- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: 6% overall utilization.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

6% overall utilization --> 7 point bump

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 6% overall utilization.

If aggregate utilization changed, buy definition individual card utilization changed. It's not like something crucial was being hidden here. That's why we ask questions to try and get to the bottom of the reason(s) for a score change. SJ never stated that an individual card utilization didn't change or didn't cross a threshold. He did however clearly state that the score change he experienced came before the 1st of the month, ruling out age of accounts factors, yet the need to pry about age of accounts factors possibly increasing was still an issue for whatever reason.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 6% overall utilization.

@Anonymous wrote:If aggregate utilization changed, buy definition individual card utilization changed. It's not like something crucial was being hidden here. That's why we ask questions to try and get to the bottom of the reason(s) for a score change. SJ never stated that an individual card utilization didn't change or didn't cross a threshold. He did however clearly state that the score change he experienced came before the 1st of the month, ruling out age of accounts factors, yet the need to pry about age of accounts factors possibly increasing was still an issue for whatever reason.

Check post 4

Check post 10

And to be clear, I now know that the day of the month don’t matter in this case.

Because we now know that 6% Aggregate is not a Thing, that individual card utilization going from 25% to 1% is in fact, and likely always has been, the Thing.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 6% overall utilization.

@SouthJamaica wrote:

@Thomas_Thumb wrote:

@SouthJamaica wrote:The reason I was able to get clean data -- which is a challenge in my profile -- is that I just subscribed to a new Experian product which gives me daily updates of the report including updates of 4 scores: FICO 8, FICO 2, and an Auto and Bankcard score. So it's clean data, but only applicable to EX. Several days later on my MyFICO dashboard there was a 6 point increase in TU FICO 8. So it's possible that it was related, but impossible for me to have any degree of certainty about that one.

It didn't occur during the changeover of the month; it occurred earlier.

Please report before/after on all scores received. It is more insightful as various models behave differently. I find it useful to look at Shifts in Classic score compared to Auto and Bankcard. If all three shift the same way more than 5 points, that's a tell sign that some factor fundamental to the algorithm has crossed a threshold.

Because # cards with balances, aggregate utilization and individual card utilization (typically highest card UT%) all affect score, it is helpful to mention # cards reporting (say 6 of 20 for example) and highest card UT%. SJ, is all that information available to you on these reports?

@Anonymous questions @Thomas_Thumb I always learn from you.

1. Yes all that information is available to me from these reports.

2. There was no change in number of accounts with balances (stayed the same at 12 of 30).

3. There was no instance of a >30% account dropping to <9%.

4. It did not occur on a change of month, it occurred between the 23rd and the 24th, and there was no change to age of anything.

5. The only change was that one account reporting a 25% balance dropped to a 1% balance. There were a total of 8 accounts reporting >9% balances on the 23rd; there were a total of 7 accounts reporting >9% balances on the 24th.

6. The changes in the Classic, Auto, and Bankcard scores seem to support your hypothesis that some factor fundamental to the algorithm may have crossed a threshold:

Classic 8 +7

FICO 2 +-0 (EX Fico 98 model)

Auto 8 +9

Bankcard 8 +8

I don't think we can rule out individual card utilization as potentially influencing score. Was 25% your highest card UT and if so, what was the next highest that remained?

BTW - thanks for adding the other scores. Interesting to see the lack of movement in EX Fico 98. This particular model was insensitive to an increase in # cards reporting and higher utilization but, EX Fico 04 (score 3) reacted strongly. unfortunately I can't say too much about Fico 8 & Fico 9 because those models ignore my high spend AU card.

In a couple weeks I will be allowing a personal card to report a balance in the 20% to 25% range - up from 2%. I don't plan on getting a 3B report but, I'll get free scores on EX Fico 9, EX Fico 8, TU Fico 8 and EQ BCE Fico 8 as well as EX , TU and EQ VS3.

| Fico Model Name | Before | After |

| # accts with balances | 4 | 5 |

| # Inquiries | 0 | 0 |

| Aggregate UT% w/AU | 1.1 | 5.4 |

| AU card UT % | 2.6 | 16.4 |

| EX Classic Fico 9 | 850 | 850 |

| EX Classic Fico 08 | 850 | 850 |

| EX Classic Fico 04 | 830 | 809 |

| EX Classic Fico 98 | 839 | 842 |

| EX Auto Fico 09 | 887 | 886 |

| EX Auto Fico 08 | 897 | 895 |

| EX Auto Fico 98 | 858 | 861 |

| EX Bankcard Fico 09 | 879 | 878 |

| EX Bankcard Fico 08 | 900 | 900 |

| EX Bankcard Fico 98 | 864 | 867 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 6% overall utilization.

@Thomas_Thumb wrote:

@SouthJamaica wrote:

@Thomas_Thumb wrote:

@SouthJamaica wrote:The reason I was able to get clean data -- which is a challenge in my profile -- is that I just subscribed to a new Experian product which gives me daily updates of the report including updates of 4 scores: FICO 8, FICO 2, and an Auto and Bankcard score. So it's clean data, but only applicable to EX. Several days later on my MyFICO dashboard there was a 6 point increase in TU FICO 8. So it's possible that it was related, but impossible for me to have any degree of certainty about that one.

It didn't occur during the changeover of the month; it occurred earlier.

Please report before/after on all scores received. It is more insightful as various models behave differently. I find it useful to look at Shifts in Classic score compared to Auto and Bankcard. If all three shift the same way more than 5 points, that's a tell sign that some factor fundamental to the algorithm has crossed a threshold.

Because # cards with balances, aggregate utilization and individual card utilization (typically highest card UT%) all affect score, it is helpful to mention # cards reporting (say 6 of 20 for example) and highest card UT%. SJ, is all that information available to you on these reports?

@Anonymous questions @Thomas_Thumb I always learn from you.

1. Yes all that information is available to me from these reports.

2. There was no change in number of accounts with balances (stayed the same at 12 of 30).

3. There was no instance of a >30% account dropping to <9%.

4. It did not occur on a change of month, it occurred between the 23rd and the 24th, and there was no change to age of anything.

5. The only change was that one account reporting a 25% balance dropped to a 1% balance. There were a total of 8 accounts reporting >9% balances on the 23rd; there were a total of 7 accounts reporting >9% balances on the 24th.

6. The changes in the Classic, Auto, and Bankcard scores seem to support your hypothesis that some factor fundamental to the algorithm may have crossed a threshold:

Classic 8 +7

FICO 2 +-0

Auto 8 +9

Bankcard 8 +8

I don't think we can rule out individual card utilization as potentially influencing score. Was 25% your highest card UT and if so, what was the next highest that remained?

BTW - thanks for adding the other scores. Interesting to see the lack of movement in EX Fico 98. This particular model was insensitive to an increase in # cards reporting and higher utilization but, EX Fico 04 (score 3) reacted strongly. unfortunately I can't say too much about Fico 8 & Fico 9 because those models ignore my high spend AU card.

In a couple weeks I will be allowing a personal card to report a balance in the 20% to 25% range - up from 2%. I don't plan on getting a 3B report but, I'll get free scores on EX Fico 9, EX Fico 8, TU Fico 8 and EQ BCE Fico 8 as well as EX , TU and EQ VS3.

Fico Model Name Before After # accts with balances 4 5 # Inquiries 0 0 Aggregate UT% w/AU 1.1 5.4 AU card UT % 2.6 16.4 EX Classic Fico 9 850 850 EX Classic Fico 08 850 850 EX Classic Fico 04 830 809 EX Classic Fico 98 839 842 EX Auto Fico 09 887 886 EX Auto Fico 08 897 895 EX Auto Fico 98 858 861 EX Bankcard Fico 09 879 878 EX Bankcard Fico 08 900 900 EX Bankcard Fico 98 864 867

No it wasn't the highest. The highest was 28% on both reports.

I don't think the score change had anything to do with the change in individual utilization.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 6% overall utilization.

@NRB525 wrote:Because we now know that 6% Aggregate is not a Thing, that individual card utilization going from 25% to 1% is in fact, and likely always has been, the Thing.

My understanding has always been that 8.9% utilization on an individual card is a profile-specific threshold. Someone correct me if I'm wrong on that, but I believe plenty of people have stated that it is a threshold where many others have crossed it plenty of times and reported no score change at all.

I'm very aware of your Post 10, as that's where you ignored SJ saying that the change came before the 1st of the month, but you continued to pry about age of accounts factors. In your most recent post here, you backtrack and say that you know it's a non-factor. I guess I figured you would have drawn that conclusion back at Post 10.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 6% overall utilization.

@Anonymous wrote:

@NRB525 wrote:Because we now know that 6% Aggregate is not a Thing, that individual card utilization going from 25% to 1% is in fact, and likely always has been, the Thing.

My understanding has always been that 8.9% utilization on an individual card is a profile-specific threshold. Someone correct me if I'm wrong on that, but I believe plenty of people have stated that it is a threshold where many others have crossed it plenty of times and reported no score change at all.

I'm very aware of your Post 10, as that's where you ignored SJ saying that the change came before the 1st of the month, but you continued to pry about age of accounts factors. In your most recent post here, you backtrack and say that you know it's a non-factor. I guess I figured you would have drawn that conclusion back at Post 10.

In my profile individual utilization changes in the realm under 29% have no effect on FICO 8.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 6% overall utilization.

@SouthJamaica wrote:In my profile individual utilization changes in the realm under 29% have no effect on FICO 8.

So then, it would definitely point toward another factor such as aggregate utilization, the purpose of your post. Is there a chance that where at one time individual card utilization below 28.9% didn't matter on your profile perhaps now it does? I can't really think of any reasons why that would change outside of possibly scorecard (re)assignment, but it's something to think about. Would it be possible for you to take your individual card back up across 8.9% (but below 28.9%) and see if there's any score movement?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 6% overall utilization.

@Anonymous wrote:

@SouthJamaica wrote:In my profile individual utilization changes in the realm under 29% have no effect on FICO 8.

So then, it would definitely point toward another factor such as aggregate utilization, the purpose of your post. Is there a chance that where at one time individual card utilization below 28.9% didn't matter on your profile perhaps now it does? I can't really think of any reasons why that would change outside of possibly scorecard (re)assignment, but it's something to think about. Would it be possible for you to take your individual card back up across 8.9% (but below 28.9%) and see if there's any score movement?

That particular account was not a big deal in the context of my profile. There are a bunch of other accounts with similar percentage utilization.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 6% overall utilization.

@SouthJamaica wrote:

@Anonymous wrote:

@NRB525 wrote:Because we now know that 6% Aggregate is not a Thing, that individual card utilization going from 25% to 1% is in fact, and likely always has been, the Thing.

My understanding has always been that 8.9% utilization on an individual card is a profile-specific threshold. Someone correct me if I'm wrong on that, but I believe plenty of people have stated that it is a threshold where many others have crossed it plenty of times and reported no score change at all.

I'm very aware of your Post 10, as that's where you ignored SJ saying that the change came before the 1st of the month, but you continued to pry about age of accounts factors. In your most recent post here, you backtrack and say that you know it's a non-factor. I guess I figured you would have drawn that conclusion back at Post 10.

In my profile individual utilization changes in the realm under 29% have no effect on FICO 8.

BBS, you are being selectively blind. Both post 4 and post 10 are asking first for the list of individual card utilization changes. The reference to timing is just casting a wide net for any sort of change reasons.

SJ, are you tracking all your individual card changes on a direct monitoring service such as MF? That's quite a statement that nothing under 29% on any single card affects your FICO 8.

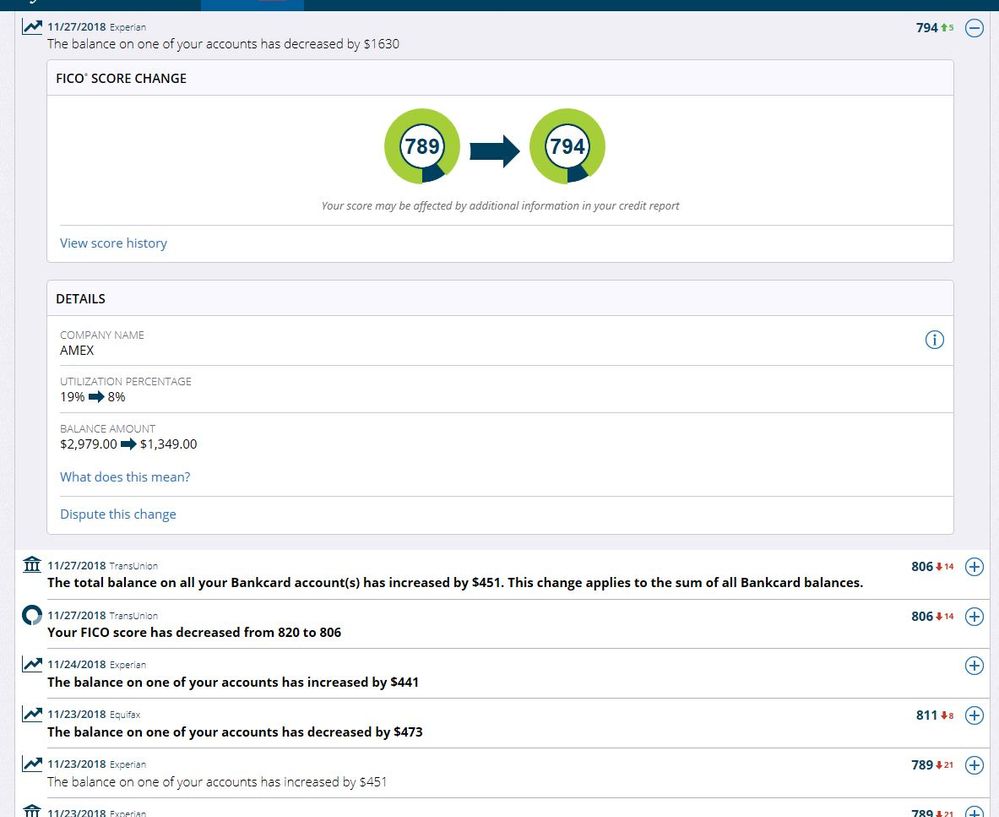

Here is a recent sequence for my cards. The $451 change is taking a card over 50%. EX lost 21 points. Even with that, a few days later paying down another card from 19% to 8% increases EX by 5 points, getting some of those back even though a card just went over 50%. I see this sort of movement all month long. I have a hard time believing anyone is not affected by individual card utilization changes more than half the time that those card balances change significantly. Going from high 20's to 1% is a significant change on one card.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 6% overall utilization.

@NRB525 wrote:SJ, are you tracking all your individual card changes on a direct monitoring service ....?

Yes I am.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687