- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- Take the myFICO Fitness Challenge 2019

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Take the myFICO Fitness Challenge 2019

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Take the myFICO Fitness Challenge 2019

I will most likely bank with them in the future. I just opened a citi check/saving account to get the $500 bonus, and make my chances better on application which ended up being my highest personal credit limit on a credit card.

Once I can downgrade my Citi checking,(1500$ min balance, from 10,000 as it is now)I will most likely open up a u.s. bank checking account. I will do it for the same reasons I did with Citi. Checking bonus, and hopeful that will give me a better chance with their credit card.

Honestly I could live with just applying for American Express cards. Business, and personal this company has blown every other bank out of the water. Between the sign-up bonuses the rewards, referrals, and everything being a SP once you are in I almost feel like applying elsewhere makes no sense. I am waiting until I pass the 2/90 rule for amex revolvers so I can accept my pre-approval for 25k a MR'S W/ ED card. But since I have at least two to three years till I get a house I am going to take advantage of sign up bonus now while I can.

Wish list- amex MR'S Sub the card doesn't matter since it won't really help my rewards as I have most everything covered.

Us Bank, maybe Rakuten visa. Hope Citi will allow ppl to PC to the dividend if not my Citi rewards Plus card will continue to get all of my $3 or less charges.

I feel like closing my capital One Quicksilver card. I have no use for it and it will not grow. I honestly don't know why I still have it. I am most likely going to charge one bill per month less than $15 just to keep it open it's my second oldest card.

I don't know if it would look better if I kept it open or closed that card before applying 4 a card from a different bank. Not sure if they would look at the small limit in a negative manner, or they would look at me closing it in a negative way.

I have successfully gotten my score over 740 while opening three new personal cards in the last 4 months.

It has been two months since my last personal approval, and I am doing my best to not apply for anything at least for another month eligible to get my third revolver with Amex. I have heard American Express does not care about new applications with other Banks so I feel like maybe I should open card from a different bank before American Express.

Any advice is always welcome sorry for the length and thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Take the myFICO Fitness Challenge 2019

I've casually come across the myFICO forums multiple times throughotu the years but never took the plunge to sign up as a member. I'm excited to be doing so now and beginning the Fitness Challenge even if it is September! Poor, misguided actions made as a youth after getting my first credit card have hit me hard, and choices at 20-22 are also still damaging my report. I'd like to attempt achieving a score of 600 prior to January 1, 2020. It'll be a long road but I'm attempting to take an aggressive strategy towards my credit repair! I hope everyone has been successful and reached some of their goals thus far!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Take the myFICO Fitness Challenge 2019

@Anonymousglad you took the plunge and stopped in! Your past will have much company in this Forum. Odds are good you will find information you can use.

Welcome! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Take the myFICO Fitness Challenge 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Take the myFICO Fitness Challenge 2019

looking to bump that score up! It's addictive.![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Take the myFICO Fitness Challenge 2019

Hello ![]()

I have the most pathetic credit goal ever. I want a CLI on AR. I know how sad that sounds, but that's my goal. It's not HP that's preventing me, it's that I'm not sure if the time is right, or when the time will be right. US Bank is weird, so I'm just sitting impatiently waiting for that one impulsive day lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Take the myFICO Fitness Challenge 2019

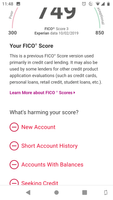

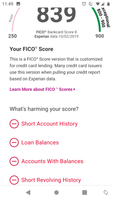

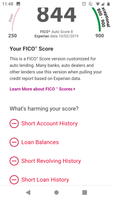

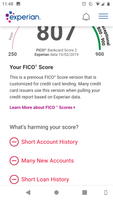

Plus score seems to keep going up after approvals🛑

Either way I'm excited to see what my score looks like when I don't have any new accounts in last 6 months..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Take the myFICO Fitness Challenge 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Take the myFICO Fitness Challenge 2019

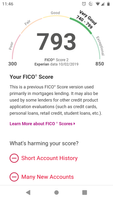

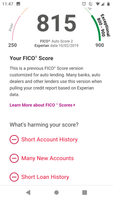

I took the plunge and paid $1 to see my additional score, was pleasantly surprised when u saw that credit seeking was hurt credit seeking was hurting my Fico 3 score. I've opened 2 account this year (September). I got hit with a CU HP in Feb 19 cuz I opened a saving account for my kid.

Well I won't be seeking anymore credit until 2021. SP CLI biannually and grow the age on my accounts

Chase FU $19.6k

BOA Cash Rewards $36k

BJs Perks Plus M/C $22k

Cap1 QS $4,950 (AU)

Best Buy $4k

Wells Fargo Active Cash $11.3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Take the myFICO Fitness Challenge 2019

@Anonymous wrote:

I have absolutely no idea how to do all that signature stuff y'all got. I want to build my credit up and save money to buy a house in spring '22. I filed bankruptcy which discharged February '19. I got discover Secured - $200 limit, Fingerhut- $300 limit and self February '19. My fingerhut is $1200 limit now. Discover is unsecured and $1800 limit. I hate Fingerhut and would like to replace it with a different retail card. I also got an auto loan through Ally in April '19 and a CC via Ollo September '19.

@Anonymous this might help: How to add card pictures to your signature: http://ficoforums.myfico.com/t5/SmorgasBoard/THIS-IS-HOW-YOU-ADD-CREDIT-CARD-PICS-TO-YOUR-PROFILE/td-p/2262839