- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- 750 = 850; Should it in your opinion?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

750 = 850; Should it in your opinion?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

750 = 850; Should it in your opinion?

We all can agree that a 750 score in most cases can land someone a loan/mortgage with the best interest rates. In some cases a lower score of 740 or even 720 has been referenced as being worthy of a top-notch rate. Since the entire real-world purpose of having a sound credit profile/score is to be able to obtain products at the best rates when you need them, for the sake of this discussion we can essentially say that a 750 score is equal to an 850 score. My question to all of you is should it be?

If a 750 score is equal to an 850 score, does scoring need to go to 850? Why not stop at 750 and just allow a large buffer there? Why should there be no real world difference between a 750 and 850, when we all know there's a big difference between 650 and 750 or 550 and 650?

I know a credit score all comes down to assigning a number relative to potential risk. If we're going to say (or lenders are going to agree) that someone possessing a 720-750 score really isn't that much more of a risk than someone with an 850 score, why does scoring go as high as it does?

IMO, there's something to be said about longevity. With respect to credit profiles and FICO scoring, longevity to me ties in very closely to age of accounts or length of credit history, whichever you want to call it, that makes up ~15% of a FICO score. The difference in many cases between possessing a 750 score and an 850 score comes down to this slice of the FICO pie. Someone with 1 year of credit history can have a 700+ score and definitely within a year and a half can have a 720-750 top-notch score. This person with a 1-2 year AoOA compared to someone with a 20 year AoOA really can't be considered an equal in terms of risk IMO. There's simply not enough credit history there to say these two are equals in terms of obtaining the best credit products. I feel like longevity should count for something, but that doesn't really seem to be the case.

I think of it from the perspective of having 2 otherwise equal employees working for me. Both are identical in all aspects of the job and are equal performers. When I sit down to write their annual reviews, they'd probably receive equal marks in every category. Perhaps one has worked for me for 2 years and the other for 20 years. I've actually written real-world reviews that mirror this illustration. On paper both employees may be equal in just about every way, but that 20 years to me, that longevity, is incredibly meaningful and must be considered.

I'm just curious to hear the opinions of everyone on here regarding the current scoring system in terms of 720-750 scores being good enough for the best products and what you feel the value is of scores higher than that?

I understand that there are rapidly diminishing returns when it comes to scoring, but it's somewhat crazy to think that a 20 year old with 2 years of credit history can possess an 800 FICO score, but it takes at least 10-15 more years and someone to be in their mid 30's to reach an 850... yet that longevity really doesn't "count" for anything.

What are your thoughts on the subject?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 750 = 850; Should it in your opinion?

At the point of an actual credit application, particularly for term loans like mortgage and auto loans, the lender must consider many factors, not just FICO score before advancing that significant sum of money.

With a Credit Card app, it involves a line of credit that may or may not be used. The lending risk is managed by watching current swipes, to allow or deny.

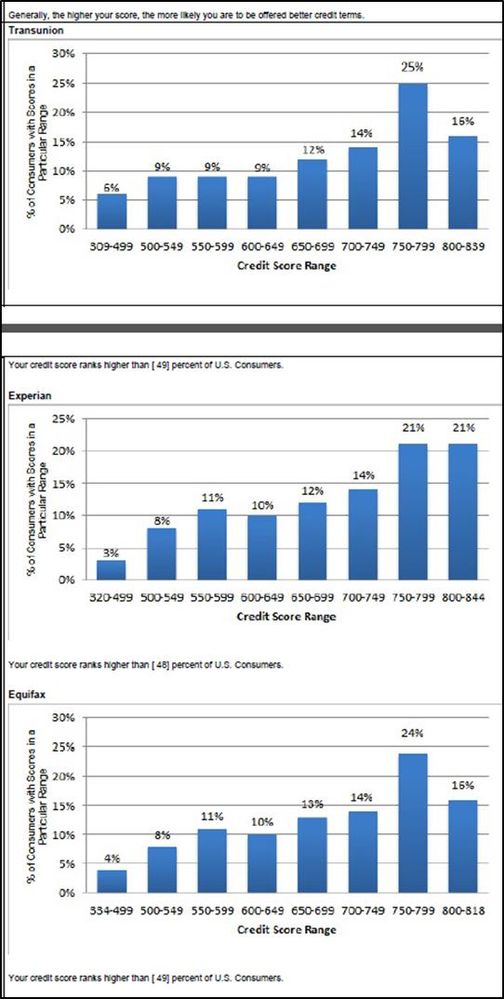

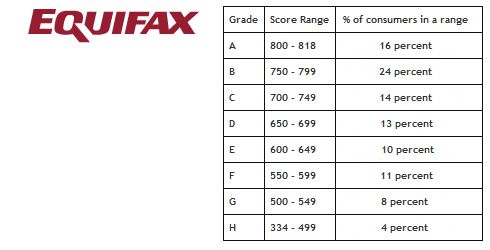

The percentage of the population achieving the highest scores is quite small, and these folks are actually less likely to take out new borrowing. Thus there is no market for a bank to address, no reason to get more refined with an “over 800 special interest rate.” That FICO 8 score we so commonly discuss is not relevant to an auto loan or mortgage, which use other algorithms.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 750 = 850; Should it in your opinion?

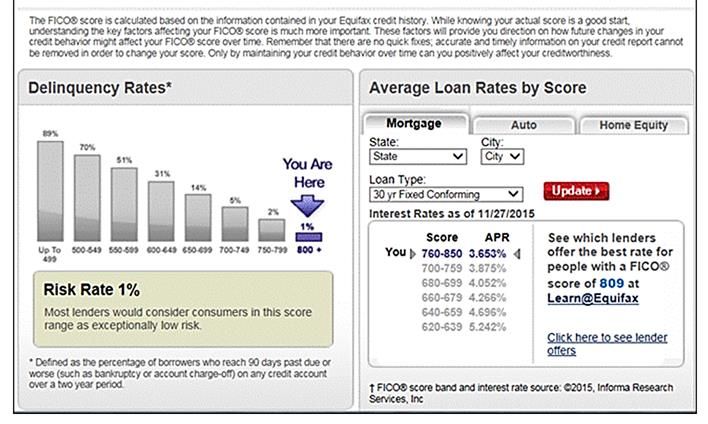

Experian has a "Super Prime" category for 780+ scores, and if my EQ report from a few years ago is anything to go by, the default risk continues to go down as you move from 750 to 850. Granted we're talking something like 4% to 2% to 1%, but there clearly is a difference.

Closed:

6/8/20:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 750 = 850; Should it in your opinion?

Same reasons why a 91% is an A but not the same thing as a 100%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 750 = 850; Should it in your opinion?

Yeah, kind of like someone getting a medical degree.... doesn't mean they had the highest gpa.

EQ: 731 TU: 705 EX: 715

Cap1 QS: 9k USBank: 7k Amex BCE: 14.1k BoA: 8k Discover: 4.4k CareCredit: 12k *Various Store Cards: 18.7k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 750 = 850; Should it in your opinion?

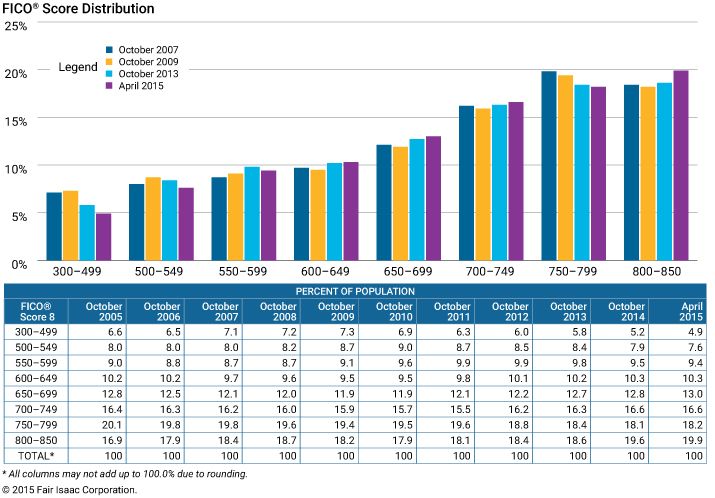

As NRB525 said there is a big difference in scoring between Fico 8 and the earlier Fico 04/Fico 98 models. Scores 760 and above are more selective with the "mortgage" models than with Fico 8. With the changes in laws and deletion of derogatory accounts it is now more difficult to differentiate among higher and lower risk profiles. As with grades in school, there has been substantial credit score inflation. These days an 800 is the old 760. The greatest score boosts have come since 2015.

I suspect lenders want enough granularity to differentiate risk of delinquency down to a 0.5% or 1% level. Below is some data on mortgage models followed by Fico 8

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 750 = 850; Should it in your opinion?

So, no one sees any value here in longevity? I suppose I'm the only one.

I'm not sure how anyone can say that someone with 1.5-2 years of credit history can be considered of equal relative risk of default as someone with 20 years of credit history when both of their scores may be about the same, in the "top-tier" range when talking attainable interest rates. Even with diminishing returns, is 1.5-2 years of experience with credit enough of a sample size to really determine if someone would be at low or high risk of default?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 750 = 850; Should it in your opinion?

@Anonymouswrote:So, no one sees any value here in longevity? I suppose I'm the only one.

I'm not sure how anyone can say that someone with 1.5-2 years of credit history can be considered of equal relative risk of default as someone with 20 years of credit history when both of their scores may be about the same, in the "top-tier" range when talking attainable interest rates. Even with diminishing returns, is 1.5-2 years of experience with credit enough of a sample size to really determine if someone would be at low or high risk of default?

I think your take is absolutely spot on. However, I will say that it already does matter... particularly to the most selective of financial institutions; and particularly, during manual reviews.

When they still can come up with reasons like, "Insufficient Length of History," and your score is already 780, than it certainly matters to have a score that's over 800.

Also, there are at least a few known banks that will not lend to someone with less than 1 or 2 years of history; as well as, to borrowers under 25 years of age. This can also include someone with a lengthy history, that - due to adding several new accounts - has significantly reduced their average age.

So, having a 750 plus doesn't quite matter, unless you have the other fundamentals to back it up. Namely, income; but, length of history is almost always an excuse not to give out the maximum offers, until your average age is like 10 years.

In fact, the only other reason that, with over 10 years of credit history, a borrower would still be under 800, is if they carry balances, or have missed a payment or two.

So, I will say that it's probably a bit unfair to someone with a lengthy history, to have to compete with someone with very limited history.

But, when you have limited history, and a high seven score... you'll definitely feel it, at least in some form or fashion.

Car dealers have always lent relatively loosely, so it doesn't matter much there, above 720. I think the highest scoring prerequisite that I've been quoted to secure the best auto lease... is 740. But again, unless you've already leased with that bank prior to, they're still going to want to verify income.

Mortgage lenders are cyclical, with the overall economy. But, pretty much anything about 760-780 gets a great rate. But, your debt to income ratio will always matter. Two years minimum of consistent verifiable income is also always a requirement. So, there's no getting around that.

Overall, you definitely have a point. But, when you're at 750, versus 850... you'll definitely notice the difference. You get the benefit of all doubt at 850. Conversely... at 750, they still want to review the rest of your credentials.

Personally, I've still had banks and credit unions asking for income verification, even when they straight up stated that the score they obtained was over 800. So, perhaps they'd be less distracted with minutae, if the score was nearer to 850? Or, perhaps there will always be some banks that just want to verify income, in just about every circumstance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 750 = 850; Should it in your opinion?

I think the other thing to think about, in terms of why 750 gets the same deals as 850... is profitability.

There's very little profit above 650, anyway. So, diminishing returns are to be taken literally, as scoring progresses.

It's just like any other risk based investment... as all investments carry some level of risk.

The bank that is willing to lend out to the average borrower, with moderate levels of risk, will reap more than the bank that only lends to the most timid and shrewdest of borrowers.

But, when the economy tanks, those 650 borrowers can become quite risky. So, it really just depends on the soundness of strategy employed by the bank; which inherently is always based on forward thinking evaluations... and market predictions, if you will.

So, 750 is perhaps the best of both worlds. You can't get buried under defaults, even in a down market. In fact, the 750 borrowers would more than likely slip a bit, and thusly become profitable in that down market. Nevertheless, you'd still be hedging against those subprime borrowers. Conversely, if all you took was 800 plus, you'd probably be out of a job in no time; unless you found other fantastic investments for your bank.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 750 = 850; Should it in your opinion?

First off, you have to remember that the only time you can really save yourself money by having a high credit score is with Mortgages and Auto loans. (At least for the great majority of people.)

To get an 800 score within a couple of years means that you only have 2 or 3 low value credit cards. You can't do it by having top tier cards because you normally won't qualify for them just starting out. Sure your scores might be high but you will have a very thin file and if it were to be manually reviewed like a Mortgage app would be, it would not leave the lender feeling all warm and fuzzy.

On the other hand, a person with 10 credit cards with 25% UTI and an AAoA of say 4 years and a 60 month auto loan that is one-half paid off and a score of 750 would most definitely look much better to a mortgage lender IMHO.

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20