- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Credit karma just cracks me up

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit karma just cracks me up

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

Vantage always has me scratching my head. It has finally gotten closer to my FICO scores but has me well below my mom's Vantage scores (even though my FICO scores are higher than hers). I am sure it has to do with having a charge-off with a balance on my profile, but still, there being a 50+ point difference between us, when my FICO scores are around 10-20 points higher than hers, is weird.

1/18 -

7/19 -

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

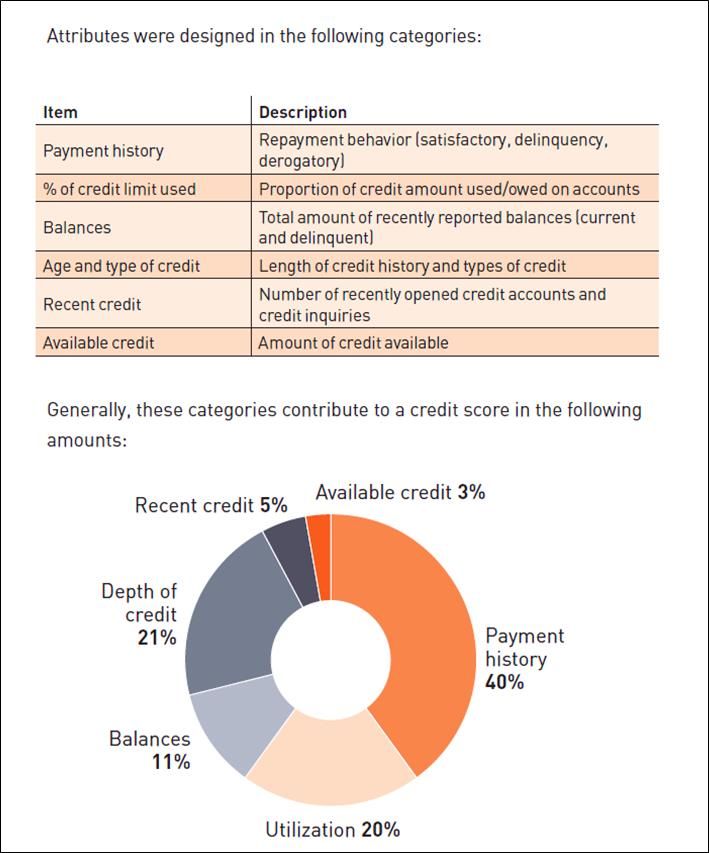

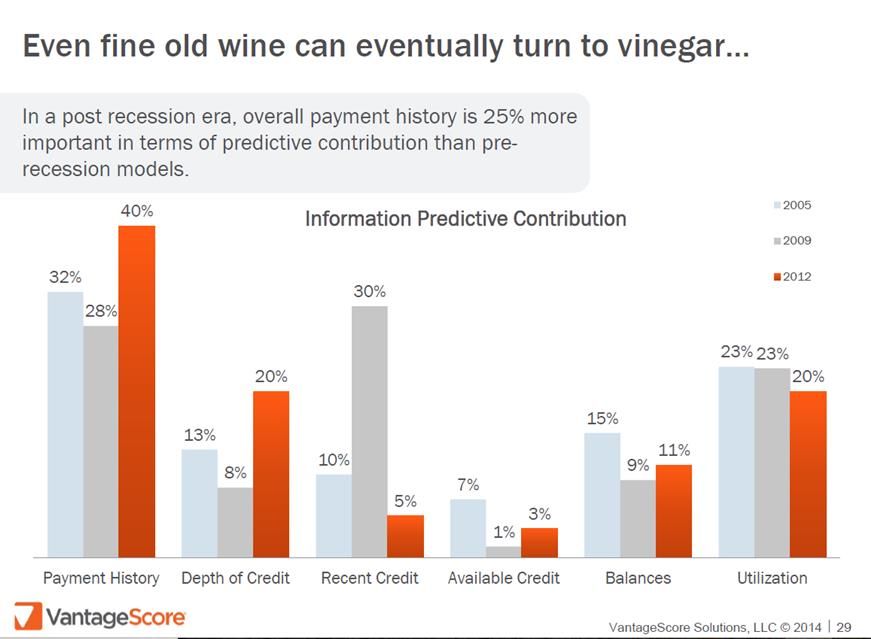

FWIW - Scoring category evolution and VantageScore 3.0 categories compared to Fico 8

[Orange bars are most recent weighting allocations for VS 3.0]

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

At three different times during the last 4 years, I've also noticed that the vantage 3.0 scores mirror my fico scores for the most part.

Its a convenient estimate nonetheless, I don't give it too much weight. I'll be sure to use/check FICO when apping for a mortgage or business loan though

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

@Anonymous wrote:

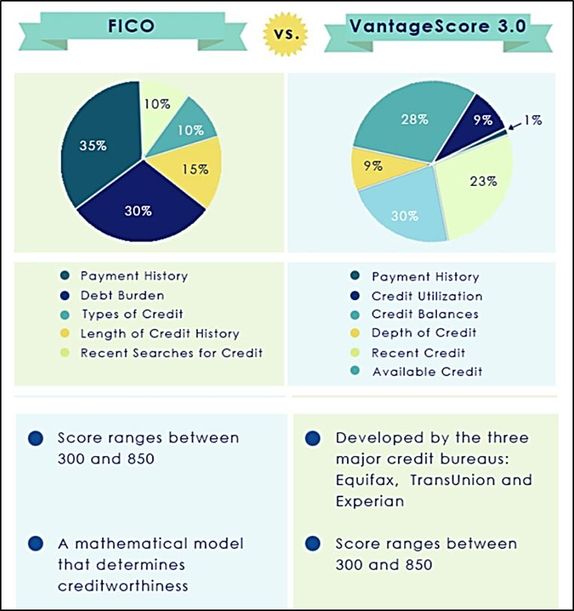

Available credit gets a 1% slice of the vs 3.0 pie. Interesting.

Actually it's 3%. The Fico/VS Info graphic was a bit dated. Added more recent graphics to the above post.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

Nice and good to know. I wonder what sort of thresholds or "sweet spot" there is in order to get max points for that small sliver of the pie.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

@Thomas_Thumb wrote:

@Anonymous wrote:

Available credit gets a 1% slice of the vs 3.0 pie. Interesting.Actually it's 3%. The Fico/VS Info graphic was a bit dated. Added more recent graphics to the above post.

What is "Depth of Credit"? Age and type of credit?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

@DaveInAZ wrote:

@Thomas_Thumb wrote:

@Anonymous wrote:

Available credit gets a 1% slice of the vs 3.0 pie. Interesting.Actually it's 3%. The Fico/VS Info graphic was a bit dated. Added more recent graphics to the above post.

What is "Depth of Credit"? Age and type of credit?

Depth of credit = age and type of credit = (length of credit history + types of credit).

Note: In addition to percent of credit limit used (utilization) VantageScore also looks at Balances (dollar amount). I have experienced a VS 3.0 score drop (7 points) that may have related to balances, not utilization. At the time my balance reported was slightly over $7800.

Could aggregate balance on CCs be a tiered factor with VS 3.0?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

Below is a list of VantageScore 3.0 Reason codes and statements (negative only although there is a positive list as well). Click on a code to go to a web page with a more detailed description of the attribute.

VantageScore 3.0 codes v3

04: The balances on your accounts are too high compared to loan amounts

05: Too many of the delinquencies on your accounts are recent

06: You have too many accounts that were opened recently

07: You have too many delinquent or derogatory accounts

08: You have either very few loans or too many loans with recent delinquencies

09: The worst payment status on your accounts is delinquent or derogatory

10: You have either very few loans or too many loans with delinquencies

11: The total of your delinquent or derogatory account balances is too high

12: The date that you opened your oldest account is too recent

13: Your most recently opened account is too new

14: Lack of sufficient credit history

15: Newest delinquent or derogatory payment status on your accounts is too recent

16: The total of all balances on your open accounts is too high

17: Balances on previously delinquent accounts are too high compared to loan amts

18: Total of balances on accounts never late is too high compared to loan amounts

21: No open accounts in your credit file

22: No recently reported account information

23: Lack of sufficient relevant account information

29: Too many of your open bankcard or revolving accounts have a balance

30: Too few of your bankcard or other revolving accounts have high limits

31: Too many bankcard or other revolving accounts were opened recently

32: Balances on bankcard or revolving accounts too high compared to credit limits

33: Your worst bankcard or revolving account status is delinquent or derogatory

34: Total of all balances on bankcard or revolving accounts is too high

35: Your highest bankcard or revolving account balance is too high

36: Your largest credit limit on open bankcard or revolving accounts is too low

39: Available credit on your open bankcard or revolving accounts is too low

40: The date you opened your oldest bankcard or revolving account is too recent

42: The date you opened your newest bankcard or revolving account is too recent

43: Lack of sufficient credit history on bankcard or revolving accounts

44: Too many bankcard or revolving accounts with delinquent or derogatory status

45: Total balances too high on delinquent/derogatory bankcard or revolving accts

47: No open bankcard or revolving accounts in your credit file

48: No bankcard or revolving recently reported account information

49: Lack of sufficient relevant bankcard or revolving account information

53: The worst status on your real estate accounts is delinquent or derogatory

54: The amount of balance paid down on your open real estate accounts is too low

55: Open real estate account balances are too high compared to their loan amounts

57: Too many real estate accounts with delinquent or derogatory payment status

58: The total of all balances on your open real estate accounts is too high

61: No open real estate accounts in your credit file

62: No recently reported real estate account information

63: Lack of sufficient relevant real estate account information

64: No open first mortgage accounts in your credit file

65: Lack of sufficient relevant first mortgage account information

66: Your open auto account balances are too high compared to their loan amounts

68: No open auto accounts in your credit file

69: Lack of sufficient relevant auto account information

71: You have either very few installment loans or too many with delinquencies

72: Too many installment accounts with a delinquent or derogatory payment status

73: The worst status on your installment accounts is delinquent or derogatory

74: The balance amount paid down on your open installment accounts is too low

75: The installment account that you opened most recently is too new

76: You have insufficient credit history on installment loans

77: Newest delinquent or derogatory status on installment accounts is too recent

78: Balances on installment accounts are too high compared to their loan amounts

79: Too many of the delinquencies on your installment accounts are recent

81: No open installment accounts in your credit file

83: Lack of sufficient relevant installment account information

84: The number of inquiries was also a factor, but effect was not significant

85: You have too many inquiries on your credit report.

86: Your credit report contains too many derogatory public records

87: Your credit report contains too many unsatisfied public records

88: One or more derogatory public records in your credit file is too recent

90: Too few discharged bankruptcies

93: The worst status on your student loan accounts is delinquent or derogatory

94: The balance amount paid down on your open student loan accounts is too low

95: You have too many collection agency accounts that are unpaid

96: The total you owe on collection agency accounts is high

97: You have too few credit accounts

98: There is a bankruptcy on your credit report

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

@Thomas_Thumb wrote:

@DaveInAZ wrote:

@Thomas_Thumb wrote:

@Anonymous wrote:

Available credit gets a 1% slice of the vs 3.0 pie. Interesting.Actually it's 3%. The Fico/VS Info graphic was a bit dated. Added more recent graphics to the above post.

What is "Depth of Credit"? Age and type of credit?

Depth of credit = age and type of credit = (length of credit history + types of credit).

Note: In addition to percent of credit limit used (utilization) VantageScore also looks at Balances (dollar amount). I have experienced a VS 3.0 score drop (7 points) that may have related to balances, not utilization. At the time my balance reported was slightly over $7800.

Could aggregate balance on CCs could be a tiered factor with VS 3.0?

Could well be. I check my credit scores Sunday mornings. CK Vantage scores remained the same 658/665 TU/EQ, while my EX Fico8 went up 10 points to 712, TU up 2 points to 714, EQ 716. My CC utilization is 17% ($20,000) but I have some hefty individual (0%APR) balances: Cap One Quicksilver $9700 (48% of CL), Cap One Spark $3950 (44%), and Amex ED $3950 (39%).