- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Average Age of Accounts Drops - I Lost 4 Fico Poin...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Average Age of Accounts Drops - I Lost 4 Fico Points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts Drops - I Lost 4 Fico Points

@Anonymous wrote:

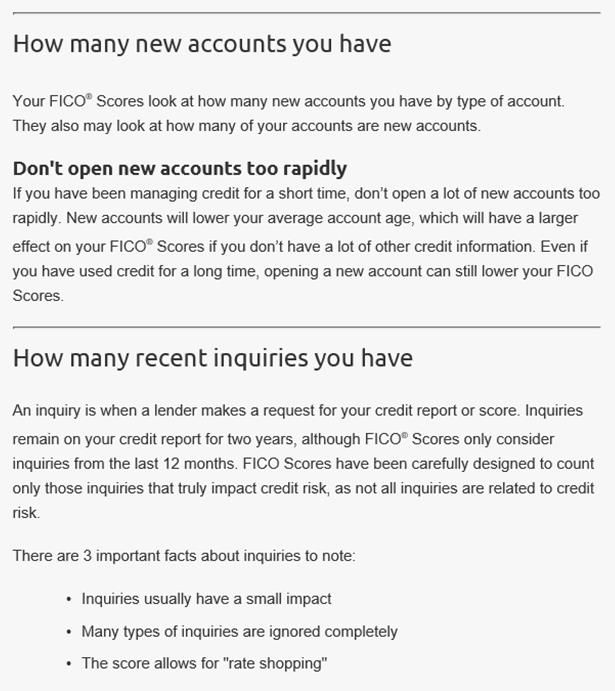

@Anonymous wrote:Even if it was 3 months old when it reported, it still is a "new account" and the number of accounts opened recently (and number of accounts with balances) can impact FICO score.

The only non-integer AAoA threshold that I've read about is believed to be at 7.8 years; everything else that has been reported has involved crossing whole numbers.

I've noticed that when when my accts reach 3 months old, I lose the Fico penalty for new accts. I know that it was not acct with balances as the acct reported with a zero balance, which would have helped my score, not hurt it.

I will watch this and see if I gain those points back when my average age reach 6.5 years.

That's interesting, new accounts penalty stayed in my reason codes for the full year, and they are still out there for my FICO 04 scores.

Do you have reports with reason codes to demonstrate that?

It's possible on the AAOA side: if there really is a boundary at 7.8 years (I'm still skeptical just because you can get an 850 at that threshold and there was some high scores thing floating around which isn't reference...) then there might be one at 6.5 years but I sort of think it's on whole years too frankly for all of them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts Drops - I Lost 4 Fico Points

@Revelate wrote:

@Anonymous wrote:

@Anonymous wrote:Even if it was 3 months old when it reported, it still is a "new account" and the number of accounts opened recently (and number of accounts with balances) can impact FICO score.

The only non-integer AAoA threshold that I've read about is believed to be at 7.8 years; everything else that has been reported has involved crossing whole numbers.

I've noticed that when when my accts reach 3 months old, I lose the Fico penalty for new accts. I know that it was not acct with balances as the acct reported with a zero balance, which would have helped my score, not hurt it.

I will watch this and see if I gain those points back when my average age reach 6.5 years.

That's interesting, new accounts penalty stayed in my reason codes for the full year, and they are still out there for my FICO 04 scores.

Do you have reports with reason codes to demonstrate that?

It's possible on the AAOA side: if there really is a boundary at 7.8 years (I'm still skeptical just because you can get an 850 at that threshold and there was some high scores thing floating around which isn't reference...) then there might be one at 6.5 years but I sort of think it's on whole years too frankly for all of them.

It's not that they are no longer considered new by Fico at 3 months, but I seem to recoup the points lost for a new acct at 3 months. It sort of like you may have too many inquiries for 24 months but they only affect your score for 6-12 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts Drops - I Lost 4 Fico Points

@Anonymous wrote:

@Revelate wrote:

@Anonymous wrote:

@Anonymous wrote:Even if it was 3 months old when it reported, it still is a "new account" and the number of accounts opened recently (and number of accounts with balances) can impact FICO score.

The only non-integer AAoA threshold that I've read about is believed to be at 7.8 years (actually it's 7 years 8 months - just under 7.7 years); everything else that has been reported has involved crossing whole numbers.

I've noticed that when when my accts reach 3 months old, I lose the Fico penalty for new accts. I know that it was not acct with balances as the acct reported with a zero balance, which would have helped my score, not hurt it.

I will watch this and see if I gain those points back when my average age reach 6.5 years.

That's interesting, new accounts penalty stayed in my reason codes for the full year, and they are still out there for my FICO 04 scores.

Do you have reports with reason codes to demonstrate that?

It's possible on the AAOA side: if there really is a boundary at 7.8 years (I'm still skeptical just because you can get an 850 at that threshold and there was some high scores thing floating around which isn't reference...) then there might be one at 6.5 years but I sort of think it's on whole years too frankly for all of them.

It's not that they are no longer considered new by Fico at 3 months, but I seem to recoup the points lost for a new acct at 3 months. It sort of like you may have too many inquiries for 24 months but they only affect your score for 6-12 months. [impact of inquiries is constant for 12 months - no lessening over time and after 12 months, the negative reason statement goes away. By definition a negative reason statement should mean the factor negatively impacts score]

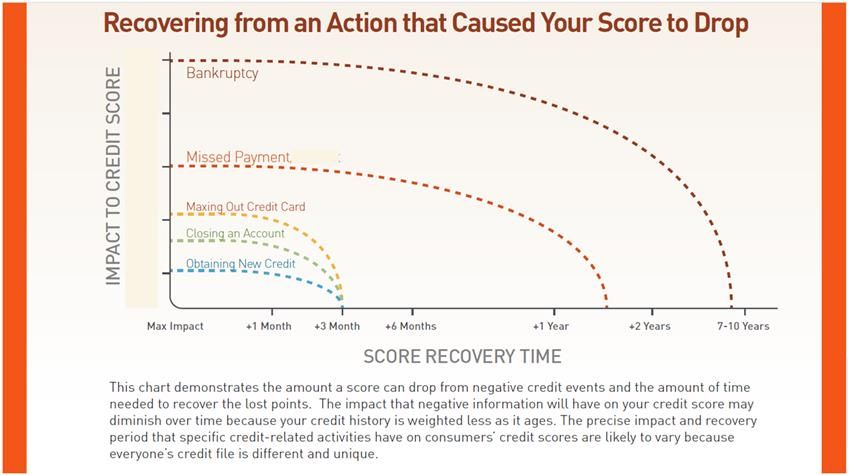

^ Agree. There have been a number of posts where a poster mentioned seeing positive score movement when their most recent new account, or accounts, reached 3 months age. There have been enough reports to suggest 3 months has some significance although the reason statement may not disappears.

A similar situation exists with 30 and 60 day lates. Two years appears to be a threshold for "mild lates" where some, not all, points are regained when the most recent late ages past two years. It is important to note, reason statements associated with those lates will still be present - because the late(s) still negatively affect score.

FYI - Other credit scoring models, such as VantageScore, explicitly refer to 3 months as an important age factor. The below is an infographic from VantageScore.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts Drops - I Lost 4 Fico Points

@Anonymous wrote:

It's not that they are no longer considered new by Fico at 3 months, but I seem to recoup the points lost for a new acct at 3 months.

How can you quantify/isolate that the points coming back though are from the account aging 3 months? I simply don't see a way that you would be able to tell with any level of certainty.

For example, you have score of 700. You app and get approved for a new account. Your score drops to 695 when the inquiry hits, then your score drops to 691 when the new account shows up on your credit report. You then quantify those 4 points lost (695-691) as being the result of the "new account." There are however other variables at play here. AoYA and AAoA dropping here may or may not be a [scoring] factor. Your number of accounts with balances (possibly increasing by 1 here) may or may not be a factor impacting scoring. The "new account" itself may or may not be a factor. What I mean is that if another new account was opened say 1 month earlier, that negative reason code related to that other new account was already in place.

My point here is that those 4 points lost from the "new account" could return in 3 months. They could return in 1 month. They could return in 5 months. It all depends on many, many factors, just a few of which I referenced above. How fast those points return is extremely profile dependent and based on how all of those other factors are impacting score as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts Drops - I Lost 4 Fico Points

@Anonymous wrote:

@Anonymous wrote:

It's not that they are no longer considered new by Fico at 3 months, but I seem to recoup the points lost for a new acct at 3 months.How can you quantify/isolate that the points coming back though are from the account aging 3 months? I simply don't see a way that you would be able to tell with any level of certainty.

For example, you have score of 700. You app and get approved for a new account. Your score drops to 695 when the inquiry hits, then your score drops to 691 when the new account shows up on your credit report. You then quantify those 4 points lost (695-691) as being the result of the "new account." There are however other variables at play here. AoYA and AAoA dropping here may or may not be a [scoring] factor. Your number of accounts with balances (possibly increasing by 1 here) may or may not be a factor impacting scoring. The "new account" itself may or may not be a factor. What I mean is that if another new account was opened say 1 month earlier, that negative reason code related to that other new account was already in place.

My point here is that those 4 points lost from the "new account" could return in 3 months. They could return in 1 month. They could return in 5 months. It all depends on many, many factors, just a few of which I referenced above. How fast those points return is extremely profile dependent and based on how all of those other factors are impacting score as well.

All I know is that I watch my reports very carefully. I subscribe to the Fico monthly 3B report. I have eliminated all other possibilities for the 4 points decrease in this thread except average age. There could be something that I'm missing but I don't see it. So I am sticking with average age at this time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts Drops - I Lost 4 Fico Points

@Anonymous wrote:

All I know is that I watch my reports very carefully. I subscribe to the Fico monthly 3B report. I have eliminated all other possibilities for the 4 points decrease in this thread except average age. There could be something that I'm missing but I don't see it. So I am sticking with average age at this time.

I don't doubt that you watch your reports carefully. What I do question here is how you are able to "eliminate all other possibilities" when we don't have enough data/research to do so. No one knows for sure how these different Age of Accounts factors impact score. This thread is a perfect example of that, as the discussion of AAoA thresholds comes up. As you can see from the responses, all you have are opinions (AAoA thresholds are only at whole number years, or there could be one at 6.5 years, 7.8 years, etc) and nothing is concrete. While these types of threads are fantastic for comparing data points and discussing scoring variables, it's not often that we come away with a definite "answer" since there are so many moving parts to the equation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts Drops - I Lost 4 Fico Points

@Anonymous wrote:

@Anonymous wrote:

All I know is that I watch my reports very carefully. I subscribe to the Fico monthly 3B report. I have eliminated all other possibilities for the 4 points decrease in this thread except average age. There could be something that I'm missing but I don't see it. So I am sticking with average age at this time.I don't doubt that you watch your reports carefully. What I do question here is how you are able to "eliminate all other possibilities" when we don't have enough data/research to do so. No one knows for sure how these different Age of Accounts factors impact score. This thread is a perfect example of that, as the discussion of AAoA thresholds comes up. As you can see from the responses, all you have are opinions (AAoA thresholds are only at whole number years, or there could be one at 6.5 years, 7.8 years, etc) and nothing is concrete. While these types of threads are fantastic for comparing data points and discussing scoring variables, it's not often that we come away with a definite "answer" since there are so many moving parts to the equation.

If you re-read the thread, you will see how I eliminated the possibilities that were suggested. Also I've watched my reports long enough to know how certain actions affect it. This is my Ex report I'm referring to and I haven't had a score drop for a new account since my 4th or 5th new acct. I now have 12 new accts so I'm sure adding one more account would not affect my score. It's these kind of things that I watch.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts Drops - I Lost 4 Fico Points

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

It's not that they are no longer considered new by Fico at 3 months, but I seem to recoup the points lost for a new acct at 3 months.How can you quantify/isolate that the points coming back though are from the account aging 3 months? I simply don't see a way that you would be able to tell with any level of certainty.

For example, you have score of 700. You app and get approved for a new account. Your score drops to 695 when the inquiry hits, then your score drops to 691 when the new account shows up on your credit report. You then quantify those 4 points lost (695-691) as being the result of the "new account." There are however other variables at play here. AoYA and AAoA dropping here may or may not be a [scoring] factor. Your number of accounts with balances (possibly increasing by 1 here) may or may not be a factor impacting scoring. The "new account" itself may or may not be a factor. What I mean is that if another new account was opened say 1 month earlier, that negative reason code related to that other new account was already in place.

My point here is that those 4 points lost from the "new account" could return in 3 months. They could return in 1 month. They could return in 5 months. It all depends on many, many factors, just a few of which I referenced above. How fast those points return is extremely profile dependent and based on how all of those other factors are impacting score as well.

All I know is that I watch my reports very carefully. I subscribe to the Fico monthly 3B report. I have eliminated all other possibilities for the 4 points decrease in this thread except average age. There could be something that I'm missing but I don't see it. So I am sticking with average age at this time.

The score drop is not associated with your slight reduction in average of accounts. It's likely due to the new account REPORTING. New accounts that don't report can't impact score. They must 1st report and then score may be impacted as a result. Score can be affected by the new reporting status and possibly by the incremental increase in # ofnew accounts: "Too many accounts recently opened".

I can't recall if # of open accounts reporting balances changed with the additional account reporting or not. If the # reporting a balance increased, that could negatively impact OP's score.

Side note: Some posters have stated experiencing a short term score drop when a inactive account is used and a balance reports.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts Drops - I Lost 4 Fico Points

@Thomas_Thumb wrote:

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

It's not that they are no longer considered new by Fico at 3 months, but I seem to recoup the points lost for a new acct at 3 months.How can you quantify/isolate that the points coming back though are from the account aging 3 months? I simply don't see a way that you would be able to tell with any level of certainty.

For example, you have score of 700. You app and get approved for a new account. Your score drops to 695 when the inquiry hits, then your score drops to 691 when the new account shows up on your credit report. You then quantify those 4 points lost (695-691) as being the result of the "new account." There are however other variables at play here. AoYA and AAoA dropping here may or may not be a [scoring] factor. Your number of accounts with balances (possibly increasing by 1 here) may or may not be a factor impacting scoring. The "new account" itself may or may not be a factor. What I mean is that if another new account was opened say 1 month earlier, that negative reason code related to that other new account was already in place.

My point here is that those 4 points lost from the "new account" could return in 3 months. They could return in 1 month. They could return in 5 months. It all depends on many, many factors, just a few of which I referenced above. How fast those points return is extremely profile dependent and based on how all of those other factors are impacting score as well.

All I know is that I watch my reports very carefully. I subscribe to the Fico monthly 3B report. I have eliminated all other possibilities for the 4 points decrease in this thread except average age. There could be something that I'm missing but I don't see it. So I am sticking with average age at this time.

The score drop is not associated with your slight reduction in average of accounts. It's likely due to the new account REPORTING. New accounts that don't report can't impact score. They must 1st report and then score may be impacted as a result. Score can be affected by the new reporting status and possibly by the incremental increase in # ofnew accounts: "Too many accounts recently opened".

I can't recall if # of open accounts reporting balances changed with the additional account reporting or not. If the # reporting a balance increased, that could negatively impact OP's score.

Side note: Some posters have stated experiencing a short term score drop when a inactive account is used and a balance reports.

As I stated previously the reason that I don't think it's the new acct is because I've opened 12 accts this year and have not have a score decrease since around the 5th or 6th new acct. That means that I've opened 5 or 6 new accts this year with no score decrease, why would this new acct cause a score decrease.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average Age of Accounts Drops - I Lost 4 Fico Points

@Anonymous wrote:

As I stated previously the reason that I don't think it's the new acct is because I've opened 12 accts this year and have not have a score decrease since around the 5th or 6th new acct. That means that I've opened 5 or 6 new accts this year with no score decrease, why would this new acct cause a score decrease.

Did the new account which reported after a 3 month delay have a balance when it reported? If so what balance did it report and what is the CL for the card? Individual credit card utilization can influence score regardless of aggregate utilization.

Do you know how many accounts had non zero balances at the exact time your before and after scores were reported? A change in # of accounts with balances can impact score. I don't think it's strictly % of accounts reporting based. QTY likely plays a roll in absolute terms.

There is also a tipping point for # of open revolving accounts. Once you cross an undefined threshold, it is viewed negatively by Fico.

- "Number of revolving accounts"

How many total accounts do you have? Given 12 new accounts under 12 months and an average AAoA of 6.5 years, the average age of your other accounts must be well aged.

| New accounts | New accounts | Older accounts | Stated AAoA | Required AAoA | Req AAoA |

| under 1 year (QTY) | AAoA (months) | Assumed QTY | All accts (months) | Older accts (months) | Older(years) |

| 12 | 6 | 4 | 78 | 294 | 24.5 |

| 12 | 6 | 8 | 78 | 186 | 15.5 |

| 12 | 6 | 12 | 78 | 150 | 12.5 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950