- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- AoYA 6 month threshold - TU +11 points

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AoYA 6 month threshold - TU +11 points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA 6 month threshold - TU +11 points

@Anonymous wrote:I know that TT on some scoring models has determined that a negative reason code can exist related to AoYA for as long as 5 years. Kind of crazy when you think about it, although I'd be shocked if the penalty associated with that reason code was worth more than a couple of points.

I do find it a bit odd that AoYA only matters scoring wise on clean scorecards. I would think someone on a dirty scorecard that has opened an account recently would still represent elevated risk (relative to not opening one) the same way it would for an individual on a clean scorecard.

You may be right on FICO 9, and also on FICO 8 BC.

It hasn't been the case on FICO 8 Classic AFAIK from my own data and I've conclusively demonstrated it doesn't exist in FICO 04.

Interestingly enough this whole analysis might shed some light into the AU score too as there's an analogous entry for length of installment history but I don't know if the revolving one is there. I lost some of my reports from when I was briefly totally clean but at some point I'll see if I can try to look into that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA 6 month threshold - TU +11 points

It’s just throwing those in the mix on the classic that’s more curious. Considering you said the language of the reason codes are sometimes not precise, I wonder if it could’ve changed in meaning between iterations of the algorithm.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA 6 month threshold - TU +11 points

Do we have a list of the meaning of all the negative reason codes? So many new accounts is going to be what? When there are multiple under a year? Does that give a bigger penalty? Separate from that hit to AAOA?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA 6 month threshold - TU +11 points

@Anonymous wrote:

It’s only on clean scoresheets. AoYA is not a factor on dirty scorecards.

Not true. It's profile specific

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA 6 month threshold - TU +11 points

That’s why we’re differentiating dirty score cards do not get AoYA awards per testing by @Revelate. But the relative award is going to depend upon the scoresheet most likely and especially the rebucketing event at 12 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA 6 month threshold - TU +11 points

@Anonymous wrote:

What does profile specific mean? It means it depends on the scorecard. That’s what differentiates profiles other than whether they’re revolver only or installment only, as far as we know.

Yes, but there are factors outside of scorecard segmentation that can influence how 2 different profiles in the same scorecard may react based on CR data. One example that comes to mind that's been theorized is that the presence of a recent inquiry (verses having none recent) may result in a signal strength change on that profile for different pieces of scoring criteria.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA 6 month threshold - TU +11 points

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA 6 month threshold - TU +11 points

@Anonymous wrote:

I have a clean TU (766) and received zero bump at 1 year aoya. Same for EX and EQ that both show a 30 day late 4 years ago. Seems even a clean card isn’t guaranteed any score increase at 1 year.

This really surprises me. When will the first statement balance be reported this month?

I ask that because on December 4, 2018, I pulled a myFICO 1B report that showed my TU score at 666. On December 1, 2018 I should have seen some points from my only account, an SSL, aging to 1 year on every age metric: AoOA, AAoA, and AoYA.

But those points weren't there until sometime between Dec 4 and Dec 20 when I applied in person at my credit union for my first card. Their TU FICO 8 HP showed my score at 728 - a +62 point increase since Dec 4.

I am pretty sure that I didn't get 62 points solely from an SSL changing utilization from 17% to 8.47%. Maybe something delayed at TU? It still puzzles me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA 6 month threshold - TU +11 points

@Anonymous wrote:

@Anonymous wrote:

What does profile specific mean? It means it depends on the scorecard. That’s what differentiates profiles other than whether they’re revolver only or installment only, as far as we know.Yes, but there are factors outside of scorecard segmentation that can influence how 2 different profiles in the same scorecard may react based on CR data. One example that comes to mind that's been theorized is that the presence of a recent inquiry (verses having none recent) may result in a signal strength change on that profile for different pieces of scoring criteria.

Well that's been true with or without inquiries, and with both 60D lates, collections, and tax liens.

I'm absolutely confident in saying AOYA does not exist in the derogatory scorecards for FICO 8 Classic and FICO 04: I didn't have good access to EX FICO 2 when clean to be fair, but I have for EQ FICO 5 too, just TU brings this home most concretely because no CFA and no inquiries ever land there and I can optimize accounts with balances concretely.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AoYA 6 month threshold - TU +11 points

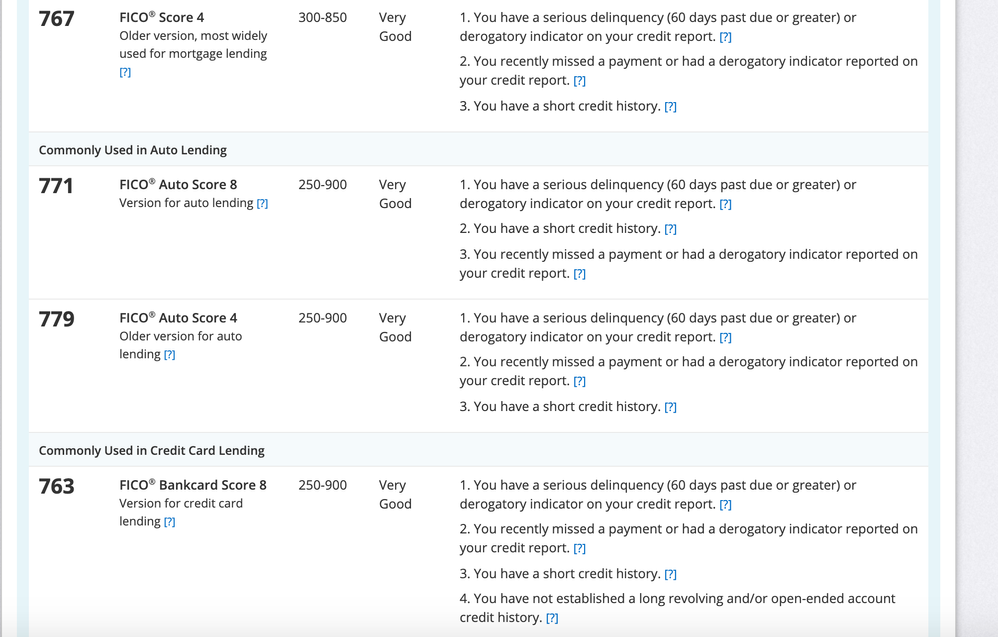

And actually it might not exist in some of the industry options either, didn't see this before but from May and an account opened literally two weeks prior (so technically 1 month prior) and a Citi DC revolver at that so none of this installment loan not counting on clean files that we're seeing:

TU FICO 04 Classic

- 1. You have a serious delinquency (60 days past due or greater) or derogatory indicator on your credit report.

- 2. You recently missed a payment or had a derogatory indicator reported on your credit report.

- 3. You have a short credit history

The reason code, if it existed, would show up there: but once you get pretty enough that you have no inquiries and no accounts with balances when we're talking file optimization this is what's left. At some point recently missed goes away, I wonder if I'll hit two reason codes. Note no reason codes there for installment loan ratios for TU 04 at least in my scorecard, passing strange it's not in the FICO 8 AU on the 60D late scorecard though, have to go back to my old thread but pretty sure I saw movement in FICO 8 AU.

FICO 8 AU even:

- 1. You have a serious delinquency (60 days past due or greater) or derogatory indicator on your credit report.

- 2. You have a short credit history.

- 3. You recently missed a payment or had a derogatory indicator reported on your credit report.

Same 3 in different order, again doesn't have a 4th.

Where this diverges is FICO 8 BC:

- 1. You have a serious delinquency (60 days past due or greater) or derogatory indicator on your credit report.

- 2. You recently missed a payment or had a derogatory indicator reported on your credit report.

- 3. You have a short credit history.

- 4. You have not established a long revolving and/or open-ended account credit history.

There's our newly found AOYA friend.

And just in case people think I'm making conjectures or doctoring, pics cause it did happen. Apologies for being grumpy.