- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Equifax and Transunion near 750. Experian 66...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Equifax and Transunion near 750. Experian 660???

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax and Transunion near 750. Experian 660???

@thornback wrote:

@Anonymous wrote:So I was looking at the Apple Card. Rejection mail and they said they used Transuion and my credit score is 657 w/ them not 748. So something else most be going on that I am not seeing and why is it being hidden from me?

Well, Apple Card pulls TU FICO 9, not TU FICO 8. Generally, on clean, derog-free reports, FICO 9 tends to be a bit higher than FICO 8 scores.

Nothing is being hidden from you. If you're using Credit Karma to view your TU report, keep in mind you have to click on Closed Accounts to see them... if that charge-off is, in fact, still present on your TU report, it would be considered a closed account and not in plain view with your open accounts.

But forget Credit Karma or any of the other sources you've been using for a moment -

You need to pull all three of your credit reports from a better source so you can review them line by line and find out what's going on. The best source for your situation is annualcreditreport.com. This site is regulated by the Federal Goverment and allows consumers to pull a report from each bureau once per year (twice in some states) for free. It is comprehensive - providing full report data that is not offered by commercial sources. Go there, pull your reports - print them if it's easier for you to review a paper copy - and go over them carefully, line by line so that you can become fully informed of the information reported. Come back and let me know what you find so we can go from there.

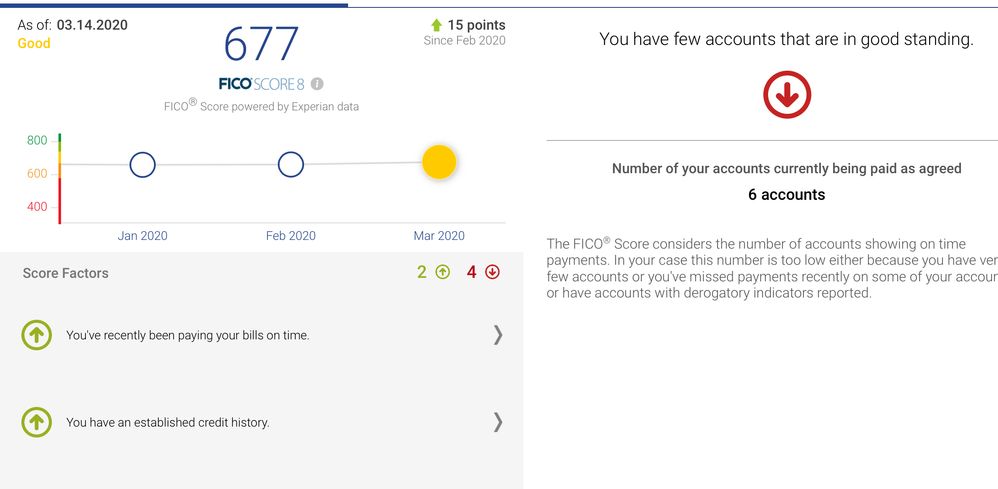

OK I will do that to humor you lol, but in the meantime. Please see previous post that my Credit score drop over 40 pts last month for no reason on Trans and EQ and rose on Experian 15 pts for no reason. Only thing different since then is I did have my credit card Near 10% Utilization by paying off.

This is a sick system. See image in this message and above.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax and Transunion near 750. Experian 660???

As has been pointed out several times now, CreditKarma does not give your Fico 8 scores. It's giving you Vantage scores. There is no "error" it is simply a different scoring system. If I'm not mistaken the majority of scores given as courtesy by credit cards are using Vantage scores - this is why they all line up with CreditKarma. But they are not Fico scores and they're not accurate.

It says right underneath your CreditKarma numbers that it's calculated using a Vantagescore model. Meanwhile it says directly below your Experian number that it is Fico8. If you want to see your actual Fico scores for TU and EQ, you can pay to view them with either a membership or the aforementioned $1 trial.

Apple is using Fico 9. This is why they're telling you its 657 and not the 700+ CreditKarma is giving you.

You are comparing apples and oranges. They are both fruit, but they are entirely different things. As mentioned earlier, CreditKarma is not a good source of your credit score and should mostly be used to monitor your accounts.

You said you would view your other real fico scores to "humor" the person trying to help you, but you are still going back to CreditKarma. It looks like, based on your Apple denial, your scores aren't actually 100 points apart.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax and Transunion near 750. Experian 660???

@Anonymous wrote:

@thornback wrote:

@Anonymous wrote:I dont have, or never owned that card. Never received any mail about it. So I have been trying to remove when discovered it about 4 months ago on Experian.

Gotcha. So it's either a severe mixup on the creditors end, or fraud/identity theft. Have you tried reaching out to the creditor directly? If not, then try that route first as, if they agree it's not your account, it would be the easiest way to get it removed.

Otherwise, read this post for further advice on how to go about getting it removed:

So I was looking at the Apple Card. Rejection mail and they said they used Transuion and my credit score is 657 w/ them not 748. So something else most be going on that I am not seeing and why is it being hidden from me?

CREDIT KARMA is NOT FICO. Get your actual scores as advised on this thread anbd forget about CK's scores all together.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax and Transunion near 750. Experian 660???

@Anonymous wrote:

@thornback wrote:

@Anonymous wrote:So I was looking at the Apple Card. Rejection mail and they said they used Transuion and my credit score is 657 w/ them not 748. So something else most be going on that I am not seeing and why is it being hidden from me?

Well, Apple Card pulls TU FICO 9, not TU FICO 8. Generally, on clean, derog-free reports, FICO 9 tends to be a bit higher than FICO 8 scores.

Nothing is being hidden from you. If you're using Credit Karma to view your TU report, keep in mind you have to click on Closed Accounts to see them... if that charge-off is, in fact, still present on your TU report, it would be considered a closed account and not in plain view with your open accounts.

But forget Credit Karma or any of the other sources you've been using for a moment -

You need to pull all three of your credit reports from a better source so you can review them line by line and find out what's going on. The best source for your situation is annualcreditreport.com. This site is regulated by the Federal Goverment and allows consumers to pull a report from each bureau once per year (twice in some states) for free. It is comprehensive - providing full report data that is not offered by commercial sources. Go there, pull your reports - print them if it's easier for you to review a paper copy - and go over them carefully, line by line so that you can become fully informed of the information reported. Come back and let me know what you find so we can go from there.

OK I will do that to humor you lol, but in the meantime. Please see previous post that my Credit score drop over 40 pts last month for no reason on Trans and EQ and rose on Experian 15 pts for no reason. Only thing different since then is I did have my credit card Near 10% Utilization by paying off.

This is a sick system. See image in this message and above.

First - Please go back to the beginning of this thread and read my post regarding Vantage 3 model (Credit Karma) scores (Post #4). You CANNOT compare FICO scores and Vantage scores to one another. They are two completely separate scoring models / algorithms and, therefore, differ greatly in how they respond to credit changes.

I do not know why your Vantage scores dropped ~40 points. We have no way of knowing the possible cause(s) without additional data from your credit report. If you really want help, you need to take the time to thoroughly read through the information that is being provided to you, let it sink in, take the advice of pulling your FICO scores for all three bureaus (you actually need your mortgage scores - as I previously noted - since you are seeking a mtg. refinance), as well as your credit reports from annualcreditreport.com, and proceed with providing us with more detailed info (ie. accounts, balances, credit limits, age of accounts, derogatories, etc.). FICO scoring is like a science - and, while we, collectively, have a good grasp on the ins and outs - we can't determine anything without a sufficient amount of data.

On another note: You doing as recommended is not to "humor" me, or anyone else - it's to help you as you came to this board seeking answers and advice. You can choose to ignore the advice given and the requests for more info - makes no difference to me - but you will not receive the help you seek.

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647

Starting FICO 8s | 09/2017: EX 641 ✦ EQ 634 ✦ TU 647Current FICO 8s | 04/2022: EX 796 ✦ EQ 793 ✦ TU 790

Current FICO 9s | 04/2022: EX 790 ✦ EQ 788 ✦ TU 782

2022 Goal Score | 800s

My AAoA: 4.6 years not incl. AU / 4.9 years incl. AU

My AoOA: 9.2 years not incl. AU / 11.2 years incl. AU

Inquiries: EX 0/12 ✦ EQ 0/12 ✦ TU 0/12

Report Status: Clean

Garden Status:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax and Transunion near 750. Experian 660???

Credit Karma is for monitoring your accounts only. Ignore those credit scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax and Transunion near 750. Experian 660???

So. Vantage scores off by 100 pts???? Really??? And you think that is ok? That is like me buying a digital scale and weighing my self and saying I am 40 lbs light than I am! Not right and somebody need to pay for that.

@Anonymous wrote:As has been pointed out several times now, CreditKarma does not give your Fico 8 scores. It's giving you Vantage scores. There is no "error" it is simply a different scoring system. If I'm not mistaken the majority of scores given as courtesy by credit cards are using Vantage scores - this is why they all line up with CreditKarma. But they are not Fico scores and they're not accurate.

It says right underneath your CreditKarma numbers that it's calculated using a Vantagescore model. Meanwhile it says directly below your Experian number that it is Fico8. If you want to see your actual Fico scores for TU and EQ, you can pay to view them with either a membership or the aforementioned $1 trial.

Apple is using Fico 9. This is why they're telling you its 657 and not the 700+ CreditKarma is giving you.

You are comparing apples and oranges. They are both fruit, but they are entirely different things. As mentioned earlier, CreditKarma is not a good source of your credit score and should mostly be used to monitor your accounts.

You said you would view your other real fico scores to "humor" the person trying to help you, but you are still going back to CreditKarma. It looks like, based on your Apple denial, your scores aren't actually 100 points apart.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax and Transunion near 750. Experian 660???

It's not off, it's an entirely different scoring system (one that is rarely used).

In the same way that FICO 2 is a different scoring system from FICO 8.

This is like comparing kindergartners to 3rd graders. They both go to the same school but they're different. Or a Corvette and a Camaro. They are both Chevy sports cars, but they aren't equal.

Yes I think that is okay. I don't really understand what the point of Vantage is, but I understand it's not FICO and it's ok with me. I don't have to pay attention to it. Why would somebody have to pay for that?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax and Transunion near 750. Experian 660???

You are comparing a scale analogy??

Again vantage scores are not FICO scores. They are scored totally differently and for the most part don't matter as most lenders do not use them. I am not sure how much more clear it can be?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax and Transunion near 750. Experian 660???

@Anonymous wrote:So. Vantage scores off by 100 pts???? Really??? And you think that is ok? That is like me buying a digital scale and weighing my self and saying I am 40 lbs light than I am! Not right and somebody need to pay for that.

@Anonymous wrote:As has been pointed out several times now, CreditKarma does not give your Fico 8 scores. It's giving you Vantage scores. There is no "error" it is simply a different scoring system. If I'm not mistaken the majority of scores given as courtesy by credit cards are using Vantage scores - this is why they all line up with CreditKarma. But they are not Fico scores and they're not accurate.

It says right underneath your CreditKarma numbers that it's calculated using a Vantagescore model. Meanwhile it says directly below your Experian number that it is Fico8. If you want to see your actual Fico scores for TU and EQ, you can pay to view them with either a membership or the aforementioned $1 trial.

Apple is using Fico 9. This is why they're telling you its 657 and not the 700+ CreditKarma is giving you.

You are comparing apples and oranges. They are both fruit, but they are entirely different things. As mentioned earlier, CreditKarma is not a good source of your credit score and should mostly be used to monitor your accounts.

You said you would view your other real fico scores to "humor" the person trying to help you, but you are still going back to CreditKarma. It looks like, based on your Apple denial, your scores aren't actually 100 points apart.

If you want to use a scale comparison it is like having a scale that measures weight in pounds and one that measures weight in stones. Both are accurate measurements of your weight but are not going to be the same number and the amount the value changes when you gain or lose weight will not be the same.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax and Transunion near 750. Experian 660???

@dragontears wrote:

@Anonymous wrote:So. Vantage scores off by 100 pts???? Really??? And you think that is ok? That is like me buying a digital scale and weighing my self and saying I am 40 lbs light than I am! Not right and somebody need to pay for that.

@Anonymous wrote:As has been pointed out several times now, CreditKarma does not give your Fico 8 scores. It's giving you Vantage scores. There is no "error" it is simply a different scoring system. If I'm not mistaken the majority of scores given as courtesy by credit cards are using Vantage scores - this is why they all line up with CreditKarma. But they are not Fico scores and they're not accurate.

It says right underneath your CreditKarma numbers that it's calculated using a Vantagescore model. Meanwhile it says directly below your Experian number that it is Fico8. If you want to see your actual Fico scores for TU and EQ, you can pay to view them with either a membership or the aforementioned $1 trial.

Apple is using Fico 9. This is why they're telling you its 657 and not the 700+ CreditKarma is giving you.

You are comparing apples and oranges. They are both fruit, but they are entirely different things. As mentioned earlier, CreditKarma is not a good source of your credit score and should mostly be used to monitor your accounts.

You said you would view your other real fico scores to "humor" the person trying to help you, but you are still going back to CreditKarma. It looks like, based on your Apple denial, your scores aren't actually 100 points apart.

If you want to use a scale comparison it is like having a scale that measures weight in pounds and one that measures weight in stones. Both are accurate measurements of your weight but are not going to be the same number and the amount the value changes when you gain or lose weight will not be the same.

So all these companies like credit karma saying they are showing you useful information are actually scamming you? Why am I able to get credit cards through their reporting services? If I apply through their website I get approved. It's like preapproval.

In the meantime I can't even get an Apple Card. Apparently Barclays is using some other score that I'm not even seeing How do I find out if there is a lien or something?

The rejection email I got said thwy used Trans Union which showing a report lower than what I'm saying but still it's to the point where I should get a credit card.(650) I think there something else going on.

How do I find some sort of tax lien or bank lien or something going on that I'm not aware of.