- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Achieved 800 FICO with 30-day late reporting

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Achieved 800 FICO with 30-day late reporting

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

I'd love to see a profile with an aged 30D and an ~820 score. This thread with the 800 reference is the highest I've personally seen thus far, but I'm sure there are other examples out there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

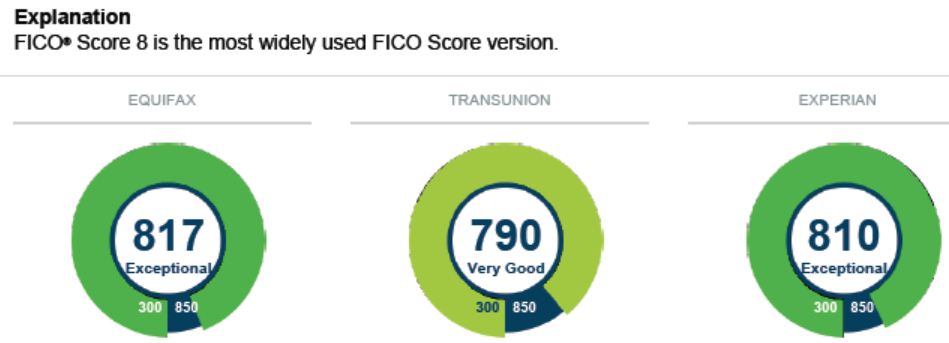

I looked at my history and the highest I've had with a 6y 30D was 806 on EX and 805 on EQ with AGG UTL of 13%, no IND over 20%. However, a year + before I reached 817 on EQ with 3 30Ds and 3 60Ds with 1% AGG UTL, 3 accts each with a 30D & 60D for the same months of service.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

Great info, Trudy. I would imagine that aggregate utilization threshold crossing would have been good for maybe 15 points, which would have placed you right around TTs estimate if you were optimized.

Regarding your profile at the time you had multiple 30's and 60's present, were you maxed out in terms of age of accounts factors? Did you have the boost present from an almost-paid-off installment loan at the time?

Also, are the 30's and 60's you referenced tied to one another? What I mean is that if you have a 60D present, naturally the month before would be a 30D, but that 30D doesn't really "count" as a 30D since it's really part of the 60D. Just trying to clarify if those 30's were part of the 60's, or if they were independent 30's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

@Anonymous wrote:Great info, Trudy. I would imagine that aggregate utilization threshold crossing would have been good for maybe 15 points, which would have placed you right around TTs estimate if you were optimized.

Regarding your profile at the time you had multiple 30's and 60's present, were you maxed out in terms of age of accounts factors?

When I managed the 817 & 810 with the 30s & 60s: AoOA 22y3m, AAoA 12y4m, AoYA 1y8m also AoYRA

805 with a single 30D on EQ: AoOA 23y4m, AAoA, 11y11m, AoYA 11m also AoYRA. By this time the 30, 60D in succession was removed early.

806 with a single 30D on EX: 23y6m, AAoA 12y1m, AoYA 1y1m. By this time the 30, 60D in succession was removed early.

Did you have the boost present from an almost-paid-off installment loan at the time?

AGG was around 76%

Also, are the 30's and 60's you referenced tied to one another? What I mean is that if you have a 60D present, naturally the month before would be a 30D, but that 30D doesn't really "count" as a 30D since it's really part of the 60D. Just trying to clarify if those 30's were part of the 60's, or if they were independent 30's.

I had a 30D & 60D in succession on 3 accts and several months later a single 30D on each acct.

Edit to include pic of lates:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

Meanwhile, I have a 30 day old from 2017, but otherwise a clean report. I have 16 CCs, a mortgage and two car loans at 0% interest. I have a 20+ year credit history. My utilization is at 36% on all cards with all but 3 under 68%. My score is in the 600s.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Achieved 800 FICO with 30-day late reporting

@KeithW wrote:Meanwhile, I have a 30 day old from 2017, but otherwise a clean report. I have 16 CCs, a mortgage and two car loans at 0% interest. I have a 20+ year credit history. My utilization is at 36% on all cards with all but 3 under 68%. My score is in the 600s.

Get that aggregate utilization down to 9%, all your individual card utilizations to under 29% and allow no more than 3 cards to report a balance. That may boost your score 80-100 points. As an interum step, get aggregate utilization below 29%, all cards below 49% and 5 cards max with a balance. Key metric for individual cards is the card with the highest % utilization - so don't leave one at a high level.

The impact of the late should be much less after the 5 year mark. Of course, you can write a good will letter and try to get it removed.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950