- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Anticipated Score Jump from large drop in utilizat...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Anticipated Score Jump from large drop in utilization?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anticipated Score Jump from large drop in utilization?

@Thomas_Thumb wrote:

@Anonymous wrote:Thanks!

So it sounds like you are going from 5 out of 11 showing a positive balance to 3 out out of 11. That's going from 45% of your revolving tradelines to 27%. If there is a breakpoint at 33%, then you will get some extra points. But if the breakpoints for your scorecard are at 25% and 50% then you'd get no extra points. (Another confounder is the fact that two of the 11 cards are AUs, which might also be treated by FICO a bit differently -- I can't be sure.)

Some people have reported score changes that they think could be related to going from a util of 8.9% to (say) 6.5%. But there's not been a lot of confirming hard evidence from other people. The generally accepted wisdom is that no one should count on getting any additional scoring benefit once he/she gets down to 8.9%. (Again, the fact that some of your cards are AUs might mean that lowering further will get you some points.)

If you could create one more $0 balance you might get some benefit, but it sounds like you don't have any available money for that.

You mention that your report has one installment account on it. If it is a closed account, then it's easy to suggest a method that will get you many extra points, though not in the tight timeframe you mention. If it is an open account, then there is nothing that can be done.

Best of luck....

CGID - Below is a summary of what I have experienced for AU and NPSL charge card accounts followed by a listing of statements direct from Fico.

Credit scoring AU cards part AU cards AU cards part of NPSL Charge cards NPSL Charge cards Charge cards part Scoring of Ag UT% considered open accounts with part of Ag UT% looked at of open accounts Model name Calculation for card UT% balance count calculation for B/HB UT % with balance count Fico 09 NO NO NO NO NO YES Fico 08 NO NO NO NO NO YES Fico 04 YES YES YES NO NO YES Fico 98 YES YES YES Not Sure YES YES VS 3.0 YES YES YES NO NO Not Sure

Curious... My husband is an AU on 3 of my cards. Using the above table they shouldn't figure into FICO 8, but they are a part of his open tradeline count, his AAoA and his overall utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anticipated Score Jump from large drop in utilization?

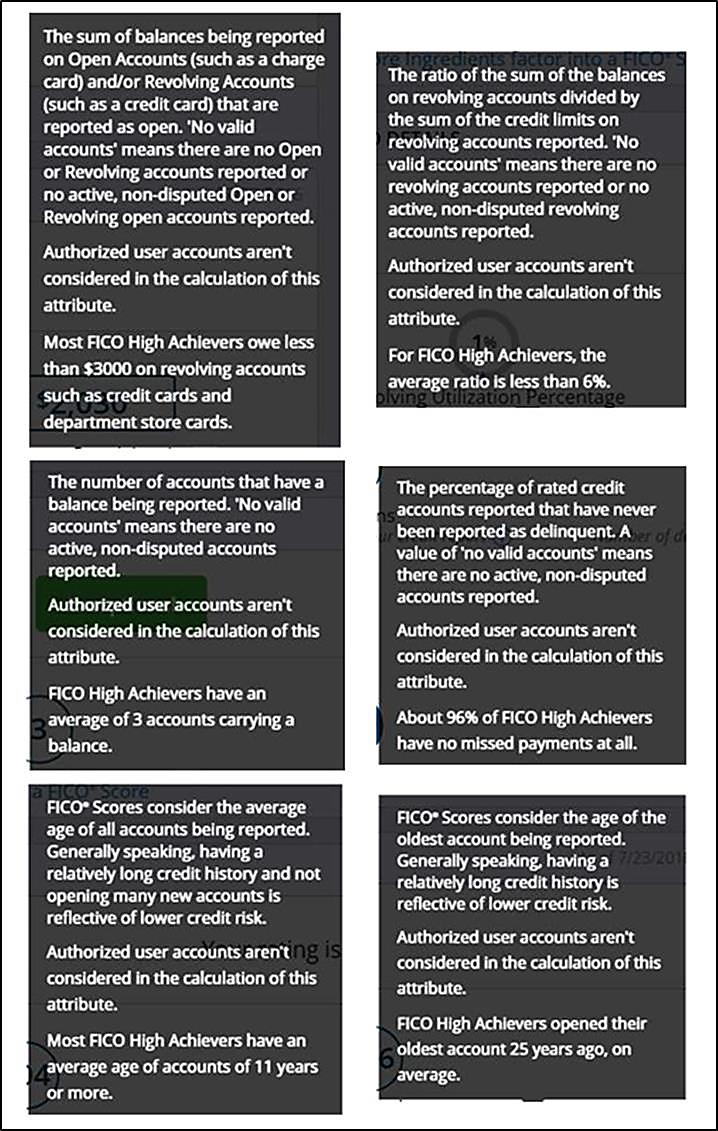

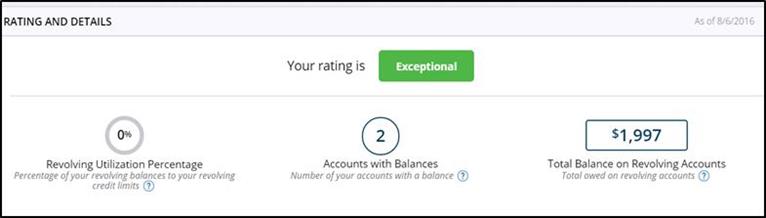

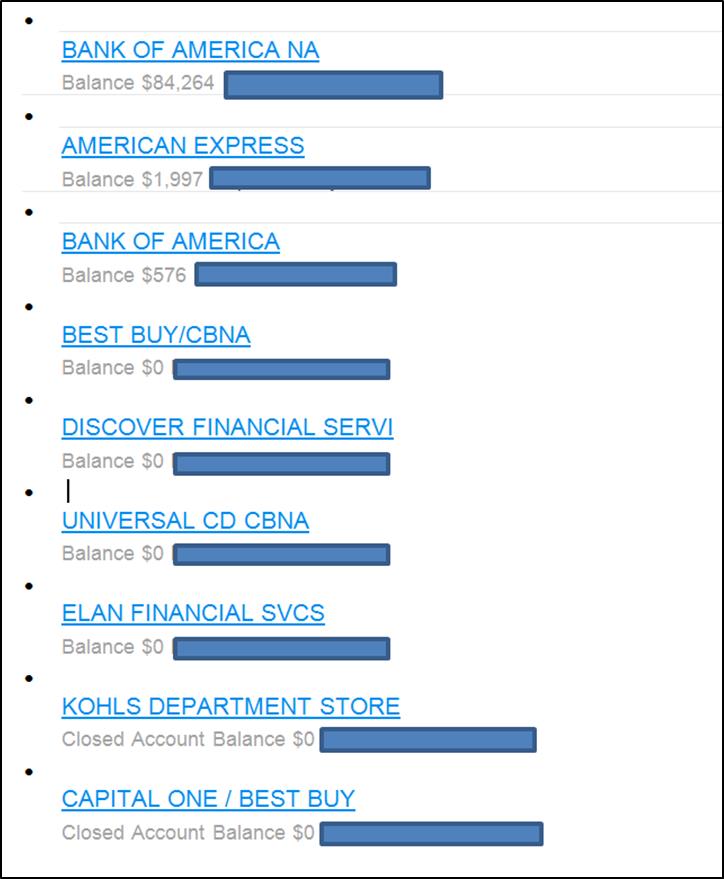

I had always thought my AU account counted toward FICO 08 as well because it is listed as an open account. However, I confirmed that neither the AU card nor my charge card are used by FICO 08 in computing aggregate utilization as evidenced in the MyFICO "RATING AND DETAILS" summary detail shown below. At this time I had no balance on any of my 4 credit individual cards Also, the AU card does not factor into the "total number of open accounts with balances attribute" for Fico 08.

Notes:

1) The AU card is included in open accounts with balance in Fico 04, Fico 98 and Vantagescore 3.0 models.

2) The AU card credit limit does appear to be included in the aggregate credit limit for me. However, the AU card charges are not included in my aggregate utilization calculation. Why? Because responsibility for charges is assigned to the primary cardholder.

3) For the below summary The was about $576 reported on the BOA AU card and $1997 on the AMEX card. However, utilization was computed to be 0% by Fico 08. [this is in agreement with Fico's statement regarding AU accounts].

4) This AU account has been open for 20 years. However, only DW charges against the card. Does the fact I have not used the AU card issued to me in 18 years impact how it is treated?

Side note: If your husband has an active account with Fico for credit scores, go to the score tab and look at details to double check if fico included the AU cards in # open accounts with balances and AG UT%. [if you get to the below, click on the "?" to display the text box where Fico states what is looked at in their analysis.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950