- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Can no longer micromanage balances

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Can no longer micromanage balances

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can no longer micromanage balances

Due to the erratic reporting behavior of my personal lines of credit with NFCU and PenFed, I can no longer micromanage

my balances.

Either I'm going to have to lay low on using those lines of credit, or I'm just going to have to let my utilization have its own way, or -- as Tom_Thumb might put it -- let it go "natural" ![]()

But gone are the days of ensuring that accounts I'm using report at zero, since I never know what day of the month will be the day chosen by either of those institutions as the day to report.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can no longer micromanage balances

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can no longer micromanage balances

Hey SJ! The good news in your case (as I am sure you know) is that you have such a ginormous number of credit cards that there surely will be no scoring difference whether 4 cards report a positive balance or 1 card reports a positive balance. You'll still have the overwhelming number of your accounts reporting $0 (over 80% of them).

Incidentally, if you still want to keep all accounts but one reporting $0, couldn't you just use the billpay feature of a checking account to push a little bit more than you need to into them four days before the earliest possible statement date? Even if the balance is a small negative number, it will still report $0 -- right?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can no longer micromanage balances

@SouthJamaica wrote:Due to the erratic reporting behavior of my personal lines of credit with NFCU and PenFed, I can no longer micromanage

my balances.

Either I'm going to have to lay low on using those lines of credit, or I'm just going to have to let my utilization have its own way, or -- as Tom_Thumb might put it -- let it go "natural"

But gone are the days of ensuring that accounts I'm using report at zero, since I never know what day of the month will be the day chosen by either of those institutions as the day to report.

Welcome aboard and no worries! You have a nice aggregate CL buffer. As long as you stay under 50% reporting any Fico 8 score change directly related to # cards/accounts with balances should be a yawn.

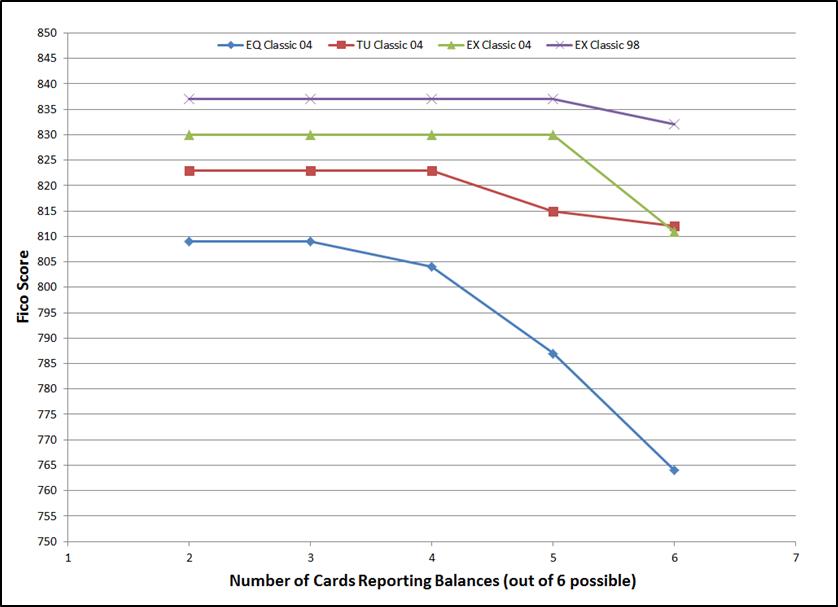

Three times a year I let 100% of my 6 cards come out to play and post all charges on statements. It's that time again. Fico 8 and Fico 9 are not phased by such behavior. However, Fico 04, specifically the EQ's tweaked version drop rather dramatically - 45 points (vs score with 2 or 3 reporting). This happens even though AG UT is held belo 3%.

No desire to see the temporary Fico 04 and Fico 98 beat down this time around so no 3B report.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can no longer micromanage balances

@Anonymous wrote:Hey SJ! The good news in your case (as I am sure you know) is that you have such a ginormous number of credit cards that there surely will be no scoring difference whether 4 cards report a positive balance or 1 card reports a positive balance. You'll still have the overwhelming number of your accounts reporting $0 (over 80% of them).

Incidentally, if you still want to keep all accounts but one reporting $0, couldn't you just use the billpay feature of a checking account to push a little bit more than you need to into them four days before the earliest possible statement date? Even if the balance is a small negative number, it will still report $0 -- right?

It doesn't matter about the statement date, because they are not reporting the statement balances.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can no longer micromanage balances

@Thomas_Thumb wrote:

@SouthJamaica wrote:Due to the erratic reporting behavior of my personal lines of credit with NFCU and PenFed, I can no longer micromanage

my balances.

Either I'm going to have to lay low on using those lines of credit, or I'm just going to have to let my utilization have its own way, or -- as Tom_Thumb might put it -- let it go "natural"

But gone are the days of ensuring that accounts I'm using report at zero, since I never know what day of the month will be the day chosen by either of those institutions as the day to report.

Welcome aboard and no worries! You have a nice aggregate CL buffer. As long as you stay under 50% reporting any Fico 8 score change directly related to # cards/accounts with balances should be a yawn.

Three times a year I let 100% of my 6 cards come out to play and post all charges on statements. It's that time again. Fico 8 and Fico 9 are not phased by such behavior. However, Fico 04, specifically the EQ's tweaked version drop rather dramatically - 45 points (vs score with 2 or 3 reporting). This happens even though AG UT is held belo 3%.

No desire to see the temporary Fico 04 and Fico 98 beat down this time around so no 3B report.

Actually it's the mortgage scores that concern me, because those are usually my weakest link.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can no longer micromanage balances

Ah. I see, well I am sure it won't matter to your score, given your huge number of credit cards. How often do you use those LOCs anyway? I imagine that for any particular purchase, there's some credit card that is better suited then those accounts. E.g. some 2% or 3% or 5% cash back card. Am I mistaken?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can no longer micromanage balances

@SouthJamaica wrote:

@Thomas_Thumb wrote:

@SouthJamaica wrote:Due to the erratic reporting behavior of my personal lines of credit with NFCU and PenFed, I can no longer micromanage

my balances.

Either I'm going to have to lay low on using those lines of credit, or I'm just going to have to let my utilization have its own way, or -- as Tom_Thumb might put it -- let it go "natural"

But gone are the days of ensuring that accounts I'm using report at zero, since I never know what day of the month will be the day chosen by either of those institutions as the day to report.

Welcome aboard and no worries! You have a nice aggregate CL buffer. As long as you stay under 50% reporting any Fico 8 score change directly related to # cards/accounts with balances should be a yawn.

Three times a year I let 100% of my 6 cards come out to play and post all charges on statements. It's that time again. Fico 8 and Fico 9 are not phased by such behavior. However, Fico 04, specifically the EQ's tweaked version drop rather dramatically - 45 points (vs score with 2 or 3 reporting). This happens even though AG UT is held belo 3%.

No desire to see the temporary Fico 04 and Fico 98 beat down this time around so no 3B report.

Actually it's the mortgage scores that concern me, because those are usually my weakest link.

Well, I don't see a drop on Fico mortgage scores until I let more than 3 of my cards report balances. At 4 of 6 (67%) I experienced a 5 point drop on EQ and no drop on TU or EX. I experience a significant Fico mortgage impact at 5 of 6 (83%) for EQ and 6 of 6 (100%) for TU/EX. (see paste below for details)

SJ - Just limit use on your cards each month to under 30% of total # and you should be good to go. Really you shouldn't experience a significant point drop (say more than 10) on your mortgage scores until you allow more than 50% to report a balance.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can no longer micromanage balances

@Anonymous wrote:Ah. I see, well I am sure it won't matter to your score, given your huge number of credit cards.

I'm not so sure about that, but I don't t think it will make a huge difference.

How often do you use those LOCs anyway?

Everything I have I use every month.

I imagine that for any particular purchase, there's some credit card that is better suited then those accounts.

Not really. Some of my payments penalize me for using a credit card. Other payments are simply more conveniently made by check than by credit card.

E.g. some 2% or 3% or 5% cash back card. Am I mistaken?

This will probably surprise you. I don't actually decide on which credit cards to use that way. It would be logical but something in my brain resists being directed by a bank as to how to pay for stuff. So I just rotate my cards. Yes I prefer getting 3% cash back to getting nothing back, but I don't care enough about it to let that alter my way of doing things. E.g., I use my Ring card, which is my favorite credit card, to make some purchases every month, which makes no sense at all, but I like to appease the Ring gods. I know I'm leaving money on the table, but I prefer that to leaving some of my precious brain cells on the table.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Can no longer micromanage balances

@Thomas_Thumb wrote:

@SouthJamaica wrote:

@Thomas_Thumb wrote:

@SouthJamaica wrote:Due to the erratic reporting behavior of my personal lines of credit with NFCU and PenFed, I can no longer micromanage

my balances.

Either I'm going to have to lay low on using those lines of credit, or I'm just going to have to let my utilization have its own way, or -- as Tom_Thumb might put it -- let it go "natural"

But gone are the days of ensuring that accounts I'm using report at zero, since I never know what day of the month will be the day chosen by either of those institutions as the day to report.

Welcome aboard and no worries! You have a nice aggregate CL buffer. As long as you stay under 50% reporting any Fico 8 score change directly related to # cards/accounts with balances should be a yawn.

Three times a year I let 100% of my 6 cards come out to play and post all charges on statements. It's that time again. Fico 8 and Fico 9 are not phased by such behavior. However, Fico 04, specifically the EQ's tweaked version drop rather dramatically - 45 points (vs score with 2 or 3 reporting). This happens even though AG UT is held belo 3%.

No desire to see the temporary Fico 04 and Fico 98 beat down this time around so no 3B report.

Actually it's the mortgage scores that concern me, because those are usually my weakest link.

Well, I don't see a drop on Fico mortgage scores until I let more than 3 of my cards report balances. At 4 of 6 (67%) I experienced a 5 point drop on EQ and no drop on TU or EX. I experience a significant Fico mortgage impact at 5 of 6 (83%) for EQ and 6 of 6 (100%) for TU/EX. (see paste below for details)

SJ - Just limit use on your cards each month to under 30% of total # and you should be good to go. Really you shouldn't experience a significant point drop (say more than 10) on your mortgage scores until you allow more than 50% to report a balance.

I'm comforted by that, thank you ![]() I should be able to manage staying within those guidelines

I should be able to manage staying within those guidelines ![]()

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687