- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- DP for AZEO and AU accounts

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

DP for AZEO and AU accounts

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP for AZEO and AU accounts

If not then I guess you took the no revolving credit penalty and the care credit does not count which then causes me to wonder if mine does, because if it does not, then the credit limit is useless towards utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP for AZEO and AU accounts

Good question, Birdman. However, my score already took a 6 point ding from the inquiry and the new account a few days prior (the new Barclays Uber reported in less than 12 hours!). My score was stable for several days until that AU account reported a $0 balance. My score has been stable since that same day since the Discover account has yet to report and no other changes have reported.

It looks like the AU account was helping my score with an AZEO effect. But it looks like Care Credit is NOT being treated like a normal bank card. Rather strange how that works.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP for AZEO and AU accounts

I’m going to have to test my carecredit. Might I ask where EX stated it was a retail card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP for AZEO and AU accounts

It didn't explicitly state the Care Credit is the retail card, but by process of elimination it looks like that is the card they are flagging as retail (all other cards are major bank issued and are true credit cards like Visa or Mastercard).

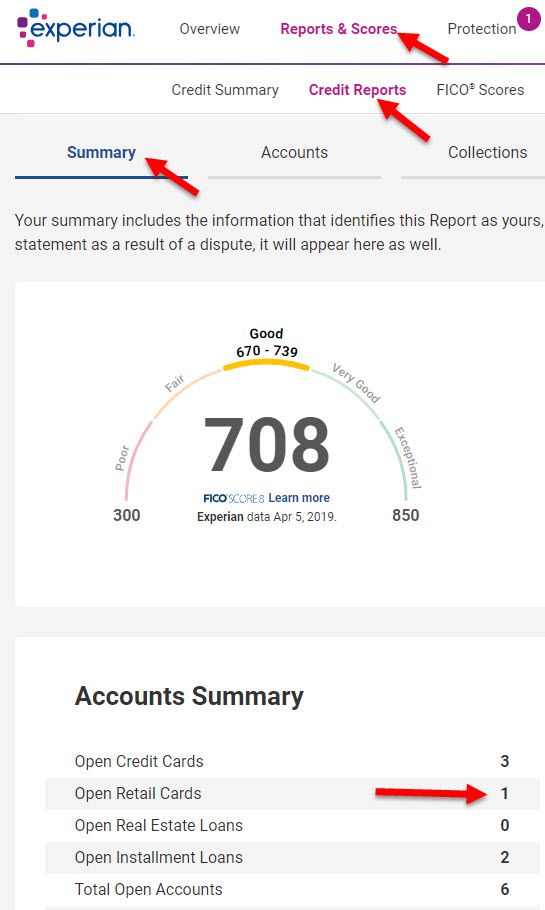

In the EX CreditWorks, go to "Reports & Scores", then "Credit Reports", and then "Summary". That window shows a quick summary of accounts and aging.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP for AZEO and AU accounts

I just discovered that my AU card that I was testing also says that and is a retail card so either way it may not count.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP for AZEO and AU accounts

I have been performing an AU efficacy test myself: https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/AU-efficacy-test/m-p/5566440#M153581

My no revolving account balance penalty at EX was 14 points just like yours. (14 @TU, 13 @EQ). I confirmed it, now that a national bank card has reported. Plus, I just paid it off to reinflict the no revolving account balance penalty, so that I can next test my carecredit card as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP for AZEO and AU accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP for AZEO and AU accounts

By EX2 you mean the Mortgage scores correct?

When my trial started on Mar 28, the EX2 was 733 (this was before the HP for a CC app).

Later in the day on Mar 28, I apped for Discover and they HP EX.

Also on Mar 28, I apped for Uber and they HP TU.

EX2 on Mar 29 dropped to 727 (the only difference was the HP showing on my EX).

My trial period expired on April 7 and the EX2 score stayed at 727 all that time, so no change (sounds weird!).

Was this what you were looking for, or is there something else that EX2 means?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP for AZEO and AU accounts

Can you please go back and pull your reports for the first and the second and tell me the EX2 mortgage scores for each day please?

It’s very weird that your carecredit did not count and caused the no revolving penalty on FICO 8. So, I’m trying to determine whether or not it counted on the old mortgage model. If it did, your score would’ve rose or stayed the same. If it did not, you would’ve suffered a drop, like you did on your FICO 8.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DP for AZEO and AU accounts

@Anonymous wrote:

Can you please go back and pull your reports for the first and the second and tell me the EX2 mortgage scores for each day please?

The score was unchanged. It was 727 on April 1 and April 2... all the way to the trial ended. EX2 only changed after the HP was made on Mar 28 and it held firm at 727 from Mar 29 all the way to April 7.