- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Am I reading this right?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Am I reading this right?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Am I reading this right?

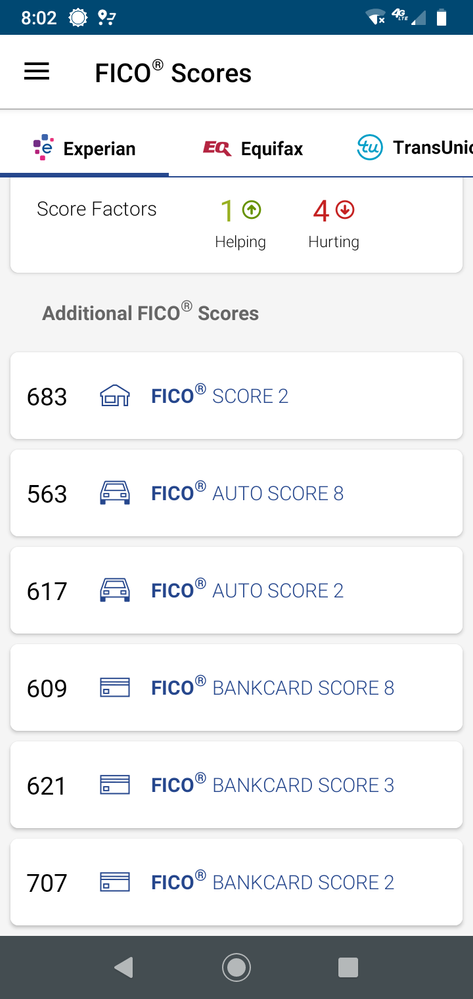

Ok, so I was going crazy waiting for MyFico Premier to update in 3 days (you know us rebuilders...), so I used the 7 day free trial on the Experian.

Am I reading this right? My crappy scorecard is at a 683 EX mortgage score? Or am I confused?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I reading this right?

Thank you!

Well, my local credit union requires a 650 MMS, so I suppose 650. It's hard to tell the future MMS requirements with the zombie apocalypse going on, though...

I'm picking up a 3rd CC tomorrow, to use AZEO. I'm assuming AZEO would counteract any score loss from the new account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I reading this right?

@Anonymous wrote:

Thank you!

Well, my local credit union requires a 650 MMS, so I suppose 650. It's hard to tell the future MMS requirements with the zombie apocalypse going on, though...

I'm picking up a 3rd CC tomorrow, to use AZEO. I'm assuming AZEO would counteract any score loss from the new account.

@Anonymous When do you plant to apply for mortgage?

If on a derogatory score card, you won't receive a new account penalty for FICO 8. I'm not sure how EX2, TU4, EQ5 will react. Perhaps the same. However, you may receive a score decrease for HP inquiry on that specific bureau,.reduced AAoA, which in comparison is a small penalty for the greater goal. As you stated, it will counteract.

Having at least 3 cards will aid you in doing AZEO for FICO 8. 5 cards is preferred for mortgage scores. 3 will work so don't go crazy with applying for new accounts.

EX2 + 3 Bureau scores and reports for $1 at Experian or CreditCheckTotal (part of EExperian. Cancel in 7 days or less to avoid the reoccurring charge.

TU4 WyHy quarterly score. Not sure on membership requirement. Maybe hard pull TTU

EQ5 Get a savings account with DCU. Soft pull EQ to be a member. Free monthly score.

You can also obtain your 3 bureau mortgage scores at FICO Advanced . Cancel plan after you obtain your scores and reports to avoid re-occurring monthly charge.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I reading this right?

Thank you so much for your input, @AllZero .

I plan on mortgage app in December, that's why I want to get the 3rd card done in July (6 months prior). Tinker Federal Credit Union has a secured CC version, so worst case scenario I'll end up with a card with 1 EX HP either way.

I'd prefer 12 months without a HP, but at least it'll be THEIR HP they see when app'ing with them for the mortgage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I reading this right?

@Anonymous wrote:Thank you so much for your input, @AllZero .

I plan on mortgage app in December, that's why I want to get the 3rd card done in July (6 months prior). Tinker Federal Credit Union has a secured CC version, so worst case scenario I'll end up with a card with 1 EX HP either way.

I'd prefer 12 months without a HP, but at least it'll be THEIR HP they see when app'ing with them for the mortgage.

You're welcome.

As you stated, 12 months without new accounts or inquiries is preferred. It'll give your profile a chance to age some and your scores to rise.

Pull your TU4 and EQ5 scores to see where you land on your MMS.

In the meantime, address any derogatories or delinquenies so you will be prepared to meet that score requirement when you do apply for mortgage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Am I reading this right?

@Anonymous wrote:Thank you so much for your input, @AllZero .

I plan on mortgage app in December, that's why I want to get the 3rd card done in July (6 months prior). Tinker Federal Credit Union has a secured CC version, so worst case scenario I'll end up with a card with 1 EX HP either way.

I'd prefer 12 months without a HP, but at least it'll be THEIR HP they see when app'ing with them for the mortgage.

I would not necessarily stick with one mortgage lender if it's possible. Always shop around.