- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Adding an installment loan -- the Share Secure tec...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Adding an installment loan -- the Share Secure technique

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Anonymous wrote:

@Subexistence wrote:

@Anonymous* The early paydown essentially negates any problem with the interest rate

Disadvantages:

* Hard pull (we expect on Equifax)

* People with low scores may be rejected

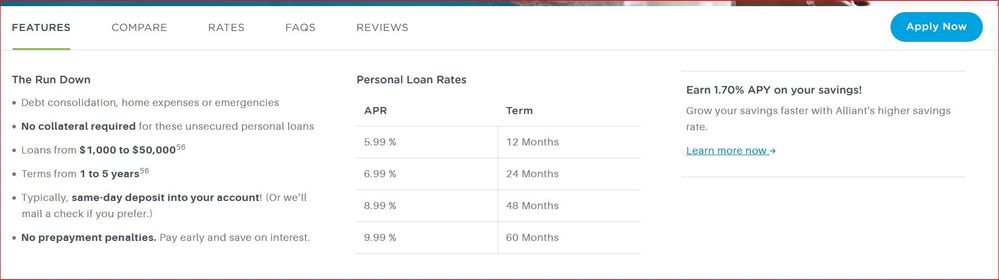

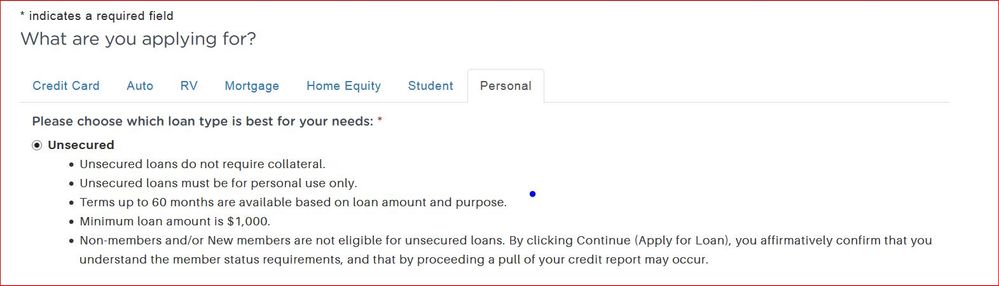

Alliant Credit Union (unsecured loan option)

Score: 99% chance this will work

Advantages:

* Works basically just like a Share Secure loan as far as early paydownHas anyone tested the unsecured version?

I'm considering it. You can still pay early per their FAQ to save on interest. But does anyone know if it's 1k per 12 months? That part isn't clear. But then I guess if they give me 5k and I give them back $4k within a month then it's it's irrelevant.

Woo hoo! Thanks for this and please do consider testing it.

You are of course completely right. There's this odd worry about having to take out a 5k loan vs. a $500 loan. You correctly perceive that it does not matter since you will be paying off almost all of the balance in the first month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Anonymous wrote:Is a student loan considered an installment loan? I currently have a open student loan and one credit card after my bankruptcy. I'm trying to find a way to boost my score and based on what I am reading, this method might not help me seeing I already have an installment loan.

Yes it's an installment loan.

So the way to use it to boost your score is to pay it down, but not to zero. The sweet spot will be when you get to 9% of the original amount.

Another installment loan would do nothing for you.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

does alliant unsecured require proof of income, paystubs, etc.?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

Hi,

I've read the Alliant guide and tried to sign up for membership however it currently does not list Foster Care to Success as one of its communities on the form. Is there an equally cheap alternative organization? Thank you.

Update: I was able to become a member. I realized I was looking for Foster Care in the wrong place. However it looks like there are no secured loans available at all on the website right now. I thought that they still have one but it requires a hard pull vs a soft pull in the past. Can someone verify? Thank you.

Chase IHG 8.5K | Chase Freedom 5K | Chase Sapphire 3K

Bank of America Cash 40K | Bank of America Travel 40K

AMEX Delta Gold 30K | AMEX Everyday 25K | AMEX Delta 13K | AMEX Blue Cash Everyday 2.62K

Citi Rewards Plus 31K | Citi ThankYou Premier 18.7K

PenFed Pathfinder 5K | PenFed Platinum 5K

TD Cash 14K | Uber Visa 13K | USBank Cash+ 10K

Wells Fargo Cash Wise 6.5K | Discover IT 5.2K

Overstock 13K | Target RedCard 2.5K | Victoria Secret Angel 1K | LOVE LOFT .25K

BP Visa 5K | Walmart MC 3.3K

08/18: TCL 246.95K | AoOA: 18Y | AAoA: 5.0Y || TU: 820 | EQ: 823 | EX: 815 || INQ - TU: 3 | EQ: 3 | EX: 7

12/18: TCL 386.95K | AoOA: 18Y | AAoA: 3.1Y || TU: 805 | EQ: 813 | EX: 769 || INQ - TU: 5 | EQ: 4 | EX: 10

11/19: TCL 421.55K | AoOA: 18Y | AAoA: 4.2Y || TU: 818 | EQ: 820 | EX: 794 || INQ - TU: 6 | EQ: 5 | EX: 9

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

You actually should've signed up with Freelancer's Union and that would've been completely cost free.

But anyways yes unfortunately Alliant no longer offers SSL. They do still offer unsecured loans, but as you noted that requires a HP.

Closed:

6/8/20:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Anonymous wrote:If you are willing to get a hard pull, and your scores are 700+, then Alliant is still a good option. Just get an unsecured loan for 60 months, and pay it down to 8% of the original balance in the first month. The next due date should get pushed 4.5 years into the future. Be sure to cancel any autopay you have set up and you should be good to go.

My score is 683, I have about one year of credit history (Amex Platinum). I guess my score would have been much higher if I had chosen a credit card instead of a charge card as my first card (since utilization isn't reported for charge cards).

2-3 weeks ago, I was also approved for the Amex SPG Luxury card with a credit limit of 10,000$.

Would it make sense to get an unsecured loan from Alliant? Or would that only hurt my score?

I am doing well financially (that's how I got the Amex cards), but I'd like to get more "premium" rewards credit cards.

I'm a non-resident alien and I only have an ITIN, no SSN. I'm only in this for the points. ;-)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

I'd wait until you have had a small balance reporting on your true credit card and a zero balance reporting on your charge card. You would want to optimize your score before applying for any unsecured loan.

I think I have heard that Alliant has become unwilling to approve unsecured loans until the person has been a member of the credit union for at least six months. So if you want to move ahead with this idea, see if you can get a savings account opened and funded today (i.e. well before Jan 31).

Can you confirm that you have no open installment accounts of any kind, closed or open? If not, pursuing the loan strategy probably makes a lot of sense. You'll benefit from both the help to your Credit Mix and the larger Amounts Owed category.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

Thanks. My true credit card statement closed 10 days ago, I guess they assigned it the same billing cycle as my charge card.

So the balance has already been reported, but I haven't paid the bill yet as I only got access to it today.

Why is it good if there is a zero balance reporting on the charge card?

What about the secured loan from Ideal? Could that be an option?

Ideally I'd like to push my score way above 700 as quickly as possible to get more credit cards.

A friend of mine went the same route as me, but he got a true credit card as his first card, and though he's had it for an even shorter time than me, his score is ~780, so almost 100 points higher...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Anonymous wrote:

@Anonymous wrote:If you are willing to get a hard pull, and your scores are 700+, then Alliant is still a good option. Just get an unsecured loan for 60 months, and pay it down to 8% of the original balance in the first month. The next due date should get pushed 4.5 years into the future. Be sure to cancel any autopay you have set up and you should be good to go.

My score is 683, I have about one year of credit history (Amex Platinum). I guess my score would have been much higher if I had chosen a credit card instead of a charge card as my first card (since utilization isn't reported for charge cards).

2-3 weeks ago, I was also approved for the Amex SPG Luxury card with a credit limit of 10,000$.

Would it make sense to get an unsecured loan from Alliant? Or would that only hurt my score?

I am doing well financially (that's how I got the Amex cards), but I'd like to get more "premium" rewards credit cards.

I'm a non-resident alien and I only have an ITIN, no SSN. I'm only in this for the points. ;-)

Personally, now that Alliant is no longer a friendly partner in doing SSL's, and there isn't any equivalent substitute except NFCU, I don't think you should take out an installment loan just to improve your credit score. It will drag your score down in several ways before it improves it. Your score will improve on its own as long as you pay promptly.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

Thank you. I can't join NFCU unfortunately. Any reports on Ideal?

I mean, I don't necessarily have to play this 60-month game like people did with Alliant.

I don't need the money either. It would be perfectly fine for me to get a 500$ loan and pay it back over a shorter period, as long as it helps my score...