- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Adding an installment loan -- the Share Secure tec...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Adding an installment loan -- the Share Secure technique

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Anonymous wrote:Thanks DMM. We always urge all people to pull their reports and be certain that they have no open installment accounts before implementing the SSL technique. Presumably the Apple account shows up there.

What I am most curious about is whether FICO is classifying the Apple installment account as a Finance Company Account. In principle it is just a tech version of what people do when they finance a bed at Rooms To Go or a washer-dryer at Best Buy. FCAs hurt your FICO score even if you make perfect payments, and it's often not clear from your report whether the account will be classified as such.

While I personally do not have an Apple installment loan, my partner does. They aren't credit savvy, but maybe this is an excuse to get them started and look at the CR to see what it says. Where on the CR would I potentially find this information?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

Well the first thing you want to do is pull your reports. The report will be a list of accounts. Each one will be classified as a Revolving or Installment account. Your partner and you should go through each account to make sure you know each one: e.g. "Oh, yeah, that looks like my Chase Freedom card.... that one looks like my student loan..." etc.

You may find a few that you do not not easily recognize. According to the link you gave me, the creditor for the apple account will be listed as:

Citizens Bank, N.A., doing business as Citizens One

When you drill into that account, you may find that it has an account type or subtype of Finance Company Account. If so, then it is certainly an FCA. Unfortunately, it could seem like a vanilla installment account but FICO sees some kind of code (invisible to you) that will classify it as an FCA.

If so then you might see an FCA reason statement next to one of your many scores that suggests that you have an FCA on the report somewhere.

The absence of such a reason code does not in itself prove that FICO is not dinging you for an FCA -- it could be that your other penalties are just more substantial.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

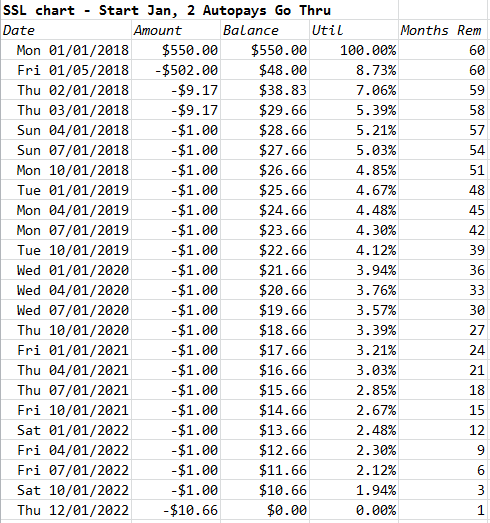

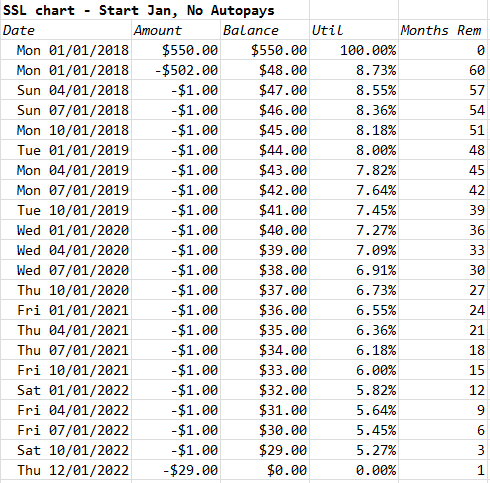

I'm hoping my math is right... ETA: Not factoring in interest charged

I wanted to make sure I'd be able to use the mentioned method of a quarterly autopayment of $1-2 without spending down the balance over the course of the loan. The first chart assumes a couple autopayments go through; if autopays are successfully deleted before any post, then the second chart. Also, I used $550 as a starting balance, and for the table below I put in a start date of 1/1/18, although I'm likely going to start mine this month.

Just thought I'd share so people can see what it looks like over time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@manyquestions wrote:

@Anonymous wrote:Alright, I have credit freezes on my reports currently and also farud alerts. I know I'll have to lift the freeze but would the fraud alerts affect me from being approved for the loan or should I just wait to be safe til those come off?

I don't recall any posts about that. Are you a member of Alliant CU yet? With a fraud alert they are supposed to contact you, but it seems to vary by creditor. You might have to talk to them for verification.

No, not currently an Aliant member. So don't know if it'll affect me becoming a member too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

Didn't make it past becoming a member. What would my next steps be?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@BrokenBones wrote:Didn't make it past becoming a member. What would my next steps be?

That might mean (a) that you applied to become a member of Alliant and were rejected or (b) that you did become a member of Alliant but were turned down when you applied for the loan. You'll probably need to tell the folks here which of those it was. You'll also need to tell the folks here:

What information did you get from Alliant when it turned you down? What did Alliant say? Have you followed up with them to get a more detailed explanation?

What is your EQ FICO 8 score?

Do you have any particular derogs on your EQ report? Have you opened (or applied for) several new accounts lately? (Cards or loans?)

Have you ever had any problems with a bank before? Bounced checks? Anything like that? Have you ever pulled your ChexSystems report? Have you opened a number of bank accounts in the last couple years?

Do you have your EQ report frozen?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

Well, went and applied for the savings account and received a "Pending membership". Says it needs a manual review and I should recieve an e-mail update in about two business days. Hopefully they just contact me to make sure it was me applying for the account since I put a fraud alert due to the Equifax fiasco on my reports. Also did a temporary lift on my EQ report in order to apply.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

I'm new to this whole loan idea to boost and rebuild credit. How long are you supposed to wait after any new accounts before trying this?

Do you have any particular derogs on your EQ report? Have you opened (or applied for) several new accounts lately? (Cards or loans?)

Have you ever had any problems with a bank before? Bounced checks? Anything like that? Have you ever pulled your ChexSystems report? Have you opened a number of bank accounts in the last couple years?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

You will see three options. Make sure you are careful to find the right one. You want the one that is for up to 60 months. That is Shared Secured. Do not choose Term Secured or Certificate Secured. Click on APPLY NOW for Share Secured.

The rest of the application is straightforward. Make sure you choose $500 and 60 months.

So, you actually have to keep this going for 60 months to work? I understand that you're only paying $2 every few months to keep it active but there is no way to get rid of it sooner just to get rid of it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding an installment loan -- the Share Secure technique

@Anonymous wrote:

So, you actually have to keep this going for 60 months to work? I understand that you're only paying $2 every few months to keep it active but there is no way to get rid of it sooner just to get rid of it?

Yes. You need the loan to be open on your report to get the benefit of it. Head back to post #2 (The Theory Behind The Technique): it explains that there.