- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Debt to Credit ratio. Loan vs. Total. Is it a...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Debt to Credit ratio. Loan vs. Total. Is it a big deal?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Debt to Credit ratio. Loan vs. Total. Is it a big deal?

Hello everyone,

I wasn't sure where this should go so Mods please move to appropriate location if needed.

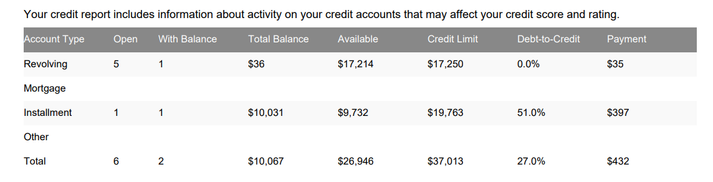

I was going through my EQ report and saw this:

I'm curious how my auto loan balance is affecting my profile. I see the 51% ratio, but then see the 27% ratio for Total.

Would increasing CL on CC accounts affect anything? Or should I not even worry about it since installment is listed separately from revolving?

Thanks for any insight

R.I.P Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt to Credit ratio. Loan vs. Total. Is it a big deal?

It's basically split up into three different Categories so you have your REVOLVING (Open ended accounts/Credit Cards), INSTALLMENT (that would be like some loans or Car loans here/Mortgage) and then there is OTHER/PERSONAL (which some other loans may fall under and then you have your INDIVIDUAL Utilization and Overall UTL/AGG I hope this helps ![]() It's always good for your MIX to have either Mortgage or Auto on there

It's always good for your MIX to have either Mortgage or Auto on there ![]() As well as around 3 cards for 'optimal use'

As well as around 3 cards for 'optimal use'

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt to Credit ratio. Loan vs. Total. Is it a big deal?

Also I see your Credit Cards are showing 0% you don't want that I know that may sound backwards, but you are at the 51% because it looks like you have paid your car down to 51% of the remaining loan, but you want at least one of your Bank/Bank issued cards to report somewhere between 2-8.9% and it's ok to have the others report 0 no problem but you would be dropped some points for an all 0 penalty

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt to Credit ratio. Loan vs. Total. Is it a big deal?

Yeah, I've been trying to keep a balance on one card but with all of them reporting on different dates, it's a bit tough. I was letting one of the CapOne cards report every month which was going pretty well, but I forgot a few times and just paid everything top down.

R.I.P Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt to Credit ratio. Loan vs. Total. Is it a big deal?

@DoogieBall wrote:Yeah, I've been trying to keep a balance on one card but with all of them reporting on different dates, it's a bit tough. I was letting one of the CapOne cards report every month which was going pretty well, but I forgot a few times and just paid everything top down.

You are fine. It shows $36 reported. There is activity and I do not believed you will be hit with an all-zero penalty.

Someone correct me if this train of thought is somehow incorrect?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt to Credit ratio. Loan vs. Total. Is it a big deal?

Assuming the $36 reported balance is on a major bank card, you should be fine. That's also assuming that you haven't paid the $36 down to zero and are awaiting a $0 reported balance on that account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt to Credit ratio. Loan vs. Total. Is it a big deal?

@Anonymous As Brutal said that is true and Also assuming that it's not on a High Limit card to where they may possibly round down to 0% for example if your CL is 5k and you put less than 40 dollars on it sometimes they will round it down to zero so just be careful ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt to Credit ratio. Loan vs. Total. Is it a big deal?

When you say "they" may round it down who are you referring to? I'm not sure if you mean a CMS or the Fico algorithm.

My understanding has always been that a CMS will often round down for a percentage that's < 0.5% and display 0%, but that doesn't impact the Fico algorithm as any non-zero dollar balance reported will constitute utilization, even if it's .0001% of a limit, for example.