- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: 15 Point drop.. seems strange to me.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

15 Point drop.. seems strange to me.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

15 Point drop.. seems strange to me.

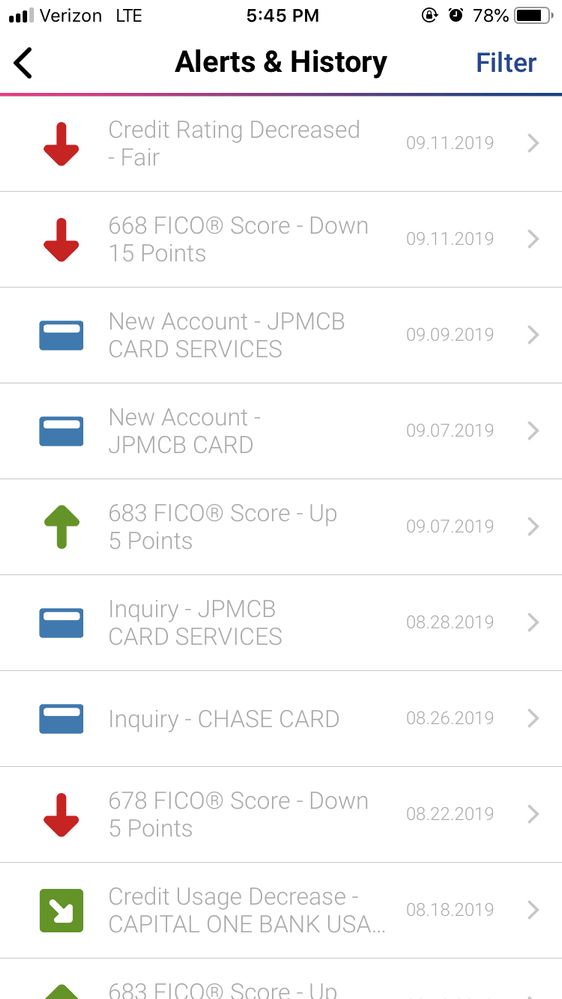

Does this make sens to you? The new account showed on my report 9/7 and no chang in score. Nothing else changed and then four days later a 15 point drop. Was this just a delay in the effect the new card had on my score?

FICO 8 EXP, EQ, TU: 675-715 (depending on Utl.) | AAoA 3 Years 3 Months | AoYA 0 Months

Closed: American Honda Finance Installment $16,000 paid satisfactorily | Capital One Secured $700 paid satisfactorily | Wells Fargo credit card $3,000 paid charge off settled less than full amount (badie 2015) | Bank of America credit card $1,000 paid charge off settled less than full amount (badie 2015)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 15 Point drop.. seems strange to me.

How many inquiries did you have before and after? I noticed that you took 2 inquiries in the span of 3 days and see no score drop during that period of time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 15 Point drop.. seems strange to me.

@Anonymous wrote:How many inquiries did you have before and after? I noticed that you took 2 inquiries in the span of 3 days and see no score drop during that period of time.

@Anonymous

To answer your question on Hard Inquiries:

Experian: From 0 to 1

Transunion: From 1 to 2

Equifax: From 1 to 1 (no change)

Chase pulled from Experian and TransUnion hence the changes to those two. I don't think the inquiry is what made the 15 point drop becuase days after the pull no credit changes took place. My AAoA did fall from 3 years 6 months to 3 years 3 months and my AoYA from 14 months to 0. Perhaps this is the reason for the change and would explain the delay (i.e. when account showed on report instead of just the inquiry).

FICO 8 EXP, EQ, TU: 675-715 (depending on Utl.) | AAoA 3 Years 3 Months | AoYA 0 Months

Closed: American Honda Finance Installment $16,000 paid satisfactorily | Capital One Secured $700 paid satisfactorily | Wells Fargo credit card $3,000 paid charge off settled less than full amount (badie 2015) | Bank of America credit card $1,000 paid charge off settled less than full amount (badie 2015)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 15 Point drop.. seems strange to me.

Agreed. An AoYA reset from 12+ months to 0 months will cause such a drop. In fact, some experience a drop as high as the 20-25 point range, so 15 points really isn't all that bad.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 15 Point drop.. seems strange to me.

@CreditSage wrote:The new account showed on my report 9/7 and no chang in score. Nothing else changed and then four days later a 15 point drop. Was this just a delay in the effect the new card had on my score?

I do recall reading that if one is on a derogatory scorecard, one does not get a new account scoring penalty. Maybe someone can confirm if memory doesn't serve me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 15 Point drop.. seems strange to me.

@AllZero wrote:

^ You found your answer. AoYA reset. Bonus points removed.

Well that is a bummer. I lost 15 points for the AoYA reset but gained 15 points for a few things which happened all at once:

NFCU CLI from $5,300 to $6,800.

UTL dropping to aggregate 8% from high 60%.

Pretty much a wash. I wonder if I should apply for the other cards I want while AoYA is 0... hmmm..

FICO 8 EXP, EQ, TU: 675-715 (depending on Utl.) | AAoA 3 Years 3 Months | AoYA 0 Months

Closed: American Honda Finance Installment $16,000 paid satisfactorily | Capital One Secured $700 paid satisfactorily | Wells Fargo credit card $3,000 paid charge off settled less than full amount (badie 2015) | Bank of America credit card $1,000 paid charge off settled less than full amount (badie 2015)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content