- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Best credit monitoring service?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best credit monitoring service?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best credit monitoring service?

@rbentley wrote:

@Anonymous wrote:

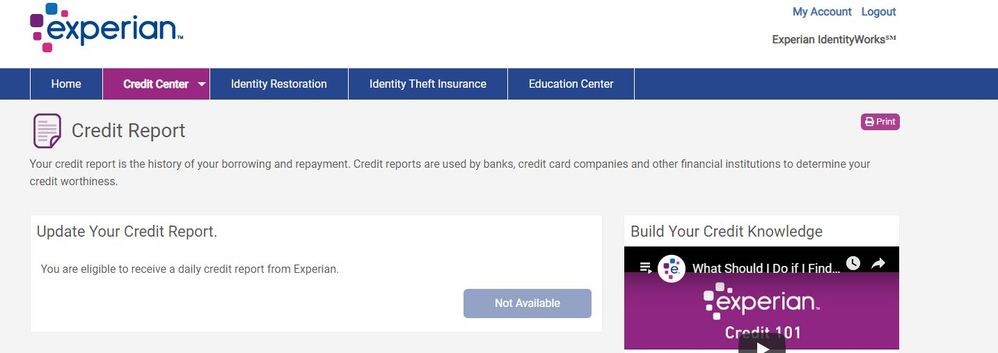

All the way on top after logging in, do you see the tab "Reports and Scores" between "Overview" and "Identity Protection"?I must be being really dense. I dont have those headings. Here is what is "way on top after logging in" for me.

I could be wrong but I think it's actually Creditworks that's being referred to here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best credit monitoring service?

I have CreditWorks and assume its the same path to get your FICO 8 and other scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best credit monitoring service?

Ah, I think I see the problem. EX IdentityWorks does not give you a score, but EX IdentityWorks Plus must. That is why I couldn't see scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best credit monitoring service?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best credit monitoring service?

@Anonymous wrote:

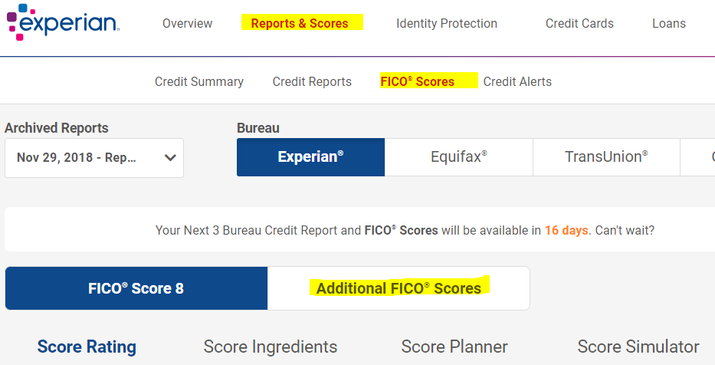

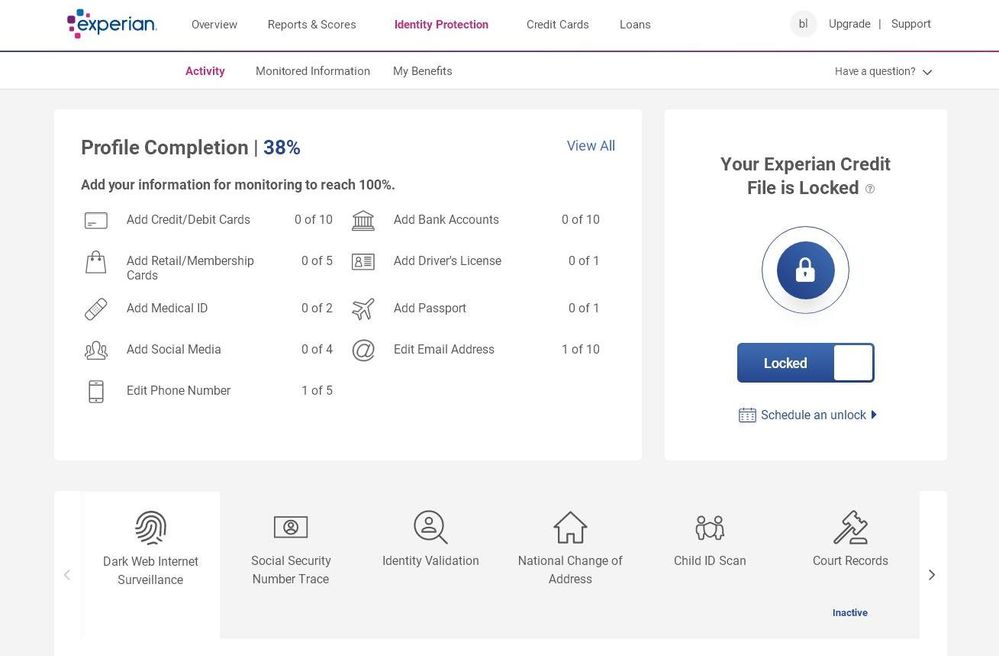

Here is my IdentityWorks Plus login. Is your IdentityWorks subscription free?

Yes, some company I had an account with had a data breach and I got 2 years of IdentityWorks free to monitor for problems. It must be their base IdentityWorks program. I didn't really realize they had a IdentityWorks Plus available.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best credit monitoring service?

I didn't know they had a free base IdentityWorks program, must be a special deal with the breached company.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best credit monitoring service?

There is an Experian free service, FICO 8 Classic and report once a week. Basically the same as Discover scorecard AFAIK. Actually I should've mentioned that, CK + EX freebie and done. I had that before I upgraded recently, I don't think it was special deal I've had the service for a while actually. If you don't mind the annoyance of skipping past the upsell opportunity every single time this works great, same data presentation for the report as the upgraded service.

Identity Works Plus ($10 / month, 9.95 or whatever) - EX only, daily pull, FICO 8 and industry options, FICO 2 and industry options, and FICO 3 which like the myFICO product is really confused if it's BC or base (out of 850 so it's probably base but it's flatly labeled two different ways in the Experian interface, which is the only mistake I've seen so far, well reason codes aren't clearly marked in order and massaged so I had to translate from an older myFICO report). I've got some interesting changes coming up over the next few months so figured I'd try to catch them.

There's also Identity Works Premium which is I think is basically $20/month or maybe 30/month (I'm not sure if what I'm looking at is an upgrade price for those of us with the Plus product) which gives you the report data from EQ / TU and I think FICO 8 scores from them too. I don't see value in this product as a CMS honestly, I can get the report data and I can get the TU score from multiple credit cards at this point. EQ FICO 8 is meh for me in terms of use, EQ FICO 5 from DCU and EQ FICO 9 from Penfed are likely the only two EQ scores I will ever be underwritten on again for the next decade so I'm not really worried.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best credit monitoring service?

@Anonymous wrote:

@NRB525 wrote:You get what you pay for.

That's not always true and CCT $1 trials are a perfect example of that. One receives much more with a pair of $1 CCT trials ($2/mo) than if they were to purchase a "real" CCT monthly membership for $30-$40 or whatever it costs.

CGID gives great advice above regarding no-cost and ultra-low-cost options. Like him, I'm one of the many that goes that route and I'm extremely satisfied with the results.

I'm not sure how you can say MF is not worth the subscription fee, if you haven't ever signed up for it, to see what is included.

The alternatives being presented here mean visiting several different websites to try to get individual corners of your credit profile, then paste them on a wall like a conspiracy theory diagram to try to reconstruct your credit scores. Or starting / stopping subscriptions on a specific time frame to trick "The Man". That's fine if you think your time is best spent on that, and you can distinguish the real FICO scores from the "Opps, not really FICO" offerings.

I find it more time efficient to just let MF bring that all together for me, for $1 per day.

If one tries the MF subscription for a month or two, and determines they would rather not pay for the service, or that they've learned all they need for now, the subscription can be cancelled. So it is not like you sign up for $350 per year or $480 per year and pay that out of pocket.

And the Discover card option is the easiest, really. It shows TU FICO 8 every month, right on the account statement.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best credit monitoring service?

I have certainly signed up for the myFICO Ultimate before and then cancelled two weeks later, just to grab all two dozen or so of my scores. I have done that twice in the last 3 and a half years. I believe that BBS has done that before as well.

He and I are both big advocates of people using it (a) if they need mortgage scores due to an upcoming home purchase and (b) if it makes them happy. Happiness in life is hard to overrate, so we certainly don't urge people not to use it.

We do, however, let people know about zero or near-zero cost alternatives, just so that they can make an inforned decision. Certainly these budget approaches can be supplemented with the occasional Ultimate signup (e.g. once every 18 months) to grab all scores.

BTW I personally find the $30/mo flavor of the myFICO Ultimate the least appealing (the one that you say costs you a buck a day). You only get reports and the full plethora of scores once every 90 days. The cheaper product ($360/year) ends up needing a bunch of free tools for reports if you don't want to be limited to every 90 days -- so if I was going to be a regularly subscriber (one-stop shop) I'd plunk down the $480/year for the version of the service that gives me the 3B report every 30 days. Once a person commits to having all the free tools for reports, it becomes harder (for me) to want to spend an additional $360 per year.

PS. I have myself never used CCT, though BBS and many others love it. What I do is simply use my credit cards for my free FICO scores and then the free tools for reports. There are of course additional sources for free FICO scores beyond credit cards, which I described earlier in the thread. And I didn't even mention all of them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best credit monitoring service?

@NRB525 wrote:

@Anonymous wrote:

@NRB525 wrote:You get what you pay for.

That's not always true and CCT $1 trials are a perfect example of that. One receives much more with a pair of $1 CCT trials ($2/mo) than if they were to purchase a "real" CCT monthly membership for $30-$40 or whatever it costs.

CGID gives great advice above regarding no-cost and ultra-low-cost options. Like him, I'm one of the many that goes that route and I'm extremely satisfied with the results.

I'm not sure how you can say MF is not worth the subscription fee, if you haven't ever signed up for it, to see what is included.

NRB, my comment above was related specifically to CCT and I was using their products as a reference that you don't always get what you pay for. I was speaking specifically about CCT and CCT only, not CCT verses other CMS products. That being said, a pair of CCT $1 trials without question delivers more to the customer (4 [weekly] 3B reports, 4 [weekly] sets of FICO 8 scores) verses their normal $30-$40 monthly membership. That was my only argument based on your "you get what you pay for" comment.

Regarding everything else you said, as CGID has said probably 100 times on this forum it all comes down to what is best for the individual. You see value and convenience in having a monthly membership to a CMS. I don't. CGID doesn't. It doesn't make any of us "right" or "wrong" it's just all personal preference. I don't knock anyone that pays $10/mo, $30/mo, $60/mo etc. for a CMS. Like CGID, I may make them aware of the low cost and ultra low cost options out there, as many aren't in the know about them. From there they can make an informed decision as to whether or not the options presented make sense for them, or if continuing to roll with their monthly membership is a better personal fit.

What something is "worth" is in the eye of the beholder. Something is "worth" what someone is willing to pay. For me, more than a few dollars per month isn't something I'd be willing to regularly pay. It's just not that important to me. I'm sure there are some out there though that have monthly subscriptions to multiple CMS products, perhaps paying $100+/mo for several services. Clearly to them, it's worth it.

This subject is quite like the one you see in the rebuilding forum, asking if credit repair services are "worth it" or not. Some like myself aren't willing to spend a dime on them and would rather do the work myself, where others will lay down hundreds of dollars per month to Lexington Law or another company because to them, it's worth it.