- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Credit karma just cracks me up

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit karma just cracks me up

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

@Thomas_Thumb wrote:Sarge12,

If you don't mind sharing, what are your latest CBIS Auto and Home scores? Also, did they drop as a result of the new credit/HPs you mentioned in another thread?

I have not done any myfico pulls since April, and that was before the recent pulls. I will probably wait at least a couple of months to do a full pull with all the scores to be sure the new accounts are fully reporting. I am going to start spending the cash for a 3B pull with all scores only about once every 6 months unless there are major changes in the fico 8 scores I recieve for free. I doubt either of the new credit cards is even on any reports yet.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

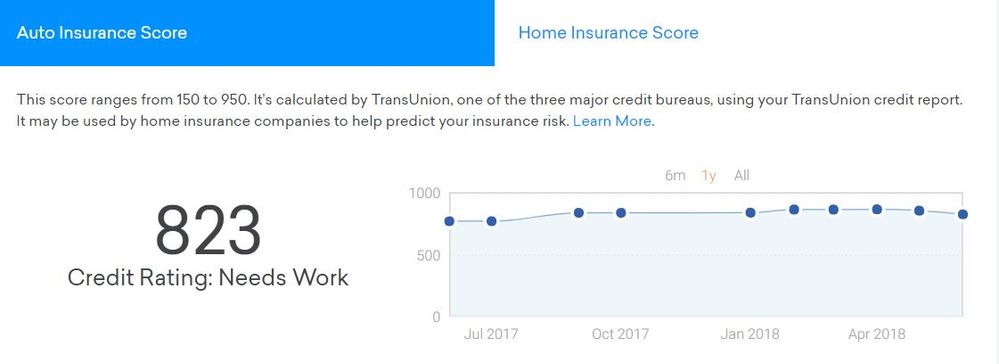

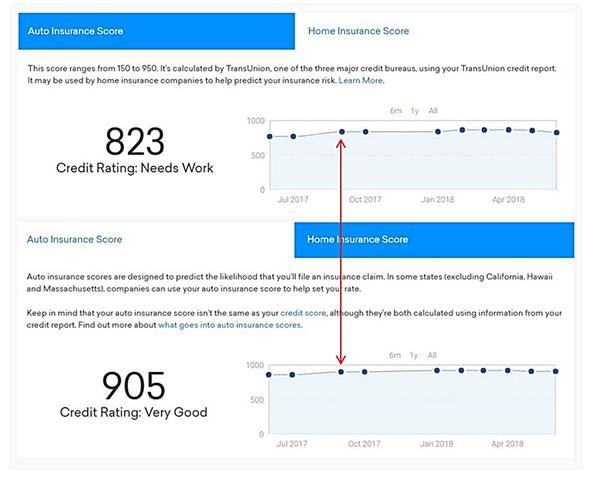

TT I think this is what you are referring to...finally found score that is somewhat bad with home insurance. Might be due to teens breaking into my house and catching it on fire resulting in 150,000 loss. TT..I also had an auto accident resulting in death, I was not at fault...drunk pedestrian in street.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

Sarge12,

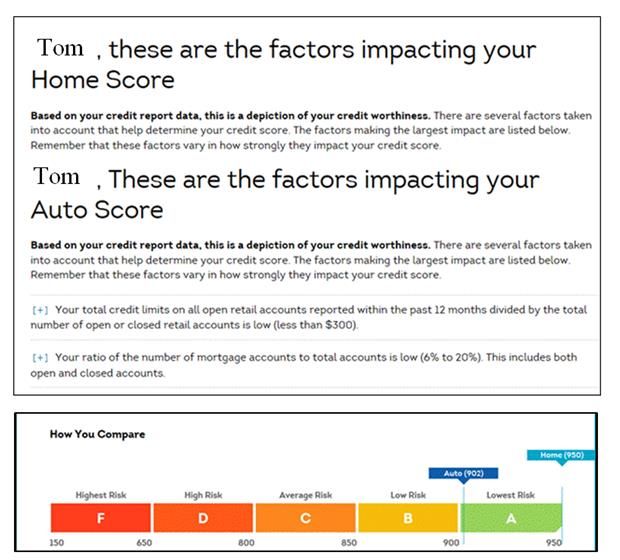

Thank's for the data. My understanding is credit based insurance scores don't consider claim history or accidents. The CBIS are based on evaluation of credit related attributes (see reason statements in the TransUnion CBIS thread): https://ficoforums.myfico.com/t5/General-Credit-Topics/Transunion-Credit-Based-Insurance-Scores/m-p/...

The scores are subsequently used in conjunction with claim history, accidents, moving violations, location and yes - age to determine premiums.

It appears you had a credit event in August or September 2017 that created a step change increase in both your Auto and Home scores.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

@Thomas_Thumb wrote:Sarge12,

If you don't mind sharing, what are your latest CBIS Auto and Home scores? Also, did they drop as a result of the new credit/HPs you mentioned in another thread?

Now that I figured out...I think...what scores you were referring to, and saw that my home score needs work...how the heck do I work on it? I mean, to have as high of fico scores as I do, just don't know exactly what I could do to improve the home insurance score CK reports. Even after the fire loss that was recovered partially from the breaking and entering teens, my insurance rates on my home are not all that bad. According to the CK site it has been fairly low as far as it goes back. What good is this score if I can do nothing to improve it? Why is my Home insurance not high? It comes from CK, so does it really mean much? Considering 4 insurance company adds were on that page, I might ignore this one. I had a hard time even finding it on CK after seeing your screenshot of it on another post.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

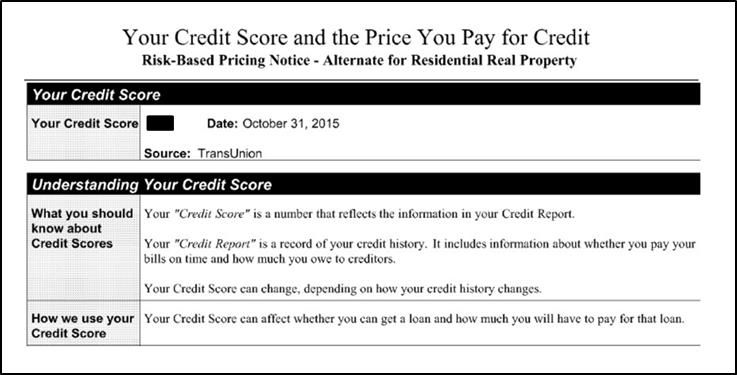

The CBIS scores actually are from TransUnion - I know as I purchased them once direct from TU (late 2015) and they match the scores presented by CK. LexisNexis is the industry leader in CBIS. From what I have seen TransUnion is the 2nd most commonly used CBIS with Fico CBIS possibly being 3rd. Yes, Fico does have CBIS models but I have never seen a Fico CBIS score.

I can't say why your Home score is much lower. The best source for an answer would be TransUnion - but you may have to purchase a score directly from TU to get any feedback. TransUnion does provide some reason statements with your score report and a CSR may be able to offer additional insight. I'm attempting to tease out differences between Auto and Home along with score impact of key attributes but, data available is limited. Even the TU reason table I found is 14 years old and certainly things have changed.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

@Thomas_Thumb wrote:The CBIS scores actually are from TransUnion - I know as I purchased them once direct from TU and they match the scores presented by CK. LexisNexis is the industry leader in CBIS. From what I have seen TransUnion is the 2nd most commonly used CBIS with Fico CBIS possibly being 3rd. Yes, Fico does have CBIS models but I have never seen a Fico CBIS score.

I can't say why your Home score is much lower. The best source for an answer would be TransUnion - but you may have to purchase a score directly from TU to get any feedback. I'm attempting to tease out differences between Auto and Home along with score impact of key attributes but, data available is limited. Even the TU reason table I found is 14 years old and certainly things have changed.

It appears from the reason table you are referring to you would just about need to go 5 years without getting a new card to get that score pristine...yeah, think I'll ignore it. According to credit karma though the Home CBIS is different and developed in house at each insurance provider, which might result in wildly different rates between insurers.

The following is cut and paste from CK::::

To find your home insurance scores, contact your current home insurer or its competitor. Remember, each insurance company uses its own modeling to determine your score. Your premiums could be lower for the companies that calculate a higher score for you.

If CK is correct on that...what good is the one they provide????

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

As mentioned in the other thread and link to a study CBIS insurance scores can/do have a huge impact on premiums. You generally cannot get a CBIS score direct from an insurer. I know StateFarm uses LexisNexis CBIS but, they would tell me nothing regarding my CBIS score. Fortunately I was able to obtain scores direct from LN before they closed down consumer access early this year.

I can't recall who Inverse uses for insurance but, his insurer used TU CBIS as part of determining his premiums.

Below is a link to a post which has info on impact of CBIS.

Consumer Reports did a piece on this a few years back as well.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

@Thomas_Thumb...so the info that I cut and pasted from CK about each insurer using their own credit modeling for a score is wrong. Why am I not surprised. It is certainly not the first non fact based information I have seen there. Does anyone think the approval odds they post are in any way correct? And the credit score simulator everywhere is less accurate than tarot cards or ouija boards. Strange thing is, the credit alerts from CK often alerts me before some sites I've paid for have. I personally think that with as many areas of our lives that various credit scores affect, and as much data as they collect on us, all credit scores should be free for the consumers at least once a month. The idea that insurance rates, hiring, interest rates, rent access, and many other things that have an affect on ones life, should warrant free and frequent access to that info for everyone, and not just once per year. They should pass a law that mandates it, especially since ID theft and fraudulant accounts is so prevelant.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

The CK info is a generalization. A few insurers don't use CBIS at all in determining premiums but, over 90% consider CBIS when setting premiums. Quite a few insurers use 3rd party CBIS models (such as State Farm and AAA) but many others use, half baked, internally developed CBIS models.

Sarge, not sure what state you reside in but, some states (three as I recall) prohibit insurance companies from utilizing CBIS when setting premiums. Perhaps the reason your home insurance is not elevated although your CBIS "needs work" is because your insurance company puts little or no focus on CBIS or you live in a state that prohibits its use. Of course the most commom 3rd party CBIS is LexisNexis and that model may like your profile better. Unfortunaterly you can no longer check your LN scores as a consumer.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit karma just cracks me up

@Thomas_Thumb wrote:The CK info is a generalization. A few insurers don't use CBIS at all in determining premiums but, over 90% consider CBIS when setting premiums. Quite a few insurers use 3rd party CBIS models (such as State Farm and AAA) but many others use, half baked, internally developed CBIS models.

Sarge, not sure what state you reside in but, some states (three as I recall) prohibit insurance companies from utilizing CBIS when setting premiums. Perhaps the reason your home insurance is not elevated although your CBIS "needs work" is because your insurance company puts little or no focus on CBIS or you live in a state that prohibits its use. Of course the most commom 3rd party CBIS is LexisNexis and that model may like your profile better. Unfortunaterly you can no longer check your LN scores as a consumer.

I live in South Carolina and have State Farm for everything except the motorcycle policies which are with progressive. I have always had State Farm....44 years...so the length of time I've been a customer is likely an influence. You said State Farm uses Lexis-Nexis, so it may be different.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20