- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Do new accounts themselves actually drop scores?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Do new accounts themselves actually drop scores?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

@Anonymous wrote:

@oilcan12 wrote:

@Anonymous wrote:

I just got my updated TU FICO 08 though my mortgage company and it shows a 22 point drop from where it was last month prior to me apping.

Are you sure it wasn't TU FICO 04. That is exactly the kind of drop I would have expected from 04 if there had been no new accounts in the previous 6 months.

Could you supply a little more information? Such as:

AAoA

How long since new accounts before the recent ones

How old is your mortgage

Any changes in utilization

How many credit cards you have

Positive it's FICO 08. Direct from their site: "The FICO® Score provided to you is the FICO® Score 8 based on TransUnion Data, and is the same score that Nationstar uses, along with other information, to manage your account."

The information you requested:

AAoA = 7 years (unchanged from when I added the 3 accounts)

No accounts added in the 15 months prior to the 3 I just added last month. 3 accounts added 15 months ago, 2 accounts added 3 years prior to that, 1 account added 2 years before that. So broken down into accounts added by year: 2010 = 1, 2011 = 0, 2012 = 2, 2013 = 0, 2014 = 0, 2015 = 3, 2016 = 3.

Mortgage is 7 years old

Utilization has been 1-6% overall for the last 2 months. I took it down from around 35% to mid-single digits and made sure all accounts reported as such prior to my app "spree" for the 3 new accounts I obtained.

Total credit cards are 5. I had 2 prior to 3 I added. I will be closing one of the original 2 in the next month or so as it's a Care Credit account that was only used for one purchase ever, some dental work, and it's about to be paid off - I'll be down to 4 active revolvers at that time.

I've got 21 total accounts on my credit reports currently, and 5 of them are almost 16 years old.

It seems strange that your score took such a big hit. I have years of data points showing that new accounts don't affect FICO scores. Maybe it was because you didn't have any accounts in the past 15 months. I don't have any data points on that. That could be a FICO 8 threshold.

What was your overall utilization for the score before the apps compared to your overall utilization at the time to the score drop.

It seems like I remember you once said that your oldest card is reported several times on your credit report. Are you sure that all of those clones (for want of a better word) count for your AAoA?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

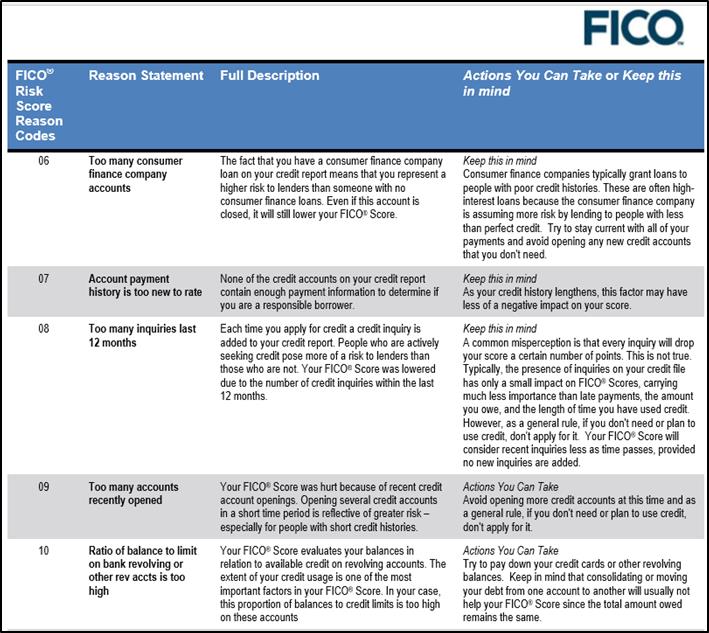

Pasted below are some reason codes that were part of a pdf file from Experian dated 2014. I believe it is for Fico 08 although not stated explicitly anywhere in the document..

Three new accounts, particularly with a "thin" file coupled with nothing else new in over a year could explain the drop.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

@oilcan12 wrote:It seems strange that your score took such a big hit. I have years of data points showing that new accounts don't affect FICO scores. Maybe it was because you didn't have any accounts in the past 15 months. I don't have any data points on that. That could be a FICO 8 threshold.

What was your overall utilization for the score before the apps compared to your overall utilization at the time to the score drop.

It seems like I remember you once said that your oldest card is reported several times on your credit report. Are you sure that all of those clones (for want of a better word) count for your AAoA?

Nice memory on that story I told. Yes, those 5 accounts all impact my AAoA which is 7+ years. Without them my AAoA would be about half that, which it isn't as evidenced by my 3B reports pulled.

My overall utilization before I apped should be in the same bucket; it was 6% before I apped. If anything it's on the lower end now since I added $42,500 in credit lines from those 2 reported accounts so it fluctuates between 1%-2% now. Once the 3rd and final account reports which will add another $10k to utilization I highly doubt I'll rise above 1% utilization very often.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

@Thomas_Thumb wrote:Pasted below are some reason codes that were part of a pdf file from Experian dated 2014. I believe it is for Fico 08 although not stated explicitly anywhere in the document..

Three new accounts, particularly with a "thin" file coupled with nothing else new in over a year could explain the drop.

Would my file really be considered "thin" though? It's got 22 accounts on it, oldest accounts 15+ years, 7 years AAoA? I would think that would put me more toward the thick/aged end of things rather than thin... but I'm not expert on that by any means.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

@Anonymous wrote:

@Thomas_Thumb wrote:Pasted below are some reason codes that were part of a pdf file from Experian dated 2014. I believe it is for Fico 08 although not stated explicitly anywhere in the document..

Three new accounts, particularly with a "thin" file coupled with nothing else new in over a year could explain the drop.

Would my file really be considered "thin" though? It's got 22 accounts on it, oldest accounts 15+ years, 7 years AAoA? I would think that would put me more toward the thick/aged end of things rather than thin... but I'm not expert on that by any means.

BBS -

Your overall file certainly is not thin. Question I have is: How many open CC accounts did you have before opening the three recent accounts? For example, if you went from 3 accounts to 6 accounts, that's a big change. Also, opening the 3 accounts in a 30 day time window may mean they get grouped together which then triggers the "too many" designation.

[side notes - Could 3 new accounts be the trigger of "too many" and does the QTY count encompass a limited timeframe such as 30 or 45 days? If the accounts were opened over a three month span would that have made a difference?]

The fact that your most recent prior openings are 15 months old may be a consideration in change of behavior risk analysis.

On the other hand, if you had 30 open CCs, with 2 being opened in the last 3 to 6 months, then opening another 3 accounts may not be considered an "event" so no score change.

A couple key points are:

1) Fico specifically states "too many" recent account openings is looked at in scoring. The "too many" is likely profile dependent - or perhaps the impact of too many on score. Not sure about the definition of recent but, my guess is under 6 months.

2) Any recentness impact on score, if that's the cause, should be a short term effect, perhaps 90 days - IMO

Note of caution: I do not have personnal experience testing the "too many" factor so my feedback is based on 2nd hand information such as the reason statement list.

I can't recall if you mentioned any reason statements for your score drop in earlier posts

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

Thanks for the feedback there. Yes, I only had 2 open CC accounts prior to opening 3 new ones. As I stated earlier though, only 2 have reported... still waiting on Amex to report so that's kind of scary that the first 2 resulted in a 22 point drop since I'm still waiting to get hit with the third.

If I end up taking a hit for 90 days or so I don't really care. The only thing that makes me nervous is where my scores are with respect to the drop. If i was dropping from 770 to 740 it wouldn't worry me as much as dropping from 740 to 710 (which looks like could happen). I don't want the issuers of the 3 new cards I got to see a 30 point drop when they SP me or when I ask for a CLI and raise any red flags essentially dropping from very good credit down to just "good" depending on how you consider scores.

I mean my profile to any single creditor will look exactly the same except that they'll see 2 other additional CC accounts. That being the only piece of data that's changed hopefully won't be enough to spook any of my new creditors...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

Who are the issuers? is your starting limit not good? I ask because depending on the issuer and how you use the card you might get auto increases within 3 months. So maybe don't request a cli so soon--unless right away. Personally I called barclay the day I was approved and requested an increase. Didn't do another HP and gave me an increase of 4500. I took a 40 point hit for opening up 4 cards in 24 hours though. EX went down to 707. I don't think i'm done taking the hit yet actually, it's only been a few days now. In retropsect I probably should have spread them out. The problem with taking new account hits is there's no fast way to undo them--just wait it out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

The issuers were Discover, Amex and Synchrony (Lowe's). The only one with a low SL was the Lowe's card which I immediately called and got raised to what I wanted after reading many threads here on them. The Discover and Amex limits are acceptable, but I would like them higher as I can exceed 40% or so on those limits in any given month which I simply don't like to do utilization wise. I know additional payments per month can be made to avoid this, but having higher limits on Amex and Discover would be more comfortable for me. As you said, waiting it out is probably all that can be done. I wonder if there are any other data points on here somewhere of people that reported similar drops from similar mini sprees and how long it took their scores to rebound from them. Maybe I'll start a thread asking those that have done mini sprees to chime in on this subject... not sure if this forum is best for that or the CC forum or CC approvals forum?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

Feel free to start that thread because I would like to know too. Did you call amex and ask for an increase as well? Amex customer service has been spotty the past few years, but definietly call if you haven't--confirm they don't do another HP though. Discover doesn't do increases first 3 months. But i've read people went from 2000 to 30k in a year with discover. I would be interesting in knowing how sprees affect peoples scores and how long they affected them--in case you wanna make that thread![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

I will definitely make a thread in a little bit. I'll post the link to it in here.

I did not request an Amex CLI upon approval. In reading through the monster 3X CLI thread it sounded like results were mixed in requesting a CLI upon approval; some got them and some didn't, but most stated that if they DID receive one it was usually smaller than a 3X CLI. I figured my best bet would be to wait the 61+ days and request the full 3X CLI and have the best chances of getting it, or at least getting close(r) to it.