- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Clean/Thin/Young..ish/New Account DPs

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Clean/Thin/Young..ish/New Account DPs

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Clean/Thin/Young..ish/New Account DPs

Starting this thread to gain insight and provide DPs for how a Clean/Thin/Young ish/New Account profile may respond.....

***Equifax Fico 9 per NFCU is 765

AAoA - 6 yrs 10 mos

AoOA - 27 years (closed acct)

AoYA - 1 month

0 inquiries

1. Old Mervyns 200 limit CC opened 27 years ago/now closed

2. Discover IT secured 200 limit opened March 2020

3. NFCU nRewards secured 200 limit opened April 2020

4. BB&T Spectrum Cash Rewards 11k sl opened June 2020

***Trans Union Fico is no score - not enough history to generate

AAoA - 2 months

AoOA - 3 months

AoYA - 1 month

One inquiry- NFCU

1. Discover IT secured 200 limit opened March 2020

2. NFCU nRewards secured 200 limit opened April 2020

3. BB&T Spectrum Cash Rewards 11k sl opened June 2020

***Experian Fico is no score - not enough history to generate

AAoA - 2 months

AoOA - 3 months

AoYA - 1 month

Three Inquiries - Discover and 2 for BofA declines Cash Reward and Secured

1. Discover IT secured 200 limit opened March 2020

2. NFCU nRewards secured 200 limit opened April 2020

3. BB&T Spectrum Cash Rewards 11k sl opened June 2020

Currently PIF / AZ. Thinking my EX and TU will generate a score by September, possibly August? Once I see what they start out at, my current plan for curiosity sake is to then see how each change will affect scores. i.e. AZ, then AZEO, then add installment tl (NFCU ssl). I’m not sure how much time between each step I should wait before the next move...possibly 2 ish months? Thoughts? I am currently gardening and hoped to do so until at least November or December, but I have to admit I will have a hard time not checking for a pre-qual and apping for NFCU MR at the end of August before 30k sub expires. How often do they put sub on MR, every few months?

@Anonymous

ETA: I most likely will wait to app for MR until Nov or Dec...truly believe it is in my best interest with this current economic climate not to appear as credit seeking, ruffle the feathers of my current cc FIs and/or risk aa. Even though I’ve seen where some are approved for 2nd card with NFCU before nRewards graduates, I think waiting for mine to graduate and giving NFCU more time to get to know me will greatly enhance my chances for not only an approval, but also a potentially nice sl.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean/Thin/Young..ish/New Account DPs

@Subexistence posted some data on scoring with SSL/AZEO, pretty much fully optimized

The scores coming out of the 6 month gates should be listed around there, but I'd estimate mid-high 700

I think the major hits at that point are inquiries and new account penalty

Any AAOA under 1 year is scored the same, or so I've read around

My oldest is 10mo and avg is 5mo and I'm sitting around 73x on EQ and 740+ on TU/EX. 8 revolvers and 2 installments open, 1 closed. I have AZEO and SSL score boosts, but again I have lost a ton of points from inqs and new account/short credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean/Thin/Young..ish/New Account DPs

Thank you @Anonymous ...appreciate the info/feedback! 🙂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean/Thin/Young..ish/New Account DPs

Well you’ve got the scorecards right except for Equifax is aged because of the old account of course.

You will get a score in September. It would not hurt to go ahead and do the SSL. To be honest, I don’t think I would be that scared of adding another card considering two of those are secured, so what do they have to get nervous about? And BBT hasn’t shown any signs of being shaky. But YMMV.

Actually very good selections, I might add. I was actually recommending beginning cards to someone the other day, and I recommended Discover, AOD, and BBT. And I recommended they join Navy in preparations for the next card. I recommend you join AOD.

OK so you should maybe expect score jumps at AoYA at 3, 6, 9, and 12 months AOYRA at TransUnion. You’ll see them at 3s and at 12 months of course due to AoYRA.

Be on the lookout for gains in AAOA at 6 month intervals.

AoORA=AoOA for you, so you may see gains typically misattributed to AoOA, like at 2.5 years AoORA on version 8. We do not know where the AoOA segmentation threshold is for version 9, we believe version 8 is at 3 years old, so it could be the same or different. EX2 is believed to be at 2 years. 2004 versions we don’t know. Update: mortgage scores appear to segment at two years.

AAoRA is still an enigma and we need to learn those thresholds as well, and if they award points.

So not only can you hopefully keep an eye out for version 9 dps, but also for those that are unknown on 8. And even on the 2004 versions, if you have access. You will definitely need a spreadsheet to keep track of the aging at each bureau. I would recommend keeping track of the following aging metrics individually for each bureau: AoOA, AAoA, AoORA (for you, same as AoOA), AAoRA, and AoYRA. And once you get an installment, AoOIA, AoOOIA, AAoIA.

You will also find a lot of information on what to expect in thin/young profiles in posts by @Anonymous. Also there are links in post 7 of the Primer to similar topics. Look forward to your DP’s.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean/Thin/Young..ish/New Account DPs

Thank you @Anonymous !

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean/Thin/Young..ish/New Account DPs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean/Thin/Young..ish/New Account DPs

@Anonymous

Update:

EX - no score, should generate next month

TU - no score, should generate next month

EQ 9 - 809 up 44 points from 765 last month ( per NFCU )

I have been doing pif with all reporting AZ, but misunderstood the date my first statement w/BB&T would cut. I thought it would cut on the 10th....made a small charge on the 11th and statement actually cut the 12th making me AZEO <1% util.

I suspected I would see an increase due to the AZEO, but was not expecting 44 points as I understood it is typically a 15-20 point gain. Nothing else has changed, no inquiries, no new trade lines.

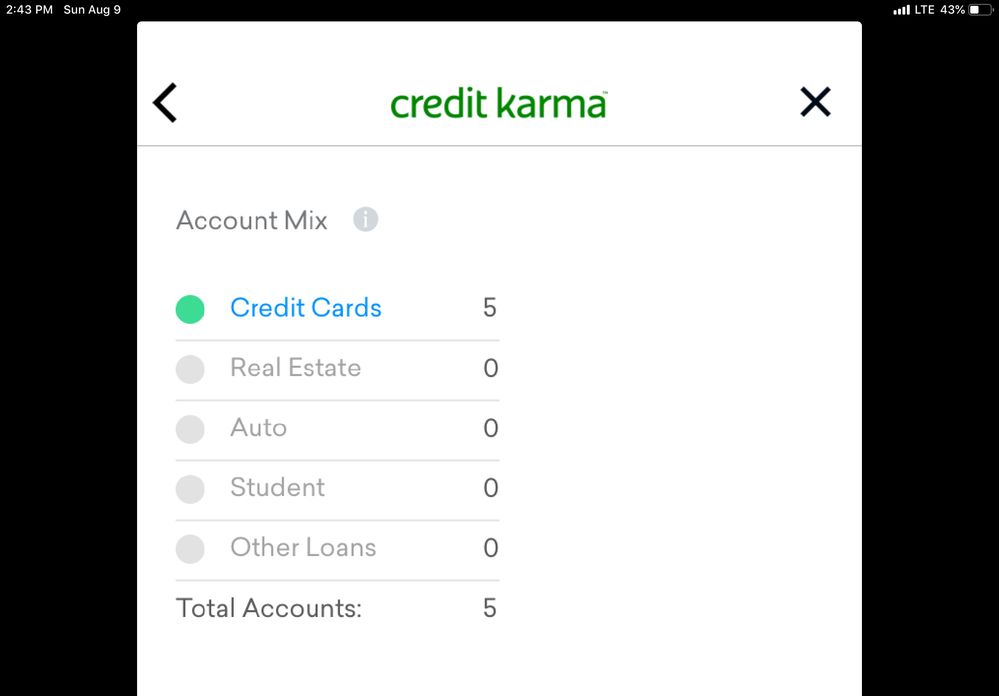

ETA: I just realized, I actually did have a change between between NFCU’s EQ monthly score updates between July and August....it’s been nagging at me, why 44 points? I neglected to remember the first card BB&T sent was mailed to the wrong address and I never received the card. They closed that account, reissued a new card and sent to the correct address, so my bureaus now show 2 BB&T accounts - one open, one closed. My previous EQ 9 of 765, I received via NFCU on July 3rd and at that time still only showed one BB&T account....newest update for today now lists both accounts, again...one open, one closed. I’m guessing as now my EQ lists 3 open CCs and 2 closed for a total of 5....this puts my EQ as a thick file? My apologies I didn’t remember about the closed account when I stated above I had no other changes in my above comments. 🤓

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean/Thin/Young..ish/New Account DPs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Clean/Thin/Young..ish/New Account DPs

@Anonymous

No, nothing else on report. 3 open cards, 2 closed cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content