- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Accidental 30 day late payment drops my score 91 p...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Accidental 30 day late payment drops my score 91 pts?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidental 30 day late payment drops my score 91 pts?

So long story short. I made payments on my Cap one CC (never missed one), However I have had many issues with them. Well to my great excitement, I saw that my credit score had dropped 91pts. I looked at the reason and Cap one stated that I had a 30 day delinquency. After calling them, they stated I had missed my last two payments. Dumbfounded, I went to my (ex) bank and sure enough, the money they claimed they never received was withdrawn from my account.

I called Cap One back and after two hours and a half hours and multiple calls to my old bank( to verify the money was really withdrawn), they removed the delinquency and even gave me a $25 credit. So yes it will be taken off of my account next reporting session for Cap One, however, I did not know this a day earlier when I applied for a bankamericard (new bank and they suggested to apply to transfer my cap one balance since BOA was offering 0% APR for 15 months ![]() ). Therefore they pulled my bad credit score showing a last delinquency late payment of 0 months ago

). Therefore they pulled my bad credit score showing a last delinquency late payment of 0 months ago ![]() .

.

OK OK, maybe that wasn't that short of a story, however my questions are, can a late payment really affect the score that much and why? seems absured, especially since I have been doing very well for at least the last 4 years.

Also, I know this is not in a credit card section, buuut it fits with the flow. Does anyone know what Score the Bankamericard requires?

This is my first post so I hope I made it in the right place! Thanks all!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidental 30 day late payment drops my score 91 pts?

A late payment is one of the biggest signs of risk in the eyes of a lender, especially if it's recent. 0 months? Probably the highest single piece of risk a lender could see from one month to the next. 91 points is a perfectly reasonable amount for your score to drop with the introduction of a new late payment. It doesn't matter if you have 2 years of great credit history prior or 20 years of great credit history prior. The most important thing is the most recent information and if most recently you've been late that's what they have to go on, as it vastly increases the chances of you being late again.

I'm glad to hear that Cap One took ownership of their mistake and that your report will again be clean.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidental 30 day late payment drops my score 91 pts?

I would not be so nice to a bank who committed a crime like that.

Congrats on getting it fixed but in the future if any bank commits a federal crime, please consider reading up on your rights and the process to maintain those rights.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidental 30 day late payment drops my score 91 pts?

Thanks Brutal!

Yeah I can see the immediate ramifications and understand those. I think it is just the fact that after research, I saw that if those were legit, it would have stayed on my credit for a whole seven years, just seems like a long time. This is mostly because I used to work with credit scores all of the time (was in an industry where it was my duty to deny or accept based off of a full credit report.) and I'd see a report where 6 years ago someone seemed to have had a bad past but was clean since, however there credit was still a little off.

I really appreciate the answer! I'm always happy to learn ![]() !

!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidental 30 day late payment drops my score 91 pts?

ABC:

You're the second person to tell me this. When I saw the issue on my report and had it fixed, I immediately called my bank about the credit app I had filed. They are doing a reconsider app on my behalf and my personal banker has set up a meeting to talk to me about it. This is because, as he said " What they did might not be legal as it may have affected you in many ways. Just as you are responsible to them by law, they are responsible to you."(roughly). I guess I was just so concerened about getting it removed that I didn't even stop to think about it in that way. I appreciate your input!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidental 30 day late payment drops my score 91 pts?

@Anonymous wrote:So long story short. I made payments on my Cap one CC (never missed one), However I have had many issues with them. Well to my great excitement, I saw that my credit score had dropped 91pts. I looked at the reason and Cap one stated that I had a 30 day delinquency. After calling them, they stated I had missed my last two payments. Dumbfounded, I went to my (ex) bank and sure enough, the money they claimed they never received was withdrawn from my account.

I called Cap One back and after two hours and a half hours and multiple calls to my old bank( to verify the money was really withdrawn), they removed the delinquency and even gave me a $25 credit. So yes it will be taken off of my account next reporting session for Cap One, however, I did not know this a day earlier when I applied for a bankamericard (new bank and they suggested to apply to transfer my cap one balance since BOA was offering 0% APR for 15 months

). Therefore they pulled my bad credit score showing a last delinquency late payment of 0 months ago

.

OK OK, maybe that wasn't that short of a story, however my questions are, can a late payment really affect the score that much and why? seems absured, especially since I have been doing very well for at least the last 4 years.

Also, I know this is not in a credit card section, buuut it fits with the flow. Does anyone know what Score the Bankamericard requires?

This is my first post so I hope I made it in the right place! Thanks all!

Where are you getting your score from?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidental 30 day late payment drops my score 91 pts?

@Anonymous wrote:Thanks Brutal!

Yeah I can see the immediate ramifications and understand those. I think it is just the fact that after research, I saw that if those were legit, it would have stayed on my credit for a whole seven years, just seems like a long time. This is mostly because I used to work with credit scores all of the time (was in an industry where it was my duty to deny or accept based off of a full credit report.) and I'd see a report where 6 years ago someone seemed to have had a bad past but was clean since, however there credit was still a little off.

I really appreciate the answer! I'm always happy to learn

!

You've also got to consider that a single 30-day late is likely the starting point for many worse delinquencies/derogs just as worse severity lates, collections, BK, etc. No doubt the majority that have those far more severe negative items present started off with a single 30 day late at the beginning of the downward spiral. Lenders know this. As a result, when they see a 30 day late they don't know if it's going to be an isolated incident or if it's going to lead to a far worse situation. Better safe than sorry on their end and scoring goes along with this. If the 30 day late stayed on your report, most of the impact from it would be gone in about 2 years even though it would be visible for the full 7 years. FICO scoring can be understanding of an isolated minor late payment that ages a bit, but not multiples or ones of greater severity.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidental 30 day late payment drops my score 91 pts?

@Anonymous wrote:

If the 30 day late stayed on your report, most of the impact from it would be gone in about 2 years even though it would be visible for the full 7 years. FICO scoring can be understanding of an isolated minor late payment that ages a bit, but not multiples or ones of greater severity.

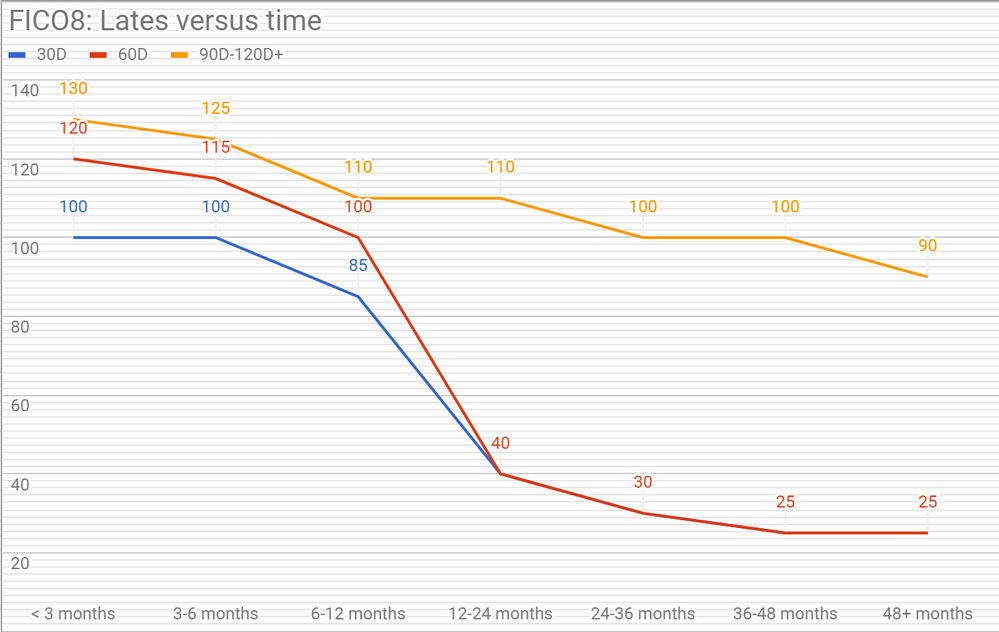

Yup, the 2 year mark is when 30D and 60D hurts a LOT less, but 90D+ continues to ding almost 100 points until the full 7 year mark. The full ding of a 30D/60D happens at 3 years and then it hurts for about 25 points until it ages off.

My chart:

It's curious to me how the 60D isn't that much more painful except initially -- FICO's analyses must show that people who pay off a 60D are just as likely to default as a 30D if it doesn't recur after 2 years...

Something to note is a 60D late mark actually means you've missed 3 payments (typically), not 2. Charge something on June 15th, miss your June 30th payment, miss your July 30th payment (30D ding) and then if you don't pay by August 30th, you get a 60D ding.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Accidental 30 day late payment drops my score 91 pts?

While the above pictured chart regarding late payments and their impact over time is a good guideline, it's important to reference that it is likely just a general "best fit" type graph for your average profile and results can vary greatly in either direction.

For example, the chart suggests that a 4 year old 120 day late payment is "worth" around 100 points. On my profile, having this exact lone baddie removed resulted in a 68 point gain on TU. On EX and EQ, I experienced 71 and 50 point gains respectively for a lone 90 day late being removed that was 2.5 years old, numbers that are also lower than what the chart suggests would be the case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content