- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- 2% Util --> 9 point dip on EQ FICO 8?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

2% Util --> 9 point dip on EQ FICO 8?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% Util --> 9 point dip on EQ FICO 8?

@SouthJamaica wrote:

@iv wrote:

@SouthJamaica wrote:Bizarrely, EQ dropped another 3 points when another card reported taking me to 2.5% utilization and 8 out of 19 cards reporting.

Once again, EX and TU were unmoved.

Are you sure it's just not a difference in triggers between the CRAs?

(IE: did EX and TU send an alert, but with unchanged scores, or did only EQ send an alert?)

Only EQ sent alert

This is becoming less interesting as it becomes clear that only EQ cares. I.e. this 12 point drop appears to be strictly an EQ thing, not a FICO 8 thing.

And I'm guessing it's just a temporary EQ thing at that.

I think I figured out what may have caused the 12 point drop in EQ and not in TU & EX, and it isn't the change in utilization.

In playing around with the simulator, it was saying that my EQ score would drop 10 points, and neither of my other scores would move, if I were to add a card or increase my credit limits. Actually I did both. It appears that EQ doesn't want me to add any credit availability, while TU and EX would neither punish nor reward me for it.

I hope this doesn't mean I have to start cancelling cards. I love those little suckers, each and every one of them, even the ugly BCE card.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% Util --> 9 point dip on EQ FICO 8?

@SouthJamaica wrote:

@SouthJamaica wrote:

@iv wrote:

@SouthJamaica wrote:Bizarrely, EQ dropped another 3 points when another card reported taking me to 2.5% utilization and 8 out of 19 cards reporting.

Once again, EX and TU were unmoved.

Are you sure it's just not a difference in triggers between the CRAs?

(IE: did EX and TU send an alert, but with unchanged scores, or did only EQ send an alert?)

Only EQ sent alert

This is becoming less interesting as it becomes clear that only EQ cares. I.e. this 12 point drop appears to be strictly an EQ thing, not a FICO 8 thing.

And I'm guessing it's just a temporary EQ thing at that.

I think I figured out what may have caused the 12 point drop in EQ and not in TU & EX, and it isn't the change in utilization.

In playing around with the simulator, it was saying that my EQ score would drop 10 points, and neither of my other scores would move, if I were to add a card or increase my credit limits. Actually I did both. It appears that EQ doesn't want me to add any credit availability, while TU and EX would neither punish nor reward me for it.

I hope this doesn't mean I have to start cancelling cards. I love those little suckers, each and every one of them, even the ugly BCE card.

FICO scores are not influenced by the number of cards you have or your credit limits.

Did adding another card cause you to cross an AAoA threshold?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% Util --> 9 point dip on EQ FICO 8?

@SouthJamaica wrote:

@iv wrote:

@SouthJamaica wrote:Bizarrely, EQ dropped another 3 points when another card reported taking me to 2.5% utilization and 8 out of 19 cards reporting.

Once again, EX and TU were unmoved.

Are you sure it's just not a difference in triggers between the CRAs?

(IE: did EX and TU send an alert, but with unchanged scores, or did only EQ send an alert?)

Only EQ sent alert

This is becoming less interesting as it becomes clear that only EQ cares. I.e. this 12 point drop appears to be strictly an EQ thing, not a FICO 8 thing.

And I'm guessing it's just a temporary EQ thing at that.

You're not receiveing EX and TU alerts for balance changes?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% Util --> 9 point dip on EQ FICO 8?

@Thomas_Thumb wrote:Thanks.

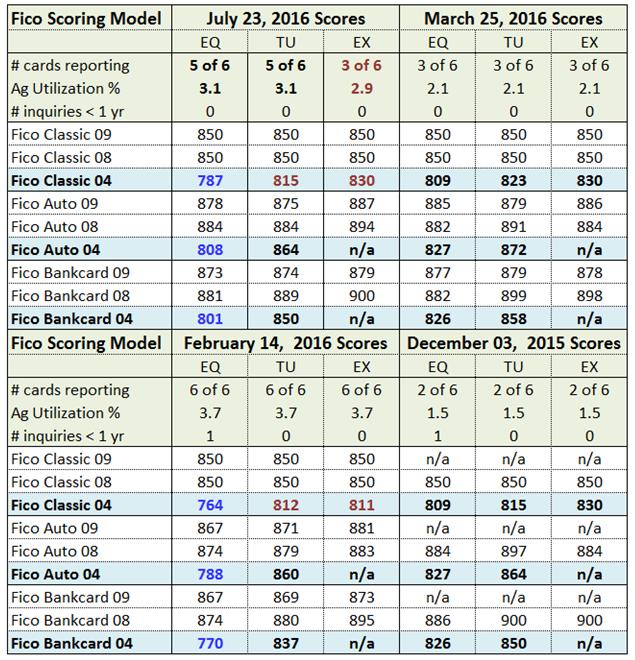

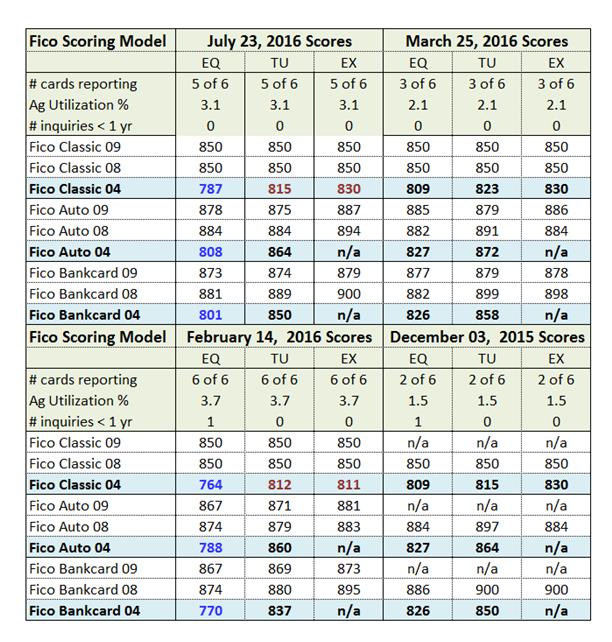

I just want to re-confirm my EQ Fico 04 punishment [that I think relates to AMEX] as previously experienced back in February.

* At that time my AMEX was reporting 49% B/HB but I also had 6 of 6 cards reporting. This time AMEX will be 100% with "only" 4 of 6 reporting.

Ok - couldn't wait until the 26th and pulled my 3B today. My AMEX charge card did report $1997 and does show 100% B/HB. Total cards reporting a balance was 5 of 6 - BB card slipped in with $33.

As expected and shown previously, no change in Classic Fico 08 or Classic Fico 09 scores. As before all EQ Fico 04 scores (mortgage & enhanced) took a big hit. Pretty sure now that the AMEX charge card is the culprit in the EQ Fico 04 deep dives - none of the credit cards posted more than 2% utilization. Dip not as severe as in February - possibly because there is no inquiry on file or perhaps because 5 of 6 cards reported instead of 6 of 6 cards.

Note 1: There were no charges on AMEX card for the 3/2016 and 12/2015 3B reports.

Note 2: Experian appears to be using older data. Classic Fico 04 stayed at 830 and Bankcard Fico 08 was 900. Those results are not consistent with 5 of 6 cards reporting balances and AMEX at 100% B/HB.

* AMEX charge card balance is included in the aggregate utilization for July 2016. Without AMEX, AG UT would be less than March 2016.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% Util --> 9 point dip on EQ FICO 8?

@Thomas_Thumb wrote:

@Thomas_Thumb wrote:Thanks.

I just want to re-confirm my EQ Fico 04 punishment [that I think relates to AMEX] as previously experienced back in February.

* At that time my AMEX was reporting 49% B/HB but I also had 6 of 6 cards reporting. This time AMEX will be 100% with "only" 4 of 6 reporting.

Ok - couldn't wait until the 26th and pulled my 3B today. My AMEX charge card did report $1997 and does show 100% B/HB. Total cards reporting a balance was 5 of 6 - BB card slipped in with $33.

As expected and shown previously, no change in Classic Fico 08 or Classic Fico 09 scores. As before all EQ Fico 04 scores (mortgage & enhanced) took a big hit. Pretty sure now that the AMEX charge card is the culprit in the EQ Fico 04 deep dives - none of the credit cards posted more than 2% utilization. Dip not as severe as in February - possibly because there is no inquiry on file or perhaps because 5 of 6 cards reported instead of 6 of 6 cards.

Note 1: There were no charges on AMEX card for the 3/2016 and 12/2015 3B reports.

Note 2: Experian appears to be using older data. Classic Fico 04 stayed at 830 and Bankcard Fico 08 was 900. Those results are not consistent with 5 of 6 cards reporting balances and AMEX at 100% B/HB.

Thomas_Thumb,

You went from 3 of 6 cards reporting and 2.1 utilization to 5 of 6 cards reporting and 3.1 utilization. I'm not sure that it is necessary to asume that the AMEX charge card figured into the points loss.

You took less of a hit on EQ 04 with 5 out of 6 cards reporting than with 6 out of 6 cards reporting in February. That is not exactly inconsistent.

It could very well be that the AMEX charge card was the culprit, but charge card effect is not really isolated.

Last year I dropped from 780 on EQ 04 with 2 cards reporting to 769 with 4 cards reporting (all <1%) to 758 with 5 cards reporting and 1 card at 8.61%. Aggregate utilization was <1% in all cases. Of course, I am positive that I was experiencing a different Score Card treatment of inquiries than you are currently experiencing.

Although I have no personal experience in this matter, it has always been my understanding that FICO 04 ignores charge card utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% Util --> 9 point dip on EQ FICO 8?

The charge card should not factor in. However, I have investigated this in detail and EQ has it coded differently than TU and EX. I filed a dispute with EQ last year and submitted info from AMEX but no success. EQ is still reporting it abnormally.

The AMEX is having an effect on EQ Fico 04 score relative to the other CRA Fico 04 scores - IMO it is a near certainty.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% Util --> 9 point dip on EQ FICO 8?

@oilcan12 wrote:

@SouthJamaica wrote:

@SouthJamaica wrote:

@iv wrote:

@SouthJamaica wrote:Bizarrely, EQ dropped another 3 points when another card reported taking me to 2.5% utilization and 8 out of 19 cards reporting.

Once again, EX and TU were unmoved.

Are you sure it's just not a difference in triggers between the CRAs?

(IE: did EX and TU send an alert, but with unchanged scores, or did only EQ send an alert?)

Only EQ sent alert

This is becoming less interesting as it becomes clear that only EQ cares. I.e. this 12 point drop appears to be strictly an EQ thing, not a FICO 8 thing.

And I'm guessing it's just a temporary EQ thing at that.

I think I figured out what may have caused the 12 point drop in EQ and not in TU & EX, and it isn't the change in utilization.

In playing around with the simulator, it was saying that my EQ score would drop 10 points, and neither of my other scores would move, if I were to add a card or increase my credit limits. Actually I did both. It appears that EQ doesn't want me to add any credit availability, while TU and EX would neither punish nor reward me for it.

I hope this doesn't mean I have to start cancelling cards. I love those little suckers, each and every one of them, even the ugly BCE card.

FICO scores are not influenced by the number of cards you have or your credit limits.

Did adding another card cause you to cross an AAoA threshold?

If it had, don't you think it would have affected TU & EX too?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% Util --> 9 point dip on EQ FICO 8?

@oilcan12 wrote:

@SouthJamaica wrote:

@iv wrote:

@SouthJamaica wrote:Bizarrely, EQ dropped another 3 points when another card reported taking me to 2.5% utilization and 8 out of 19 cards reporting.

Once again, EX and TU were unmoved.

Are you sure it's just not a difference in triggers between the CRAs?

(IE: did EX and TU send an alert, but with unchanged scores, or did only EQ send an alert?)

Only EQ sent alert

This is becoming less interesting as it becomes clear that only EQ cares. I.e. this 12 point drop appears to be strictly an EQ thing, not a FICO 8 thing.

And I'm guessing it's just a temporary EQ thing at that.

You're not receiveing EX and TU alerts for balance changes?

Yes I am receiving the same alerts... but the scores are holding steady.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% Util --> 9 point dip on EQ FICO 8?

@SouthJamaica wrote:

@oilcan12 wrote:

@SouthJamaica wrote:

@SouthJamaica wrote:

@iv wrote:

@SouthJamaica wrote:Bizarrely, EQ dropped another 3 points when another card reported taking me to 2.5% utilization and 8 out of 19 cards reporting.

Once again, EX and TU were unmoved.

Are you sure it's just not a difference in triggers between the CRAs?

(IE: did EX and TU send an alert, but with unchanged scores, or did only EQ send an alert?)

Only EQ sent alert

This is becoming less interesting as it becomes clear that only EQ cares. I.e. this 12 point drop appears to be strictly an EQ thing, not a FICO 8 thing.

And I'm guessing it's just a temporary EQ thing at that.

I think I figured out what may have caused the 12 point drop in EQ and not in TU & EX, and it isn't the change in utilization.

In playing around with the simulator, it was saying that my EQ score would drop 10 points, and neither of my other scores would move, if I were to add a card or increase my credit limits. Actually I did both. It appears that EQ doesn't want me to add any credit availability, while TU and EX would neither punish nor reward me for it.

I hope this doesn't mean I have to start cancelling cards. I love those little suckers, each and every one of them, even the ugly BCE card.

FICO scores are not influenced by the number of cards you have or your credit limits.

Did adding another card cause you to cross an AAoA threshold?

If it had, don't you think it would have affected TU & EX too?

Maybe. Maybe not.

I don't personally see a problem with EQ 08 dropping 12 points and EX and TU remaining unaffected. FICO score changes for different bureaus aren't always the same.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 2% Util --> 9 point dip on EQ FICO 8?

@Thomas_Thumb wrote:The charge card should not factor in. However, I have investigated this in detail and EQ has it coded differently than TU and EX. I filed a dispute with EQ last year and submitted info from AMEX but no success. EQ is still reporting it abnormally.

The AMEX is having an effect on EQ Fico 04 score relative to the other CRA Fico 04 scores - IMO it is a near certainty.

Thomas_Thumb,

That is very interesting information about you charge card being coded differently on EQ. Have to called the AMEX credit bureau number to see if they can do anything to get it coded correctly?

It would certainly be interesting if you could isolate the charge card effect a little more in a future experiment. I'm not suggesting that the charge card utilization could not have caused the score drop on EQ 04. I'm just pointing out that, on occasion, FICO scores for different bureaus can behave quite differently.

The table below demonstrates the potential differences in behavior of EQ 04 and TU 04 for a particular Score Card. In my current Score Card I would not expect to see such a big difference.

| 11/22/2015 | 2/13/2016 | |

| # Cards Reporting Balances | 2 | 4 |

| Aggregate Utilization | < 1% | < 1% |

| Highest Card Utilization | < 1% | < 1% |

| EQ 04 | 791 | 769 |

| TU 04 | 824 | 824 |