- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: 57% Account --> 0, EX FICO 8 --> +10

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

57% Account --> 0, EX FICO 8 --> +10

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 57% Account --> 0, EX FICO 8 --> +10

@Thomas_Thumb wrote:Thanks for the additional info.

The magnitude of score shift seems to be pointing toward scorecard assignment/profile as an influencing factor.

I’m confused, you think this is an odd score improvement?

It seems about right to me. Over 50% to under 50% on an account has been a score move of about this amount in my experience.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 57% Account --> 0, EX FICO 8 --> +10

@NRB525 wrote:

@Thomas_Thumb wrote:Thanks for the additional info.

The magnitude of score shift seems to be pointing toward scorecard assignment/profile as an influencing factor.

I’m confused, you think this is an odd score improvement?

It seems about right to me. Over 50% to under 50% on an account has been a score move of about this amount in my experience.

No, SJ's 10 - 11 point drop is rather typical for a thick file having recent credit. I'd anticipate drops up to 15 points for recent credit files that are also thin files. The question and comment were in context with BBS reporting a lower score drop (pasted below). My conclusion was the difference was likely profile/scorecard based on SJ's information - which is what he speculated as well.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 57% Account --> 0, EX FICO 8 --> +10

I am now trying to fathom an account with over $500k reported limits as thin or young.

What are those AAoA and AYoA metrics?

How many new accounts in the last 12 months?

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 57% Account --> 0, EX FICO 8 --> +10

@NRB525 wrote:I am now trying to fathom an account with over $500k reported limits as thin or young.

What are those AAoA and AYoA metrics?

How many new accounts in the last 12 months?

AAoA 3 yrs 6 mos

AoYA 2 mos

7 accts in last 12 mos

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 57% Account --> 0, EX FICO 8 --> +10

@NRB525 wrote:I am now trying to fathom an account with over $500k reported limits as thin or young.

Thin I agree with completely, as it would be nearly impossible if not completely impossible for one to obtain $500k in reported limits with only 3-4 accounts on their CR.

Young is a different story though. If one is still in the process or has recently finished the process of building those limits, it means they were opening lots of accounts and thus two-thirds of their age of accounts factors (AoYA and AAoA) are likely to be relatively low. I think we often consider only AoOA when discussing whether a file is young, but there are 3 age of accounts factors that all generate negative reason statements associated with young age.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 57% Account --> 0, EX FICO 8 --> +10

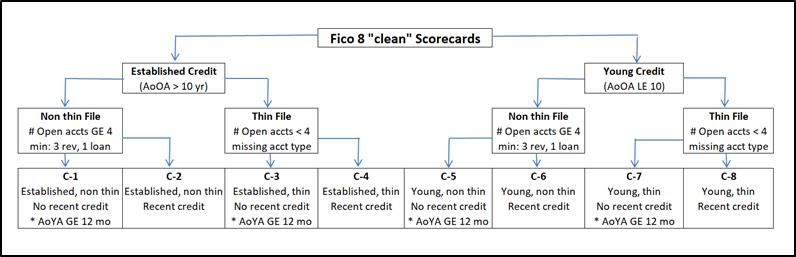

The scorecard segmentations are probably better labeled as: Credit history/file age (segmentation based on AoOA - not AAoA), credit management experience (segmentation based on acct types & total accts), new/recent credit. Young is a bit confusing so I changed young in the above post to recent for clarification.

Those 7 accounts in the last 12 months should certainly put SJ on one of the four clean scorecards associated with recent credit. QTY of accts under 12 (or 24) months might be part of the equation as well. Based on the below illustration you would place in C2 and BBS would place in C1. Recent credit scorecards likely react more strongly to high card utilization than their no new credit counterparts - IMO.

Not really sure on the AoOA segmentation age. It could be 12 years. Likewise, the thin/(non thin) could be thick/(not thick) in which case the # of acct threshold would be higher and segmentation might consider open + closed (threshold > 10?) in addition to QTY open only.

If segmentation is thick/(non thick), I'd place in the C3 scorecard; otherwise I sneak by into C1. My guess is a non thick (thin) scorecard may react more strongly to new credit than its thick (non thin) counterpart.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 57% Account --> 0, EX FICO 8 --> +10

@Thomas_Thumb wrote:The scorecard segmentations are probably better labeled as: Credit history/file age (segmentation based on AoOA - not AAoA), credit management experience (segmentation based on acct types & total accts), new/recent credit. Young is a bit confusing.

Those 7 accounts in the last 12 months should certainly put SJ on one of the four clean scorecards associated with recent credit. QTY of accts under 12 (or 24) months might be part of the equation as well. Based on the below illustration you would place in C2 and BBS would place in C1. Recent credit scorecards likely react more strongly to high card utilization than their no new credit counterparts - IMO.

Not really sure on the AoOA segmentation age. It could be 12 years. Likewise, the thin/(non thin) could be thick/(not thick) in which case the # of acct threshold would be higher and segmentation might consider open + closed (threshold > 10?) in addition to QTY open only.

If segmentation is thick/(non thick), I'd place in the C3 scorecard; otherwise I sneak by into C1. My guess is a non thick (thin) scorecard may react more strongly to new credit than its thick (non thin) counterpart.

Cool. Thank you for that. Very informative.

In my case the age of oldest account isn't young at all; it's 30 yrs 6 mos. And the profile definitely (a) is non-thin, (b) has recent credit and inquiries, and (c) has a low AAoA.

So I must be on FICO 8's C-2.

It seems that if I could put together a 1-year period of no new personal accounts, and no disasters, I could be on C-1.

It surprises me that AAoA is not a scorecard determinant.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687