in time.

DEARLY DEPARTED:

NEXT UP:

Starting Score: 700

Starting Score: 700Current Score: 800

Goal Score: 850

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Check In Thread

@Technician2210 wrote:

@Anonymous wrote:Believe it or not it is officially March 2021! In some areas of the country and posters on this Forum have been planting their early crops. As for myself, the Arctic Circle still prevails with temps below zero again!

Since we are on the cusp of spring some of you may want to consider what your course and direction are for March? Cleaning out the sock draw and using that card so a lender doesn't think you no longer love them and close it or reduce the credit line? You may want to cull the herd on credit and deliberately eliminate unused credit lines (remember to check on what that might do long term - 10 years is an estimate on how long credit may remain on your CBs)?

Lot's of good solid spring cleaning may be the ticket?

I have two sock drawer cards that I need to put a little something on this month. I have calendar alerts set up on my phone to let me know the last day I can use my cards, and a "hold time" of 3 days before my statement closes. That way I don't make the mistake of leaving a balance hanging out there, or running the risk of a payment not clearing in time.

Sounds like a good method to keep ahead of the game! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Check In Thread

I don't know why or for how long, but all my medical collections (all from the same company) all dropped off one of my credit reports. They were only on 2/3 now just 1/3 TransUnion.

Either way, other than my 2 lates (Feb 2019, Feb 2020), I have a relatively clean file and my score jumped 55 points.

Like I said I don't know why. Maybe they aren't reporting to that credit agency anymore. Maybe the company is no longer collecting and will send it elsewhere. Makes little sense since TransUnion still has them on their report. I am a little worried that they will pop back up and decrease my score more than when they fell off. For the moment I will take it and be happy with it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Check In Thread

Hey All!

Last month ended off with a pleasant suprise in the form of an SUV lease!

I was definitely looking for a new vehicle this year but wanted to wait until my scores hit a strong 700 before going for one as I wanted a lease and nothing but a lease. Well, I got approved anyway after verifying income and a lot of prayer! I also spent a bit on my credit cards so my scores all took a cute hit between the balance increases, a couple of inquiries and the new accounts finally posting onto all bureaus.

All of these are to be expected and time will heal any bruises. I do have one item left on the agenda before I enter the garden by the end of this month... to open a secured NFCU card (as I was denied for unsecured even after recon). That will be the last new account I will add for the next 6 months and hopefully after that time I can upgrade to unsecured and get approved for a GoRewards, along with CLIs on my other open accounts.

I have a collection account and a charge off I plan on doing PTD... that alone will significantly increase my scores.

Then bring my card balances back down to around 8-10% usage...and of course keep paying everything else on time.

By summertime I will be ready for the next step in my journey!

Best of luck and hope everyone stays encouraged in whatever journey they are on!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Check In Thread

I love your use of alerts. Great shared tip, TY! I tend towards that and paying my balances after 7-10 days. Mostly because 2 of them are relatively high APR's.

I'm getting closer to grasping their Report Dates. From my former understanding that the CRA's can pull whenever, not capricious, but for as yet not fully identified and known, I pay more often or closer to usage.

Thanks for the sharing of one more way to use the alerts and reminders in my phone. 🙏🏻 I'm sure it'll help others, too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Check In Thread

Hey everyone,

I think it's been about a year since I checked in last. Not much happening.

Focus continues to be a focus on overall financial health more than anything else.

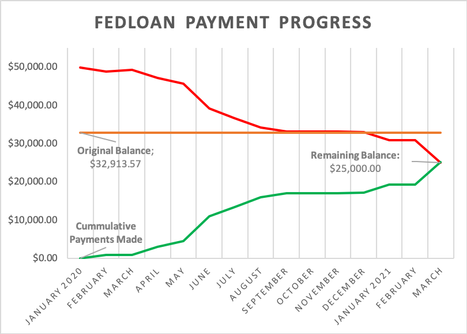

I hit a a couple of milestones in 2021 toward paying down the last of my debt. In January my balance finally fell below the original balance on my old student loans. Now with the payment I've made this month, payments made now exceeds current balance.

Getting that loan off my back continues to be my #1 priority moving forward. I'd love to see it gone by the end of the year, but I think that is a bit over ambitious.

I'd be happy to have the balance in the vicinity of $15,000 come 2022.

On the credit score front, I haven't been focusing too much there.

Scores across all three bureaus remain steady in the mid-700s.

Getting my balance down on that loan is probably the one thing I can do to improve my scores at this point.

In about 6 months, my only remaining late payments will fall off. Another substantial boost, I'm hoping.

A lot of positive things happening! Going to be an exciting year.

Also up for orders this year, so my Wife and I are excited about what this next tour may be and where we'll end up.

Here's to hoping 2021 is a big improvement over 2020!

FICO 8 Score Progress:

April 2018:

June 2020:

March 2021:

May 2021:

Oct 2021:

Jan 2022:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Check In Thread

@jlegleiter wrote:Hey everyone,

I think it's been about a year since I checked in last. Not much happening.

Focus continues to be a focus on overall financial health more than anything else.

I hit a a couple of milestones in 2021 toward paying down the last of my debt. In January my balance finally fell below the original balance on my old student loans. Now with the payment I've made this month, payments made now exceeds current balance.

Getting that loan off my back continues to be my #1 priority moving forward. I'd love to see it gone by the end of the year, but I think that is a bit over ambitious.

I'd be happy to have the balance in the vicinity of $15,000 come 2022.

On the credit score front, I haven't been focusing too much there.

Scores across all three bureaus remain steady in the mid-700s.

Getting my balance down on that loan is probably the one thing I can do to improve my scores at this point.

In about 6 months, my only remaining late payments will fall off. Another substantial boost, I'm hoping.

A lot of positive things happening! Going to be an exciting year.

Also up for orders this year, so my Wife and I are excited about what this next tour may be and where we'll end up.

Here's to hoping 2021 is a big improvement over 2020!

Congratulations on your lates falling off soon in just 6 months. That's great! 🥳 And how you continue to make headway on the paying down of your SL's. 👊🏻

Thank you for your service. 🙏🏻🇺🇸🇺🇸🇺🇸

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Check In Thread

Slight uptick in my scores this month. EX finally hit 670 and TU V3 725. I've been maintaining util below 3% at statement cut, then PIF, utilizing all 4 CC. TCL just over $7k. I would like to get my TCL over $15k when possible. I'm 1.25 yrs into rebuild and 2 years post Ch7 discharge.

I plan to app for NFCU More Rewards CC in April and then request CLI on my NFCU cashRewards. I hope to replace my expiring Self loan with a NFCU SSL loan by EOY. Thereafter, likely 2022, I will actively review my business CC options.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Check In Thread

@Anonymous,

Thanks for the kind words and encouragement.

Yep, I've been throwing everything I can at that loan. I see we're getting another round of stimulus payments.

I honestly hadn't been following the news back in the states for a couple weeks, so this snuck up on me.

I'll be sending mine right back to the government. That will take my balance down to ~$20k.

It's been a long road for me. I think I first started browsing these forums back in 2008, but didn't join until 2011.

Even then, I didn't get serious about really repairing my credit until the spring of 2018.

This journey has really taught me the importance of financial literacy, and am determined that I will do everything I can to ennsure my kids learn from my mistakes and enter adulthood with knowledge that I didn't have. The long term consequences of poor financial health can be devestating.

FICO 8 Score Progress:

April 2018:

June 2020:

March 2021:

May 2021:

Oct 2021:

Jan 2022:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: March 2021 Check In Thread

Late check In .. enjoy reading all the success stories!

I can say FICO2 is moving on up, to the east side ..deluxe apartment and all![]()

Do @Anonymous 's do anything fast?