- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Does VS 3.0 model ignore very low utilization?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Does VS 3.0 model ignore very low utilization?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does VS 3.0 model ignore very low utilization?

Not that I care about VS 3.0 scores at all, but I found this interesting. We all know that when it comes to FICO scoring, any reported balance on a single revolver even if it's just a few bucks constitutes revolving credit use and allows one to escape the no revolving credit use penalty.

Does anyone know if with VS 3.0 there's some sort of minimum? Allow me to explain what I saw with my file. 2 CK updates ago on TU my score was 836 and that was with AZEO and a balance of a few thousand dollars on a high limit card (say 5% of the card limit, aggregate 1%). On the next update, that card had reported $0 and a $3 balance reported on a different card. So, I'm still at AZEO, except with a $3 reported balance. -13 to the TU score, 823. Today I saw that another card of mine reported balance on TU of around $100, +13 points back to 836. It's worth noting that I'm at AZE2 now, but if the $3 balance is being "ignored" it could be seen as AZEO still I suppose.

Any thoughts on this outside of the standard VS 3.0 scores dont matter and their algorithm is screwy anyway? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does VS 3.0 model ignore very low utilization?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does VS 3.0 model ignore very low utilization?

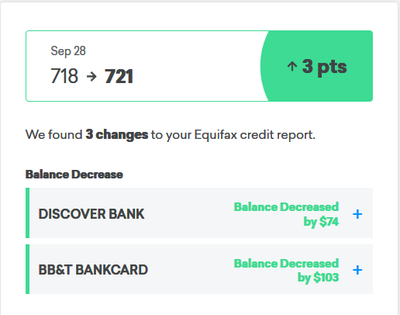

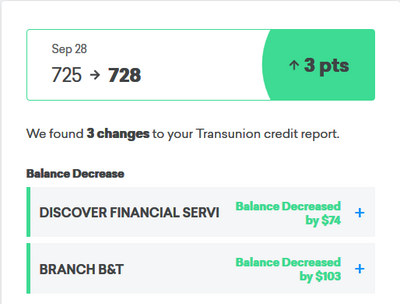

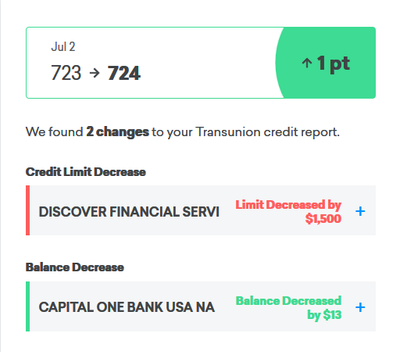

Recently my score changed with AZE2 and balance decreases. The new time line on CK named "See whats Changed" shows a history now and it goes back a long way. When it went back to AZEO. There was no change back. It stayed the same. YMMV. First time I went AZE2 for 2 months straight with 7 cards at 1% util. Back in july same thing with only AZEO. The Discover was a transfer of my CL when I opened my 2cd card in June

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does VS 3.0 model ignore very low utilization?

@Anonymous wrote:Not that I care about VS 3.0 scores at all, but I found this interesting. We all know that when it comes to FICO scoring, any reported balance on a single revolver even if it's just a few bucks constitutes revolving credit use and allows one to escape the no revolving credit use penalty.

Does anyone know if with VS 3.0 there's some sort of minimum? Allow me to explain what I saw with my file. 2 CK updates ago on TU my score was 836 and that was with AZEO and a balance of a few thousand dollars on a high limit card (say 5% of the card limit, aggregate 1%). On the next update, that card had reported $0 and a $3 balance reported on a different card. So, I'm still at AZEO, except with a $3 reported balance. -13 to the TU score, 823. Today I saw that another card of mine reported balance on TU of around $100, +13 points back to 836. It's worth noting that I'm at AZE2 now, but if the $3 balance is being "ignored" it could be seen as AZEO still I suppose.

Any thoughts on this outside of the standard VS 3.0 scores dont matter and their algorithm is screwy anyway?

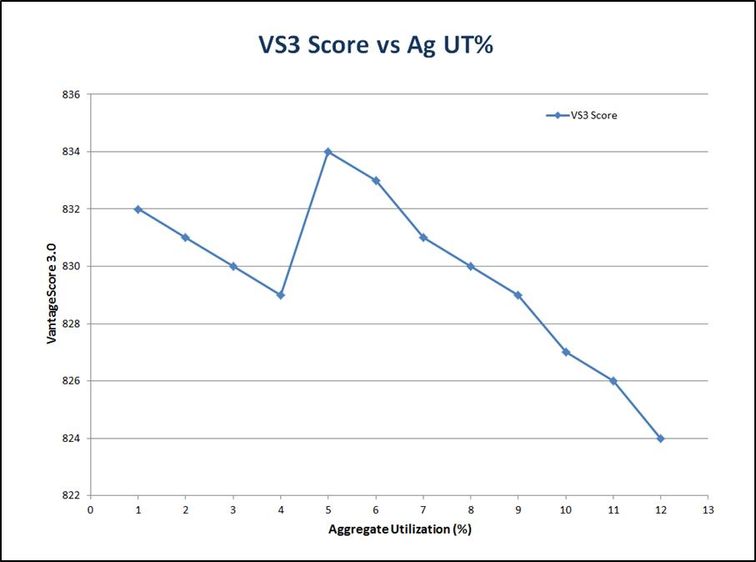

I do know VantageScore is a bit unusual regarding utilization. Optimum utilization for score is in a narrow band between 4.5% and 4.9% as I recall. I provided the below graph previously from the VS simulator in CK. My real world scores behaved in a similar fashion. Earlier this year I looked UT% in 0.1% increments in the 3.5% to 5.5% range and its impact on VS3 score. I cant find the data but the peak score occurred in a narrow band (4.7% to 5.0% or thereabouts).

Although you don't like the simulator, I'd suggest adjusting your balance with all else being equal and look at the results.

...

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does VS 3.0 model ignore very low utilization?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does VS 3.0 model ignore very low utilization?

I reached my optimal score on VS3 with one card reporting at less than 1% of available credit for 8 cards. I had high credit card debt in early 2016 and purposed to bring it $0. When I finally joined MyFico I was down to $0 out of 73K+. Then I let one account report for $148 and achieved my highest score - 832. I had a MTG with 23% paid and an auto loan with 40% paid. When I finally found the courage to report 2 cards (total $568) my VS3 dropped a few points but my FICO score was on the rise.

For me (if there are also profiles with VS3) it doesn't like me reporting much more that $500 on 1 card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does VS 3.0 model ignore very low utilization?

Interesting TT, good to know. This was the first time I've ever observed a score drop from ultra low (but non-zero) reported utilization on VS 3.0, but I definitely don't monitor those scores much at all and for all I know have received the same score penalty in the past and just wasn't aware.