- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- AZEO at < 8.9% vs < 28.9%?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AZEO at < 8.9% vs < 28.9%?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AZEO at < 8.9% vs < 28.9%?

I've read some conflicting data points and/or opinions on this, so I felt it was thread-worthy. This question assumes ideal aggregate utilization is a constant, say 1%-5% (but up to 8.9% I'm sure is OK).

What data points do you all have on taking your AZEO card above the 8.9% threshold, but keeping it below the next 28.9% threshold? I've read many times that on a single individual card that no penalty is realized in crossing 8.9%, so long as the individual card stays below 28.9% utilization and aggregate utilization remains in the ideal range. Conversely, I've read that people have taken a slight ding.

I've only had my AZEO card at < 8.9% and then at > 28.9% and > 48.9% (where I've received a ding) but never in the 9%-28.9% range.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO at < 8.9% vs < 28.9%?

Profile: 3 CCs, 11 student loans, one derog.

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO at < 8.9% vs < 28.9%?

Two questions.

One, when you say AZEO card at 14%, do you mean going to 14% from a number less than 8.9% prior? I'm assuming this is the case, just want to clarify.

Two, you mention 1 derog. Is it a major or a minor, meaning do you possess a clean score card or a dirty score card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO at < 8.9% vs < 28.9%?

Major derog. 4 yr old paid chargeoff. Dirty.

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO at < 8.9% vs < 28.9%?

Not sure if this is beneficial, AZEO back when I had a reallllly dirty profile (not sure what difference it makes?)- 29% utilization, And dropping to 8% the following month gave me a 27-30 point gain across the board.

Current Scores 4/18: EQ8 645/EQ9 686/TU 664/EX 682

Starting Scores 10/17: EQ 590 /TU 592/EX 560

AAoA: 3y6mo

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO at < 8.9% vs < 28.9%?

I am currently doing my annual experimenting with individual utilization on fico 8 since I rarely go over 8.9% individual or 5% overall. Having 0% interest $0 fee balance transfers available each January on my lowest limit card makes for cheap experimentation.

Going from AZEO 0.18% individual/0.018% overall to AZEO 25.8% individual/2.08% overall...

TransUnion stayed the same at 801 (however AZE2 scored like AZE3 usually does for me)

Equifax dropped 2 points from 787 to 785

Experian dropped 5 points from 790 to 785

The next month I lowered the individual utilization to 18.9% and the hit was gone on EQ.

I am still trying to figure out where the 5 point hit on EX goes away for me. It was still there at 18.9% and 14.9%. Last year I saw a 2 point hit at 13% and it was gone at 8.9%. I am planning to test 13.9% when that card reports this month unless anyone has other suggested thresholds to test between 14.9% and 13%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO at < 8.9% vs < 28.9%?

Interesting data points above, speedy, suggesting that on your profile a threshold exists somewhere between 8.9% and 28.9% on individual card utilization. It sounds like the potential impact, at least on your profile is minor at 2-5 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO at < 8.9% vs < 28.9%?

@Anonymous wrote:Interesting data points above, speedy, suggesting that on your profile a threshold exists somewhere between 8.9% and 28.9% on individual card utilization. It sounds like the potential impact, at least on your profile is minor at 2-5 points.

Correct, minor impact that is consistent across varying numbers of cards reporting a balance which has a somewhat larger but still minor impact (9-12 points at 4/5 cards reporting a balance) on EQ and TU for me.

I would like to retest AZE2 with 19-28.9% individual utilization to see if it repeats scoring like AZE3 on TU, but I will not purchase stuff just to test this.

Within my normal spending patterns it seems like the worst thing I can do to my fico 8 scores is allow all 0 balances to report which causes a 25-37 point drop for me.

Thanks for the interesting thread topics.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO at < 8.9% vs < 28.9%?

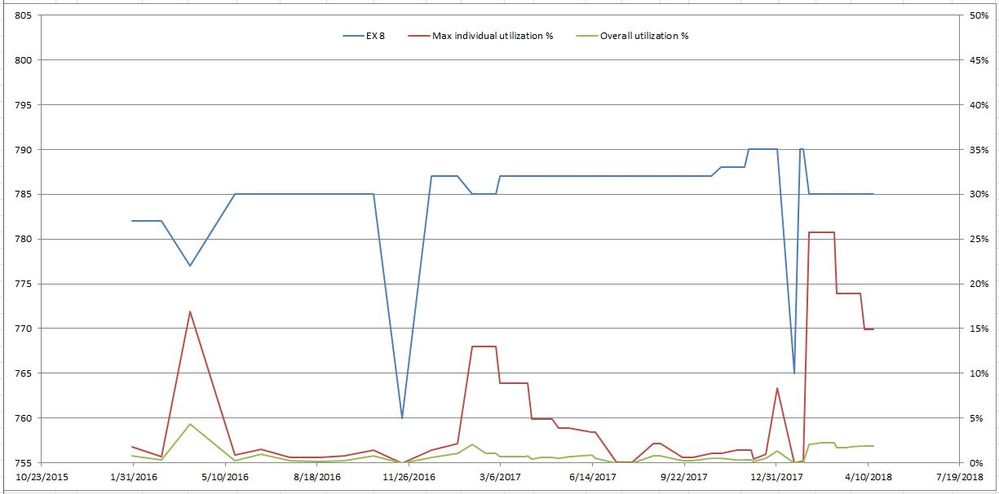

The relationship between my fico 8 scores and individual utilization can be most cleanly seen on experian. The only times my EX score changes are when aging thresholds are crossed, all 0 revolving balances report, or I have utilization above 8.9%. I have other charts for EQ and TU fico 8 as well as EQ and TU Vantagescore 3, but those seem to be affected by number of cards reporting a balance and it is harder to quickly see how utilization affects the scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AZEO at < 8.9% vs < 28.9%?

@Anonymous wrote:I've read some conflicting data points and/or opinions on this, so I felt it was thread-worthy. This question assumes ideal aggregate utilization is a constant, say 1%-5% (but up to 8.9% I'm sure is OK).

What data points do you all have on taking your AZEO card above the 8.9% threshold, but keeping it below the next 28.9% threshold? I've read many times that on a single individual card that no penalty is realized in crossing 8.9%, so long as the individual card stays below 28.9% utilization and aggregate utilization remains in the ideal range. Conversely, I've read that people have taken a slight ding.

I've only had my AZEO card at < 8.9% and then at > 28.9% and > 48.9% (where I've received a ding) but never in the 9%-28.9% range.

BBS...I have one card that all the debt on it and all the interest paid belongs to my sister...It is the only card that does not get PIF every month. It has a 10k cl, and a month ago it went over 50% utilization for the first time. It resulted in about a 10-15 point drop in my score. It came back up the next month after it dropped back below 50%. Hope this helps in your assessment, but since utilization is a point in time metric, I don't really spend much time worrying about it anymore. None of my scores have dropped below 800 in a long, long time. They also have not went over 825...not once!! I dropped credit check total, so I only get EX and TU scores from discover and Amex...I'll pull EQ about every 6 months.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20