- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Can anyone share ALL of their FICO scores?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Can anyone share ALL of their FICO scores?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can anyone share ALL of their FICO scores?

I think it would be cool to see the scores relative to one another, possibly allowing us to draw some conclusions regarding the weight of some scoring factors. Along with your scores it would be necessary to provide some of your profile data as well in order to get a feel for what the algorithm is considering. Thanks in advance to anyone that takes the time to contribute.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anyone share ALL of their FICO scores?

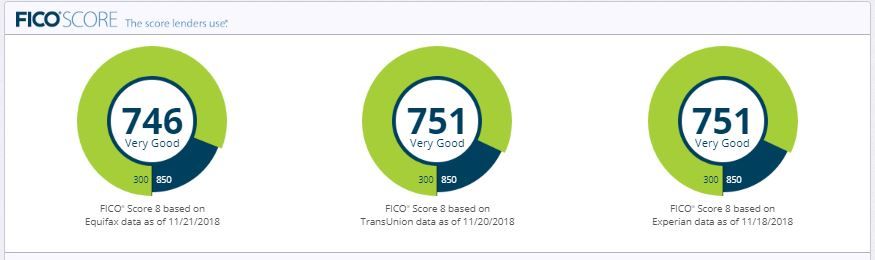

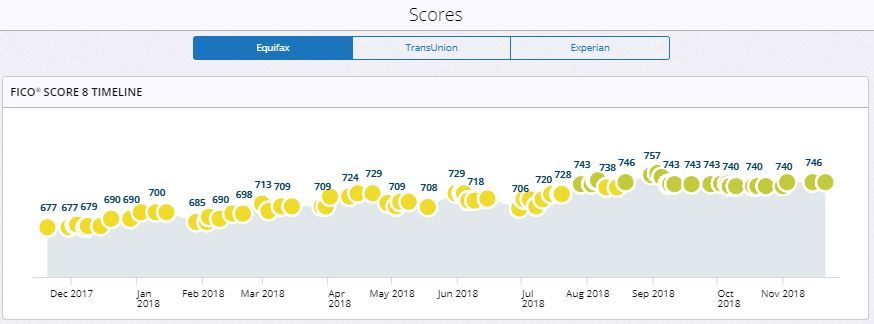

Current EQ FICO Score 8 - 746 as of Nov 18, 2018

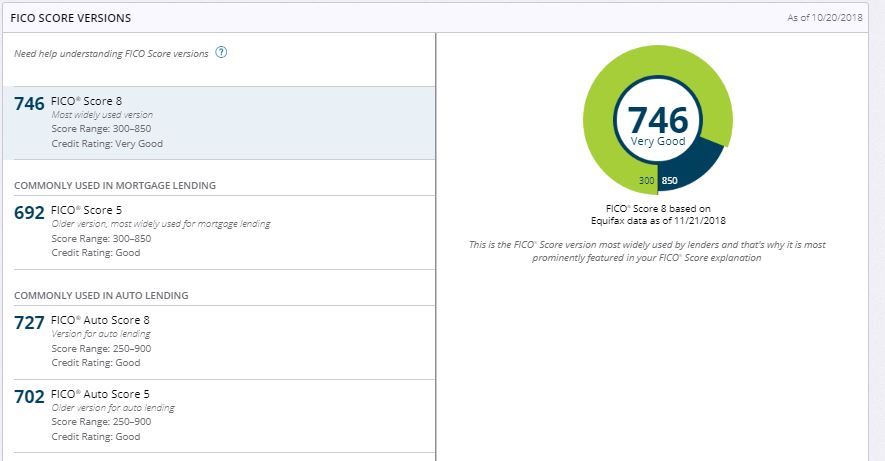

EQ FICO Scores as of Oct 20, 2018

FICO Score 8 - 740

FICO Score 5 - 692 COMMONLY USED IN MORTGAGE LENDING

FICO Auto Score 8 - 727

FICO Auto Score 5 - 702

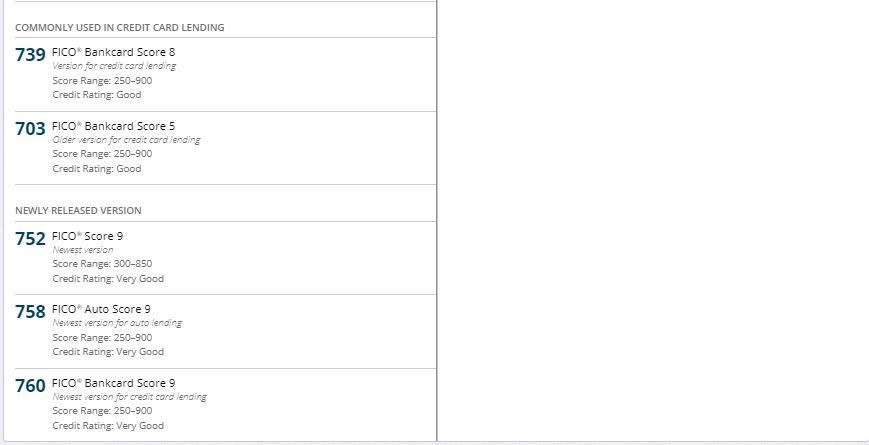

FICO Bankcard Score 8 - 739

FICO Bankcard Score 5 - 703

FICO Score 9 - 752

FICO Auto Score 9 - 758

FICO Bankcard Score 9 - 760

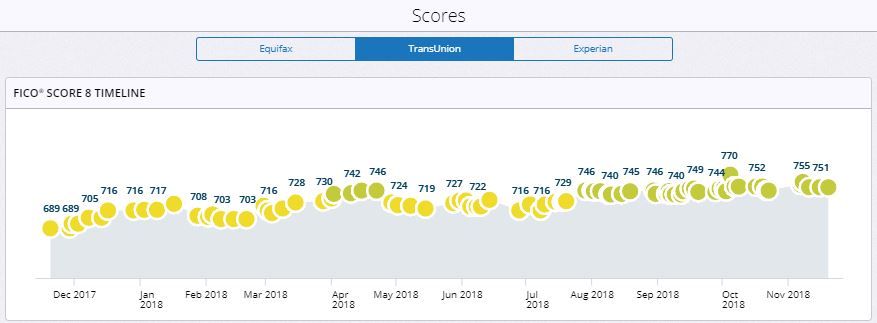

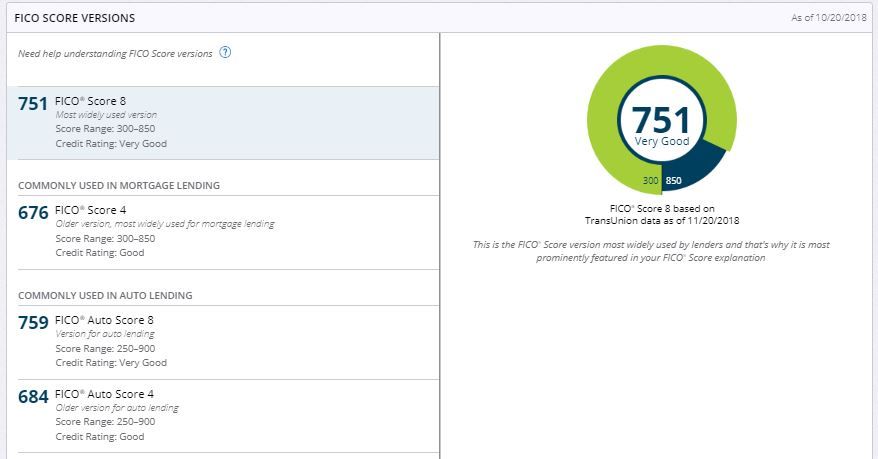

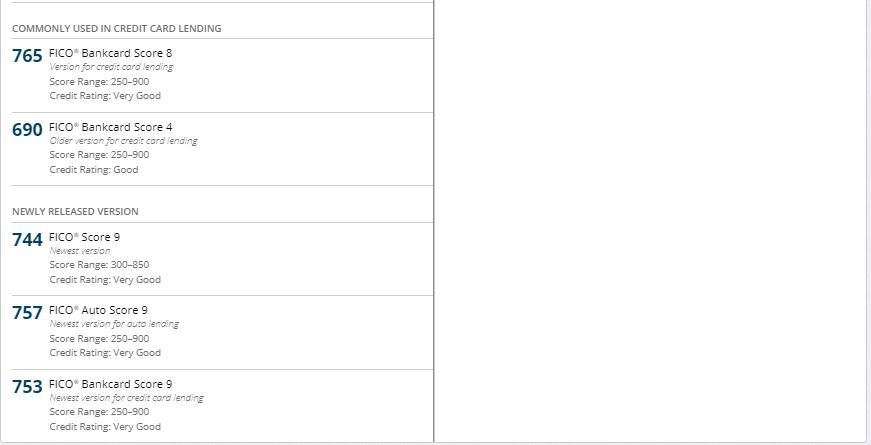

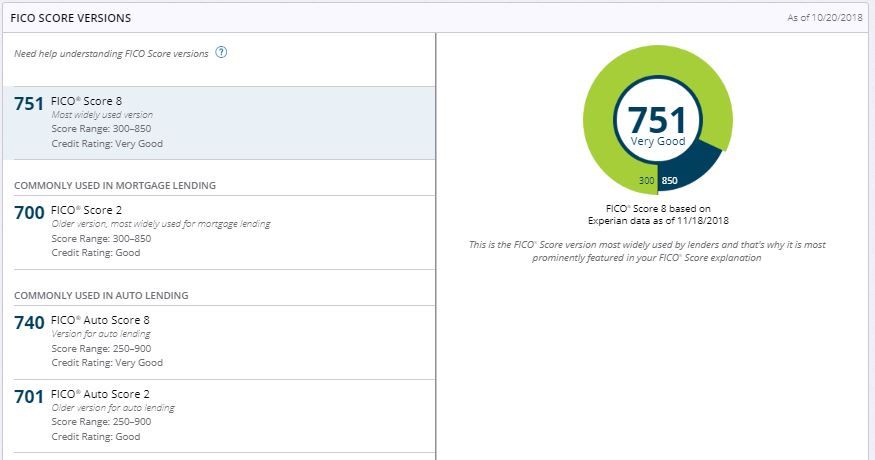

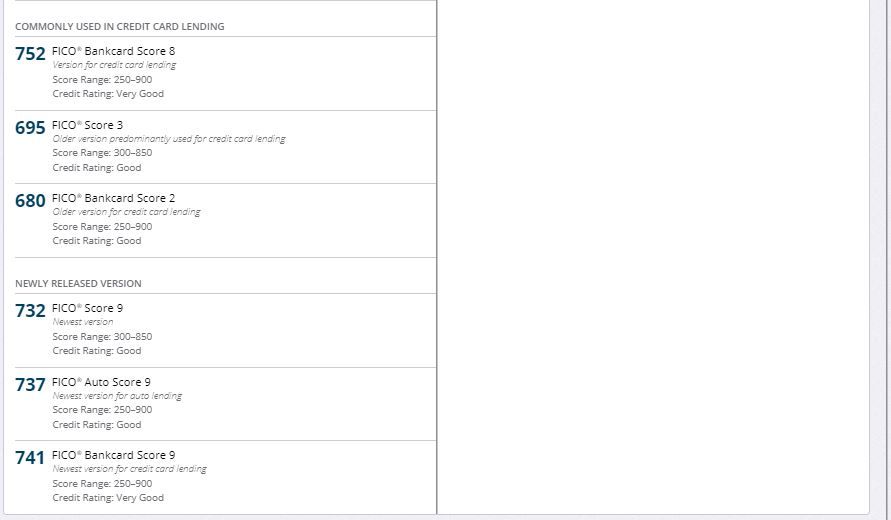

Current TU FICO Score 8 - 751 as of Nov 18, 2018

TU FICO Scores as of Oct 20, 2018

FICO Score 8 - 752

FICO Score 4 - 676 COMMONLY USED IN MORTGAGE LENDING

FICO Auto Score 8 - 759

FICO Auto Score 4 - 684

FICO Bankcard Score 8 - 765

FICO Bankcard Score 4 - 690

FICO Score 9 - 744

FICO Auto Score 9 - 757

FICO Bankcard Score 9 - 753

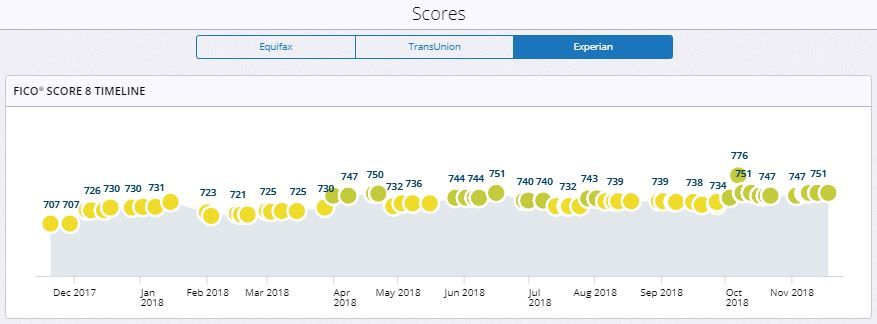

Current EX FICO Score 8 - 751 as of Nov 18, 2018

TU FICO Scores as of Oct 20, 2018

FICO Score 8 - 747

FICO Score 2 - 700 COMMONLY USED IN MORTGAGE LENDING

FICO Auto Score 8 - 740

FICO Auto Score 2 - 701

FICO Bankcard Score 8 - 752

FICO Bankcard Score 3 - 695

FICO Bankcard Score 2 - 680

FICO Score 9 - 732

FICO Auto Score 9 - 737

FICO Bankcard Score 9 - 741

Something odd that I noticed looking at my full FICO report is my reported risk rate or the chances of me getting into serious credit trouble such as a 90-day late, charge-off or bankruptcy. Using FICO 8 scores EQ 746 and EX 751 have me at a 5% risk rate but TU 751 has me at a 2% risk rate.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anyone share ALL of their FICO scores?

Hi BBS;

I guess I am wondering why you think you are saving money by not getting the MyFICO score set? You spend a lot of time researching and discussing score factors, yet without the entire set of scores for your own file, it seems to me you have a big gap in your available information to understand all the various FICO scores. With this request, you want to get other's score sets to try to draw conclusions.

My suggestion is to subscribe for a month or two to get the score set, and dig through the details there. You will get a much better perspective, and be able to draw conclusions because you know more details about your own situation.

Cheers

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anyone share ALL of their FICO scores?

Scores below were pulled on November 12th. Due to inquiries becoming unscorable, TU8 and EX8 are now three points higher than they were at that time, and EQ has likely risen too. But for the sake of comparing apples to apples, I'm not adjusting those in the list below.

I have a glitch in that I have a duplicate account reporting that should be removed. No luck on that so far. But for the purposes of this thread, that shouldn't matter.

I'm going to be eligible to pull another 3B soon. That should cover the unscorable inquiries. But it might not be a clean comparison. I may have one card instead of two reporting a positive balance. Or I might have an unusually large balance on that card. It's a low-limit card, currently with a negative balance to free up a little extra room for a furniture purchase. So what happens depends on whether or not I buy the furniture by the time the statement closes on Monday.

Classic:

- EQ 8: 805

- TU 8: 808

- EX 8: 801

- EQ 5: 802 (mortgage)

- TU 4: 796 (mortgage)

- EX 2: 809 (mortgage)

- EQ 9: 832

- TU 9: 816

- EX 9: 812

Auto:

- EQ 8: 774

- TU 8: 813

- EX 8: 782

- EQ 5: 821

- TU 4: 783

- EX 2: 793

- EQ 9: 844

- TU 9: 820

- EX 9: 822

Bankcard:

- EQ 8: 815

- TU 8: 819

- EX 8: 812

- EQ 5: 809

- TU 4: 829

- EX 2: 828

- EX 3: 808

- EQ 9: 843

- TU 9: 825

- EX 9: 820

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anyone share ALL of their FICO scores?

Posted previously in another thread. 3 of 5 cards reported balances (4 of 6 if AU card included). Link provided below.

Here is an overall summary - multiple 3B reports:

| Fico Model Name | Mar-15 | Jul-15 | Dec-15 | Feb-16 | Mar-16 | Jul-16 | Aug-16 | Oct-16 | Mar-17 | Apr-18 |

| EQ Classic Fico 09 | *** | *** | *** | 850 | 850 | 850 | 850 | 850 | 850 | 850 |

| EQ Classic Fico 08 | 850 | 850 | 850 | 850 | 850 | 850 | 850 | 850 | 850 | 850 |

| EQ Classic Fico 04 | 796 | 809 | 809 | 764 | 809 | 787 | 809 | 804 | 804 | 777 |

| EQ Auto Fico 09 | *** | *** | *** | 867 | 885 | 878 | 866 | 878 | 885 | 870 |

| EQ Auto Fico 08 | 877 | 884 | 884 | 874 | 882 | 884 | 874 | 884 | 887 | 881 |

| EQ Auto Fico 04 | 816 | 827 | 827 | 788 | 827 | 808 | 827 | 831 | 831 | 807 |

| EQ Bankcard Fico 09 | *** | *** | *** | 867 | 877 | 873 | 858 | 873 | 876 | 868 |

| EQ Bankcard Fico 08 | 877 | 886 | 886 | 874 | 882 | 881 | 876 | 881 | 887 | 881 |

| EQ Bankcard Fico 04 | 816 | 825 | 826 | 770 | 826 | 801 | 825 | 822 | 822 | 786 |

| EQ Average Fico | 839 | 847 | 847 | 834 | 854 | 846 | 848 | 853 | 855 | 841 |

| Fico Model Name | Mar-15 | Jul-15 | Dec-15 | Feb-16 | Mar-16 | Jul-16 | Aug-16 | Oct-16 | Mar-17 | Apr-18 |

| TU Classic Fico 09 | *** | *** | *** | 850 | 850 | 850 | 850 | 850 | 850 | 850 |

| TU Classic Fico 08 | 850 | 850 | 850 | 850 | 850 | 850 | 850 | 845 | 850 | 850 |

| TU Classic Fico 04 | 823 | 823 | 815 | 812 | 823 | 815 | 815 | 823 | 823 | 801 |

| TU Auto Fico 09 | *** | *** | *** | 871 | 879 | 875 | 860 | 866 | 880 | 870 |

| TU Auto Fico 08 | 891 | 897 | 897 | 879 | 891 | 885 | 877 | 872 | 891 | 882 |

| TU Auto Fico 04 | 872 | 872 | 864 | 860 | 872 | 864 | 864 | 872 | 872 | 837 |

| TU Bankcard Fico 09 | *** | *** | *** | 869 | 879 | 874 | 863 | 865 | 879 | 873 |

| TU Bankcard Fico 08 | 899 | 900 | 900 | 880 | 899 | 881 | 886 | 873 | 899 | 891 |

| TU Bankcard Fico 04 | 858 | 858 | 850 | 837 | 858 | 850 | 850 | 858 | 858 | 812 |

| TU Average Fico | 866 | 867 | 863 | 856 | 867 | 860 | 857 | 858 | 867 | 852 |

| Fico Model Name | Mar-15 | Jul-15 | Dec-15 | Feb-16 | Mar-16 | Jul-16 | Aug-16 | Oct-16 | Mar-17 | Apr-18 |

| EX Classic Fico 09 | *** | *** | *** | 850 | 850 | 850 | 850 | 850 | 850 | 850 |

| EX Classic Fico 08 | 850 | 850 | 850 | 850 | 850 | 850 | 850 | 850 | 850 | 850 |

| EX Classic Fico 04 | 830 | 830 | 830 | 811 | 830 | 830 | 830 | 830 | 830 | 809 |

| EX Classic Fico 98 | 839 | 837 | 837 | 832 | 837 | 815 | 817 | 837 | 839 | 842 |

| EX Auto Fico 09 | *** | *** | *** | 881 | 886 | 887 | 863 | 882 | 887 | 886 |

| EX Auto Fico 08 | 889 | 889 | 884 | 883 | 884 | 894 | 869 | 891 | 897 | 895 |

| EX Auto Fico 98 | 858 | 857 | 857 | 852 | 857 | 837 | 838 | 857 | 858 | 861 |

| EX Bankcard Fico 09 | *** | *** | *** | 873 | 878 | 879 | 862 | 874 | 879 | 878 |

| EX Bankcard Fico 08 | 898 | 898 | 900 | 895 | 898 | 900 | 892 | 897 | 900 | 900 |

| EX Bankcard Fico 98 | 870 | 868 | 865 | 853 | 862 | 836 | 842 | 859 | 864 | 867 |

| EX Average Fico | 862 | 861 | 860 | 858 | 863 | 858 | 851 | 863 | 865 | 864 |

Feb-16 - All 6 cards reporting balances. INQ (EQ=1, TU=0, EX=0)

Jul-16 - AMEX charge B/HB = 100%. INQ (EQ=0, TU=0, EX=0)

Aug 16 - AMEX B/HB = 100%. No revolvers reporting balances (AU card not counted in Fico 8, Fico 9). INQ (EQ=0, TU=0, EX=0)

Apr-18 - 5 of 6 cards reporting balances. AU card utilization at 16.4% (hurting Fico 04 model scores). INQ (EQ=1, TU=1, EX=0)

There is some insight that can be gained for various model behaviors relative to one another when comparing 3B reports. Below is one such comparison looking at reports side by side. Conclusions from this comparison (supported by other comparisons in the past) were:

1) Increasing # cards reporting has no negative impact on Experian Fico scores for any model (Classic 8, Classic 98, Bankcard 8 & Bankcard 98)

2) Increasing # cards reporting has a mild impact on EQ and TU Bankcard Fico 8 (likely EQ and TU Classic Fico 8 as well but masked by buffer).

3) Increasing # cards reporting has a substantial impact on both EQ and TU Classic Fico 04 and Bankcard Fico 04 scores.

4) For my profile Classic and Bankcard scores change in lock step (considering buffer).

5) The presence of an inquiry significantly increases sensitivity of TU Fico 04 to # cards reporting. In the years prior to the TU inquiry my TU Fico scores showed little movement when 5 cards reported balances.

...

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anyone share ALL of their FICO scores?

@NRB525 wrote:Hi BBS;

I guess I am wondering why you think you are saving money by not getting the MyFICO score set?

I think you've misinterpreted the purpose of my post. This has nothing to do with trying to "save money" - I thought I was pretty clear in my original post that I'm looking to grab all of the scores myself for the first time. As I said originally, my profile has finally plateaued; I'm not expecting any changes to my report for the next year or two outside of the obvious age factors, which is why I haven't grabbed all of my scores in the past. I'm looking for others to post all of their scores, as it allows everyone (not just me) to draw conclusions about how the different models may handle different profile data with respect to scoring.

Big thanks to Medic, HO & TT thus far for contributing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anyone share ALL of their FICO scores?

If you need further data points from me, just let me know.

Your FICO credit scores are not just numbers, it’s a skill.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anyone share ALL of their FICO scores?

One thing I've noticed is that mortgage scores generally speaking seem to run a bit (and sometimes a good bit) lower than Classic 8 scores, although I have not looked at all that many direct comparisons. The data provided by Medic and TT above seems to go along with this. HO however, I'm very surprised to see that your mortgage scores are right in line with your Classic 8's, with your EQ mortgage score actually being higher than your EQ Classic 8. In your opinion, is there something in your profile that you attribute this somewhat abnormality to?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anyone share ALL of their FICO scores?

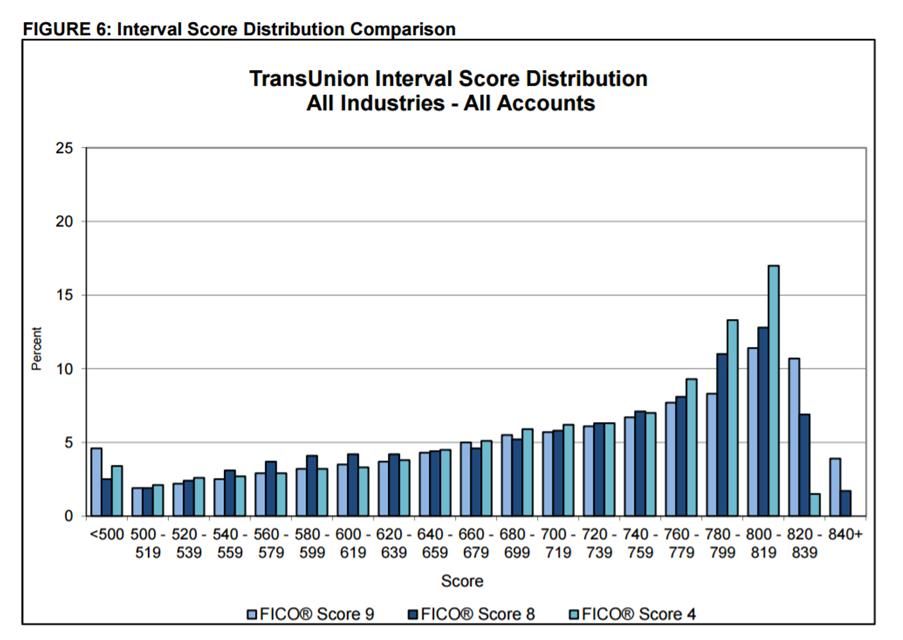

In general, the skew comes toward higher Fico 8 scores occurs at the top end of the score range do to mortgage scores being limited to 818/839/844 for EQ/TU/EX, respectively.

Percentile tables show no significant difference between Classic Fico 8 and Classic Fico "mortgage" in the mid score range (say 620 to 760).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can anyone share ALL of their FICO scores?

BBS...... I wasn't sure if you are aware but don't get the one time reports($60) or the monthly($40) either. Sign up for the quarterly($30) then cancel. Resign up each month for the quarterly. Obviously you'll save at least $30 from not getting the one time reports, and save $10 each month by signing up for the quarterly/cancel method and still have all of your scores updated each month.