- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- Re: May 2021 Check In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

May 2021 Check In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: May 2021 Check In Thread

@Kenny wrote:

@GApeachy wrote:@Kenny Nooooo, that's a new one on me. Was it financed or something to cause that hp? Sorry it went down like that but enjoy your new xbox👏.

Yes, it was Affirm. I should have realized, but it also was the only thing available to purchase an Xbox series x, so oh well! Not a big deal, just I always try to refrain from a HP over something so trivial.

Okay, well that makes sense. In the end, you got what you want and that's all that matters. Ty for sharing and something that gives you steady pleasure on a daily basis isn't a waste. Have fun!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: May 2021 Check In Thread

@Ficoproblems247 wrote:May is officially my last month in the agonizing garden! The 27th will be 1 year since my last app

You have some mighty staying power, you'll reap the benefits of it.... can't wait to hear of future app approvals. Wish I had that kind of staying power. Keep us posted. 👍

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: May 2021 Check In Thread

My current goals are to continue to pay down my utilization. I'm down to balances on only 2 cards, with total utilization at ~ 14%. (Bureaus still show it at ~ 18% since one card that has been paid off is not reported yet) I've been using the snowball method. Next one to be paid off middle of the month.

This month my oldest account reaches 3 years old. Don't know if this makes a fico difference, but is a big moment for me, since 3 years ago this month I began my journey into credit land. I've been in the garden for what feels like forever at this point. Not sure if I will venture out of the garden or not yet. I am itching for the excitement of will they approve/if so how much, but since I really am unsure of approval with my utilization (one card is ~ 24%) staying put currently.

Starting score - May 2018

April 2021

AAoA - 1 year 6 months

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: May 2021 Check In Thread

Hi All!

My May check in.

Everything is in check, except my gardening .. it's @GApeachy 's fault!!! ...JK

Missing @Anonymous ??? .. AWOL?

Wishing everyone great success on their credit journey.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: May 2021 Check In Thread

@M_Smart007 wrote:Everything is in check, except my gardening .. it's @GApeachy's fault!!! ...JK

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: May 2021 Check In Thread

Happy May myFICO gardening family . . . I’m peeking in and haven’t entered yet but I am setting-up my goals and certainly look forward to getting that support from the myFICO Forums gardening community.

My timeline | Officially enter the garden 6/19/2021 |

My specific goal | · Wait on BoA adverse trade line to purge in 12/2022 (EQ/EX). · Sit back, water my new trade lines and watch them grow. · Wait for my new trade lines to age for twelve months. · Watch and monitor my credit reports and scores. |

I have read (in the community forum) that my FICO scores may temporarily drop since I’ve been approved for several new credit cards:

- Decision Pending ~ PenFed Visa Platinum Rewards Signature 4/23/2021 (HP: Equifax)

- American Express Blue Cash Preferred 3/2021 (HP: Experian)

- Navy Federal Go Rewards on 4/2/2021 (HP: TransUnion)

Just one HP from each CRA. I am hoping that applying for multiple new lines of credit at once won’t have an even more substantial impact.

I really want the Chase Marriott Bonvoy and they keep sending me mailers but I’m afraid it would be automatically denied. I received a mailer on 5/1/2021 offering 50k bonus points if I open an account before June 16, 2021. So I haven’t decided yet on applying, especially if PenFed approves me and then I will be 3/24 considering the Chase 5/24 new account rule. So I think June 19, 2021 might be a good time to focus on gardening my credit. babygirl1256 | ATR: Aim to Refrain

Current FICO 8 Score in 06/2021: EQ-796, TU-806, EX-812

Goal FICO 8 Score in 06/2022: EQ-825, TU-850, EX-850

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: May 2021 Check In Thread

As of today, I am now at FICO 8:

- Equifax 696

- TransUnion 688

- Experian 686.

And these are increases I've had between yesterday and today, for minor things like my accounts having grown 1 month, etc. My accounts haven't reported yet -- they usually all do by the 7th. I am pretty excited. I've always had very low scores, with the lowest ever being like 343 or something awful like that.

I paid my collections off, and am now paying deep into my student loans ($500 a month so I can get done in 5 years). Can't wait. <3 My goal is buying a car. Ours is close to dead, so it's good timing. Been a long time coming.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: May 2021 Check In Thread

That's great lizmariposa . . . keep working on it and you will continue to see and enjoy the rewards of your hard work!

Current FICO 8 Score in 06/2021: EQ-796, TU-806, EX-812

Goal FICO 8 Score in 06/2022: EQ-825, TU-850, EX-850

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: May 2021 Check In Thread

Hello guys, new guy checkin! Hoping to get more cards in May!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: May 2021 Check In Thread

Hope everyone is making progress toward their respective goals, whatever they may be.

I think I missed the April check in. April 18 marked three years since I signed up for myFICO, and have been tracking and tending to my credit dutifully since then. I haven't been the most aggressive at trying to boost my scores as quickly as possible. I instead focused on consistant positive habit and responsible choices and let the scores follow accordingly. More on that in just a moment!

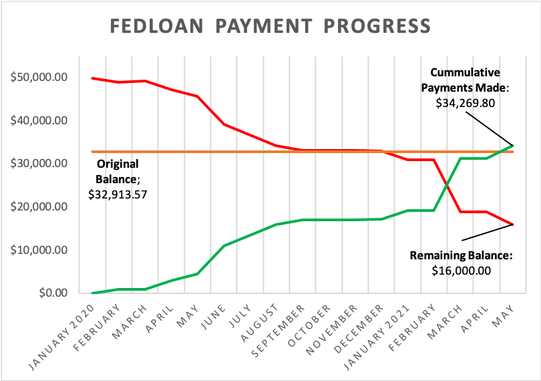

As was the case in March, my focus continues to be in paying down my loan debt. Been throwing everything at it that I can. Seeing significant progress. Started the year with a $31,000 balance, but as of today I've been able to get that balance down to $16,000. Progress will likely slow the rest of the year, but I shouldn't have any trouble getting it below $10,000 by year's end. Can't wait to see the last of this debt vanish!

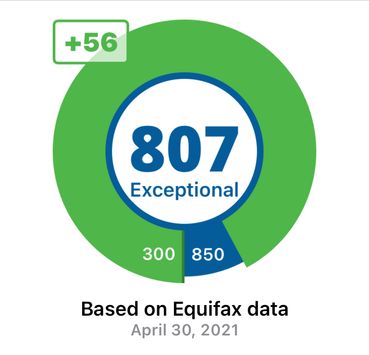

Going back to the topic of scores, I received a score alert this morning that I had a new score. Logged into myFICO expecting a couple of points increase, but instead was greated to this!!:

It's been a long three years, slowly climbing 200 points to finally see that 800+ score. Great feeling. I really wish that I knew in my 20s what I know now.

FICO 8 Score Progress:

April 2018:

June 2020:

March 2021:

May 2021:

Oct 2021:

Jan 2022: