- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- EX ticked to 850 - 3 possible reasons why:

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

EX ticked to 850 - 3 possible reasons why:

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EX ticked to 850 - 3 possible reasons why:

My EX FICO Score 8 has been steady at 847 since June. Completely bulletproof. It doesn't matter if I have 2 of 9 accounts (1 revolver, 1 installment loan) with a balance or 9 of 9 accounts; never budges from 847.

I did a CCT pull this morning and noticed my score ticked up to 850. The change can only be from one of three things, the age of accounts factors that increased by 1 month on 9/1/18:

AAoA: 81 months --> 82 months (~6.8 years).

AoOA: 209 months --> 210 months (17.5 years now).

AoYA: 15 months --> 16 months

Tough to say here with 3 variables, but I'd more or less rule out AoYA. I'm not convinced that there's any change realized between 12 months and 23 months when it comes to AoYA. Perhaps something may be gained at 24 months? Anyway, I think it has to be AAoA or AoOA.

I'm personally leaning slightly more toward AAoA here reaching 82 months rather than AoOA reaching 210 months. Other than a gut feeling, I have no reason why I feel that way. Any opinions here on either of these two points being a threshold for a gain? Perhaps someone else has a data point on their file from the same point in time for either of these factors?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX ticked to 850 - 3 possible reasons why:

@Anonymous wrote:My EX FICO Score 8 has been steady at 847 since June. Completely bulletproof. It doesn't matter if I have 2 of 9 accounts (1 revolver, 1 installment loan) with a balance or 9 of 9 accounts; never budges from 847.

I did a CCT pull this morning and noticed my score ticked up to 850. The change can only be from one of three things, the age of accounts factors that increased by 1 month on 9/1/18:

AAoA: 81 months --> 82 months (~6.8 years).

AoOA: 209 months --> 210 months (17.5 years now).

AoYA: 15 months --> 16 months

Tough to say here with 3 variables, but I'd more or less rule out AoYA. I'm not convinced that there's any change realized between 12 months and 23 months when it comes to AoYA. Perhaps something may be gained at 24 months? Anyway, I think it has to be AAoA or AoOA.

I'm personally leaning slightly more toward AAoA here reaching 82 months rather than AoOA reaching 210 months. Other than a gut feeling, I have no reason why I feel that way. Any opinions here on either of these two points being a threshold for a gain? Perhaps someone else has a data point on their file from the same point in time for either of these factors?

I know it's off topic, but.... congratulations ![]()

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX ticked to 850 - 3 possible reasons why:

I know it's off topic, but.... congratulations

Come on SJ, that's not the response I was looking for. Thanks though buddy ![]()

The reason why I'm leaning toward AAoA here a bit is because there has been some buzz over the years that 94 months (~7.8 years) may be the top threshold for AAoA in terms of scoring. I guess I figured that exactly 12 months less, 82 months, could potentially be another point. On one hand that makes a little sense to me, but then I have my own personal data which somewhat shoots that down. On my own profile on EX I know for certain that 78 months (6.5 years) was a definite threshold, yielding a 4 point change. I had the opportunity to get a very solid data point on this, as earlier this year I had my AAoA reach 78 months, +4, then an old account fell off bringing it back down to 75 months, -4, then I pulled my scores again a day or two after arriving back at 78 months, +4. It would just seem strange to me that if 78 months is a threshold that 82 months only 4 months later could be another good for a +3. Who knows, though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX ticked to 850 - 3 possible reasons why:

Odds are in favor of AAoA. As mentioned in other posts increments for AAoA are months - not years. There is a tendency to package AAoA thresholds in whole years but, CBIS scoring models explicitly use months. I think Fico may as well.

Sure AoOA could be a possibility but, likelihood is much less IMO.

AoYA ![]() in a pipe dream but not the real world.

in a pipe dream but not the real world.

Of course there is the possibility of something else like a change in utilization or # cards reporting that is affecting score but has yet to show on a report. I sometimes wonder if scores could be pulled from a different database than account summaries.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX ticked to 850 - 3 possible reasons why:

TT, while I'm leaning toward AAoA as well, don't you find it a bit suspect that a threshold would exist at both 78 and 82 months on a file? You'd think if 4 months is enough to yield 3-4 point gains that close together that we'd see far more reported thresholds no? Maybe I'm looking at it the wrong way.

I am 100% positive that utilization changes or number of accounts with a balance were not a factor here. Even if they somehow were, I already proved that on EX my profile was bulletproof from 2 of 9 accounts all the way to 9 of 9 accounts with my score staying at 847 the entire time. I also pulled my scores from CCT 2 days before August ended (847 still on EX) which really isolates the next pull to only see something age of accounts related with the changing of the month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX ticked to 850 - 3 possible reasons why:

The bigger question is: What happened to your Fico 8 score associated with the other two CRAs?

I assume they have the same AoOA & perhaps AoYA but, may or may not have the same AAoA. If those scores didnot react in a similar fashion, I'd rule out AoOA as a possibility.

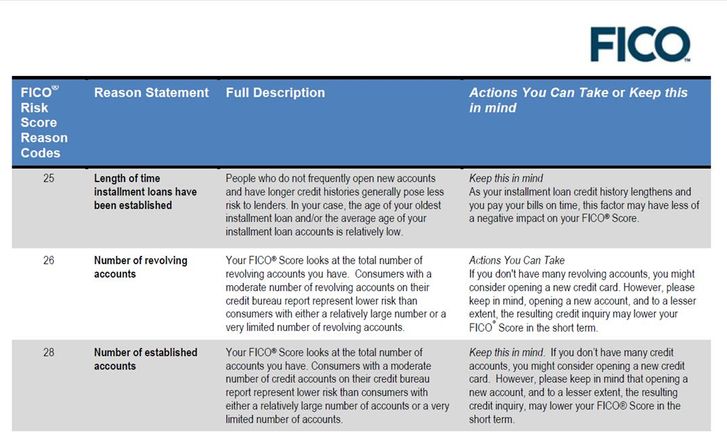

Side note: There are reason codes that suggest Fico looks at installment loans seperately from revolving accounts from an aging perspective.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX ticked to 850 - 3 possible reasons why:

The below Fico reason code summary table is for mortgage Ficos. Note the differences among CRAs.

It may provide some insights on other things to look.

https://crecreditservices.com/resources/education/fico-score-factor-codes/

NIU = Not in use for this scoring model

IS .. = Industry Specific Option

*** | Experian | Equifax | Transunion |

Reason Code | (Alpha/Numeric) (Fico II) | (Beacon 5.0) | (FICO Classic 98/04) |

Amount owed on accounts is too high | A/01 | 01 | 01 |

Level of delinquency on accounts | B/02 | 02 | 02 |

Too few bank revolving accounts | C/03 | NIU | NIU |

Proportion of loan balances to loan amounts is too high | I/33 | 33 | 03 |

Too many bank or national revolving accounts | D/04 | 04 | NIU |

Lack of recent installment loan information | Y/32 | 32 | 04 |

Too many accounts with balances | E/05 | 05 | 05 |

Too many consumer finance company accounts | F/06 | 06 | 06 |

Account payment history is too new to rate | G/07 | 07 | 07 |

Too many inquiries in the last 12 months | H/08 | 08 | 08 |

Too many accounts recently opened | J/09 | 09 | 09 |

Proportion of balance to credit limits is too high on bank revolving or other revolving accounts | K/10 | 10 | 10 |

Amount owed on revolving accounts is too high | L/11 | 11 | 11 |

Length of time revolving accounts have been established | M/12 | 12 | 12 |

Time since delinquency too recent or unknown | N/13 | 13 | 13 |

Length of time accounts have been established | O/14 | 14 | 14 |

Lack of recent bank revolving information | P/15 | 15 | 15 |

Lack of recent revolving account information | Q/16 | 16 | 16 |

No recent non-mortgage balance information | R/17 | 17 | 17 |

Number of accounts with delinquency | S/18 | 18 | 18 |

Too few accounts currently paid as agreed | T/19 | 19 | 27 |

Date of last inquiry too recent | NIU | NIU | 19 |

Time since derogatory public record or collection too short | V/20 | 20 | 20 |

Amount past due on accounts | W/I | 21 | 21 |

Serious delinquency. Derogatory public record or collection | X/22 | 22 | 22 |

Number of bank or national revolving accounts with balances | 23 | 23 | NIU |

No recent revolving balances | U/I | 24 | 24 |

Length of time installment loans have been established | IS | IS | NIU |

Number of revolving accounts | IS | IS | NIU |

Number of bank or other revolving accounts | IS | IS | NIU |

Too few accounts currently paid as agreed | T/27 | 19 | 27 |

Number of established accounts | IS | 28 | 28 |

No recent bankcard balances | 29 | NIU | 29 |

Date of last inquiry too recent | NIU | NIU | 19 |

Time since most recent account opening is too short | Z/30 | 30 | 30 |

Too few accounts with recent payment information | I/O | 31 | NIU |

Amount owed on delinquent accounts | 34 | 34 | IS |

Lack of recent installment loan information | Y/32 | 32 | 04 |

Proportion of loan balances to loan amounts is too high | I/33 | 33 | 03 |

Amount owed on delinquent accounts | IS | 34 | 31 |

Payment due on accounts | 45 | NIU | NIU |

Length of time open installment loans have been established | IS | NIU | NIU |

Number of consumer finance company accounts established relative to length of consumer finance history | IS | NIU | NIU |

Serious delinquency and public record or collection filed | 38 | 38 | 38 |

Serious delinquency | 39 | 39 | 39 |

Derogatory public record or collection filed | 40 | 40 | 40 |

Lack of recent auto loan information | 98 | NIU | IS |

Length of time consumer finance company loans have been established | NIU | NIU | 98 |

Lack of recent auto loan information | NIU | NIU | 97 |

Lack of recent auto finance loan information | NIU | IS | NIU |

Lack of recent consumer finance company account information | IS | IS | IS |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX ticked to 850 - 3 possible reasons why:

@Thomas_ThumbThe bigger question is: What happened to your Fico 8 score associated with the other two CRAs?

I assume they have the same AoOA & perhaps AoYA but, may or may not have the same AAoA. If those scores didnot react in a similar fashion, I'd rule out AoOA as a possibility.

I was already at 850 on TU, so there's nothing to see there. EQ was also at 847 just like EX, but EQ did not increase. My AAoA is greater on EQ than it is on EX. When EX moved from 81 months to 82 months on 9/1/18, EQ moved from 88 months to 89 months. I don't really know that it matters though whether a change would be seen with score using different bureau data, as the thresholds could be different across the CRAs no? I mean, we already know certain factors like number of accounts with a balance impact a score drawn on EQ data before they do on EX/TU for example. My AoOA and AoYA are indeed the same across all bureaus, just not AAoA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX ticked to 850 - 3 possible reasons why:

<sneaks in the door so no one can see me as I shout....>

CONGRATULATIONS !!!!

<runs out the door quickly becore BBB can yell at me>

>5/2023 All 3 reports 840ish (F8) F9s = 850 but my app finger is still twitching

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EX ticked to 850 - 3 possible reasons why:

@Anonymous wrote:

@Thomas_ThumbThe bigger question is: What happened to your Fico 8 score associated with the other two CRAs?

I assume they have the same AoOA & perhaps AoYA but, may or may not have the same AAoA. If those scores didnot react in a similar fashion, I'd rule out AoOA as a possibility.

I was already at 850 on TU, so there's nothing to see there. EQ was also at 847 just like EX, but EQ did not increase. My AAoA is greater on EQ than it is on EX. When EX moved from 81 months to 82 months on 9/1/18, EQ moved from 88 months to 89 months. I don't really know that it matters though whether a change would be seen with score using different bureau data, as the thresholds could be different across the CRAs no? I mean, we already know certain factors like number of accounts with a balance impact a score drawn on EQ data before they do on EX/TU for example. My AoOA and AoYA are indeed the same across all bureaus, just not AAoA.

Thresholds are built into the Fico model as part of the core algorithm. CRAs can tweak the model by adjusting weights and adding or subtracting certain secondary scoring attributes. However, the core model is controlled by fico and the CRAs don't have access to those specifics. After all, the CRAs jointly developed VantageScore in an effort to compete with Fico.

Clearly the CRAs can choose to add or subtract some "non core" scoring attributes as evidenced by NIU and IS in the above table. All CRAs use AoYA and AAoA so, those factors can be helpful in validating thresholds by monitoring how score responds to a change

AoOA is looked at as well but, it is a bit muddled due to its use in assigning profiles to scorecards. Also, some CRAs may look at AAoA and AoOA specific to installment loans while other CRAs may not. Furthermore, there is a reason code that makes specific reference to age of open loans that may or may not be used by a given CRA.

Curious what you revolving account AoOA and installment loan AoOA are by CRA. Do you have any differences in open loan ages among the CRAs? Any differences in aggregate installment loan B/L ratio?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950