- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: 99% Utilization of $250K

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

99% Utilization of $250K

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

99% Utilization of $250K

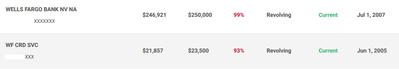

Hi, not my accounts, thank god. question is how much of a score bump could one realize in the below scenario if one pays the card down to 100$. EX is @ 666, both the card and equity line have flawless payments since 2012 and both have been maxed out for years. both coded as revolving accounts. I have no idea if an equity lines weight is the same as a card which is why I am asking. Thank you

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 99% Utilization of $250K

Edit to add: idk

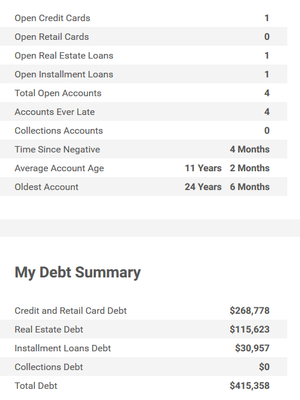

but....Everytime I pay down my equity line, even by a few hundred, I get at least 4 points. I'm at 82% utl.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 99% Utilization of $250K

@GApeachy wrote:Edit to add: idk

but....Everytime I pay down my equity line, even by a few hundred, I get at least 4 points. I'm at 82% utl.

your answer, while appreciated, has nothing to do with my query

question is how much of a score bump could one realize in the below scenario if one pays the card down to 100$.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 99% Utilization of $250K

@bourgogne wrote:

@GApeachy wrote:Edit to add: idk

but....Everytime I pay down my equity line, even by a few hundred, I get at least 4 points. I'm at 82% utl.

your answer, while appreciated, has nothing to do with my query

question is how much of a score bump could one realize in the below scenario if one pays the card down to 100$.

yeah, sorry......I pulled a Forest Gump I guess ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 99% Utilization of $250K

Are these two accounts the only revolving accounts? If not, we'd need a list of all revolving accounts with their credit limits and balances. (If the person has closed accounts with a positive balance we need to know that as well.)

Does this person have a completely clean report? No lates, collections, etc. on any accounts? That's also relevant for people making guesses as to how much score boost would be possible.

Your proposed scenario is to pay the card down to 100k. Do you mean pay the equity line down? It looks like the card currently has a balance of roughly 21k.

Finally, in the paydown scenario, would the person still have a revolving account at > 90% utilization? (I.e. only one account is being paid down?)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 99% Utilization of $250K

@Anonymous wrote:Are these two accounts the only revolving accounts? If not, we'd need a list of all revolving accounts with their credit limits and balances. (If the person has closed accounts with a positive balance we need to know that as well.)

Does this person have a completely clean report? No lates, collections, etc. on any accounts? That's also relevant for people making guesses as to how much score boost would be possible.

Your proposed scenario is to pay the card down to 100k. Do you mean pay the equity line down? It looks like the card currently has a balance of roughly 21k.

Finally, in the paydown scenario, would the person still have a revolving account at > 90% utilization? (I.e. only one account is being paid down?)

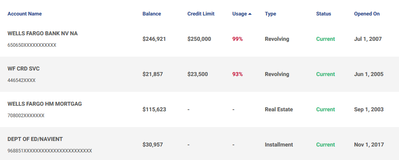

Hi CGID, its been a long time, hope you have been well. sorry I was not more clear. the card cut is on 1/17 and it will be paid down to $100 before then. 4 month late on student loan, co on 8/17 on a $7.5K chase card, now reporting `Paid, was a charge-off' at some point I am going to try and get that removed based on some medical issues that were going on with the man. he had a stoke on 8/17 and lots of issues leading up to it hence the lack of focus on his credit. he had a PFO procedure done just yesterday. I have known the individual since 1975, he is a very dear friend. lots of card offers btw, chase, amex, etc. his file age is good, just some recent hiccups. I am afraid the equity line will stay pretty maxed out until he can do a refi but if it will help to toss a few dollars at it he can do that. I was incorrect, his ex is 660 right now. just a wild guess would be good. it has to be paid down so its a moot point, I will report back how the score changed, i am just curious. he has a solid relationship with WF, long standing loads never late, card never late, etc. any ideas or comments would be greatly appreciated. Thank you very much.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 99% Utilization of $250K

I don't think this file is being negatively affected by the HELOC. I have a second mortgage which is viewed as a LOC by two bureaus, the Utilization is 98.7% and they are both like #shrug. My FICO 8 scores are 840-842.

The revolving credit card is another matter. High utilization on that has an impact on score. But that's still not what creates the 660 score.

The two baddies (plus any other not listed) are what are causing the score to be mid-600s.

Paying down the revolving credit card will help some, could get closer to 700, but with two baddies, the file has a ceiling preventing much improvement in score.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 99% Utilization of $250K

@NRB525 wrote:I don't think this file is being negatively affected by the HELOC. I have a second mortgage which is viewed as a LOC by two bureaus, the Utilization is 98.7% and they are both like #shrug. My FICO 8 scores are 840-842.

The revolving credit card is another matter. High utilization on that has an impact on score. But that's still not what creates the 660 score.

The two baddies (plus any other not listed) are what are causing the score to be mid-600s.

Paying down the revolving credit card will help some, could get closer to 700, but with two baddies, the file has a ceiling preventing much improvement in score.

Thank you for responding, I really appreciate it. my buddy is like many individuals, he just does not have the time to manage this financial component in his life, he has a full plate.

I am glad that the loc may not be a huge factor in his scores, that is good to hear. I am also sure that his negs are holding his scores down. I just thought by paying down the wf card to ~1% it would help maybe get him to the low 700s and in striking distance of getting some new credit to build himself up + you are right, he needs to refi and lose the loc, but again I just wanted to remove the card util out of the equation.

On his 3rd marriage, 3 kids 1 with a spectrum disorder of some sort, flipping awful loveless marriage, up and down business issues, random health issues. Beside the student loan being 30x1 4 months ago and the chase account which before the co was obliterated with tons of late and failures to pay there are the below items I just dug up.

WELLS FARGO DEALER SVC 30x1 >> 3/14 closed 11/14

SYNCB/CHEVRON 30x2 >> 3/15, 3/15, 60x1 9/15 closed by grantor 9/15

He just has bigger fish to fry & credit is not a priority but he is a huge part of my life, 44 years of a solid friendship means something to me so if helping him craft a letter to chase or the student loan and citing his health as an excuse which is no lie to help mitigate the negs then I am happy to help.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 99% Utilization of $250K

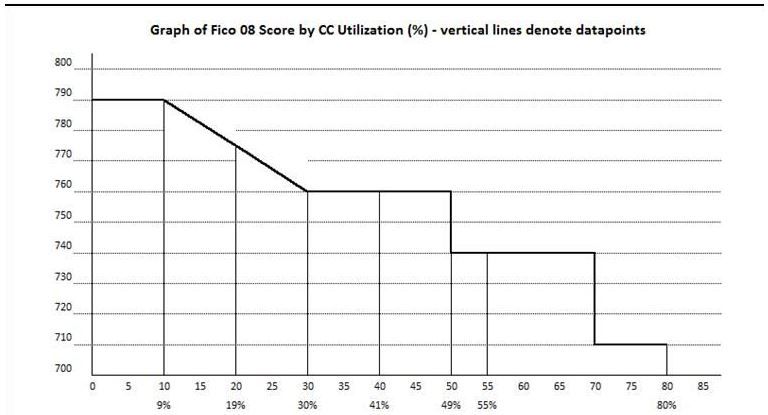

IMO and exp you will see around 10- 15 points per threshold crossed. Use this as an estiamted guidline. Please disregard thought this was about CC's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 99% Utilization of $250K

@brandonlane, thanks for the nifty chart -- I was thinking/hoping that paying the wf down would give him ~75pts .. not sure how long wf takes to report after the cut date but the truth is out there. have a nice weekend