- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Bait & Switch advertizing ! ! !

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Buffering and Deduplication of Credit Card Inquiries Research Project

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Will Combine Hard Pulls for Your Next App Spree!

@JLK93 wrote:It is a little known fact that most credit card inquiries, taken in a short period of time, will be counted as 1 for FICO scoring purposes.

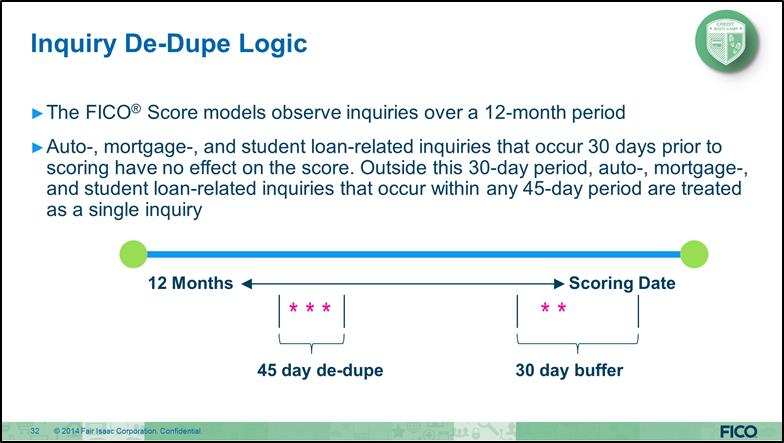

Most credit card inquiries are scored the same as mortgage inquiries by FICO. The inquiries are not be scored by FICO for 31 days. Then, any inquiries taken within a short period of time will be scored as one by FICO. Therefore, it is possible to take a large number of inquiries and only lose as few as 3 points. Theoretically, this will apply to any inquiries taken within 45 days for FICO 8. However, my research has only focused on inquiries taken within a period of 1 week.

Inquiries from BofA, Barclays, Synchrony, Capital One, virtually all Credit Unions, probably Amex and others will be combined for scoring purposes.

This means that by strategically planning your app sprees, it is possible to lose only a few points. For example, an app spree consisting of BofA, Barclays, Synchrony and several Transunion pulling Credit Unions could only cost you 3 points.

There is no need for the shopping card trick. You can get better cards with little point loss.

The delayed scoring of inquiries is referred to as buffering by FICO.

The scoring of multiple inquiries as one is referred to as deduplication by FICO. The commonly used term is deduped.

Chase, Citi and FNBO pull Bankcard Enhanced inquiries. It is unlikely that those inquiries will be combined.

I recently took 4 CLI hard pulls and on credit card app hard pull. There was no change in my scores for 31 days. At that time the hard pulls were scored as 1. The table below shows the results:

11/2/2016 11/16/2065 11/17/2016 11/18/2016 11/18/2016 11/19/2016 12/16/2016 12/17/2016 Before Spree Barclays CLI Barclays CLI BofA CLI Barclays CLI Synchrony App After Spree Deduped HPs Hard Pulls 2 3 4 5 6 7 7 7 TU 04 802 * * * * * 802 792 TU FICO 8 850 * * * * * 850 085 Bankcard 8 895 * * * * * 895 890

The following shows the deduplication (combined scoring) of 4 Credit Union inquiries:

2/17/2016 2/18/2016 2/19/2016 2/26/2016 3/21/2015 Penfed AAFCU CLI JFCU JFCU CC App Deduped HPs EQ FICO 8 815 815 815 815 812

The next table shows the combined scoring (deduplication) of 2 Hard Pulls from 2014:

11/25/2014 12/1/2014 12/1/2014 12/28/2014 1/6/2014 Before BofA CLI Barclays App After Deduped HPs TU FICO 8 809 809 809 809 806

The next table shows the delayed scoring (buffering) of a Capital One Application:

6/11/2015 6/24/2015 7/8/2015 7/15/2015 CapOne App Loan <10% Buffered HP EQ FICO 8 813 813 850 846

The next table shows the buffering (delayed scoring) of a Penfed CLI:

10/29/2015 11/27/2015 12/2/2015 Penfed CLI Buffered HP EQ FICO 8 846 846 839

The last table shows the delayed scoring (buffering) of a BofA CLI:

10/23/2015 11/22/2015 11/25/2015 BofA CLI Buffered HP TU FICO 8 849 849 846

Feel free to add your comments, data or research.

____________________________________________________________________________________________________

I can't speak to all the points here but, the 30 day buffer for inquiries has been published by Fico on multiple occassions. Credit cards are not specifically mentioned but suspect the buffer may apply to them as well. Also, on 11/20/2015 I had an unauthorized HP from PenFed on EQ. It did not influence my Fico 08 enhanced scores on a 12/3/2016 3B report. I did see an apparent influence on a 2/14/16 report which was gone (as a HP) on a 3/25/16 report. The inquiry still shows but, it was re-categorized as a SP by EQ late February - it was my only INQ. Not sure how the PenFed inquiry was coded other than it was a HP.

I have only had 2 total HPs in five years (both on EQ) so I have no personal data on De-Dupe "testing".

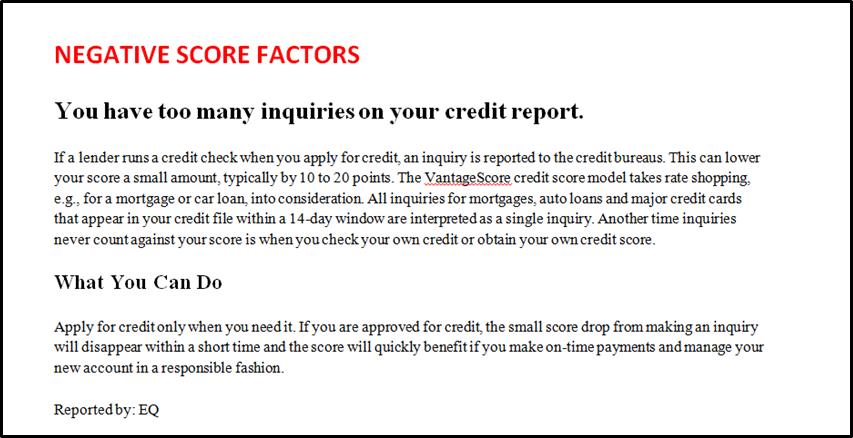

Here is something interesting from VantageScore 3.0 which came my way via a 3B TransUnion report I pulled late last year. The VS3 14 day window specifically states credit cards are included. I have not found this gem in VS 3.0 presentations or their published articles.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Will Combine Hard Pulls for Your Next App Spree!

JLK93, you didn't respond to my post Number 22 above. How can you be sure that with your profile something like 5 inquiries doesn't fall into a range of say 1-5 inquiries having the same impact based on the age/thickness of your file? So to you, it may appear that 5 inquries are scored as 1 when in fact for you 5 just may only result in a 3 point loss. On a younger/thinner file 5 inquiries could very well produce a loss of > 3 points. The theory here would be that different profiles react differently to changes (which we all already know), inquiries being one of them, so making a blanket statement like "multiple inquiries are scored as one" doesn't make much sense.

As an aside looking past just the inquries, on thicker/aged files I tend to think (from personal experience) that "new accounts" adversely impact score far more than AAoA reduction does. Like if someone opens up 5 accounts on the same day, a month or two from now after all of the accounts have reported that person may see their scores 20 points lower than they were before the "spree." When doing the math, though, AAoA if it's already say 7-10 years many times at most would drop by 1 year. In my case my AAoA didn't drop at all from my spree with respect to FICO scoring as it was still the same whole number. Therefore, for me, the two factors I had that dropped my score were the inquries and the new accounts. It's somewhat simple to distinguish between these two factors as the inquries show up before the new accounts do, which can sometimes take a cycle or two depending on the creditors, time of applying, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bait & Switch advertizing ! ! !

.

Joe & Jane Average-Citizen who read this, are simply going to "Read what they Want to HEAR".

They will walk away with a terrible mis-understanding that they can Simply & without any HARM go on an worry-free CC application Spree incurring many HARD pulls on their credit file, and BELIEVE that they will end up with Fico Scores close to 850, 850, 850.

Besides saying lQQk me with "my" Double Cab Pick-Up Truck with an extended cargo bed and a heavy duty winch on front, this thread serves no purpose.

* at a minimum, the headline of this thread should be CHANGED immediately so the incredibly large amount of people on this site using phone app's searching for a glimmer of hope to either improve their credit situation or obtain a much needed credit card.

This is NOT a topic headline which can HELP people, rather something which will un-necessarily Damage individuals, as they are using this site as a repository of TRUSTED information to make their life better for themselves and families dependent upon their effort and choices.

JLK93 wrote:

It is a little known fact that most credit card inquiries, taken in a short period of time, will be counted as 1 for FICO scoring purposes.

Average Joe Understanding & Comprehension:

* Yes Dear Wife, I today have actually applied for six different credit cards to include Capital One (with three CRA pulls).

But NO worries, I learned today that they will all be magically transformed into "only" ONE hard pull by a hypothesis of Buffering & De-Duplication.

Yes Honey, I told you I was very Smart!!! Oh, I am also on the road to getting our Fico Scores raised in the process as well.

Say HELLO the the Eight Hundreds, times three!

.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bait & Switch advertizing ! ! !

@Anonymous wrote:.

Joe & Jane Average-Citizen who read this, are simply going to "Read what they Want to HEAR".

They will walk away with a terrible mis-understanding that they can Simply & without any HARM go on an worry-free CC application Spree incurring many HARD pulls on their credit file, and BELIEVE that they will end up with Fico Scores close to 850, 850, 850.

Besides saying lQQk me with "my" Double Cab Pick-Up Truck with an extended cargo bed and a heavy duty winch on front, this thread serves no purpose.

* at a minimum, the headline of this thread should be CHANGED immediately so the incredibly large amount of people on this site using phone app's searching for a glimmer of hope to either improve their credit situation or obtain a much needed credit card.

This is NOT a topic headline which can HELP people, rather something which will un-necessarily Damage individuals, as they are using this site as a repository of TRUSTED information to make their life better for themselves and families dependent upon their effort and choices.

JLK93 wrote:

It is a little known fact that most credit card inquiries, taken in a short period of time, will be counted as 1 for FICO scoring purposes.

Average Joe Understanding & Comprehension:

* Yes Dear Wife, I today have actually applied for six different credit cards to include Capital One (with three CRA pulls).

But NO worries, I learned today that they will all be magically transformed into "only" ONE hard pull by a hypothesis of Buffering & De-Duplication.

Yes Honey, I told you I was very Smart!!! Oh, I am also on the road to getting our Fico Scores raised in the process as well.

Say HELLO the the Eight Hundreds, times three!.

INSERT CLICHE EATING POPCORN MEME HERE

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bait & Switch advertizing ! ! !

@Anonymous wrote:.

Joe & Jane Average-Citizen who read this, are simply going to "Read what they Want to HEAR".

They will walk away with a terrible mis-understanding that they can Simply & without any HARM go on an worry-free CC application Spree incurring many HARD pulls on their credit file, and BELIEVE that they will end up with Fico Scores close to 850, 850, 850.

Besides saying lQQk me with "my" Double Cab Pick-Up Truck with an extended cargo bed and a heavy duty winch on front, this thread serves no purpose.

* at a minimum, the headline of this thread should be CHANGED immediately so the incredibly large amount of people on this site using phone app's searching for a glimmer of hope to either improve their credit situation or obtain a much needed credit card.

This is NOT a topic headline which can HELP people, rather something which will un-necessarily Damage individuals, as they are using this site as a repository of TRUSTED information to make their life better for themselves and families dependent upon their effort and choices.

JLK93 wrote:

It is a little known fact that most credit card inquiries, taken in a short period of time, will be counted as 1 for FICO scoring purposes.

Average Joe Understanding & Comprehension:

* Yes Dear Wife, I today have actually applied for six different credit cards to include Capital One (with three CRA pulls).

But NO worries, I learned today that they will all be magically transformed into "only" ONE hard pull by a hypothesis of Buffering & De-Duplication.

Yes Honey, I told you I was very Smart!!! Oh, I am also on the road to getting our Fico Scores raised in the process as well.

Say HELLO the the Eight Hundreds, times three!.

While I do agree with your statement that the OP's thread title is unfortunate, from past experience I can say that it's up the OP to modify the thread title unless it's in violation of the site's TOS, which it doesn't seem to be at this time. Inaccurate thread titles are actually not that uncommon.

I can't speak for a mod (and you're welcome to reach out to one) but generally it's been said in the past that it's up to us as a community to discuss the issue here and resolve any inaccuracies or disagreements (in a FSR manner, of course).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bait & Switch advertizing ! ! !

More data is needed to prove or disprove the claim, though I will suggest FICO and the bureaus have been consistent in stating credit card inquiries aren't deduped to my knowledge from looking through their releases.

The 30 day grace period, maybe. I've read someone suggesting that previously and it might have merit and it might fit with some of my data over the years TBH. Miscoded inquiries, yeah it happens but that isn't reason to throw all inquiries out and frankly posts from the dotcom era, well, neither banks nor FICO nor the bureaus are as backwards technically as they were then. I think miscoded inquiries is something of a red herring these days... ones coded as miscellaneous, maybe they get deduped with the others and that might make sense.

Personally I'm pretty skeptical of this; what I have seen on my personal data and this has been borne out as well by some of the older testers of the algoritm: inquiries are binned, and we simply don't know what the breakpoints are and they may vary by algorithm and bureau and maybe scorecard so it absolutely sucks to try to test concretely.

What I mean by this is inquiries aren't counted linearly, for illustration 0->1 drop, 1->2 nothing, 2->3 drop (at least I did see this one concretely on EQ Beacon 5.0 during my mortgage process as I shifted between 2 and 3 on EQ multiple times) but 3+ to somewhere around 6-8 might not even be a drop.

It's so incredibly hard to determine some of this stuff, but I'd be very very cautious in making the blithe assertion that credit card inquiries (and therefore ostensibly everything else) are deduped. If someone wants to try to create a valid test bearing in mind it would likely have to be targetted against a single bureau, well I'm down to try to help but I don't think this is going to get resolved without more data. Ugh, more I think about it the more it sucks, we'd have to be pretty certain as to what the inquiries were coded as even.

I think it's safe to say fewer inquiries are better for both FICO and for lending UW, and that should likely be kept in mind... and for the majority of consumers I would suggest this should take precedence.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bait & Switch advertizing ! ! !

@Revelate wrote:More data is needed to prove or disprove the claim, though I will suggest FICO and the bureaus have been consistent in stating credit card inquiries aren't deduped to my knowledge from looking through their releases.

The 30 day grace period, maybe. I've read someone suggesting that previously and it might have merit and it might fit with some of my data over the years TBH. Miscoded inquiries, yeah it happens but that isn't reason to throw all inquiries out and frankly posts from the dotcom era, well, neither banks nor FICO nor the bureaus are as backwards technically as they were then. I think miscoded inquiries is something of a red herring these days... ones coded as miscellaneous, maybe they get deduped with the others and that might make sense.

Personally I'm pretty skeptical of this; what I have seen on my personal data and this has been borne out as well by some of the older testers of the algoritm: inquiries are binned, and we simply don't know what the breakpoints are and they may vary by algorithm and bureau and maybe scorecard so it absolutely sucks to try to test concretely.

What I mean by this is inquiries aren't counted linearly, for illustration 0->1 drop, 1->2 nothing, 2->3 drop (at least I did see this one concretely on EQ Beacon 5.0 during my mortgage process as I shifted between 2 and 3 on EQ multiple times) but 3+ to somewhere around 6-8 might not even be a drop.

It's so incredibly hard to determine some of this stuff, but I'd be very very cautious in making the blithe assertion that credit card inquiries (and therefore ostensibly everything else) are deduped. If someone wants to try to create a valid test bearing in mind it would likely have to be targetted against a single bureau, well I'm down to try to help but I don't think this is going to get resolved without more data. Ugh, more I think about it the more it sucks, we'd have to be pretty certain as to what the inquiries were coded as even.

I think it's safe to say fewer inquiries are better for both FICO and for lending UW, and that should likely be kept in mind... and for the majority of consumers I would suggest this should take precedence.

I don't see how anyone can study the examples I've provided and not see a pattern. My last test included 5 cards. It is carefully documented. There was a buffer period and then minimal score loss. The conclusion is clear. Maybe on it's own it could be doubted, but it is consisten with my other examples. I provided 3 examples of dedupes and all of the examples included buffered inquires. Buffering and deduping have always gone together. Perhaps someone can skim the data and not see the pattern.

There should be more tests. I have been trying for several monthsl to get testers. However, for months I have found no one willing to give up an inquiry for a test.

I've been watching my inquiries age off for the last year. Every inquiry from 1 to 6 was scored individually on every Bureau. There was absolutely no evidence of binning. The only exception was EX98. In that case the first 3 inquiries were scored individually and the aging of 4 through 6 caused no point gain. Inquiry #1 on EX98 was worth approximately 20 points IIRC.

Some on the people who have observed binning in the past may not have been aware some many credit card inquiries are being deduped. They may have actually observing actually observing something different than they thought.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bait & Switch advertizing ! ! !

@JLK93 wrote:I don't see how anyone can study the examples I've provided and not see a pattern. My last test included 5 cards. It is carefully documented. There was a buffer period and then minimal score loss. The conclusion is clear. Maybe on it's own it could be doubted, but it is consisten with my other examples. I provided 3 examples of dedupes and all of the examples included buffered inquires. Buffering and deduping have always gone together. Perhaps someone can skim the data and not see the pattern.

There should be more tests. I have been trying for several monthsl to get testers. However, for months I have found no one willing to give up an inquiry for a test.

I've been watching my inquiries age off for the last year. Every inquiry from 1 to 6 was scored individually on every Bureau. There was absolutely no evidence of binning. The only exception was EX98. In that case the first 3 inquiries were scored individually and the aging of 4 through 6 caused no point gain. Inquiry #1 on EX98 was worth approximately 20 points IIRC.

Some on the people who have observed binning in the past may not have been aware some many credit card inquiries are being deduped. They may have actually observing actually observing something different than they thought.

I think either binning or de-dupe explains the data in both scenarios but I might've not read it closely enough. Mea culpa to be sure I have a bunch of crap going on right now, and FICO has been patently clear that credit card inquiries are counted seperately. I'm going to be going through a likely spree in a bit which is going to land several inquiries on EX and I don't mind it tracking it if you have a test plan that can be provided.

Actually I may have pretty good data from my most recent app spree on Equifax which is the most granular in my experience of the 3 monitoring solutions, this is all FICO 8, I'll see if I can dig out some FICO 5 datapoints too which I might have from DCU:

The inquiry dates are specific to the date of the inquiry, balance updates are there for completeness and to isolate possible grace periods and are the date the monitoring solution saw them.

5/3/16: 714->714 pull by Credco for mortgage refinance, absolutely grace period on my prior data during mortgage process

5/4/16: 714->714 minus one balance -> $0

5/14/16: 714->717 for a balance increase, so something else happened here

5/16/16: 717->717 pull by Factual Data for the HELOC, should be grace period/dedupe as it was during mortgage and is coded identically

~5/20/16: 717->714 balance change, $0->$21 number of tradelines with balances breakpoint

~5/27/16: 714->714 small balance to small balance, no change as a result but for tracking grace periods or what not

6/1 report pull: 714

6/4 report pull: 713 (the Credco inquiry should be counting now)

~6/14/16: 713->713 small balance to small balance

~6/19/16: 713->716 balance change $21->$0, number with revolvers with balances again

6/20/16: 716->710 when Discover pulled

6/25/16: 710->708 when Citibank pulled

These last two is where it all falls apart for both dedupe and grace period on my data as any way it's sliced the Discover and Citibank should not have both counted if deduped, and they shouldn't have had an immediate effect if grace perioded. Doesn't look good for binning either frankly but I'm willing to suggest something else might've changed on one of the two and I haven't really scrutenized the reports bracketing those datapoints.

On the flipside EX FICO 8: 6/11 721->721 when Chase pulled and that one is absolutely coded as credit card and I didn't take a drop after 30 days either so that is one datapoint in support of binning.

I and others aren't trying to be argumentative (at least I'm not) but when there's conflicting data and we have FICO stating a thing explicitly, it's reasonable to question the data as it would be in any remotely scientific process.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bait & Switch advertizing ! ! !

Actually I have enough EQ FICO 5 datapoints to correlate I guess so here goes:

4/29: 693 (DCU)

5/3: 693 (Credco inquiry and what they pulled)

5/16: 693 (Factual Data inquiry and what they pulled)

5/27: 693 (DCU)

6/1: 693 (MF)

6/4: 693 (MF)

6/20: Discover inquiry

6/24: 693 (DCU)

6/25: Citibank inquiry

7/1: 693 (MF)

7/29: 693 (DCU)

Would suggest that's neither dedupe nor grace period, and is instead fairly good evidence of inquiry binning.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bait & Switch advertizing ! ! !

I guess finally the inquiry data.

For reference when I was at 2 inquiries my Beacon 5.0 (EQ FICO 5) score was a 700, and at 3 it is a 693. That was conclusively proved during my mortgage process last year on my file.

I started this adventure at 3 inquiries so the counts should be:

5/2: 3 inquiries

5/3: Credco pull, 3 inquiries cause grace period

5/16: Factual Data pull, 3 inquiries cause grace period and dedupe

6/4: 4 inquiries (Credco out of grace period)

6/10: 3 inquiries (my last mortgage pull from 2015 fell out of scoring range)

6/20: 4 inquiries (Discover)

6/25: 5 inquiries (Citibank)

That's where I'm suggesting 3->? inquiries may be absolutely zero change.

To be clear you're a pretty file whereas I'm not, and that may factor too... as I said this isn't easy to necessarily test concretely.