- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Adding an installment loan -- the Share Secure tec...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Adding an installment loan -- the Share Secure technique

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Glen_M wrote:

@Subexistence wrote:

[04-25-2017 11:08 AM]Ugh still no email nor phone call. I would call today but I got Stat exam tommorrow. I have Calc quiz the day after so I'll have to wait until my quiz is over with before I call. I never recieved any call for opening my savings account and it took ridiculously long for my $510 to appear so I must be very low on the priority list. Anyone else had to deal with neglect before?

@Subexistence wrote:I get Ex08 from creditscorecard.com and creditscore.com. Alliant reported on May 5th 2017 and my scorecard reports my profile from May 3rd 2017 while creditscore reports it on May 8th 2017. Therefore my scorecard has my score before the loan reported and creditscore has my score after the loan reported.

...

So I do believe that alliant is the only installment loan I have.

In any case my score on creditscorecard is 708 while my score on creditscore is 703. I don't know if I got point benefit from installment loan but it was negated by AAoA or I just didn't get any benefit at all.

Based on the timing of your previous posts, I'm guessing you haven't actually had your first due-date or statement yet (something about a minimum of 30 days before the first payment can be required). You're presumably in a similar boat as I am. The account has begun to report its existence, but payment history isnt really there yet, so the scoring effect is incomplete.

My due date is June 5th

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

Quite similar timing then. We're not likely to see the full effect of the SSL until after the first statment has been reported. I haven't read the entirety of the thread, but that doesn't seem out of line with what others have experienced. I know my loan has holes in the information being reported, which will presumably get filled in after an actual statement date has passed and been reported.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Anonymous wrote:The tricky thing is this. If you were to try to get the closed Alliant account removed, it could result in confusion on the part of Alliant and/or the CRA and result in both the open and closed accounts being removed.

There's no doubt that the extra Alliant account is lowering your AAoA. But that might not be having any effect on your score. If you are curious, you could try computing your AAoA with the extra account added and without. If the difference is (say) 4.6 vs. 4.1, then the new account is having no effect on your score. (FICO will see both as "4".)

There can be some advantage in having an extra account on your profile. It adds another layer of thickness. In nine years from now it will be helping your AAoA as a nine-year old account (if you think your AAoA will likely be less than 8.0 at that time). Some people would argue: hey, to get two installment accounts with NO hard pull, that's a gift!

I think there are pros and cons for the idea of removing. If the attempt at removal results in the open account being deleted too, you can probably fix that as well -- it just may involve more back and forth with Alliant. All depends on how much you care about this.

How does this affect people with less than 1 year AAoA?

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Subexistence wrote:

@Anonymous wrote:The tricky thing is this. If you were to try to get the closed Alliant account removed, it could result in confusion on the part of Alliant and/or the CRA and result in both the open and closed accounts being removed.

There's no doubt that the extra Alliant account is lowering your AAoA. But that might not be having any effect on your score. If you are curious, you could try computing your AAoA with the extra account added and without. If the difference is (say) 4.6 vs. 4.1, then the new account is having no effect on your score. (FICO will see both as "4".)

There can be some advantage in having an extra account on your profile. It adds another layer of thickness. In nine years from now it will be helping your AAoA as a nine-year old account (if you think your AAoA will likely be less than 8.0 at that time). Some people would argue: hey, to get two installment accounts with NO hard pull, that's a gift!

I think there are pros and cons for the idea of removing. If the attempt at removal results in the open account being deleted too, you can probably fix that as well -- it just may involve more back and forth with Alliant. All depends on how much you care about this.

How does this affect people with less than 1 year AAoA?

That's a good question. It all depends on whether there's a breakpoint at six months for AAoA. If there were, then going from 0.6 years to 0.4 years would have an effect. I haven't followed whether anyone has discovered such a breakpoint, but from the little I know, it does not exist.

The key thing to remember is that even after your AAoA goes down (typically due to new accounts being added) your AAoA will immediately start to climb back up again, month by month.

The best strategy for people in their early stages (like you) is for AAoA to be a low priority in how you think about things. The medium and long term payoff to adding (carefully and selectively) more accounts is likely to be far greater than keeping only a few accounts but trying to raise your AAoA. It's best to simply accept that your AAoA is going to be low for a while.

Your own very specific goals (which I know a bit about, and which include CC bonus chasing during 2017-2019) are really going to preclude AAoA growth. Basically just accept that your AAoA is gonna suck and see what you can do with your score in spite of it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Subexistence wrote:

@Glen_M wrote:Based on the timing of your previous posts, I'm guessing you haven't actually had your first due-date or statement yet (something about a minimum of 30 days before the first payment can be required). You're presumably in a similar boat as I am. The account has begun to report its existence, but payment history isnt really there yet, so the scoring effect is incomplete.

My due date is June 5th

Make sure you delete it June 3rd or 4th.

Did you get a $500 loan? Your screen capture show $80 balance. To get all points from this technique you need to report $44 or less.

I think next month when you have 1 card with low balance, your SSL at $44 or less, you will get a boost. Good luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@newhis wrote:

@Subexistence wrote:

@Glen_M wrote:Based on the timing of your previous posts, I'm guessing you haven't actually had your first due-date or statement yet (something about a minimum of 30 days before the first payment can be required). You're presumably in a similar boat as I am. The account has begun to report its existence, but payment history isnt really there yet, so the scoring effect is incomplete.

My due date is June 5th

Make sure you delete it June 3rd or 4th.

Did you get a $500 loan? Your screen capture show $80 balance. To get all points from this technique you need to report $44 or less.

I think next month when you have 1 card with low balance, your SSL at $44 or less, you will get a boost. Good luck.

gotcha

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

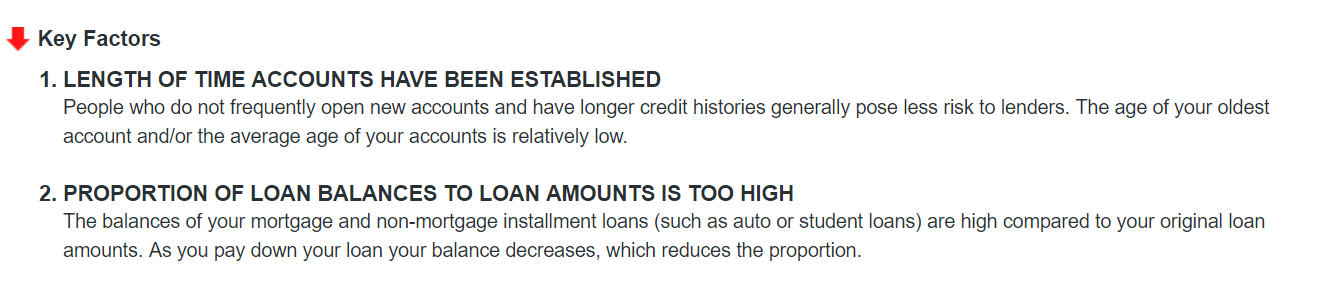

I got my TU from Disco and Eq from Lenny today. Anyways on Discover, it tells me why my Tu dropped from 717 to 715.

Apparently $80/500 is considered high installment utilization

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

New data point- please update procedure.

TL;DR: call the bank if it doesn't allow you to stop auto payment after 1st automatic payment went thru.

My first auto payment went thru on May 15. After 1 week, it still not letting me cancel auto payment online. (It's asking me to call). So I decided to call and the representative said that they will have to mail me some paper work to sign but after double checking, it's an issue in their system. They fixed their system and my auto payment is now cancelled.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Anonymous wrote:New data point- please update procedure.

TL;DR: call the bank if it doesn't allow you to stop auto payment after 1st automatic payment went thru.

My first auto payment went thru on May 15. After 1 week, it still not letting me cancel auto payment online. (It's asking me to call). So I decided to call and the representative said that they will have to mail me some paper work to sign but after double checking, it's an issue in their system. They fixed their system and my auto payment is now cancelled.

Hi Totoro. I am very happy to change the guidance, but I'd like to wait until the change is definitely needed first. Two things appear to be the case:

(1) You are the only person to ever report attempting to manually delete his auto-pay after the first one went through -- and being unable to do it. Hundreds of other people have done this with no problem.

(2) Your conversation with the Alliant rep suggests that they have researched the problem, determined that it happened because of a temporary bug in their system, which they have since fixed.

Those two things together make me want to wait a bit and see if more people report being unable to manually delete it after the autopay goes through.

Great decision to call them. We typically advise against calling except when it is needed, but in your case it was needed!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Anonymous wrote:

@Anonymous wrote:New data point- please update procedure.

TL;DR: call the bank if it doesn't allow you to stop auto payment after 1st automatic payment went thru.

My first auto payment went thru on May 15. After 1 week, it still not letting me cancel auto payment online. (It's asking me to call). So I decided to call and the representative said that they will have to mail me some paper work to sign but after double checking, it's an issue in their system. They fixed their system and my auto payment is now cancelled.

Hi Totoro. I am very happy to change the guidance, but I'd like to wait until the change is definitely needed first. Two things appear to be the case:

(1) You are the only person to ever report attempting to manually delete his auto-pay after the first one went through -- and being unable to do it. Hundreds of other people have done this with no problem.

(2) Your conversation with the Alliant rep suggests that they have researched the problem, determined that it happened because of a temporary bug in their system, which they have since fixed.

Those two things together make me want to wait a bit and see if more people report being unable to manually delete it after the autopay goes through.

Great decision to call them. We typically advise against calling except when it is needed, but in your case it was needed!

I think there might be some confusion on how to delete the automatic payment (and admittedly, I was confused first too). If you are on your accounts overview page and click on "Options" next to your loan and "Manage Automatic Payment", then indeed it'll tell you to call (I had the same problem). But if you go to "Transfers" instead and select "Scheduled Transfers", then there you should be able to delete the scheduled transfers from your savings account to the loan (at least it allowed me to do this before my first transfer was scheduled to go through).