- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Can a Lender Start Reporting To More CBs Old C...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CFAs Affirm: Can a Lender Start Reporting To More CBs Old Closed Accounts?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CFAs Affirm: Can a Lender Start Reporting To More CBs Old Closed Accounts?

OMGOSH I'm ready to tear out my hair with AFFIRM.

These people make me furious!

When I started using them, they didn't report at all. Then a couple years ago they started reporting but only to Experian.

They never disclosed they code as a CFA so even though I paid everything as agreed, in fact, early, the Affirm accounts are killing my EX score by 40 points!

I tried good will and they wont remove, in fact, they inform me they are going to start reporting to the other 2 CBs!!!

I'm filing a complaint with the Federal Trade Commission for their practises as their adverts say: "Affirm is better for your credit than credit cards"!

That is NOT true.

I had credit cards I could have and would have used if they had disclosed that they were a CFA.

Anyway- can they back report old loans that have been paid off?

The accounts are all positives- no lates EVER but they have a negative effect just like a payday loan.

I'm at my wits end with this company..

ROBERTEG, if you read this, I would really appreciate any advice you can give me.

I hope it's not: tough luck cookie.

Thanks a BUNCH!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can a Lender Start Reporting To More CBs Old Closed Accounts?

They can to my knowledge, but I'd defer to other's legalese.

How are you quantifying a 40 point drop though from a CFA (or multiple)?

Can't directly compare FICO 8 scores or earlier across bureaus and you can't really even do that with FICO 9 but it might be more accurate there since it's designed to return more similar score values for identical files. I do have a CFA on Experian and I'm pretty certain it isn't costing me anywhere that much though I am going to try a validation route on that given the lender has been mostly shutdown currently.

Crossing fingers on that one ![]() .

.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can a Lender Start Reporting To More CBs Old Closed Accounts?

@Revelate wrote:They can to my knowledge, but I'd defer to other's legalese.

How are you quantifying a 40 point drop though from a CFA (or multiple)?

Can't directly compare FICO 8 scores or earlier across bureaus and you can't really even do that with FICO 9 but it might be more accurate there since it's designed to return more similar score values for identical files. I do have a CFA on Experian and I'm pretty certain it isn't costing me anywhere that much though I am going to try a validation route on that given the lender has been mostly shutdown currently.

Crossing fingers on that one

.

Mine are multiple.. 9 total now. All are from before I learned they were CFAs.

They call their financing: installment loans for purchases. I used them for online purchases at different retailers.

Things is, all of my CBs are basically identical with EX being FAR lower than the others.

It may not be exactly 40 points but it's definitely in the neighborhood.

It isn't a drop but as my score has risen only EX has failed to rise with the other two.

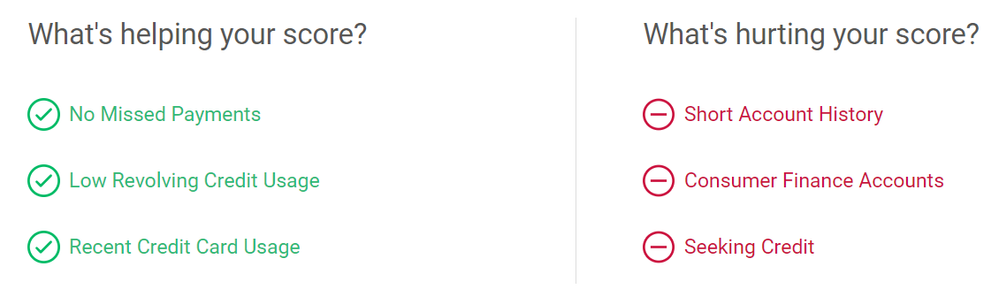

I keep getting the verbiage: "Too many CFA accounts" as why my score is low.

I swear if they tank my other scores I will max out my NFCU card on an attorney.

They led me down a bad path-

I filed a complaint with CFPB and they are referring me to FTC.

I'm really hoping they can't start reporting to more CB when they originally said they were going to start reporting, they said only EX.

That was the "contract" I agreed to online.

UGH

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can a Lender Start Reporting To More CBs Old Closed Accounts?

paging @RobertEG . He should get the ping, and hopefully chime in. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can a Lender Start Reporting To More CBs Old Closed Accounts?

Out of curiosity what rank is the Consumer Finance Accounts reason code on your Experian file? It's usually been firmly in the #4 slot for me personally, comparitively minor ding, or doesn't even make the list actually. I admittedly have all sorts of complainable problems with my EQ file historically.

The thing with the bureaus is they have a design goal of +/- 30 points variance under FICO 04 and FICO 8 as I understand it for an indentical file (the algorithms are tweaked per bureau), so really from a 40 point difference it could be as little as 10 points.

I've had a CFA on my reports since I started this journey unfortunately and it doesn't come off till 2022 (sigh), it's really unlikely that it is penalizing me that much as even anecdotally for similar files from a late / age / public record perspective, I've been higher than a lot of people on this forum.

That said I only have 1 CFA, maybe multiple is a larger problem but there's diminishing returns with all other negatives in the FICO algorithm I can't help but think that would apply to even the multiple CFA situation too.

Let me know what you get from the FTC, I'm curious on this one as I was told too "Helps your credit!" No, clearly it isn't all positive heh.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can a Lender Start Reporting To More CBs Old Closed Accounts?

It ranks #2 and is the only reason listed before "age of credit"

And yeah, I think one or two may not be an issue but it specifically states "too many" CFAs on Wells Fargo score so I'm sure it's the multiple.

I don't know what else could be depressing my EX score other than the CFAs.

The other CBs both list age of accounts.

I plan to follow through with the FTC complaint, in fact CFPB forwarded the complaint BUT...

That's a branch of the govt that's currently not open. UGH So I will have to wait & check up once the govt is open for business again.

There was definitely some false advertising & misleading info in "selling" this financing. I have screenshots of this as well as multiple complaints from other's online that are also suffering score problems.

I am just kicking myself as I had other cards, even cash but it was 0% and I figured what the heck, why not use their money.

I still don't understand "why" they're coded as a CFA when it was basically a set instalment loan for purchases but I don't know how any of that works.

I wrote Affirm again as I don't believe the rep, that billed herslf as a supervisor, really understood what my complaint/request is.

She told me to contact EX and dispute late payments etc.. Well, I didn't have any lates.

The worst part of this is: It's all online, they have phone reps but they are clueless to any of this type of issue.

I don't know how to find the EO's address/number etc.. So it may indeed take the FTC and/or an attorney to get to the core of it all.

I will update as I take steps and whatever the final decision/solution is, if there is one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can a Lender Start Reporting To More CBs Old Closed Accounts?

Take the "too many" to read >0 in pretty much all interpretations I've seen. I don't think there are multiple reason codes for CFA's in anything model developed since 2003 TBH and I'm not even sure there.

Our Experian reason codes are identical and I only have 1 CFA: Consumer Finance Accounts

The fact it's #2 in your scorecard though, and in my FICO 8 AU (I don't get reason codes unfortunately for my baseline or bankcard enhanced scores now) is #4behind:

1) Short Account History

2) Short Revolving History

3) Loan Balances

4) CFA

That's where we can see it's probably counting more against you than me for your multiple, though based on your score I'm fairly confident we're in a different scorecard on Experian but I don't know what the rest of your file looks like (apologies if I missed it) so we can't really do a good comparison even there.

I guess it's really hard for us to know, we have so little data around CFA's unfortunately. What I really wish is if my TU were clean and then compare FICO 9 scores as those are absolutely more addressable (if not 100% accurate) in terms of things like CFA counting if it's still a thing there. Sadly I've always had a 30D late on TU for the last several years so I couldn't get a good comparitive datapoint in the past, but my EQ/EX scores were absolutely higher than my TU ones by a bunch of points (except TU FICO 4, beats me there) and as such I'm fairly confident in saying CFA's are a pretty minor ding compared to virtually every other deliquency or derogatory.

Actually I guess I can have some fun with FICO 9 in the future whenever it gets integrated with good monitoring solutions:

1) EX - no late

2) EQ - 30D

3) TU - 60D

Everything else will be functionally identical once that CFA drops off. If I still even care about credit at that point haha.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can a Lender Start Reporting To More CBs Old Closed Accounts?

Yes, it's basically the same scoring difference in F9 35-40 points lower than the other 2.

I don't have any lates or derogs on any report. Aside from account ages.

I'm hoping & praying to be a test case..

If I get mine deleted, we'll know just about how much they were costing me once they're removed.

Sadly, it wont necessarily answer the scoring difference for one vs multiple but it's a start.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can a Lender Start Reporting To More CBs Old Closed Accounts?

I just felt compelled to add that.

Hope Robert can find something in the advertising that can nail those sucka’s to da wall!!😡

I pray it results in some positive news🤞

Sending Luck your way🍀😉

😊

Goal Score: 600(within a year)**MET MY GOAL** | Goal Score: 700**MET MY GOAL** | Goal score: 800

Take the myFICO Fitness Challenge

I❤️NY