- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- 50% may be utilization threshold for individual ca...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

50% may be utilization threshold for individual card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@SouthJamaica wrote:

@Anonymous wrote:

@Anonymous wrote:

@SouthJamaica wrote:

If anyone with a totally clear, non-buffered, inactive profile can figure out a way to test it, I would be pleased to see the results. But I don't know how you could meaningfully test it, since in aggregate revolving utilization any increase in balances would increase both raw dollar amounts and the percentage.

There are a couple of ways one can distinguish raw dollars from percentages.

1) From 11/13/19 to 11/14/19 there was exactly one change on my Ex CR: The balance on one card increased from $293 to $640. As a result my total revolving balance changed from $7829 to $8076 and my Agg Util from 2.389% to 2.465%. My Ex Fico 3 dropped 8 points on that day. In this case the score change seems to be caused by a $8000 treshold in "Total Revolving Balance" rather than by a change in Agg Util.

2) Suppose for simplicity your total credit limit is $100,000 and your total revolving balance changes from $5600 to $6400 and say your Ex 8 score drops. This could be due to the raw dollars crossing $6,000 or the agg util crossing 6%.

Assume sometime later that your total credit limit has increased to $110,000, your total revolving balance changes from $6200 to $5800 and your Fico 8 does not change. Then it seems that $6,000 is not a threshold and that previous change in Ex 8 was caused by a 6% threshold in Agg Util. (But since time has passed by, your profile might have changed and $6,000 might have been a threshold, but no longer is)

From your posts its seems that you are pulling your Experian CRs and scores regulary. So if you look over all that data and compute Total Balance, Total Revolving Balance and Agg Rev Util you might to able to figure out whether your changes are due to raw dollar or util.

But you should also be aware that it is not always clear which accounts to include in your calculation. I, for example, have credit unions cards, AU cards and a Heloc, and I'm not sure which of these accounts should be included. So I wrote a spread sheet which lets me compute all the metrics for the different possible sets of accounts. Closed accounts with balances also might cause problems.

@Anonymous Good info and you're correct that you gotta figure whats counting in order to do anything.

Btw, in the above example, bolded, it could not be ag util, as both are 3% to the algorithm.

The 2nd bolded part is most important. Unless things have changed, my understanding is SJ does not compute utilization and instead uses Experian's frontend calculations. Consequently, its impossible to determine anything, cuz the utilization numbers he's using aren't those being used by the algorithm. Correct me if I'm wrong @SouthJamaica.

Yes I have previously told you that you are wrong about that.

Of course I compute my own utilization.

But I also keep an eye on what experian.com is saying about it.

And I have observed that while my EX FICO 8 doesn't move in synch with my calculations, it does move in synch with experian.com's rounded whole integer numbers.

Actually you told me you use Experian's frontend and that's why we got into a big discussion about utilization, but I'll gracefully bow out, my friend.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@Anonymous wrote:

SJ, just curious what your thoughts are now that we know that balances are a scoring factor. have you thought about that and how it may be affecting the score changes? what are your thoughts?

Clearly the primary utilization mover is percentage, not absolute dollar figures.

A person can have millions in balances and have an 850 score.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

@Anonymous wrote:

I totally agree that utilization a.k.a. percentage is the primary scoring factor without a doubt. Totally agree. However we do know the balance does have a smaller effect now. Are you discounting it? Its most likely responsible for the small point changes in between percentage thresholds, wouldn’t you agree?

I don't know.

Nor do I know what the individual account utilization thresholds are. I strongly believe that 30% is one and I think 50% may be one as well.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

Yes 30% 50% 70% 90% and 100% even though you won’t believe us 😉.

oops I had to correct that I had listed the aggregate now it's individual.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

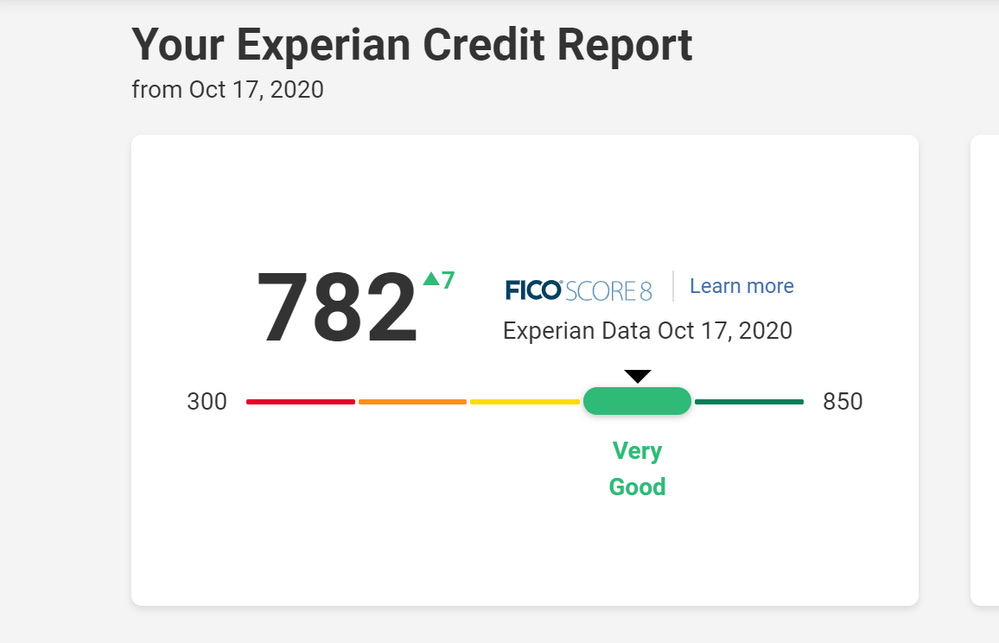

If 10% 30% 50% are UTI points for Indv cards, I dont remember when my (Only lone card that was above 50%) card went to 48% if I got an increase in points as it was above 65%. Well now that my card is at 18% I just received a 7 pt increase on EX. Just an FYI overall UTI also decreased fro 7% to 6%, these are the only changes I have seen on my credit that would seem to give me pts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 50% may be utilization threshold for individual card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content